NTUC Income Care Secure CareShield

- Key Features

- Reviews (0)

- Discussions (0)

- More Details

Advertisement

NTUC Income Care Secure CareShield

NTUC Income Care Secure CareShield

This product has not been claimed by the company yet.

Summary

NTUC CareShield Income Care Secure Reviews 2024

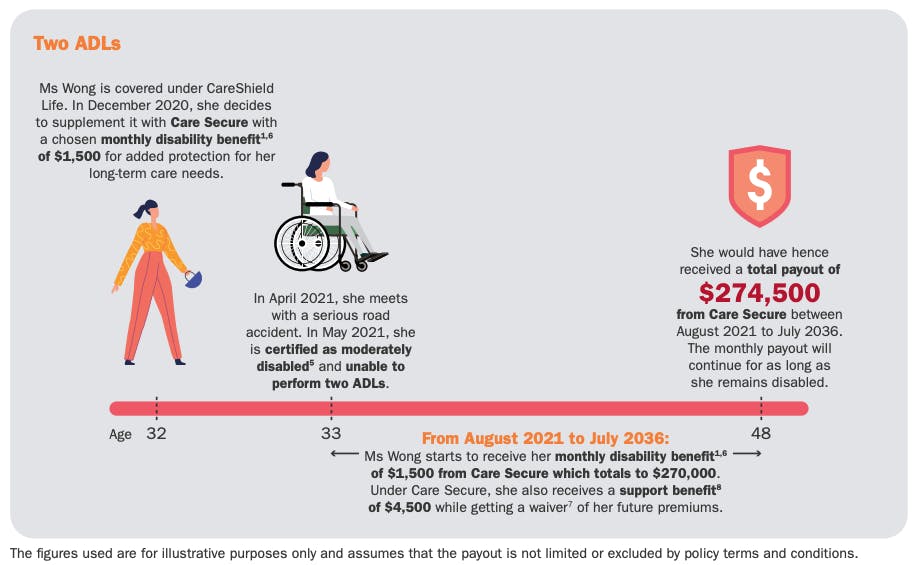

- NTUC Care Secure is a supplementary Medisave-approved disability insurance on top of the regular CareShield Life.

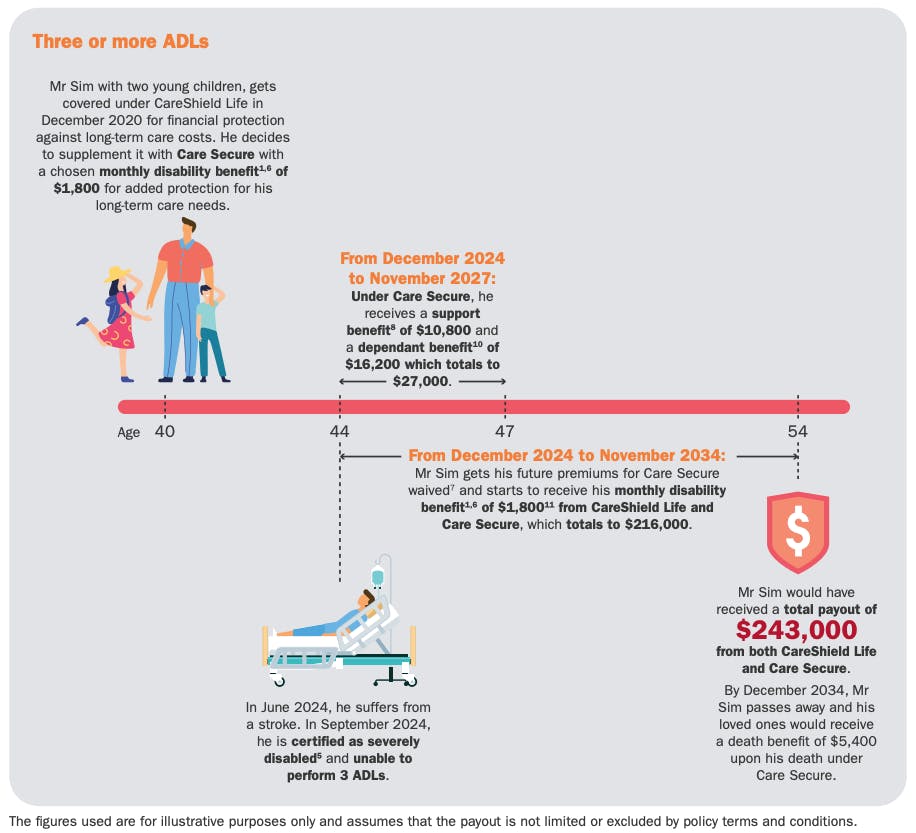

- It has added enhanced long-term coverage of support benefit, dependant benefit and death benefit for moderate to severe disabilities.

- NTUC CareShield provides up to $5,000 of monthly disability benefit in the event of the inability to perform 2 Activities of Daily Living (ADL). The disability benefits paid out will depend on one's disability status and the monthly disability benefit chosen.

- For Support Benefit: up to 600% of the monthly disability benefit will be paid out in the event of severe disability.

- For Death Benefit: Care Secure will pay 300% of the monthly disability benefit in the event of death and on the condition that the policyholder was already receiving the disability benefit.

- For Dependant Benefit: those with at least one dependant will be able to get 25% of the monthly disability benefit as dependant benefit for every month up to 36 months.

- Medisave payable: use up to $600 from your MediSave account (per insured per calendar year) to pay for your Care Secure premiums

Popular Products

4.1

18 Reviews

4.3

3 Reviews

Summary

NTUC CareShield Income Care Secure Reviews 2024

- NTUC Care Secure is a supplementary Medisave-approved disability insurance on top of the regular CareShield Life.

- It has added enhanced long-term coverage of support benefit, dependant benefit and death benefit for moderate to severe disabilities.

- NTUC CareShield provides up to $5,000 of monthly disability benefit in the event of the inability to perform 2 Activities of Daily Living (ADL). The disability benefits paid out will depend on one's disability status and the monthly disability benefit chosen.

- For Support Benefit: up to 600% of the monthly disability benefit will be paid out in the event of severe disability.

- For Death Benefit: Care Secure will pay 300% of the monthly disability benefit in the event of death and on the condition that the policyholder was already receiving the disability benefit.

- For Dependant Benefit: those with at least one dependant will be able to get 25% of the monthly disability benefit as dependant benefit for every month up to 36 months.

- Medisave payable: use up to $600 from your MediSave account (per insured per calendar year) to pay for your Care Secure premiums

NTUC Income Care Secure CareShield

NTUC Income Care Secure CareShield

$5,000

MAX MONTHLY BENEFIT

Unable to perform ≥ 2 ADLs

MONTHLY PAYOUT CRITERIA

600% of first monthly benefit

MAX LUMP SUM PAYOUT

Unable to perform ≥ 2 ADLs

LUMP SUM PAYOUT CRITERIA

0.0

0 Reviews

High to Low

No reviews found.

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

4.1

18 Reviews

4.3

3 Reviews

What Does NTUC CareShield Income Care Secure Cover?

Moderately Disabled | Severely Disabled | |

|---|---|---|

Support Benefit | 300% | 600% |

Dependant Benefit | 25% | 25% |

Death Benefit | 300% | 300% |

Coverage payouts for NTUC CareShield Care Secure in % of monthly disability benefit

Moderate Disability = inability to perform 2 out of 6 ADL

Severe Disability = inability to perform 3 or more out of 6 ADL

Activities of Daily Living (ADL)

ADL refers to ‘Activities of Daily Living’ or basic self-care tasks which is a measure of how physically independent a person is. Activity of Daily Living encompasses washing, toileting, dressing, feeding, walking or moving around and transferring.

Features of NTUC Income Care Secure

Choose from 2 premium terms - up to age 67, or age 84 years old.

Monthly Disability Benefit

- The Monthly Disability Benefit for NTUC Care Secure is available from $1,200 to $5,000 in multiples of $100.

Support Benefit

- Any policyholders receiving CareShield Life benefit will automatically be eligible for the Severe Disability benefits.

- The 600% lump sum payout for Support Benefit will be for the severely disabled only (inability to perform 3 or more ADL)

- Those considered Moderately Disabled (inability to perform 2 or more ADL), will receive only 300% lump sump payout of Support Benefit. If the condition progresses to the severe disability, you can claim the remaining 300%.

Dependant Benefit

- If you become disabled and have at least one dependant, you will receive 25% of the disability benefit as dependant benefit every month for up to 36 months in your lifetime.

- Dependants are: Your child (or children); Your husband or wife; Your parents (biological parents, step-parents, or parents who legally adopted you); and Your parents-in-law. Child means your biological child or stepchild, or legally adopted child, who has not reached the age of 21 years on the claim date.

Death Benefit

- Care Secure will pay 300% of the disability benefit in the event of your death and on the condition that you were already

receiving the disability benefit. The policy terminates thereafter

The NTUC CareShield Income Care Secure is partially payable by Medisave - up to $600 per insured calendar year

Premiums will be waived upon diagnosis of disability.

How does NTUC CareShield Income Care Secure work?

Premiums for NTUC Income CareShield Care Secure

- Premium costs depend on your premium term as well as desired monthly payout.

- Premium Waiver - The policy premium will be waived when the insured becomes unable to perform at least 2 ADL.

- Premiums paid with MediSave - NTUC CareShield premiums can be paid by your own MediSave funds up to a limit of S$600 per calendar year per insured person.

Annual Premium Price for NTUC Income Care Secure

Here are the approximate premiums for an assumed monthly benefit of $1,800.

They are sorted by gender and premium terms.

Age | MALE | FEMALE |

|---|---|---|

30 y.o | to 67 y.o: $624 to 84 y.o: $499.80 | to 67 y.o: $911.10 to 84 y.o: $699.74 |

35 y.o | to 67 y.o: $848.60 to 84 y.o: $644.40 | to 67 y.o: $1240.60 to 84 y.o: $898.60 |

40 y.o | to 67 y.o: $1,158.70 to 84 y.o: $830.20 | to 67 y.o: $1,700.40 to 84 y.o: $1,162.20 |

Annual Premium Prices for NTUC Income Care Secure

Eligibility: Who can apply for NTUC CareShield Care Secure?

- Citizenship Status: Singaporeans and Permanent Residents

- Age: 30 to 64

- With an existing CareShield Life plan

Contact NTUC Income

- Click the "Visit Site" button above to find out more

- Tel: 63321133

- Email NTUC via the NTUC Income enquiry form

Contact us at [email protected] should you require any assistance or spot any inaccuracies.

Advertisement