Best Disability Insurance in Singapore 2026

Find the best disability insurance policies in Singapore on Seedly to secure your financial future. Read reviews on coverage, premiums, claims, and many more for peace of mind.Updated February 2026Advertisement

Disability Insurance

Get amazing deals when you sign up for new financial products on Seedly 🎁

3 Products Found

4.1

18 Reviews

Agent Reliability

Ease of Claim

Application Process

"[Insurance Coverage] Looks fine, but feel unhappy. [Agent Responsiveness] Too responsive and I do..." 3d ago

4.3

3 Reviews

Singlife MyLongTermCare Careshield Plus

$5,000

MAX MONTHLY BENEFIT

Unable to perform ≥ 2 ADLs

MONTHLY PAYOUT CRITERIA

300% of monthly benefit

MAX LUMP SUM PAYOUT

Unable to perform ≥ 2 ADLs

LUMP SUM PAYOUT CRITERIA

Singlife MyLongTermCare Careshield

$5,000

MAX MONTHLY BENEFIT

Unable to perform ≥ 3 ADLs

MONTHLY PAYOUT CRITERIA

300% of monthly benefit

MAX LUMP SUM PAYOUT

Unable to perform ≥ 3 ADLs

LUMP SUM PAYOUT CRITERIA

"Good to see the review. Though not offered yet, I am more..." 3mth ago

No rating yet

0 Reviews

Disclaimer: Products with a "Visit Site" button pay to access additional features

Disability Insurance is probably one of the most important insurance policies for adults in 2021. Being physically fit does not entirely ward away the possibility of being disabled. There might be unforeseen circumstances that may befall us. Hence, having coverage from disability insurance to help alleviate the potential loss of income through monthly payouts will be significantly helpful.

Best CareShield Life Supplement Plans Review in Singapore 2024

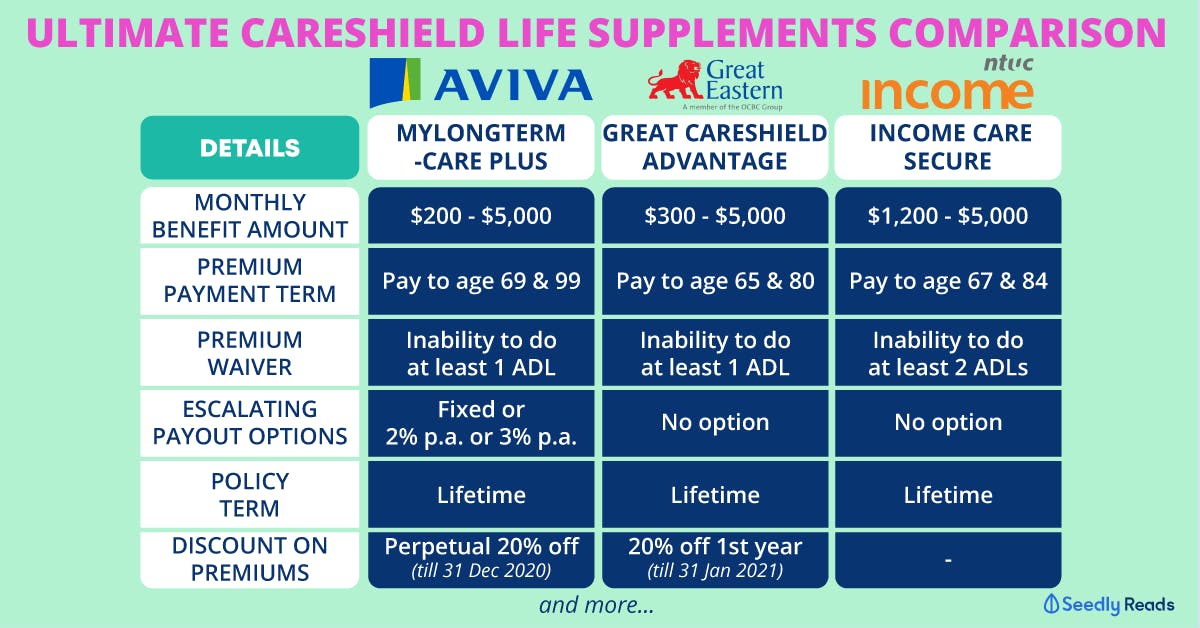

There are a total of 3 CareShield Life Supplement Plans in Singapore, they are (in no particular order):

1. Great Eastern GREAT CareShield

2. AVIVA CareShield MyLongTermCare

3. NTUC CareShield Income Care Secure

Check our our blog post on CareShield Life Supplement comparisons - is it worth it to upgrade to AVIVA, Great Eastern or NTUC Income Supplement plans?

What is CareShield Life Supplement?

Similar to Medishield Life, CareShield Life only provides basic coverage; people who prefer more comprehensive coverage can opt for CareShield Life Supplement plans for better peace of mind. CareShield Life Supplements provide additional useful benefits like higher monthly payouts, death benefits, dependent benefits, etc.

CareShield Life vs CareShield Supplement

What is CareShield Life?

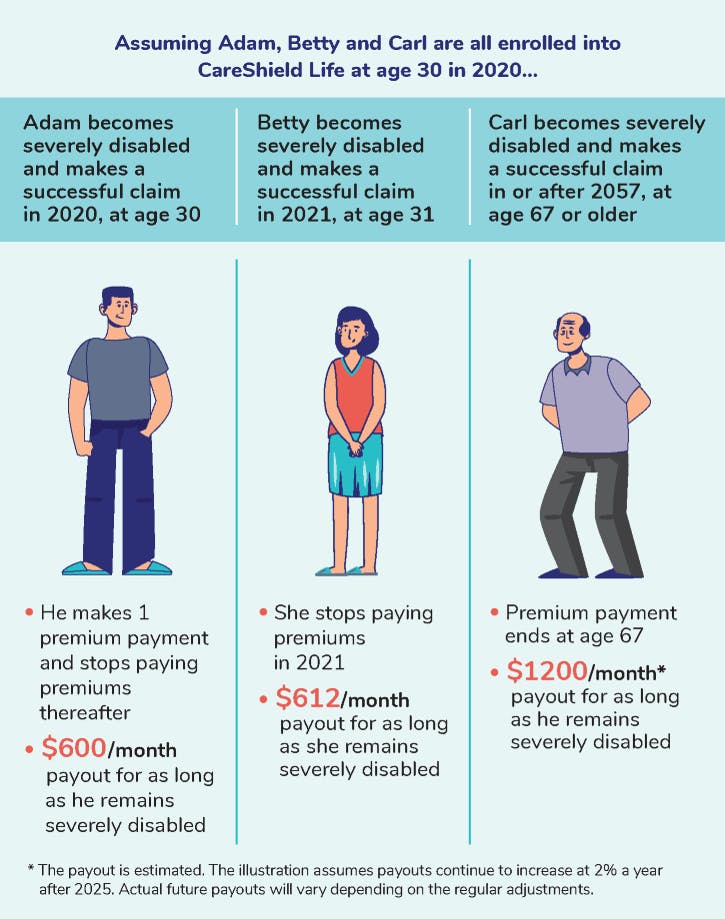

Singaporeans and PRs are covered by a basic long-term care insurance called the CareShield Life. CareShield Life seeks to provide financial relief in the event of severe disablement via monthly payouts starting at S$600, which subsequently increases over time.

In an effort to keep healthcare costs affordable, individuals can use their Medisave to pay for their own or their family members' CareShield Life Premiums. Additionally, CareShield Life is also applicable for subsidies for eligible households.

This is a type of

Criteria for Severe Disability

Out of 6 Activities of Daily Living (ADLs) - washing, dressing, feeding, toileting, moving, and transferring - so long as someone faces the inability to perform any 3 ADLs, they are MOH-accredited to be severely disabled. This is the criteria for claiming their CareShield Life payouts.

What does CareShield Life Cover?

Source: CareShieldLife.gov

- Lifetime coverage for disability after full payment of your premiums - which will occur when you turn 67 years old OR upon 10 years maturity of the policy, whichever is later

- Lifetime cash payouts as long as you are severely disabled

- Worldwide coverage - make a claim regardless of where you are residing, and receive payouts

- Payouts start from $600 and will increase annually.

- From 2020 to 2025, payouts will increase at 2% per year. Thereafter, payout increases and corresponding premium adjustments will be recommended by an independent CareShield Life Council.

Who does CareShield Life Cover?

- For those born in 1980s or later: you will be automatically covered when you turn 30, regardless of pre-existing medical conditions and disability.

- For those born in 1979 or earlier: Participation is OPTIONAL.

- For those born between 1970 and 1979, are insured under ElderShield 400 and not severely disabled: you will be automatically enrolled into CareShield Life, but can opt-out if you wish to do so.

How much does CareShield Life Cost?

- The premiums of CareShield Life depends on your age and gender

- Check out CareShield Life's Premium Calculator for an estimate of your premium

- Premiums are fully payable by MediSave

Pre-existing Medical Conditions and Exclusions

It is important to declare your pre-existing medical condition before taking up any health insurance. Any known pre-existing conditions you have prior to starting your policy will not be covered by your health insurance

Generally, the list of exclusions are:

- Mental Illness (unless it falls under the Inpatient Psychiatric Treatment benefits of your plan)

- Pregnancy and Childbirth complications

- Treatment of Sexually Transmitted Diseases

- Self-Inflicted injuries

- Treatment from injuries caused directly or indirectly by alcohol or drug misuse

- Cosmetic or plastic surgery

- Dental Treatments (except accidental inpatient dental treatments)

Tools to help you choose the best CareShield Life Supplement

To help Singaporeans make smarter personal finance decision, here are some tools to help you:

One can read up our articles on health insurance here:

- Health Insurance for Expats in Singapore Made Easy

- Singaporean’s Ultimate Integrated Shield Plan Comparison, Am I on The Best Plan?

If there are still questions after reading Real User Reviews on Health Insurance, ask the community at Seedly.

Contact us at [email protected] should you require any assistance or spot any inaccuracies