Best Insurance Savings Plans in Singapore 2026

Find the top insurance savings plans in Singapore on Seedly. Read reviews to compare coverage, premiums, eligibility, and benefits. Apply on Seedly to secure your financial future.Updated February 2026Advertisement

Insurance Savings Plans

Get amazing deals when you sign up for new financial products on Seedly 🎁

4 Products Found

4.6

409 Reviews

User Experience

Customer Support

"This was one of my early days "investment" as I came across..." 1mth ago

4.4

202 Reviews

User Experience

Customer Support

"Singlife was giving good interest rate but you need to top up..." 1mth ago

4.1

15 Reviews

"used to use it in the past. nowadays not sure if is..." 10mth ago

4.3

10 Reviews

"Referral Code: R450740 Get additional 5 ~ 14% discount when you purchase for..." 4mth ago

Disclaimer: Products with a "Visit Site" button pay to access additional features

Seedly's Product Comparison Page Listing Guidelines

For Insurance Savings Plans products to be listed on Seedly's Product Comparison Page, they have to fulfil the following criteria:

- Policies protected under the Policy Owners’ Protection (PPF) Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC)

- Higher than 1% guaranteed and non-guaranteed returns

- Provides Life insurance coverage OR

- No lock-in period and monthly commitment

Insurance Savings Plans Reviews Singapore Review 2024

Insurance savings plans like Dash EasyEarn, GIGANTIQ, and the Singlife Account give you death coverage and returns that are similar to high-interest savings account... should you use them in your journey to personal finance independence and freedom?

And which insurance savings plan is the best?

Check out the reviews left by real users on SeedlyReviews to make a smarter decision before committing!

What is an Insurance Savings Plan and Do I Really Need One?

Insurance Savings Plan is a savings plan, with insurance coverage, that provides you with a significant rate of return similar to a high-interest rate savings account.

Insurance savings plans are flexible in their premium payments where you can choose a duration to spread out your premium payments (5 to 20 years), or pay in one lump-sum.

The high returns are possible due to investments that the insurers use your premiums to fund.

For Singtel Dash EasyEarn, GIGANTIQ, Singlife Account they are Insurance Savings Plans that are also Universal Life Insurance Plans.

If you're looking for a place to park some funds or monies which you might be using in the short-term, it's not a bad idea to consider insurance savings plan if the rate of return exceeds what you can get elsewhere. The fact that you can also get some form of protection by buying an insurance savings plan is also a plus — but that's not enough though!

What Is Universal Life Insurance?

Universal Life insurance policies typically consist of 2 parts:

- Savings - usually through investments done by the insurer with interests earned getting credited into your account

- Insurance - in the form of death payout benefits.

According to Tiq, their definition of Universal Life insurance is " a whole life insurance that offers flexibility in the amount and timing of premium payments. This plan pays a death benefit and allows the build-up of cash value through offering interest crediting rate."

What differentiates Universal Life Insurance from Life insurance?

Unlike regular whole life insurance, universal life insurance allows flexibility in premium payments. You do not need to pay a fixed amount, simply pay the minimum to keep your account and policy

What Is Covered by Insurance Savings Plans?

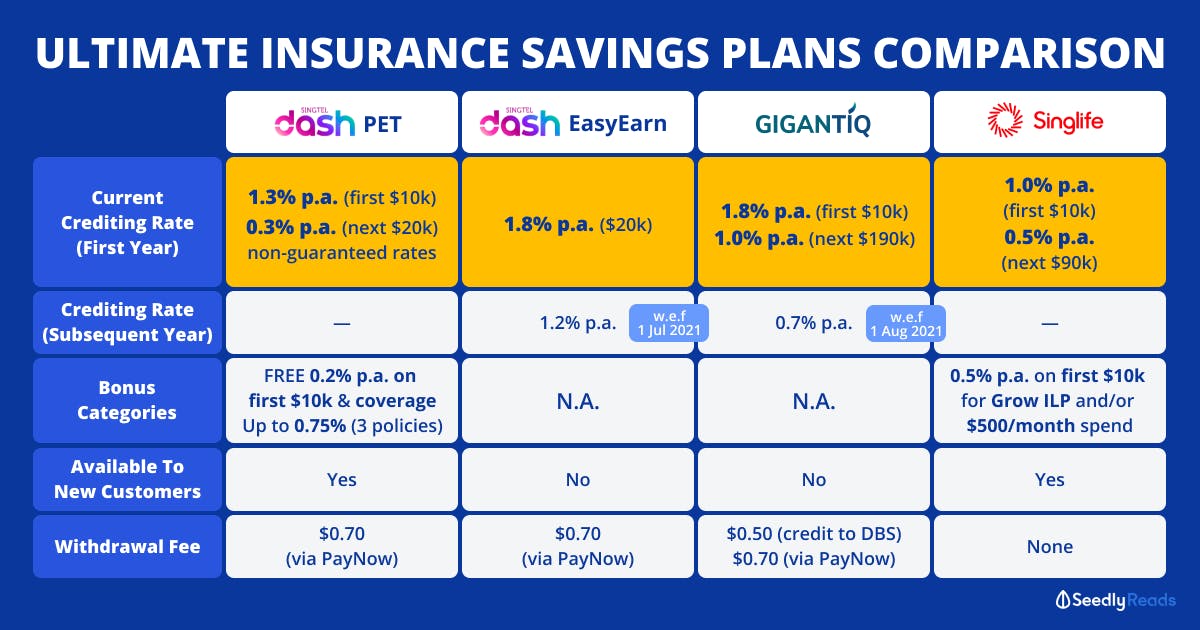

Here are their death benefit coverage and interest rates summarised:

Insurance Savings Plans | Rate of Return (p.a.) | Duration of Returns |

| Death Benefit |

|---|---|---|---|---|

1.5% guaranteed + 0.3% bonus Capped at: 1.8% first S$20k | Bonus returns (0.3%) only for the first policy year |

| 105% | |

0.7% guaranteed + 0.8% bonus Capped at: 1.5% first S$10k, 1% above S$10k | Bonus returns (0.8%) only for the first policy year |

| 105% | |

1.0% non-guaranteed Capped at: 1.0% first S$10k, 0.5% next S$90k | - |

| Up to 105% | |

1.3% non-guaranteed + 0.2% bonus Capped at: 1.3% for the first $10k, 0.3% for amounts above $10k | Non-guaranteed 1.3% p.a. + 0.2% p.a. bonus for the first policy year |

| Up to 105% |

Summary of death benefit coverage and interest rates for Dash EasyEarn, GIGANTIQ and Singlife Account:

How Much Does an Insurance Savings Plan Cost?

Singtel Dash EasyEarn, GIGANTIQ, and the Singlife Account are all single-premium plans which means you only need to pay the minimum premium once and you'll be covered for life until expiration or policy surrender.

The minimum account balance to start an insurance savings plan, as well as other fees, are as follows:

Plans | Minimum Initial Deposit | Minimum Account Balance | Minimum Top Up Amount | Withdrawal Fees |

|---|---|---|---|---|

Singtel Dash EasyEarn | S$2,000 | S$2,000 | S$500, or multiples of S$500 | S$0.70 for each withdrawal via PayNow |

GIGANTIQ | S$50 | S$50 | S$1 | S$0.50 for each withdrawal to a DBS/POSB account |

Singlife Account | S$500 | S$100 | No minimum | No fees |

Dash PET | S$50 | S$50 | S$1 Minimum S$50 top up applies via eNets | $0.70 admin fee applies for withdrawals via PayNow |

Which Insurance Savings Plan To Pick?

Dash PET vs Dash EasyEarn vs GIGANTIQ vs Singlife Account: Which of These Insurance Savings Plans is Right For You? Check out this comparison to find out!

If you're keen to know more about each plan, we've also broken down the pros and cons of each insurance savings plans in these individual articles:

Contact us at [email protected] should you require any assistance or spot any inaccuracies.