Tiq GIGANTIQ

- Key Features

- Reviews (10)

- Discussions (0)

- More Details

Advertisement

Tiq GIGANTIQ

Tiq GIGANTIQ

This product is managed by Etiqa.

Summary

Product Page Transparency

- Claimed in October 2020

GIGANTIQ Review 2024: Etiqa's All-in-One Insurance Savings Plan

GIGANTIQ is an insurance savings plan by Tiq Insurance that gives you a guaranteed 0.7% p.a. returns. There's also a bonus 0.8% p.a. return which you'll get on the first $10,000, for your first policy year.

On top of that, you'll also get a death benefit which pays up to 105% of your account value in the unfortunate situation of your demise.

Basically, the GIGANTIQ is a unique financial instrument which allows you to accumulate and grow your wealth while providing assurance in the form of a life insurance coverage, which provides a death benefit.

Even if you're a complete personal finance noob, GIGANTIQ is a product that is easily accessible.

In fact, you can start enjoying returns by depositing $50 into your GIGANTIQ account. Yep, that's all it takes.

It's highly liquid too, which means that you can withdraw your money anytime as there is no lock-in period.

If you'd like to earn more returns, you can make top-ups to your GIGANTIQ account via a simple bank transfer.

That's probably why it's such a gigantic success amongst those looking for a place to store emergency funds.

Popular Products

Summary

Product Page Transparency

- Claimed in October 2020

GIGANTIQ Review 2024: Etiqa's All-in-One Insurance Savings Plan

GIGANTIQ is an insurance savings plan by Tiq Insurance that gives you a guaranteed 0.7% p.a. returns. There's also a bonus 0.8% p.a. return which you'll get on the first $10,000, for your first policy year.

On top of that, you'll also get a death benefit which pays up to 105% of your account value in the unfortunate situation of your demise.

Basically, the GIGANTIQ is a unique financial instrument which allows you to accumulate and grow your wealth while providing assurance in the form of a life insurance coverage, which provides a death benefit.

Even if you're a complete personal finance noob, GIGANTIQ is a product that is easily accessible.

In fact, you can start enjoying returns by depositing $50 into your GIGANTIQ account. Yep, that's all it takes.

It's highly liquid too, which means that you can withdraw your money anytime as there is no lock-in period.

If you'd like to earn more returns, you can make top-ups to your GIGANTIQ account via a simple bank transfer.

That's probably why it's such a gigantic success amongst those looking for a place to store emergency funds.

GIGANTIQ

GIGANTIQ

$50

MIN. ACC BALANCE

0.7% guaranteed + 0.8% bonus

RATE OF RETURN

1.5% for first $10k

INTEREST CAP

4.3

10 Reviews

High to Low

Posted 02 Oct 2025

Purchased

GIGANTIQ

Referral Code: R450740 Get additional 5 ~ 14% discount when you purchase for TIQ BY ETIQA travel insurance and all other insurances! Travel Insurance - Extra 7% discount Private Car & Motorcycle, Personal Accident Insurance - Extra 5% discount Maid, Pet Insurance - Extra 14% discount Home Insurance - Extra 9% discount0

What are your thoughts?12 Jun 2021

Purchased

GIGANTIQ

[Interest Rate] 1.8% interest rate is one of the better insurance related plans out there [Application Process] Fast. No fuss [Customer Support ] Rather quick. Questions answered promptly [User Experience] Great app! Easy to sign in and check balances0

What are your thoughts?10 May 2021

Purchased

GIGANTIQ

Been a user since sept 2020 and am glad that the interest rate still remain at 2% with no changes in policy. Its a good place to park money and not withdraw in this low interest enviornment unless there is a need to or if other services provide better interest rate.0

What are your thoughts?17 Apr 2021

Purchased

GIGANTIQ

Applied for this for myself and my wife. The app is very engaging, though to track the balance, one has to use the Tiq by Etiqa app.0

What are your thoughts?Posted 17 Aug 2024

Purchased

GIGANTIQ

GIGANTIQ is an insurance savings plan by Tiq Insurance that gives you a guaranteed 0.7% p.a. returns. There's also a bonus 0.8% p.a. return which you'll get on the first $10,000, for your first policy year.0

What are your thoughts?Posted 09 Mar 2023

Purchased

GIGANTIQ

overall it is good product good rates would recommend to everyone. drawback is Time Period the customer service is friendly would recommend…0

What are your thoughts?Posted 26 Sep 2022

Purchased

GIGANTIQ

[User Experience] [Interest Rate] [Withdrawal Process] Surrendered the policy as the 0.7% pa is comparably low under the current savings climate. Have to maneuver around the app should one wishes to surrender policy with full withdrawal. Otherwise, partial withdrawal is still pretty visible. The funds were deposited into the designated bank account almost instantly.0

What are your thoughts?Posted 26 Sep 2021

Purchased

GIGANTIQ

A good 2% P.A interest credited monthly for the first year. Transfers are also processed right away. Moving on to other companies after the first year, since 0.7% PA, meh...0

What are your thoughts?Posted 03 Aug 2021

Purchased

GIGANTIQ

Easy to set up and decent yield of 2 percent for first year. A pity the yield will have to drop partly due to low interest environment. Hope will have better offer soon. thank u0

What are your thoughts?Posted 03 Apr 2025

Purchased

GIGANTIQ

good rates that i would recommend . the only disadvantage is take some time to process. quite user friendly0

What are your thoughts?

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

How Does GIGANTIQ Work?

By magic. LOL. JK.

GIGANTIQ is a single premium, yearly renewable, universal life plan.

It's a financial product that is a combination of a regular savings plan, insurance protection, and a traditional bank account.

The rate of returns aren't as great as what you'd get with high-interest bank savings accounts, but in this low-interest rate environment... a guaranteed 0.7% p.a. rate of return is pretty decent, no?

What Is the Highest Interest Rates for GIGANTIQ?

GIGANTIQ's rate of returns are pretty straightforward.

Effective from 1 August 2021 (inclusive) or your first policy anniversary date, whichever is later, the current crediting rate will be revised from 1.0% p.a. to 0.70% p.a.

For the first $10,000 during your first policy year, you'll earn the guaranteed 0.7% p.a. + a bonus 0.8% p.a. rate of return (1.5% p.a.).

Any other amount you put into your GIGANTIQ will just earn the guaranteed 0.7% p.a. rate of return.

If you want to increase your rate of return... just make more top-ups into your GIGANTIQ account.

The maximum amount which you can put into your GIGANTIQ account is $200,000.

But wait!

Before you throw all of your money into your GIGANTIQ account, take note that transactions fees will be charged for each partial withdrawal:

- via PayNow: $0.70 per transaction

- via Direct Credit (DBS or POSB): $0.50 per transaction

You'll also have to keep at least $50 in your GIGANTIQ account at ALL TIMES because if you don't, your policy will be de-activated if your average daily account value for the calendar month falls below $50.

An additional perk — that has yet to be released — is that you can earn up to 0.25% p.a. extra rate of return on the first $10,000 if you buy selected life or general insurance products which are offered as a supplementary rider under GIGANTIQ.

How Much Insurance Coverage Do I Get With GIGANTIQ?

If you suay suay die while your policy is still in effect, Etiqa will pay you 105% of your account value after subtracting whatever amount you owe them.

They will also pay out 105% of your account value when the policy matures immediately before you turn 100 years old.

Congratulations on turning 100, by the way!

GIGANTIQ Features To Take Note Of

- GIGANTIQ is an insurance savings plan that gives you a guaranteed 0.7% p.a. rate of return

- The policy will be automatically renewed after the one year mark UNLESS you write to Etiqa to request for a policy termination

- If your average daily account value for the calendar month falls below $50, your policy will be de-activated and you won't earn the stipulated rate of return

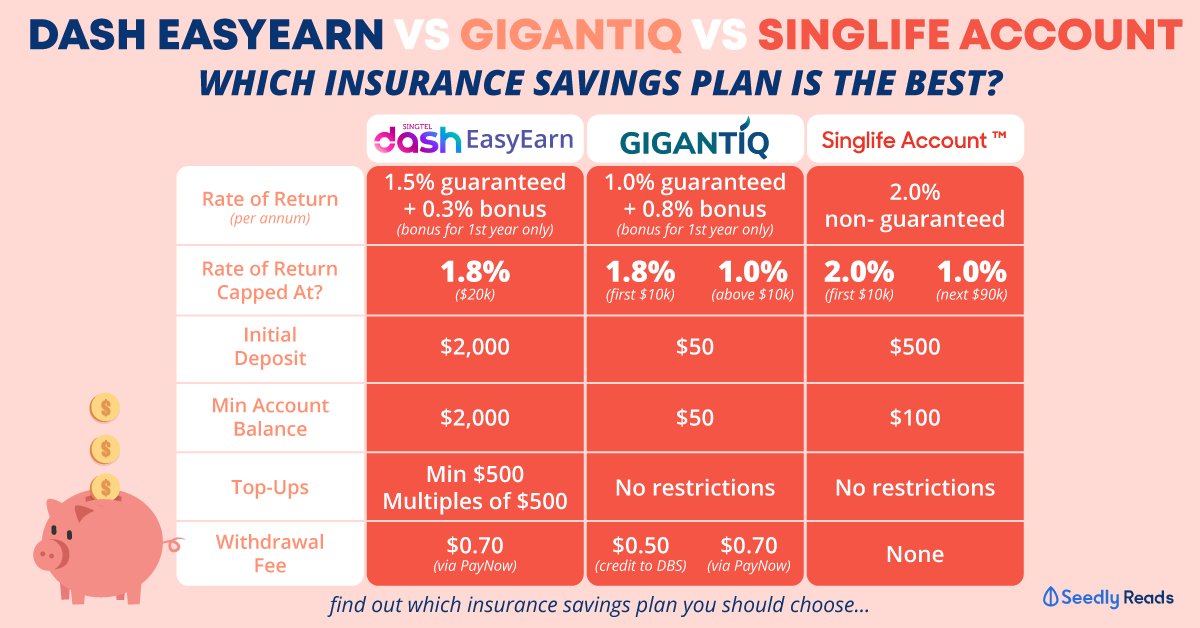

Is GIGANTIQ the Best Insurance Savings Plan in 2021?

Besides the GIGANTIQ, did you know that there's also Dash EasyEarn and the Singlife Account?

Which begets the question: is the GIGANTIQ the best insurance savings plan out there?

Check out our Insurance Savings Plan Guide where we discuss what are the differences between the different insurance savings plans and

Who Can Apply for GIGANTIQ?

If you confirm plus chop wanna get GIGANTIQ, you'll need to fulfil the following eligibility criteria:

- You are a Singapore citizen or PR with a valid NRIC, OR

- You are a foreigner with a valid work pass or permit, or a Long-Term Visit Pass

- You are between 17 to 75 years old (age as of next birthday)

- You have proof of residence (eg. bills or statements)

Oh, and by the way, each person can only have ONE GIGANTIQ plan at a time.

How Do I Apply for GIGANTIQ?

It's pretty simple.

- Download the Tiq by Etiqa app

- Register for an account

- Sign up for a GIGANTIQ plan (FYI: you'll need a photo ID for verification)

And that's it.

Toldja it was simple.

What Are the Fees and Charges for GIGANTIQ?

Although there isn't any fall-below fee with the GIGANTIQ, there are some fees and charges that you might wanna take note of:

- Minimum account balance: $50

- Minimum account top-up: $1

- $0.50 for each transaction via Direct Credit (DBS or POSB account)

- $0.70 for each transaction via PayNow

How To Contact Tiq by Etiqa

- Customer Service Tel: +65 6887 8777

- Main Office Tel: +65 6336 0477

Contact us at [email protected] should you require any assistance or spot any inaccuracies.

Advertisement