Best Health Insurance in Singapore 2025

Find the right health insurance plan in Singapore on Seedly. Compare coverage and premiums from various providers to find the best plan for medical expenses and emergencies.Updated July 2025Advertisement

Get amazing deals when you sign up for new financial products on Seedly 🎁

8 Products Found

4.4

305 Reviews

Ease of Claim

Agent Reliability

Application Process

"The agent understands and guides me in the application process. When the..." 2d ago

4.5

83 Reviews

Ease of Claim

Agent Reliability

Application Process

"Good coverage and definitely affordable. Recommended. Agent is good amd friendly. Customer..." 5mth ago

4.3

20 Reviews

"[Claims Process] Extremely fast. Everything is online and done up by agent if..." 6mth ago

3.8

24 Reviews

"I had an agent... totally disppeared for the past decade. I know..." 5mth ago

"Very robust policy and professional agents. The claims process was moderately fast..." 1mth ago

4.7

6 Reviews

"[Customer Service] The agent that serves me is pretty good and responsive. Hopefully,..." 18mth ago

4.0

6 Reviews

"My whole family bought with free insurance for the kids till 20..." 61mth ago

No rating yet

0 Reviews

Disclaimer: Products with a "Visit Site" button pay to access additional features

Seedly's Product Comparison Page Listing Guidelines

For Health Insurance products to be listed on Seedly's Product Comparison Page, they have to fulfil the following criteria:

- Policies protected under the Policy Owners’ Protection (PPF) Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC)

- Integrated Shield Plans only

Best Integrated Shield Plan Health Insurance in Singapore Review 2024

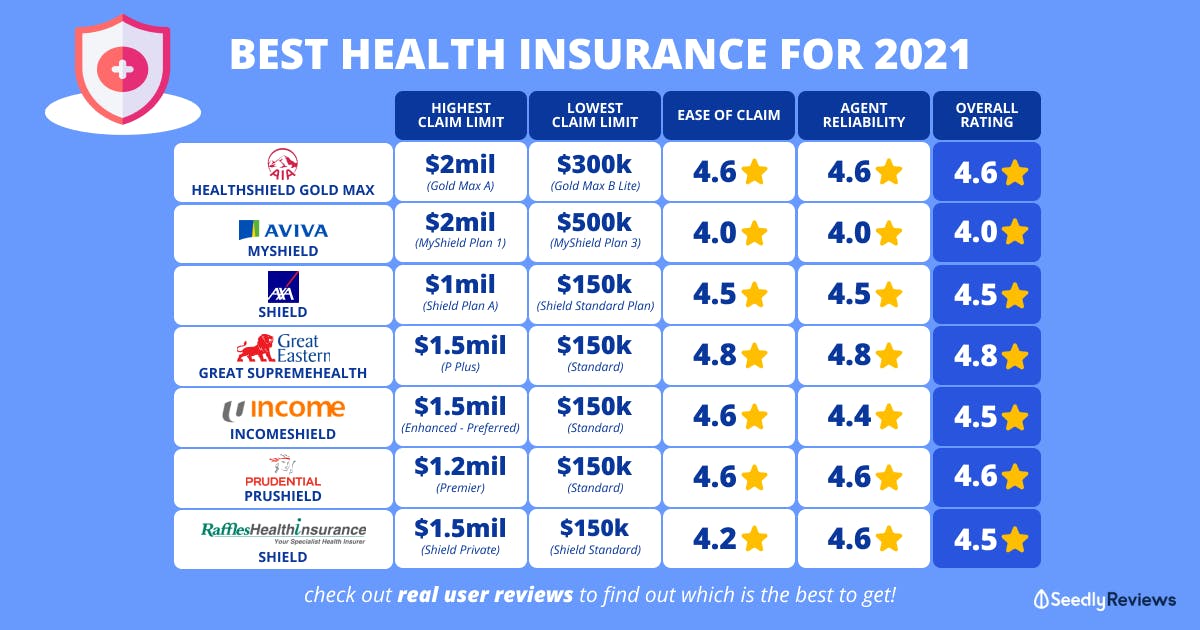

If you're looking for health insurance integrated shield plans, there are a total of 7 insurance providers and plans to choose from:

1. AIA HealthShield GoldMax

2. Aviva MyShield

3. AXA Shield

4. Great Eastern GREAT SupremeHealth

5. NTUC Enhanced IncomeShield

6. Prudential PRUShield

7. Raffles Shield

Choosing the best health insurance is not as simple as it looks.

Premiums differ depending on your age, and coverage will differ from provider to provider.

But most importantly, how much out-of-pocket expenses will we have to fork out when sh*t hits the fan?

Before we dive into the world of integrated shield plans, here's what you need to know about health insurance.

What You Need To Know About Health Insurance in Singapore

Singaporeans and PRs are covered by a basic health insurance called MediShield Life.

MediShield Life is a basic health insurance plan that is administered by the Central Provident Fund (CPF) Board to help Singaporeans offset some of their hospitalisation costs and even certain medical or surgery treatments such as chemotherapy for cancer and dialysis.

That being said, Singaporeans can receive further coverage by getting an Integrated Shield Plan (IP), which complements and adds more medical coverage on top of MediShield Life. Basically, an Integrated Shield Plan can help you get treatment at better class hospital wards or even, treatment at private hospitals if that's what you really need.

FYI: from 1 April 2019, all Integrated Shield Plans (IPs) offered by insurance providers will have a co-payment element one where the insured would have to pay at least 5% of his or her bill while the insurer pays the rest. This is unlike the previously offered full riders that was offered in the past, with insurers footing 100% of the medical bill!

Ah... the good ol' times.

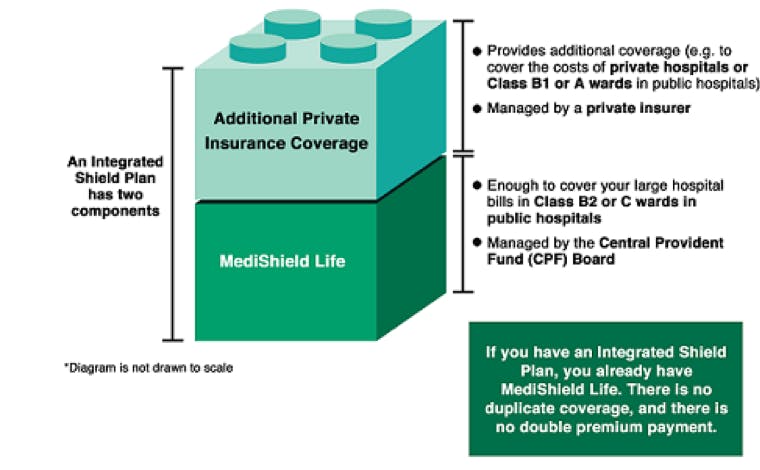

What is An Integrated Shield Plan (IP)?

An Integrated Shield plan (IP) is an optional health insurance plan, collaboratively insured by the CPF board and the private insurer of your choice. It provides additional coverage on top of the basic medical coverage which is provided by MediShield Life.

IPs are a by-product of Singapore’s two-tier healthcare system where governmental regulations and private insurance companies play their parts collectively to provide affordable universal coverage for all Singapore residents.

How Does An Integrated Shield Plan (IP) Work?

An integrated shield plan consists of 2 components:

1. MediShield Life

2. Additional private insurance coverage component by a private insurer of your choice

Together, your IP helps cover the costs incurred for hospitalisation and surgical procedures.

Source: Ministry of Health Singapore

MediShield Life

MediShield Life is a basic public health insurance scheme for Singapore residents', providing the first level of basic health care coverage.

Every citizen and permanent resident, across all ages and health profile, is automatically covered under MediShield Life, with no application required. Managed by the CPF Board, the premium for MediShield Life will be paid by your MediSave.

Additionally, lower-income families and Pioneer Generation individuals are eligible for government subsidies to their MediShield Life Premium.

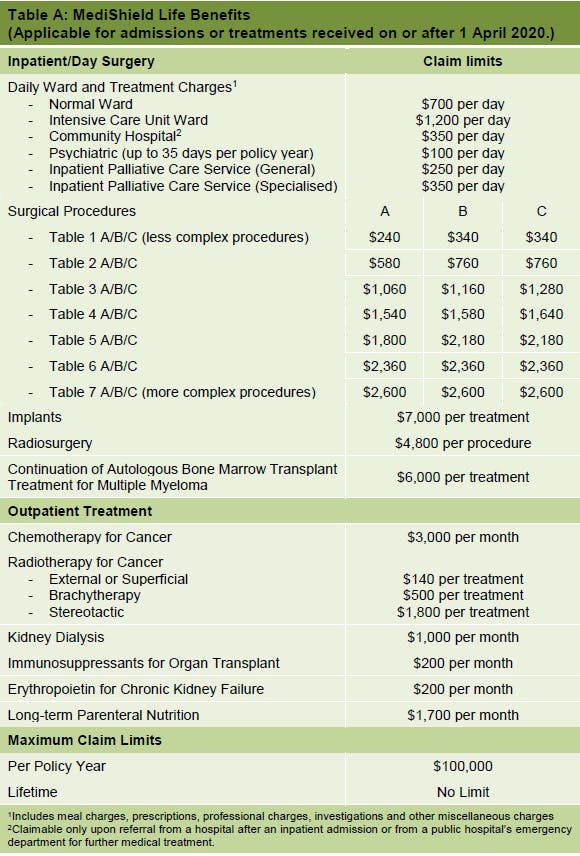

What does MediShield Life Cover?

- up to S$100,000 in policy limit

- B2/C-type wards in public hospitals only

- Selected Inpatient Treatment i.e. Day Surgery, Radio Surgery

- Selected Outpatient Treatments i.e. Chemotherapy, Radiotherapy, Kidney Dialysis and Long-Term Parenternal Nutrition with limits for each different treatment

- Staying in a A/B1-type ward or in a private hospital will be pro-rated. Meaning, your MediShield Life payout will only cover only a small proportion of the bill. The rest needs to be topped up either by cash or your MediSave account.

- The full list of MediShield Life Coverage and its benefit parameters:

(Source: Ministry of Health Singapore)

What Does An Integrated Shield Plan (IP) Cover?

There are 4 tiers of Integrated Shield Plans:

- Standard Integrated Shield Plan

- Class B1 Plans

- Class A Plans

- Private Hospital Plans

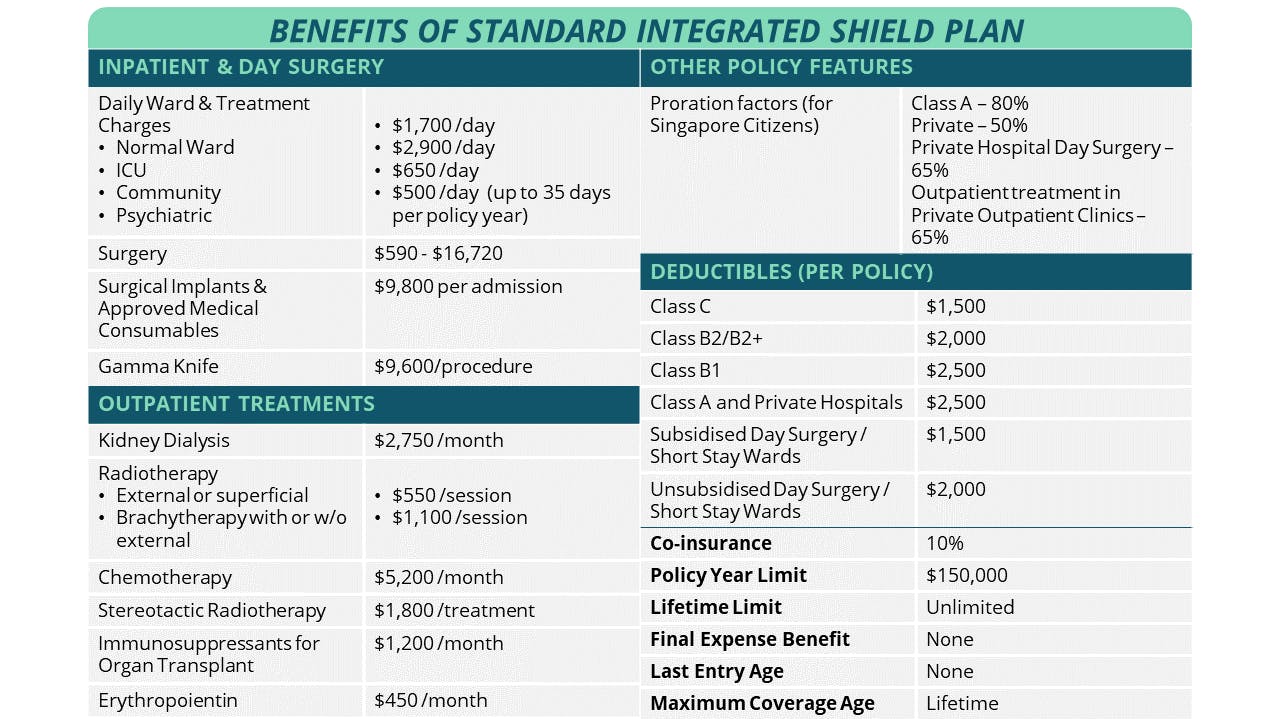

Standard Integrated Shield Plans (IP)

The most basic tier of is a private insurance product, targeted at covering large hospital bills and selected costly outpatient treatments. These are the full benefits and coverage parameters for all Standard IPs:

Standard IP costs more but also covers more than MediShield Life.

It usually covers up to Class B1 wards of public hospitals, and for most plans would have a policy limit of $150,000.

The coverage of the Standard IP is regulated by the government and is identical across all insurers. While the benefits for Standard IP are the same, private insurers are free to price their Standard plans as they like.

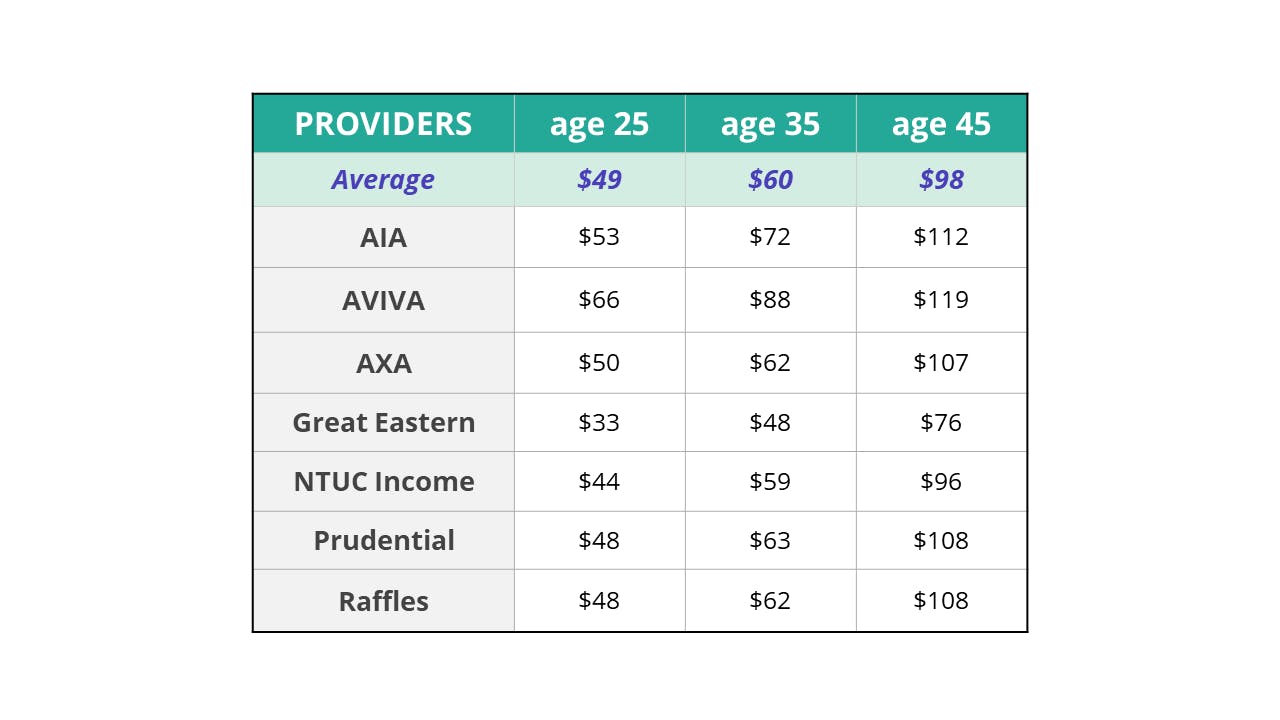

Cheapest Standard Integrated Shield Plans in Singapore 2021

Across 7 plans, and within 3 age groups, we have whittled down which are the Cheapest Standard Shield Plans.

Plan | 25 years old | 35 years old | 45 years old | Remarks |

|---|---|---|---|---|

Average | $49 | $60 | $98 | |

$33 | $48 | $76 |

| |

$44 | $59 | $96 |

| |

$48 | $62 | $108 |

|

Premium Annual Rates for Standard IP include GST

Other Standard Integrated Shield Plans available:

- AIA HealthShield Gold Max Standard

- AVIVA MyShield Standard

- AXA Shield Standard

- Prudential PRUShield Standard

Integrated Shield Plan vs MediShield Life: How is an IP different from MediShield Life?

Basically, an IP is named so because of its integration of MediShield Life - a public and government initiative, together with private insurance. MediShield Life is made compulsory by the government, whereas the extra coverage private insurance portion is optional.

With the private insurance, at a higher premium, you get higher coverage through higher claim limits, and better pro-rates if you choose higher ward classes. An example would be the policy yearly limit: for MediShield Life you get $100,000 whereas the limit for Standard IPs is $150,000, and even higher for the higher tiers of IP. You can also stand to get Medical coverage outside of Singapore.

Class B1, Class A, and Private Hospital Shield Plans

For those who prefer and can afford to stay at wards class B1 and above, opting for tiers higher than Standard IP might be better.

Note that while Standard IP and Class B1 Plans both entitle you to the same class of ward, the coverage amount and limits are different:

- Ward Entitlement: Class B1 and above, according to your chosen plan

- Policy Yearly Limit: at least $250,000 (vs Standard IP: $150,000)

- Inpatient and Day Surgery: mostly as charged

- Other Benefits that Standard IP does not have:

- Pre- and Post-hospitalisation Benefits

- Emergency Overseas Medical Treatment

- Congenital Abnormalities

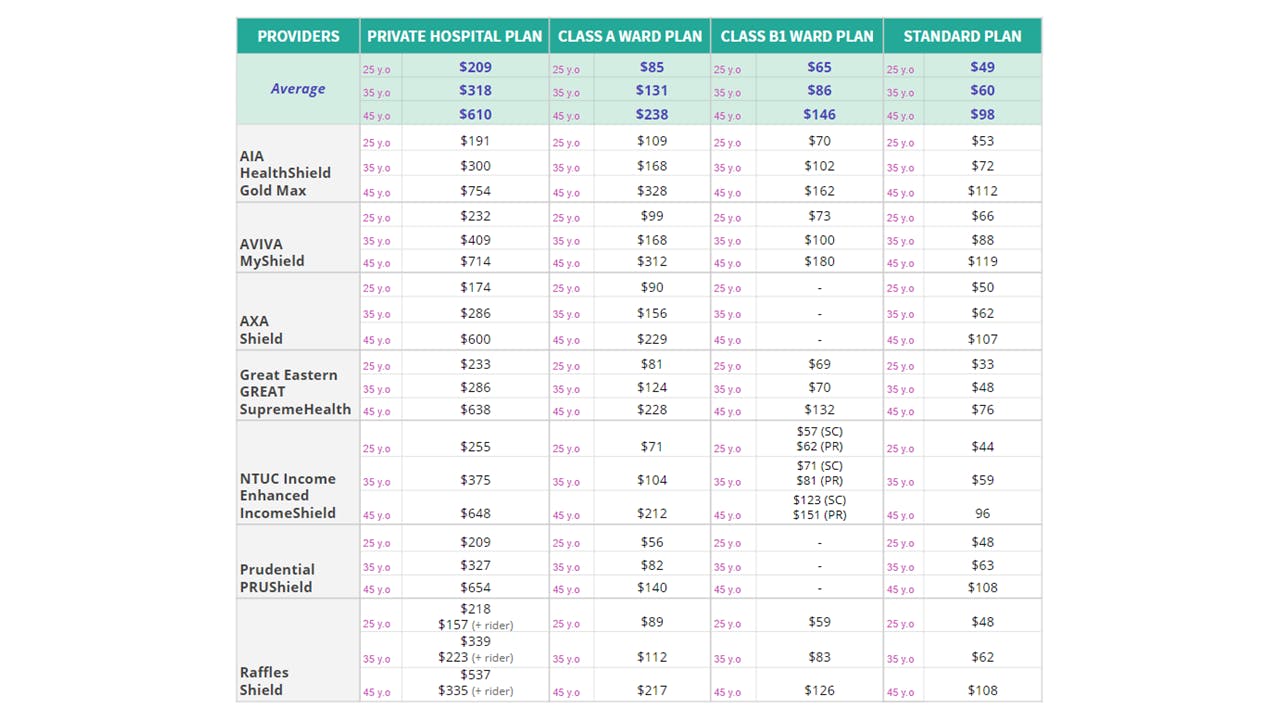

How much is Integrated Shield Plan Health Insurance in Singapore?

How much does IP private health insurance cost? Let's break it down into 3 age groups: 25, 35 and 45 year olds. *Ages referred to are age next birthday

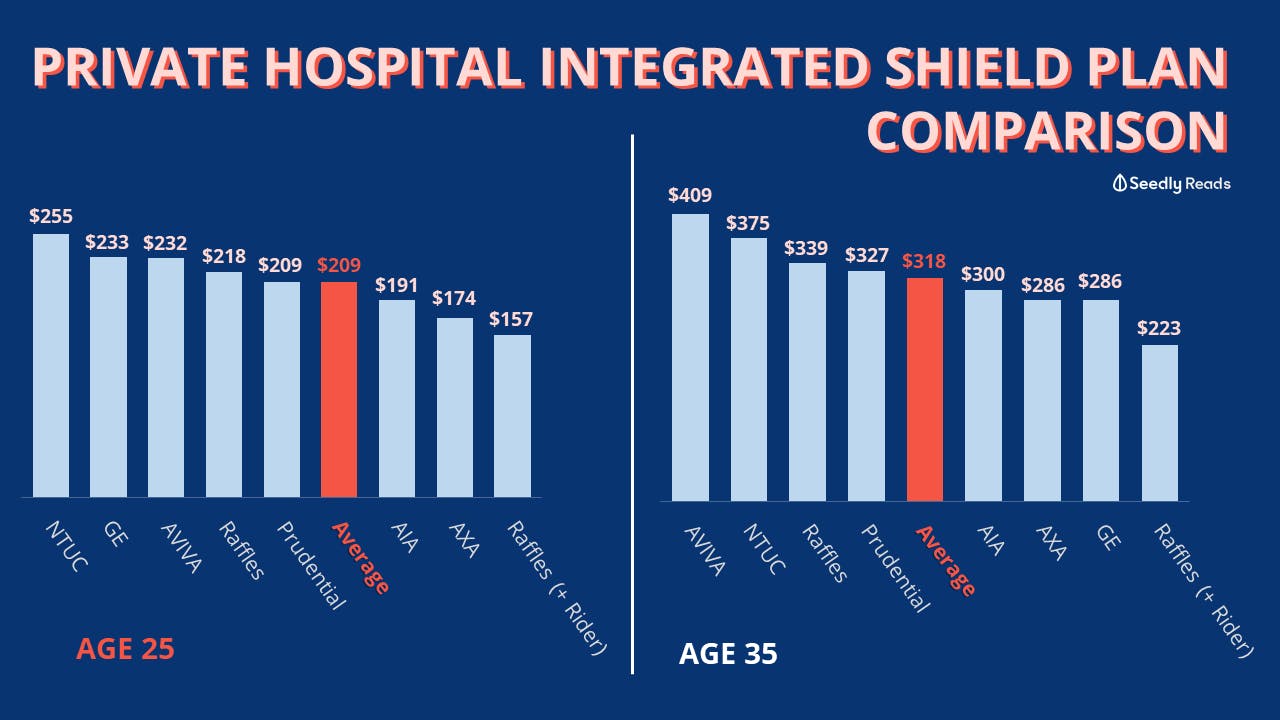

Cheapest Integrated Shield Plans For Private Hospitals:

Based on the premiums in the table above, we have compiled the most value for money plans according to their ward classes

- Raffles Shield Plan A* + Rider option

* (for Raffles Shield, purchasing a rider on top of your Class A ward plan upgrades your ward entitlement to Private Hospital wards at Raffles Hospitals, while maintaining the policy amount limits of a Class A ward plan. This plan should not to be confused with Raffles Shield Private plan, which is a plan directly for Private Hospital wards, with larger coverage.) - AXA Shield Plan A

- AIA HealthShield Gold Max A

- Great Eastern GREAT SupremeHealth P Plus

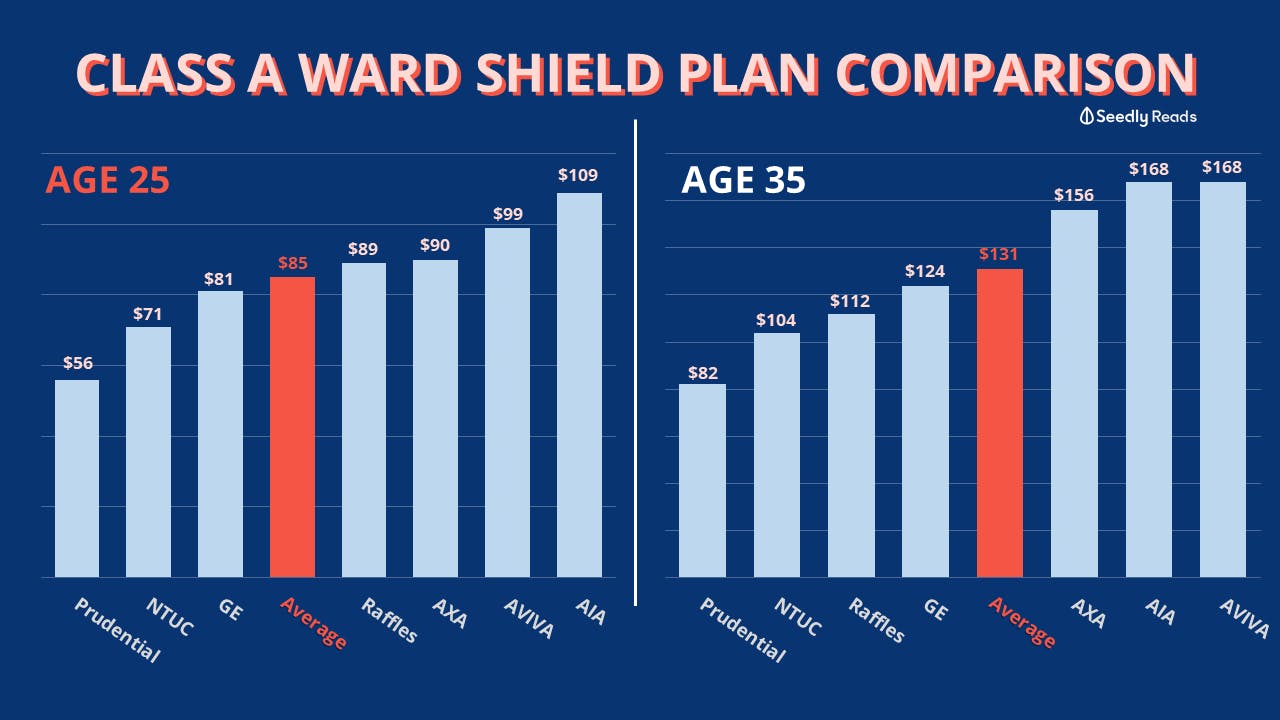

Cheapest Integrated Shield Plans For Class A Wards:

- Prudential PRUShield Plus

- NTUC Income Enhanced IncomeShield Advantage

- Great Eastern GREAT SupremeHealth A Plus

*all prices are updated as of June 2020

Paying for your Health Insurance / Integrated Shield Plan

The MediShield Life component of your Integrated Shield Plan is fully payable by MediSave.

The additional private insurance component is also payable by MediSave, but only up to the following Additional Withdrawal Limits:

- $300 per year for those at age 40 years and below on their next birthday

- $600 per year for those at age 41 to 70 years on their next birthday

- $900 per year for those at age 71 years and above on their next birthday

Any excess would need to be paid in cash.

Pre-existing Medical Conditions and Exclusions

It is important to declare your pre-existing medical condition before taking up any health insurance. Any known pre-existing conditions you have prior to starting your policy will not be covered by your health insurance

Generally, the list of exclusions are:

- Mental Illness (unless it falls under the Inpatient Psychiatric Treatment benefits of your plan)

- Pregnancy and Childbirth complications

- Treatment of Sexually Transmitted Diseases

- Self-Inflicted injuries

- Treatment from injuries caused directly or indirectly by alcohol or drug misuse

- Cosmetic or plastic surgery

- Dental Treatments (except accidental inpatient dental treatments)

Do I Still Need To Get My Own Health Insurance if I Am Covered Under My Corporate Medical Health Insurance?

Most corporate medical plans cover you for less, meaning you will pay more out-of-pocket if you have a high medical bill from getting sick or injured. You should do your research and find out what you are covered for by your work plan, and then it’s up to you if you want to take out your own healthcare plan too.

Tools To Help You Choose the Best Health Insurance in Singapore

To help Singaporeans make smarter personal finance decision, here are some tools to help you:

You can read up our articles on health insurance:

- Health Insurance for Expats in Singapore Made Easy

- Singaporean’s Ultimate Integrated Shield Plan Comparison, Am I on The Best Plan?

If there are still questions after reading the reviews left by real users, you can always head over to Seedly to ask the friendly Seedly community!

Contact us at [email protected] should you require any assistance or spot any inaccuracies

Frequently Asked Questions

Why is health insurance necessary?

Health insurance safeguards you and your family against hefty and unexpected medical expenses from accidents, illness, and disability.

How does health insurance work in Singapore?

- All Singaporeans and Permanent Residents (PRs) are covered under MediShield Life, a basic health insruance plan that helps pay for large hospital bills and selected outpatient treatments in Singapore.

- You can enhance your MediShield Life coverage by purchasing a private Integrated Shield Plan (IP), which covers your treatment in a better ward class or in private hospitals. It also covers pre and post-hospitalisation treatment, though the period of coverage differs between insurers.

- Regardless of your plan type, all insured would need to pay first pay a portion of the bill, known as deductible and co-insurance, before you can claim for the rest of your bill.

- However, having an insurance rider can help to lower the cost of your deductible and co-insurance to up to 5% of your total bill. The cost of your rider if pegged on your total premium.

- Premiums for MediShield Life is payable by MediSave, while that of Integrated Shield Plan is payable by Medisave up to withdrawal limits based on your age group. Riders are not payable by MediSave.

What to consider before choosing an integrated shield plan?

An Integrated Shield Plan is an additional private insurance coverage. It covers your treatment in a better ward class or in private hospitals. It also covers pre and post-hospitalisation treatment, though the period of coverage differs between insurers. Before choosing if you should get an IP or the extent of additional coverage, start by considering:

- If you wish to stay in private wards or receive treatment in a private hospital

- If you can afford higher IP premiums in the long run

Why get an IP Rider Plan?

Riders provide extensive add-ons that can help to lower hefty hospitalisation bills and other additional benefits, they are often not absolutely necessary. However, riders raise the cost of your monthly premiums, and they will continue to escalate with age. Consider the affordability and necessity of purchasing a rider, especially since they are not payable my MediSave.

What types of health insurance are there?

There are 5 types of health insurance plans: MediShield Life, hospital cash insurance, critical illness insurance, disability income insurance, and long-term care or severe disability insurance.

What is covered under the Integrated Shield Plans?

Integrated Shield Plans provide additional coverage that enables you receive treatment at a better ward class or in private hospitals.

How do I pay for health insurance?

- MediShield Life premiums can be paid using MediSave.

- If you have purchased an IP, you will effectively be paying for premiums of both your MediShield Life and IP at the same time. Do note that only a portion of your IP premiums may be payable by MediSave as there are withdrawal limits.

- Even with IP, payouts only start after the deductible and co-insurance is paid out-of-pocket.

- However, if you have chosen to add-on with, riders you only have to pay a 5% co-insurance. Riders are to be paid in cash.

How do I apply for a health insurance plan?

All Singaporeans and PRs are covered under MediShield Life, a basic national healthcare insurance that covers basic public hospital bills and selected costly outpatient treatment. If you decide to purchase an IP or top-up with riders, approach a private insurance company to enhance your MediShield Life.

What are the costs of health insurance in Singapore?

The costs of health insurance varies depending on numerous factors. Some of these factors affecting premiums include your age and extent of coverage.

Can foreigners buy health insurance in Singapore?

Yes, foreigners can buy private health insurance in Singapore. While foreigners are not entitled to MediShield Life coverage in Singapore, they can choose to purchase 3 main types of health insurance from private insurers:

- Integrated Shield plans

- International health insurance (local providers)

- International health insurance (global providers)

Do you need health insurance in Singapore?

While health insurance are not mandatory, other than the national basic healthcare provided for all Singaporeans and PRs, ensuring that you are adequately covered is crucial in safeguarding you and your family against hefty and unexpected hospitalisation bills and illnesses.