Great Eastern GREAT SupremeHealth Integrated Shield Plan

- Key Features

- Reviews (10)

- Discussions (0)

- More Details

Advertisement

Great Eastern GREAT SupremeHealth Integrated Shield Plan

Great Eastern GREAT SupremeHealth Integrated Shield Plan

This product is managed by Great Eastern.

Summary

Product Page Transparency

- Claimed in November 2020

Great Eastern GREAT SupremeHealth Integrated Shield Plan Health Insurance 2024

- GREAT SupremeHealth is a Great Eastern Integrated Shield Plan (IP) initiative that supplements your MediLife Shield. IPs are health insurance than cover hospitalisation.

- GREAT SupremeHealth's prices are one of the most competitive in general across all tiers of plans, from Standard to Class A, within the age group of 25 to 45.

- SupremeHealth has 3 tiers: B Plus, A Plus, and P Plus

(apart from the Standard Plan) - Policy Yearly Limit: S$500,000, S$1,000,000 and S$1,500,000

- Ward entitlement

- B Plus: to standard B1 ward at Restructured Hospitals,

- A Plus: up to Class A wards at Restructured Hospital,

- P Plus: any standard ward in Private or Restructured Hospitals - Offers Lifetime coverage

- Pre-hospitalisation benefit of up to 120 days, and

- One of the longest post- hospitalisation coverage of up to 365 days

- To customise payment and coverage, there are 2 riders available - GREAT TotalCare, the optional IP rider to SupremeHealth, and GREAT TotalCare Plus, an additional supplementary rider-on-rider to GREAT TotalCare.

- Health Connect is a hotline for GREAT SupremeHealth policyholders to understand your claims and enquire for pre-authorisation before any hospital admission

Popular Products

4.4

306 Reviews

4.5

83 Reviews

4.2

20 Reviews

3.7

25 Reviews

Summary

Product Page Transparency

- Claimed in November 2020

Great Eastern GREAT SupremeHealth Integrated Shield Plan Health Insurance 2024

- GREAT SupremeHealth is a Great Eastern Integrated Shield Plan (IP) initiative that supplements your MediLife Shield. IPs are health insurance than cover hospitalisation.

- GREAT SupremeHealth's prices are one of the most competitive in general across all tiers of plans, from Standard to Class A, within the age group of 25 to 45.

- SupremeHealth has 3 tiers: B Plus, A Plus, and P Plus

(apart from the Standard Plan) - Policy Yearly Limit: S$500,000, S$1,000,000 and S$1,500,000

- Ward entitlement

- B Plus: to standard B1 ward at Restructured Hospitals,

- A Plus: up to Class A wards at Restructured Hospital,

- P Plus: any standard ward in Private or Restructured Hospitals - Offers Lifetime coverage

- Pre-hospitalisation benefit of up to 120 days, and

- One of the longest post- hospitalisation coverage of up to 365 days

- To customise payment and coverage, there are 2 riders available - GREAT TotalCare, the optional IP rider to SupremeHealth, and GREAT TotalCare Plus, an additional supplementary rider-on-rider to GREAT TotalCare.

- Health Connect is a hotline for GREAT SupremeHealth policyholders to understand your claims and enquire for pre-authorisation before any hospital admission

Plans (4)

GREAT SupremeHealth P Plus

$1,500,000

LIMIT PER POLICY YEAR

120 / 365 days

PRE & POST HOSPITAL

As Charged

OUTPATIENT BENEFITS

Private Hospital

WARD ENTITLEMENT

4.4

10 Reviews

High to Low

Posted 18 May 2025

Purchased

GREAT SupremeHealth A Plus

Very robust policy and professional agents. The claims process was moderately fast and efficient for me0

What are your thoughts?Posted 06 Mar 2022

Purchased

GREAT SupremeHealth P Plus

[Claims Process] with the help of great eastern's very own e-connect portal, it was extremely convenient for me to book an appointment with a specialist for an endoscopy. I was suffering from suspected chronic gastritis at that point in time and even with a referral from a GP, i had to wait nearly 4 months just to get an appointment with a doctor at a government hospital. Thankfully, with this IP plan, i did not have to wait for long and managed to get my day surgery done and the claims process was extremely fast also due to my agent being very responsive.0

What are your thoughts?27 Jun 2021

Purchased

GREAT SupremeHealth A Plus

My agent has been very helpful and transparent with the application process, policy changes and any supplemental benefits (e.g. free dengue and Covid insurance). Personally I haven't made any claims. My dad who has the same insurance had to make claims for hospitalization and it was a breeze, thank goodness. Good experience with GE so far.1

What are your thoughts?Great Eastern Singapore

29 Jun 2021

Reply

Save

11 Oct 2020

Purchased

GREAT SupremeHealth B Plus

I got to know my financial advisor through a friend. After hearing from the advisor and doing my own research, I got my entire family covered with this ISP at the start of 2020. My advisor is knowledgeable and professional. Paperwork was a breeze (every single thing was done on an iPad) and we got ourselves covered real quick.0

What are your thoughts?23 Aug 2020

Purchased

GREAT SupremeHealth P Plus

Decent plan with 100% coverage with the addition of a rider. Newer plans might not have the 100% coverage but instead close to 90 over percent but they pay a lower premium1

What are your thoughts?Hi, with effect from this year March, there's no more 100% coverage for GE even for policies purchased before 2018.

Reply

Save

15 Jul 2020

Purchased

GREAT SupremeHealth B Plus

[Agent Responsiveness] [Customer Service] My agent is awesome. I had a great customer experience with GE for other policies. It was easy to self-help on their portal too.0

What are your thoughts?08 Jul 2020

Purchased

GREAT SupremeHealth A Plus

[Claims Process] Easy [Customer Service] Awesome [Agent Responsiveness] Immediate At the end of the day, to me every client has different needs and wants. The relationship between agent and client lays the foundation of the loyalty to the insuring company. You should pay what you feel is value for money with coverage, price and agent-client relationship as a means to compare.0

What are your thoughts?Posted 30 Sep 2025

Purchased

GREAT SupremeHealth P Plus

GREAT SupremeHealth is a Great Eastern Integrated Shield Plan (IP) initiative that supplements your MediLife Shield. IPs are health insurance than cover hospitalisation.0

What are your thoughts?08 Jul 2020

Purchased

GREAT SupremeHealth P Plus

[Claims Process] Relatively fuss free with e-filing at admission. Claim was processed within 2 weeks and settled. Happy with the service.0

What are your thoughts?02 Mar 2021

Purchased

GREAT SupremeHealth P Plus

It is very challenging to get pre authorisation approved while I was in an emergency condition. Phoned in to call center, the online officer Chris’ response is seen as as insult to the customer. He used phrase “ enjoy our money” making nasty comments. Which is very unprofessional.1

What are your thoughts?Great Eastern Singapore

24 Mar 2021

Hi Yan, thank you for reaching out to us on our hotline. We are glad to have resolved your matter. Thank you for your support.

Reply

Save

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

4.4

306 Reviews

4.5

83 Reviews

4.2

20 Reviews

3.7

25 Reviews

GREAT SupremeHealth Integrated Shield Plan Benefits at a Glance

- GREAT SupremeHealth Plans from the cheapest to the most premium:

- B Plus

- A Plus

- P Plus - All 3 plans cover the same areas but with different levels of coverage.

- Inpatient and Day Surgery Benefits as charged

- Enjoy Up to $1.5 million in policy yearly limit

- Pre-Hospitalisation Benefits up to 120 days, Post-Hospitalisation Benefits for Up to 365 days

- Outpatient Hospital Benefits (including chemotherapy, other cancer treatments, and kidney dialysis)

- Covers Psychiatric Treatments

- Covers Congenital Abnormalities and

- Overseas Emergency Medical Treatments

- Get access to Great Eastern's health insurance claims helpline, Health Connect, for enquiries and pre-authorisation

What does GREAT SupremeHealth Cover?

Benefit Parameters | Great SupremeHealth P Plus | Great SupremeHealth A Plus | Great SupremeHealth B Plus |

|---|---|---|---|

Ward Entitlement | Private & Restructured Hospitals | Restructured Hospitals, Class A Wards & lower | Restructured Hospitals, Class B1 Wards & lower |

Policy Yearly Limit | S$1,500,000 | S$1,000,000 | S$500,000 |

Inpatient Treatments & Day Surgeries | ✓ as charged | ✓ as charged | ✓ as charged |

Pre-hospitalisation Coverage | ✓ as charged, within 120 days before hospitalisation | ✓ as charged, within 120 days before hospitalisation | ✓ as charged, within 120 days before hospitalisation |

Post-hospitalisation Coverage | ✓ within 365 days with a certificate of pre-authorisation OR within 180 days after hospitalisation | ✓ within 365 days with a certificate of pre-authorisation OR within 180 days after hospitalisation | ✓ within 365 days with a certificate of pre-authorisation OR within 180 days after hospitalisation |

Outpatient Treatment | ✓ as charged | ✓ as charged | ✓ as charged |

Major Organ Transplant | S$60,000 per Transplant | S$40,000 per Transplant | S$20,000 per Transplant |

Emergency Overseas Treatment | As charged, limited to Singapore Private Hospital charges | As charged, limited to Singapore Restructured Hospitals, Class A Ward charges | As charged, limited to Singapore Restructured Hospitals, Class B1 Ward charges |

Add-on Rider for GREAT SupremeHealth : GREAT TotalCare

GREAT TotalCare is a rider on top of SupremeHealth Integrated Shield Plan to enhance your medical coverage and reduce your out-of-pocket expenses.

On top of GREAT TotalCare, you can also add GREAT TotalCare Plus for additional coverage benefits.

2 riders for Great Eastern Integrated Shield Plan Health Insurance:

- GREAT TotalCare - Elite & Classic

- GREAT TotalCare Plus

GREAT TotalCare Rider

- Enhanced coverage to cover up to 95% of your total hospitalisation bill

- 7 special benefits for out-of-hospital expenses like Home Health Care, Hospice Care, and Companion Accommodation

- Caps out-of-pocket expenses to S$3,000 if you have the pre-authorisation letter from Health Connect

- GREAT TotalCare rider splits further into 2 tiers: Elite and Classic

What is the difference between Great Eastern Shield Riders? TotalCare Elite vs TotalCare Classic

The Co-payment (i.e. out of pocket expenses) portion under GREAT TotalCare (ELITE) is 5% of your total eligible bill.

The Co-payment portion for GREAT TotalCare (CLASSIC) is either the Deductible OR 5% of your total eligible bill, whichever is higher.

GREAT TotalCare Rider Plus

- Emergency and non-emergency medical treatment overseas

- Comprehensive Cancer Treatment Benefits

- Additional Benefits of Emergency Assistance Services, and Non-Emergency Overseas Treatment Coverage

How much does GREAT SupremeHealth Integrated Shield Plan cost?

Below, we break down the cost of Great Eastern's Integrated Shield Plan, GREAT SupremeHealth Premium by Plans and age groups:

*assuming the insured is a Singaporean Citizen or Permanent Resident. Premiums also exclude MediShield Life Premiums

Age Next Birthday | GREAT SupremeHealth P Plus | GREAT SupremeHealth A Plus | GREAT SupremeHealth B Plus | GREAT SupremeHealth Standard |

|---|---|---|---|---|

21 to 25 years old | $233 | $81 | $69 | $33 |

26 to 30 years old | $233 | $81 | $69 | $33 |

31 to 35 years old | $286 | $124 | $70 | $48 |

36 to 40 years old | $299 | $124 | $72 | $48 |

41 to 45 years old | $638 | $228 | $132 | $76 |

* Note: Premiums in the table above exclude MediShield Life Premiums

Is Great Eastern's Integrated Shield Plan, GREAT SupremeHealth, the best health insurance plan for you?

How does Great Eastern's Shield Plan compare with others?

Benefits:

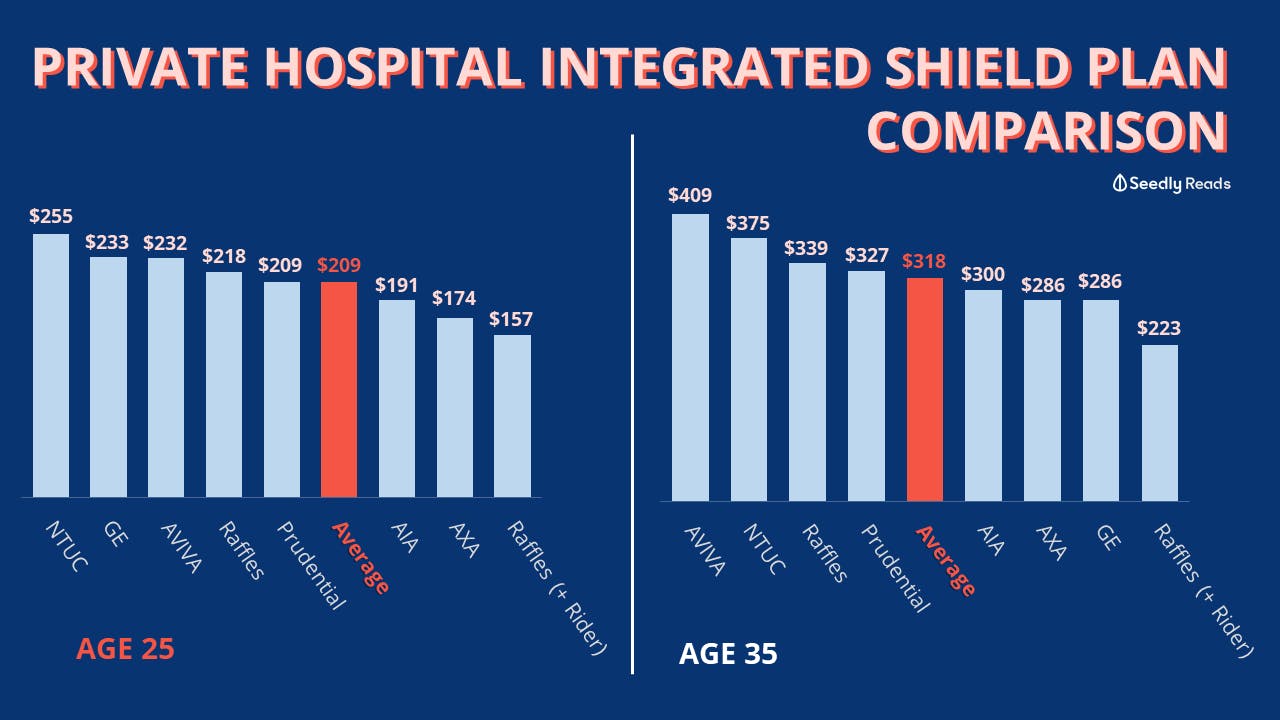

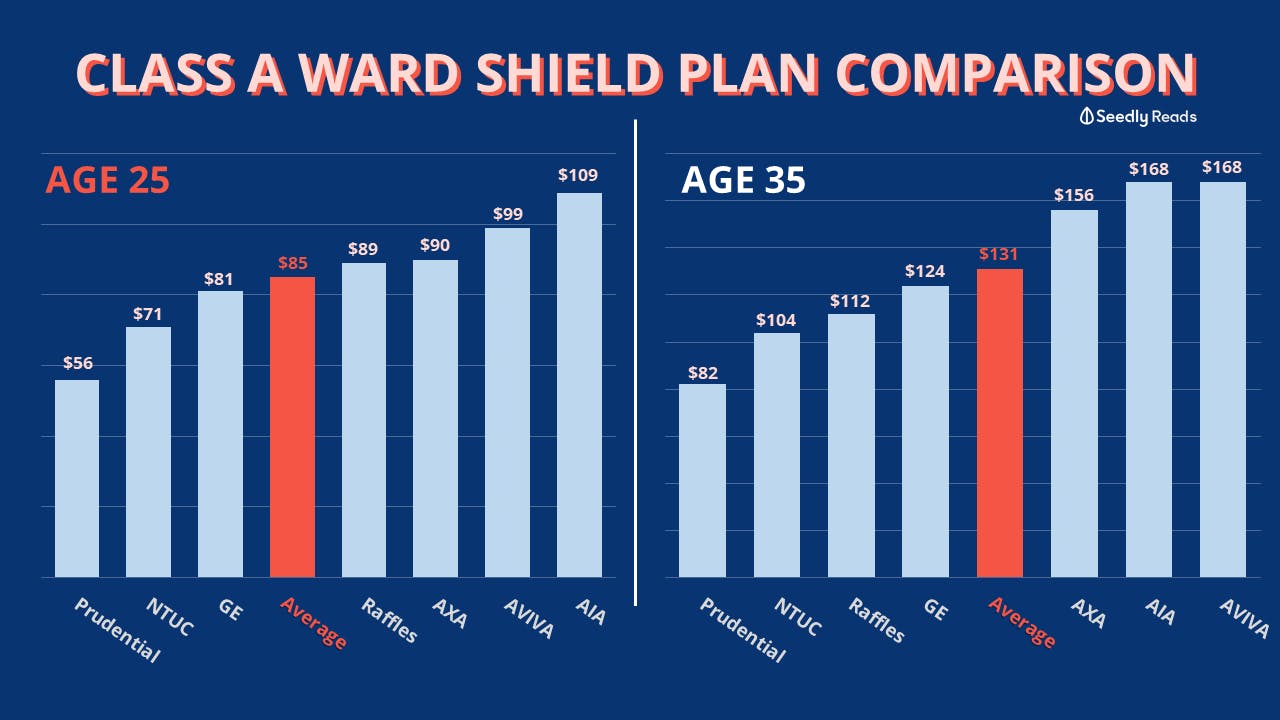

- GREAT SupremeHealth's prices are one of the most competitive in general across all tiers of plans, within the age group of 25 to 45.

- Great Eastern GREAT SupremeHealth Standard has the cheapest Standard Integrated Shield Plan. GE offers the lowest price for Standard IPs, throughout (analysing within the age group of 25 - 45).

- From our calculations, Great Eastern also offers one of the most competitive rates for Integrated Shield Plans for most of the other classes of IP from Class A Ward to Class B Ward Entitlement, for those ages between 25 to 40 years old.

- It also has one of the longest post-hospitalisation benefits, at 365 days. Yes, a whole entire year.

Cons:

- For private class wards at private hospitals, GREAT SupremeHealth is pricier than average at certain ages. From the graph above, GE Private Shield Plan premium is cheaper than average at age 35, but more expensive than average at 25. Hence, it is important to take note of your age progression and your resulting increase in premiums

Eligibility: Who can apply for Great Eastern Integrated Shield Plan, GREAT SupremeHealth?

- Citizenship Status: Singaporeans and Permanent Residents

- Age: up to 75 years of Age

Get a Quote for Great Eastern's IP - GREAT SupremeHealth

- Visit Great Eastern's website for more details on the coverage, exclusions, and quote

Contact Great Eastern

- Customer Service: 1800 248 2888

- Product Enquiries: +65 6248 2211

Contact us at [email protected] should you require any assistance or spot any inaccuracies

Advertisement

Hi Clare, thank you for your kind support. We are pleased to know that you had a good experience with us. Have a good day and stay safe