AIA HealthShield Gold Max Integrated Shield Plan

- Key Features

- Reviews (20)

- Discussions (0)

- More Details

Advertisement

AIA HealthShield Gold Max Integrated Shield Plan

AIA HealthShield Gold Max Integrated Shield Plan

This product has not been claimed by the company yet.

Summary

AIA HealthShield Gold Max Integrated Shield Plan Review 2021

HealthShield is an AIA Integrated Shield Plan Health Insurance that supplements your MediLife Shield. Here are some features of AIA HealthShield:

- Covers hospitalisation bills in private hospitals and public hospitals up to A / B1 Class wards

- Premiums can be paid by MediSave

- AIA HealthShield Gold Max Plan A has the highest claim limit offered at $2 million per policy year

- Plan A also offers up to 13 months of pre- and post-hospitalisation benefits, which is the longest duration available amongst all insurers

- Lifetime coverage

- The available optional add-on AIA VitalHealth offers extra coverage like early detection, and reduced out-of-pocket expenses by capping it at S$3,000 per year

Popular Products

4.4

306 Reviews

4.5

83 Reviews

3.7

25 Reviews

Summary

AIA HealthShield Gold Max Integrated Shield Plan Review 2021

HealthShield is an AIA Integrated Shield Plan Health Insurance that supplements your MediLife Shield. Here are some features of AIA HealthShield:

- Covers hospitalisation bills in private hospitals and public hospitals up to A / B1 Class wards

- Premiums can be paid by MediSave

- AIA HealthShield Gold Max Plan A has the highest claim limit offered at $2 million per policy year

- Plan A also offers up to 13 months of pre- and post-hospitalisation benefits, which is the longest duration available amongst all insurers

- Lifetime coverage

- The available optional add-on AIA VitalHealth offers extra coverage like early detection, and reduced out-of-pocket expenses by capping it at S$3,000 per year

Plans (3)

AIA HealthShield Gold Max A

$2,000,000

LIMIT PER POLICY YEAR

100 / 100 days

PRE & POST HOSPITAL

As Charged

OUTPATIENT BENEFITS

Private Hospital

WARD ENTITLEMENT

4.2

20 Reviews

High to Low

Posted 28 Dec 2024

Purchased

AIA HealthShield Gold Max A

[Claims Process] Extremely fast. Everything is online and done up by agent if need be. Very high tech and much more efficient than what i've heard from some other companies. [Customer Service] Efficient. They even have a 24h online chat bot [Insurance Coverage] Longest Pre and Post hospitalization coverage1

What are your thoughts?Reply

Save

Posted 11 Jul 2022

Purchased

AIA HealthShield Gold Max A

Most comprehensive, but also charges the highest. Well, good things come at a premium. If you are going for this, you might as well get the rider too - this would provide you with the most comprehensive coverage pretty much available.0

What are your thoughts?Posted 19 Mar 2022

Purchased

AIA HealthShield Gold Max A

Personally i think this is the best and most comprehensive ISP out there in terms of coverage: 1. Pre and post hospitalisation period 2. Coverage for cancer 3. Coverage for critical illness And f you can afford get a rider as well, to minimise the out-of-pocket expenses0

What are your thoughts?Posted 28 Feb 2022

Purchased

AIA HealthShield Gold Max A

Overall ok. No hidden terms. Insurance coverage are fine for young ages. But sometimes customer service replies to me in delay.0

What are your thoughts?Posted 23 Oct 2021

Purchased

AIA HealthShield Gold Max A

[Policy Changes] was an AIA agent myself, so see quite a fair bit of changes in this policy and its getting more complicated with the new rider changes, now they need pre-authorize or else can only claim up to 80% [Claims Process] it's quite easy to ask pre-authorize approval are required and most of their panel doctor know the process and can be done very fast, went for an ankle ligament restoration last year claim process for the actual hospitalisation was easy but post-hospitalisation claims must really look for agent and my agent was kinda not willing to help and I have to troubled another friend/ex-collegue of mine to help me with... He was the original writing agent of this plan before I joined the industry [Claims Documents] actually hospital period must be pre-authorised and e-file post one just scan a copy of the receipt and pass to your agent will do0

What are your thoughts?Posted 14 Sep 2021

Purchased

AIA HealthShield Gold Max A

Be sure to check your plan ranking that u have before picking the ward, plan A gives the hospitalised person more choices as to which ward to go in, dont shortchange yourself on comfort when falling ill or hospitalised if possible! Plan early:)0

What are your thoughts?28 Apr 2021

Purchased

AIA HealthShield Gold Max A

[Agent Responsiveness] The application process was a breeze. The agent was very responsive and helpful to address all queries [Insurance Coverage] From what I can see, AIA has a very comprehensive coverage for my needs. It also nicely complements my employer insurance.1

What are your thoughts?Can recommend the agent?

Reply

Save

25 Aug 2020

Purchased

AIA HealthShield Gold Max A

[Claims Process] Filed a claim last year. The claims process was really fast - the claim was settled less than a week from the time I was discharged. [Insurance Coverage] Pleased with the coverage because I was able to choose an AIA preferred panel doctor and was able to claim up to 13 months of post-hospitalisation expenses so that gave me a peace of mind. [Customer Service] My agent, Serene, was very responsive and filed the claims quickly.5

What are your thoughts?View 4 other commentsCan recommend me as well?

Reply

Save

22 Jul 2020

Purchased

AIA HealthShield Gold Max A

[Customer Service] You can participate in the vitality membership to have a chance to win a $5 voucher per week or $20 month. Membership subscription is $8 per month.0

What are your thoughts?10 Jun 2020

[Purchase Process] Good to be able to deduct via cpf And the payment is hassle free [Customer Service] Is great via the app and via your consultant [Terms & Conditions] Gives you product summary and also a soft copy cheers0

What are your thoughts?

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

4.4

306 Reviews

4.5

83 Reviews

3.7

25 Reviews

AIA Health Insurance HealthShield at a Glance

- 3 tiers of HealthShield Gold Max(excluding standard), ranging from the most expensive to cheapest:

- Plan A

- Plan B and

- Plan B Lite - Covers hospitalisation bills in private hospitals and public hospitals up to A / B1 Class wards

- Premiums can be paid by MediSave

- AIA HealthShield Gold Max Plan A has the highest claim limit offered at $2 million per policy year

- Plan A also offers up to 13 months of pre- and post-hospitalisation benefits, which is the longest duration available amongst all insurers

- Lifetime coverage

- Optional rider AIA VitalHealth, available in tiers, offers extra coverage like early detection, and reduces out-of-pocket expenses by capping it at S$3,000 per year

What does AIA Health Insurance HealthShield Cover?

Benefit Parameters | HealthShield Gold Max Plan A | HealthShield Gold Max Plan B | HealthShield Gold Max Plan B Lite |

|---|---|---|---|

Ward Entitlement | Standard Room and below, at Private hospitals | A Class ward and below, at Public Hospitals | B Class ward and below, at Public Hospitals |

Policy Yearly Limit |

| S$1,000,000 | S$300,000 |

Hospitalisation and Surgical Benefits | as charged | as charged | as charged |

Pre-hospitalisation Benefits |

| As Charged within 180 days before confinement | As Charged within 100 days before confinement |

Post-Hospitalisation Benefits |

| As Charged within 180 days after confinement | As Charged within 100 days after confinement |

Outpatient Treatment | As Charged | As Charged | As Charged |

Organ Transplant | 60,000 per transplant | 40,000 per transplant | 20,000 per transplant |

Emergency Overseas Treatment | available, but subjected to respective limits | available, but subjected to respective limits | available, but subjected to respective limits |

Critical Illness (up to 30 Critical Illnesses) | $100,000 per policy year | $75,000 per policy year | $50,000 per policy year |

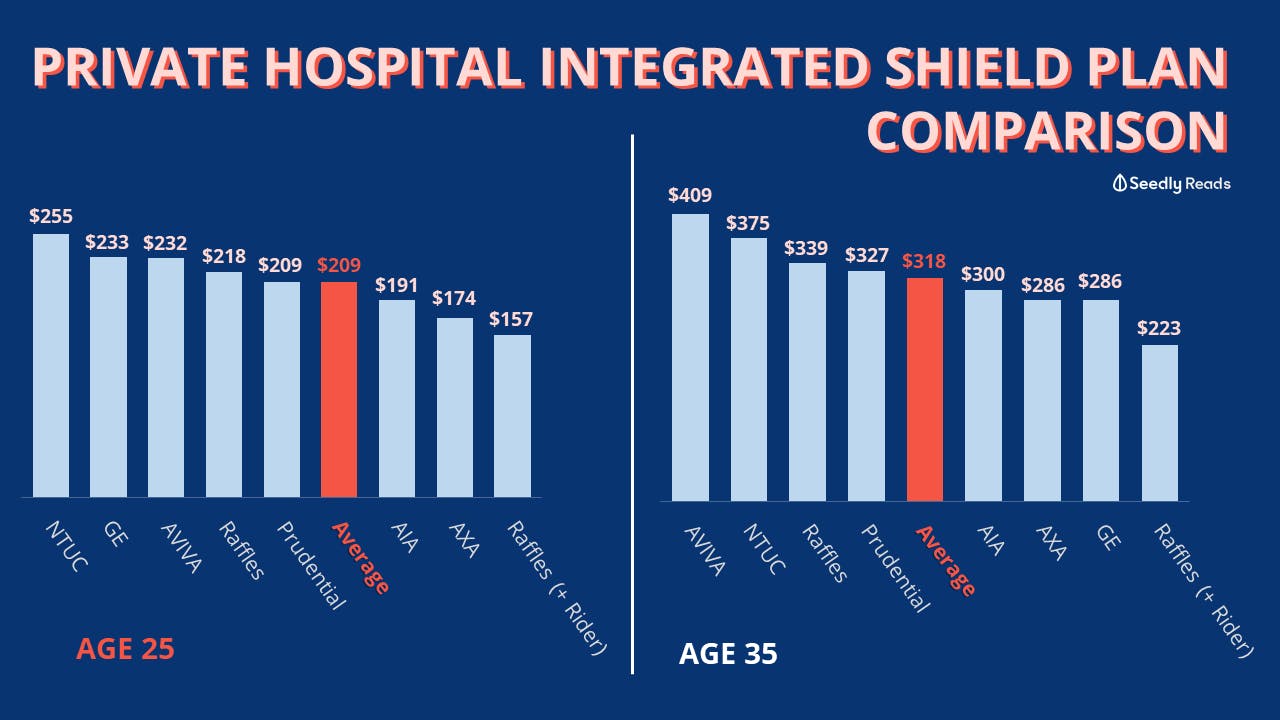

How much does AIA Health Insurance, AIA HealthShield Gold Max cost?

All premiums will increase with age, this is the approximate guideline to AIA HealthShield Health Insurance Quote based on age:

Age Next Birthday | AIA HealthShield A | AIA HealthShield B | AIA HealthShield B Lite | AIA HealthShield Standard |

|---|---|---|---|---|

age 21 to 25 | $191 | $109 | $70 | $53 |

age 26 to 30 | $247 | $109 | $70 | $53 |

age 31 to 35 | $300 | $168 | $102 | $72 |

age 36 to 40 | $334 | $168 | $102 | $72 |

age 41 to 45 | $754 | $328 | $162 | $112 |

Add-ons and Riders for AIA Health Insurance HealthShield

AIA Max VitalHealth

AIA Max VitalHealth is an AIA health insurance rider to enhance your medical coverage and reduce your out-of-pocket expenses. There are 3 VitalHealth options available:

- AIA Max Vital Health A - for Private hospitals, standard room and below

- AIA Max Vital Health B - for Public hospital, A class ward and below

- AIA Max Vital Health B Lite - for Public hospital, B1 class ward and below

AIA Max VitalHealth A | AIA Max VitalHealth B | AIA Max VitalHealth B Lite | |

|---|---|---|---|

Deductible (if treated by AIA preferred Providers) | Reimburses Deductible and Co-insurance as incurred under AIA HealthShield Gold Max | Reimburses Deductible and Co-insurance as incurred under AIA HealthShield Gold Max | Reimburses Deductible and Co-insurance as incurred under AIA HealthShield Gold Max |

Co-insurance (if treated by AIA preferred Providers) | Subject to 5% co-payment per claim on the eligible medical bill, capped at S$3,000 per policy year | Subject to 5% co-payment per claim on the eligible medical bill, capped at S$3,000 per policy year | Subject to 5% co-payment per claim on the eligible medical bill, capped at S$3,000 per policy year |

Post-Hospitalisation Alternative Medicine Benefit for Cancer and Stroke | S$5,000 per policy year | S$3,000 per policy year | S$1,000 per policy year |

Early Detection Screening Benefit |

| ☓ | ☓ |

For AIA Max VitalHealth A, you can choose if you want the optional booster - emergency and outpatient care booster. This booster contains:

- Emergency Outpatient Treatment due to Accident Benefit + Post A&E Treatment- up to $2,000 per policy year

- Ambulance Service Benefit - $250 per confinement, per treatment

- Outpatient Treatment for Hand, Food and Mouth Disease (HFMD) & Dengue Fever - $300 per policy year

- Emergency Medical Evacuation & Repatriation: $50,000 per policy year

Is AIA Health Insurance HealthShield the best health insurance plan for you?

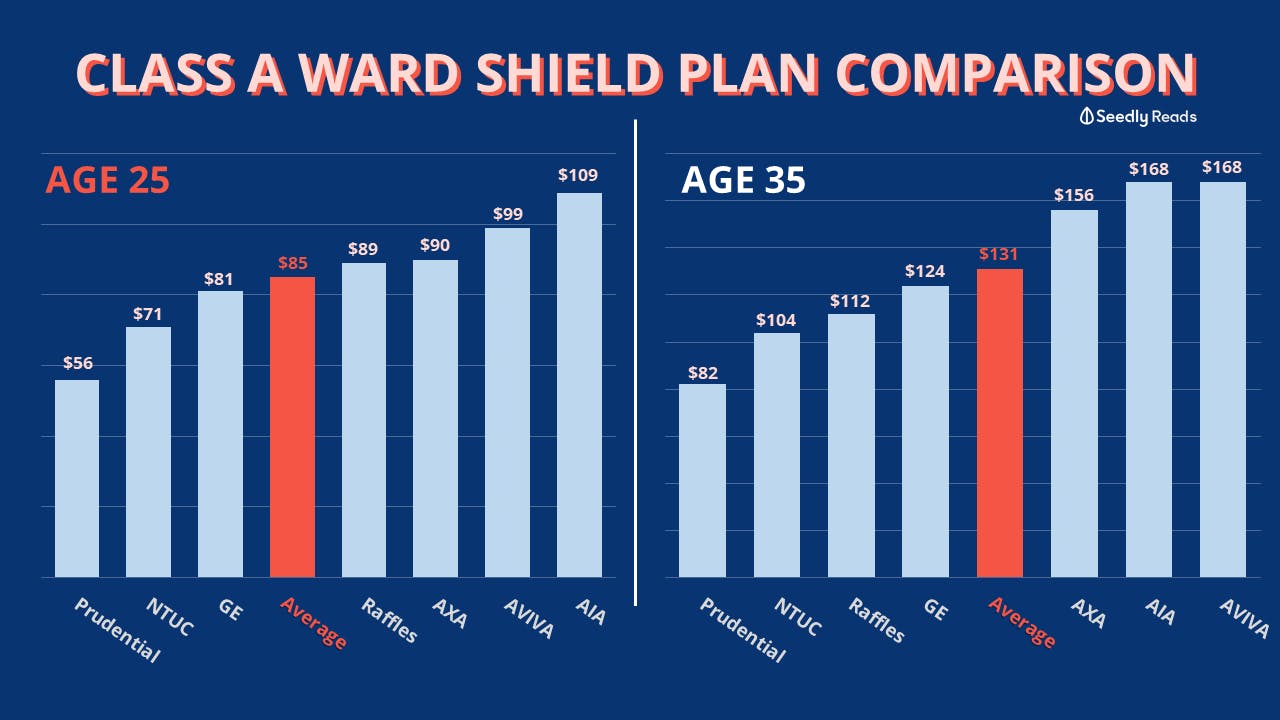

How does AIA Integrated Shield Plan compare with others?

Benefits:

Price-wise, AIA offers one of the most competitive rates for Integrated Shield Plans for Private Hospitals Ward Entitlement.

AIA HealthShield Gold Max plan A offers the highest policy limit of S$2,000,000 per year. It also has the longest pre- and post-hospitalisation benefit coverages if you use their AIA panel providers.

AIA HealthShield also offers one of the largest coverages for critical illnesses for up 30 different types, up to S$100,000 per policy year.

For Class A, Class B and Standard plans at restructured hospitals, AIA HealthShield is pricier than average. If you're looking for something cheaper, you are better off opting for other plans from providers like Prudential's PRUShield Plus or NTUC Enhanced IncomeShield Advantage. But note that those other plans do not cover critical illness so extensively.

Eligibility: Who can apply for AIA Health Insurance HealthShield Gold Max?

- Citizenship Status: Singaporeans and Permanent Residents

- Age: up to 75 years of Age

AIA Health Insurance HealthShield Gold Max Quote

- Visit AIA's website for more details on the coverage, exclusions, and quote

Contact us at [email protected] should you require any assistance or spot any inaccuracies

Advertisement

Make your health a priority. Exercise regularly, eat wholesome foods, and practice gratitude for a well-rounded approach to wellness.

https://ohanaphysiotherapy.com.au/

physiotherapist gold coast