Singtel Dash EasyEarn

- Key Features

- Reviews (15)

- Discussions (0)

- More Details

Advertisement

Singtel Dash EasyEarn

Singtel Dash EasyEarn

This product is managed by Singtel Dash.

Summary

Product Page Transparency

- Claimed in November 2020

Singtel Dash EasyEarn Review 2024: A Way To Take Your Savings Higher

Dash EasyEarn is an insurance savings plan underwritten by Etiqa Insurance that is made available to Singtel Dash users.

It gives you a guaranteed 1.50% p.a. rate of return, plus a bonus 0.3% p.a. rate of return on the first S$20,000 for the first policy year.

In terms of insurance coverage, Dash EasyEarn's death benefit covers up to 105% of your account value.

Interested in saving with Dash EasyEarn?

All you have to do is sign up to be a Dash user and top up a minimum amount of S$2,000 to get started.

If S$2,000 is too much for you, you can opt for the Dash EasyEarn Lite plan which gives you a 1.0% p.a. rate of return for your first policy year, and it only requires a minimum deposit of S$100.

Whichever plan you choose to go with, you can withdraw your money anytime as there's no lock-in period.

Popular Products

Summary

Product Page Transparency

- Claimed in November 2020

Singtel Dash EasyEarn Review 2024: A Way To Take Your Savings Higher

Dash EasyEarn is an insurance savings plan underwritten by Etiqa Insurance that is made available to Singtel Dash users.

It gives you a guaranteed 1.50% p.a. rate of return, plus a bonus 0.3% p.a. rate of return on the first S$20,000 for the first policy year.

In terms of insurance coverage, Dash EasyEarn's death benefit covers up to 105% of your account value.

Interested in saving with Dash EasyEarn?

All you have to do is sign up to be a Dash user and top up a minimum amount of S$2,000 to get started.

If S$2,000 is too much for you, you can opt for the Dash EasyEarn Lite plan which gives you a 1.0% p.a. rate of return for your first policy year, and it only requires a minimum deposit of S$100.

Whichever plan you choose to go with, you can withdraw your money anytime as there's no lock-in period.

Singtel Dash EasyEarn

Singtel Dash EasyEarn

$2,000

MIN. ACC BALANCE

1.5% guaranteed + 0.3% bonus

RATE OF RETURN

1.8% for first $20k

INTEREST CAP

4.1

15 Reviews

High to Low

Posted 21 Aug 2021

Purchased

Singtel Dash EasyEarn

[Interest Rate] Signed up for it when it first launched and was enjoying an interest rate of 2% per annum. After one year, the interest has been reduced to 1.2%, but it is still a better rate than most other insurance saving plans on the market. [User Experience] It’s very easy to navigate via the SingTel Dash app, you can view all the interests that had been credited since the start of the policy in a glance.0

What are your thoughts?10 May 2021

Purchased

Singtel Dash EasyEarn

Been a user since oct 2020 and am glad that the interest rate still remain at 2% with no changes in policy. Have not tried withdrawing the $$ yet as need to pay fees. Its a good place to park money and not withdraw in this low interest enviornment unless there is a need to or if other services provide better interest rate.0

What are your thoughts?30 Apr 2021

Purchased

Singtel Dash EasyEarn

Easy to use interface when transferring $ in, and gives a higher rate of returns. Only cons is that have to withdraw out in multiples of $100.0

What are your thoughts?26 Apr 2021

Purchased

Singtel Dash EasyEarn

Easy and Convenient experience with Dash EasyEarn so far! Signing up was straightforward and the UX/UI is nice & simple. Pretty decent rates as well, considering the low interest rate environment currently. Would recommend if you want to park cash to earn some interest while keeping it liquid.0

What are your thoughts?20 Apr 2021

Purchased

Singtel Dash EasyEarn

[Interest Rate] In this day and age of low interest rates, this is a good no-frills option to be used as a higher yield savings account. Interest is credited according to what's been committed with no risk of fluctuations like in cash management alternatives. [Withdrawal Process] To me, this is one of the biggest plus point for Dash - withdrawing into bank account is seamless and INSTANT. I've tried other options before that take between 1-3 hours to reflect the withdrawals [Others] The only other gripe I would have with this product is how the denominations for topping up and withdrawal are controlled ($500 for topping up, $100 for withdrawal)0

What are your thoughts?30 Nov 2020

Purchased

Singtel Dash EasyEarn

As an existing Dash user, it was quite intriguing to have this new product that I can park my savings aside, especially since banks have cut their rates. I closed my OCBC account and moved my money to DBS Multiplier, SingLife, Dash EasyEarn and recently Etiqa's Gigantiq to maximise whatever savings I could get and lock in the guaranteed 2%. At least I know my rates won't change until at least one year later, I'm okay with shifting money but it's still another step to take.. The signup process was very swift and I like that all the transactions are easily accessible on a single dashboard. Quite encouraging to see the daily interests increase and receive the SMS every month to know how much interests I've accumulated! I've also tried to withdraw money to Dash to spend and earn reward points, but haven't tried the withdrawal to bank account ($0.70 fee =.=) Overall, simple to signup and no-frills savings product!0

What are your thoughts?Posted 03 Apr 2025

Purchased

Singtel Dash EasyEarn

used to use it in the past. nowadays not sure if is good but can still give it a try. interest rate should be still not bad0

What are your thoughts?Posted 02 Aug 2024

Purchased

Singtel Dash EasyEarn

Dash EasyEarn is an insurance savings plan underwritten by Etiqa Insurance that is made available to Singtel Dash users.0

What are your thoughts?Posted 22 Oct 2021

Purchased

Singtel Dash EasyEarn

Been holding to easyearn for almost a year. With current low interest rate environment. 1.5% -1.8% interest rate is superb.0

What are your thoughts?16 Apr 2021

Purchased

Singtel Dash EasyEarn

My secondary option besides Singlife. The only con is that you can only withdraw in the multiple of 100.0

What are your thoughts?

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

Interest Rates for Singtel Dash EasyEarn

Dash EasyEarn | Dash EasyEarn Lite | |

|---|---|---|

Interest Rates | 1.5% p.a. guaranteed + 0.3% p.a. bonus for first policy year | 1.0% p.a. for the first policy year |

Premium Size | Save between S$2,000 - S$20,000 | Save between S$100 - S$2,000 |

Death Benefit | 105% | 105% |

Minimum Withdrawal Amount | S$100 | S$10 |

Singtel Dash EasyEarn Rate of Returns

How Does Singtel Dash EasyEarn Work?

EasyEarn is a single premium, universal life plan. It offers you some amount of protection and with the money from the one-time premium in your account, that also helps you earn attractive return rates. With no lock-in period, you can withdraw your money anytime. Essentially, it is an insurance savings plan.

EasyEarn has 2 tiers, regular Dash EasyEarn or Dash EasyEarn Lite. They differ in terms of rate of returns accruable, premium amount and withdrawal amount.

Dash EasyEarn:

- Earn 1.8% p.a. for the first policy year, starting with a minimum sum of S$2,000.

This 1.8% p.a. is made up 2 types of interest rates - a guaranteed 1.5%p.a. + 0.3% p.a. that is applicable in the first year of sign-up only. - Get insured for 105% of your total account balance in the event of death.

- If your daily average account balance falls below S$2,000, there will be no returns accruable.

Dash EasyEarn Lite:

- Earn 1.0% p.a. for the first policy year, starting with a minimum sum of S$100

- Get insured for 105% of your total account balance in the event of death.

- If your daily average account balance falls below S$100, there will be no returns accruable.

How to Earn the Highest Rate of Returns for Singtel Dash EasyEarn

How do you earn the highest rate of returns for Dash EasyEarn?

Dash EasyEarn's rate of returns is really straight-forward. The returns per annum for Dash EasyEarn is 1.8% p.a. for account balances of up to S$20,000 for the first policy year.

To earn more returns, simply top-up more into your account to earn from the 1.8% p.a. via your bank account. The total account is calculated by adding the accumulated rate of returns and any top-ups. While it might be a single premium policy, you can still top-up your account to increase the average daily balance for higher returns

However, if your daily average account balance falls below S$2,000, there will be no returns accruable.

Insurance Coverage by Singtel Dash EasyEarn

As a universal life plan, Singtel Dash EasyEarn covers you for 105% of your account balance upon death, and the minimum one-time premium is S$2,000.

If you'd like to be covered for more, simply top-up your Dash account.

A larger account balance also means you'll be earning more.

Benefits and Features of Singtel Dash EasyEarn

- In this low interest rate environment, EasyEarn has a relatively high interest rate compared to other Bank Savings Accounts but it is not the highest rate of return enjoyable amongst all the Insurance Savings Plans.

- EasyEarn gives you full access and flexibility to your savings with liquidity

To withdraw, make a request via the mobile app and choose to receive the partial withdrawal amount via PayNow (using your NRIC) or to your own POSB or DBS account via direct credit. However, the minimum amount for withdrawal is S$200 for the Dash EasyEarn plan, and S$10 for EasyEarn Lite.

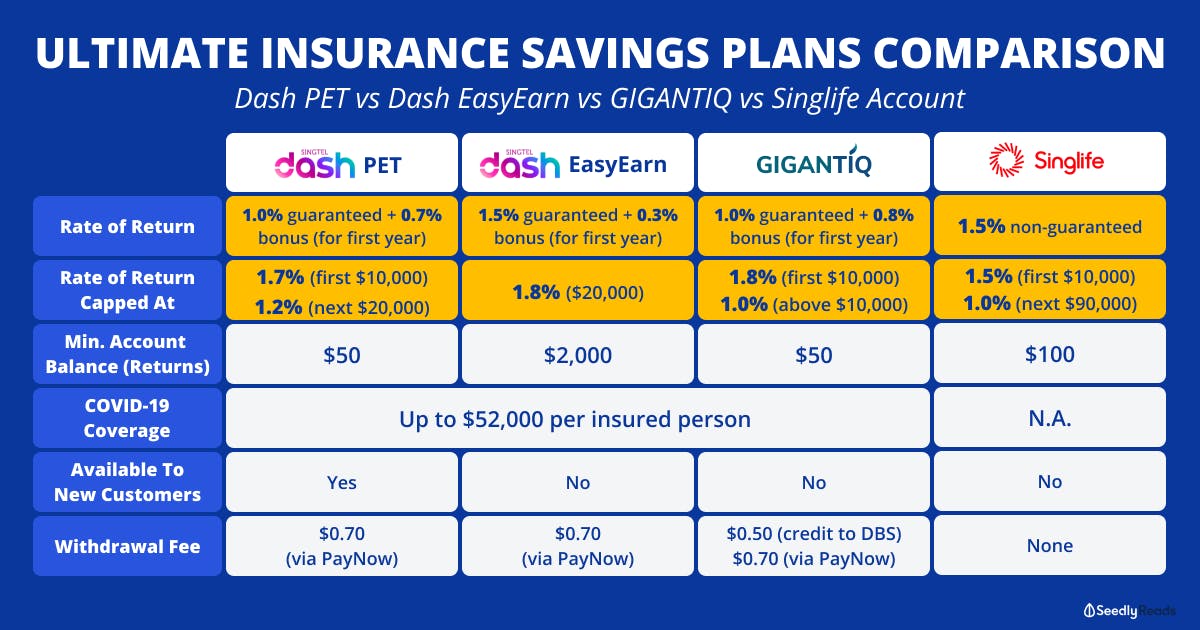

Singlife vs GIGANTIQ vs Dash EasyEarn

Between these 3 new insurance savings plans, what are the differences and which is the best for you?

Check out our Insurance Savings Plan Comparison Guide to find out if Dash EasyEarn is the best insurance savings plan!

How Do I Apply for Singtel Dash EasyEarn?

- Download and Launch the Singtel Dash App

- Tap 'Grow Money'

- Sign up for Dash EasyEarn by filling in your particulars and verifying your identity with a valid photo ID

- Top up your Dash EasyEarn account and start growing your savings!

Who Can Apply For Singtel Dash EasyEarn?

Currently, EasyEarn is only available to Singtel Dash users.

On top of that, you'll need to fulfill the following eligibility criteria:

- You are a Singapore citizen or PR with a valid NRIC, OR

- You are a foreigner with a valid work pass or permit, or a Long-Term Visit Pass

- You are between 17 to 75 years old (age as of next birthday)

Not sure if you're eligible?

Chill. Just sign up or log in to your Singtel Dash app to check your eligibility.

Fees and Charges for Singtel Dash EasyEarn

- A transaction fee of S$0.70 will be charged for each partial withdrawal request. However, no transaction fee is applicable for partial withdrawal request into Dash Wallet.

- Minimum Withdrawal Amount: S$100 for EasyEarn, and S$10 for EasyEarn Lite

- Minimum Top-up: S$500 for EasyEarn, S$50 for EasyEarn Lite.

Contact Etiqa

- Customer Service Tel: +65 6887 8777

- Main Office Tel: +65 6336 0477

- Address: 16 Raffles Quay, Hong Leong Building, #01-04A, Singapore 048581

Contact us at [email protected] should you require any assistance or spot any inaccuracies.

Advertisement