Singtel Dash PET 2

- Key Features

- Reviews (409)

- Discussions (0)

- More Details

Advertisement

Singtel Dash PET 2

Singtel Dash PET 2

This product is managed by Singtel Dash.

Summary

Product Page Transparency

- Claimed in March 2021

Singtel Dash PET Review 2024

Dash PET 2 is an insurance savings plan underwritten by Etiqa Insurance made available to Singtel Dash users, that lets you save and protect yourself better with 100% capital guaranteed! By simply saving, you earn 1.0%* p.a. base return on your flexible basic plan + up to 3.20% p.a. returns when you add on 1/3/5-year fixed plans.

How does Dash PET 2 take care of you?

Protect:

• Enjoy FREE life protection of 105% account value

• More add-on protections from just 2 cents a day

Earn:

• Save from just S$50 with 100% capital guaranteed and earn up to 17.06% returns upon maturity

• Stack bonus returns of up to 0.75%^ p.a. with add-on protections

• Interest is accrued daily and credited monthly

Transact:

• No restrictions on how you can use your basic account. Use it to pay premiums for your insurance protection or for everyday expenses.

Launch ‘Grow Money’ on your Singtel Dash app to sign up! Visit dash.com.sg/dashpet2 for more info.

Important Notes

Dash PET 2 is not a bank account or a fixed deposit. It is an insurance savings plan that earns a crediting interest rate. Please visit https://tiq.com.sg/dash-plans-crediting-rates/ for the latest updates on the prevailing crediting rates for your plans. Terms apply. This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K). Protected up to specified limits by SDIC.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Information is accurate as of 30 May 2023. This advertisement has not been reviewed by the Monetary Authority of Singapore.

*Crediting rate for the basic plan is non-guaranteed.

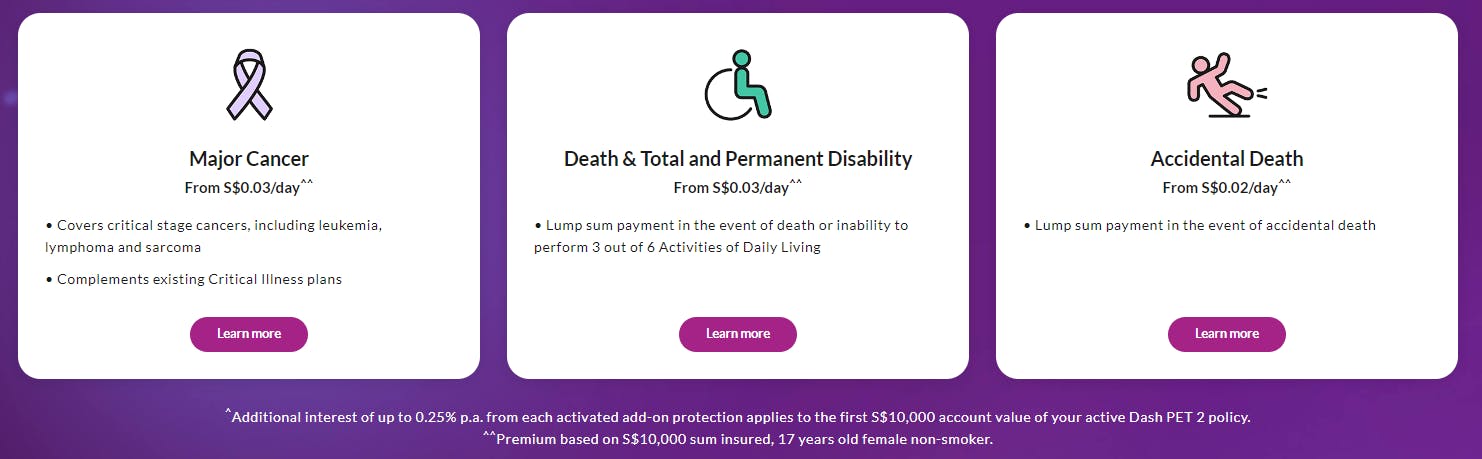

^Additional interest of up to 0.25% p.a. from each activated add-on protection applies to the first S$10,000 account value of your active Dash PET 2 policy.

Popular Products

Summary

Product Page Transparency

- Claimed in March 2021

Singtel Dash PET Review 2024

Dash PET 2 is an insurance savings plan underwritten by Etiqa Insurance made available to Singtel Dash users, that lets you save and protect yourself better with 100% capital guaranteed! By simply saving, you earn 1.0%* p.a. base return on your flexible basic plan + up to 3.20% p.a. returns when you add on 1/3/5-year fixed plans.

How does Dash PET 2 take care of you?

Protect:

• Enjoy FREE life protection of 105% account value

• More add-on protections from just 2 cents a day

Earn:

• Save from just S$50 with 100% capital guaranteed and earn up to 17.06% returns upon maturity

• Stack bonus returns of up to 0.75%^ p.a. with add-on protections

• Interest is accrued daily and credited monthly

Transact:

• No restrictions on how you can use your basic account. Use it to pay premiums for your insurance protection or for everyday expenses.

Launch ‘Grow Money’ on your Singtel Dash app to sign up! Visit dash.com.sg/dashpet2 for more info.

Important Notes

Dash PET 2 is not a bank account or a fixed deposit. It is an insurance savings plan that earns a crediting interest rate. Please visit https://tiq.com.sg/dash-plans-crediting-rates/ for the latest updates on the prevailing crediting rates for your plans. Terms apply. This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K). Protected up to specified limits by SDIC.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Information is accurate as of 30 May 2023. This advertisement has not been reviewed by the Monetary Authority of Singapore.

*Crediting rate for the basic plan is non-guaranteed.

^Additional interest of up to 0.25% p.a. from each activated add-on protection applies to the first S$10,000 account value of your active Dash PET 2 policy.

Singtel Dash PET

Singtel Dash PET

$50

MIN. ACC BALANCE

1.0%* p.a. base return + up to 3.20% p.a. returns on your fixed plan riders

RATE OF RETURN

Up to 3.20% p.a. for the first S$200K

INTEREST CAP

4.6

409 Reviews

Service Rating

User Experience

Customer Support

High to Low

Posted 17 Jan 2026

Purchased

Singtel Dash PET

This was one of my early days "investment" as I came across due to being a Singtel customer. The returns was not bad but subsequent, I closed it as I need to withdraw the funds.1

What are your thoughts?Reply

Save

Posted 18 Feb 2025

Purchased

Singtel Dash PET

Dash PET 2 is an insurance savings plan underwritten by Etiqa Insurance made available to Singtel Dash users, that lets you save and protect yourself better with 100% capital guaranteed! By simply saving, you earn 1.0%* p.a. base return on your flexible basic plan + up to 3.20% p.a. returns when you add on 1/3/5-year fixed plans.0

What are your thoughts?Posted 06 Aug 2024

Purchased

Singtel Dash PET

Dash PET 2 is an insurance savings plan offered by Etiqa Insurance, exclusively for Singtel Dash users. This plan guarantees 100% of your capital and provides an opportunity to save and protect your finances. With a base return of 1.0% per annum on your flexible basic plan, you can also earn up to 3.20% per annum by opting for additional 1/3/5-year fixed plans. [Interest Rate] [Hidden Terms] [Insurance Benefit]0

What are your thoughts?Posted 24 May 2024

Purchased

Singtel Dash PET

Used this in the past, the plan is very good. I feel the rates can be better and more competitive, thats the reason I switched my plan.0

What are your thoughts?Posted 25 Jul 2023

Purchased

Singtel Dash PET

The Singtel Dash PET 2 is a brilliant addition to the range of financial products offered to Singtel Dash users. As a policyholder, I am impressed with the flexibility and security this insurance savings plan provides. The 100% capital guarantee offers peace of mind, knowing that my savings are protected.0

What are your thoughts?Posted 11 Jul 2023

Purchased

Singtel Dash PET

app is easy and simple, fast withdrawal too, customer service is friendly and helpful the interest rate considered not as high as fds now though…0

What are your thoughts?Posted 02 Feb 2023

Purchased

Singtel Dash PET

Just sign up and start using it. It is quite useful and easy. There was reward given as well. Many feature under one app.0

What are your thoughts?Posted 30 Dec 2022

Purchased

Singtel Dash PET

[User Experience] easy to use interface. shows clearly on your account balance, interest gain and withdrawl all at one glance.0

What are your thoughts?Posted 27 Dec 2022

Purchased

Singtel Dash PET

[Withdrawal Process] Fast and relevent. Very useful everytime i withdraw i get it immediately. Recommendable with my family and friends.0

What are your thoughts?Posted 11 Dec 2022

Purchased

Singtel Dash PET

[Application Process] It was rather easy to start using SingTel Dash PET! [User Experience] The overall design and functionality of the platform is great!0

What are your thoughts?

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

Interest Rates for Singtel Dash PET 2

Interest Rates | 1.0%* p.a. base return + up to 3.20% p.a. returns on your fixed plan riders |

|---|---|

Minimum Deposit | S$50 |

Death Benefit | 105% |

Minimum Top Up Amount | S$1 |

Interest Rates for Singtel Dash PET 2

How Does Singtel Dash PET 2 Work?

Dash PET 2 is a single premium, insurance savings plan that offers savings at high returns, with 100% capital guaranteed and flexibility of funds on your basic plan.

How to Earn the Highest Rate of Returns for Singtel Dash PET 2

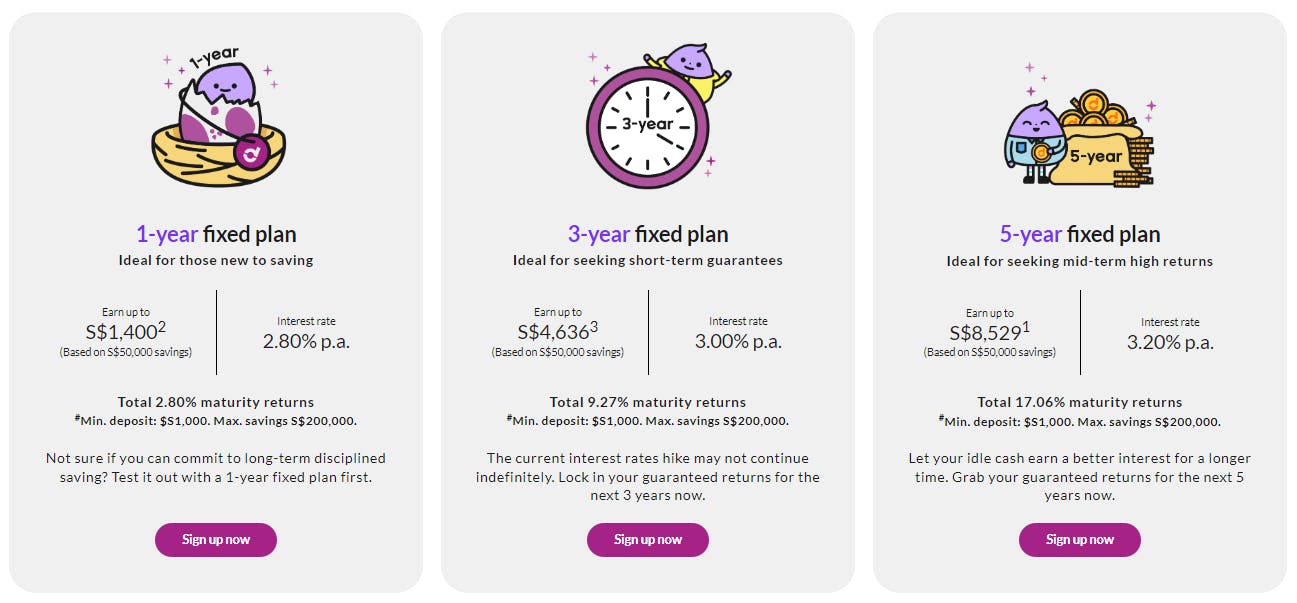

With the flexible basic plan, choose to add on 1/3/5-year fixed plan riders to your base plan as per your savings goal:

The longer you save, the MORE the returns!

Enjoy up to 0.75%^ p.a. additional interest on your Dash PET 2 savings when you add more coverage:

How Do I Apply for Singtel Dash PET 2?

- Download and Launch the Singtel Dash app

- Tap Grow Money

- Sign up for Dash PET 2 by filling in your particulars and verifying your identity with a valid photo ID

- Top up your Dash PET 2 account and start growing your savings!

Who Can Apply For Singtel Dash PET 2?

Currently, Dash PET 2 is only available to Singtel Dash users.

On top of that, you'll need to fulfil the following eligibility criteria:

- You are a Singapore citizen or PR with a valid NRIC, OR

- You are a foreigner with a valid work pass or permit, or a Long-Term Visit Pass

- You are between 17 to 75 years old (age as of next birthday)

Not sure if you're eligible?

Chill. Just sign up or log in to your Singtel Dash app to check your eligibility.

Already have Singtel Dash EasyEarn?

Even if you already have a Singtel Dash EasyEarn account, you can still sign up for Dash PET 2.

Important Notes

*Crediting rate for the basic plan is non-guaranteed.

1 This is based on a 5-year fixed plan with S$50,000 savings, which earns a guaranteed return of 3.20% p.a. and matures after 5 years.

2 This is based on a 1-year fixed plan with S$50,000 savings, which earns a guaranteed return of 2.80% p.a. and matures after 1 year.

3 This based on a 3-year fixed plan with S$50,000 savings, which earns a guaranteed return of 3.00% p.a. and matures after 3 years. #The minimum deposit per fixed plan is S$1,000, top-ups are not allowed. The aggregate cap for all Dash PET and Dash PET 2 policies and fixed plan riders per Life Insured is S$500,000. Dash PET 2 is not a bank account or a fixed deposit. It is an insurance savings plan that earns a crediting interest rate. Please visit https://tiq.com.sg/dash-plans-crediting-rates/ for the latest updates on the prevailing crediting rates for your plans. SingCash Pte. Ltd. Company Reg. No 201106360E (“Dash”) is the Group Policy owner of Dash PET 2. This policy is underwritten by Etiqa Insurance Pte. Ltd. This content is for reference only and is not a contract of insurance. Full details of policy terms and conditions can be found in the policy contract. The information contained on this product advertisement is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You are recommended to read the Policy Illustration, Product Summary, Product Terms and Conditions and Frequently Asked Questions (where applicable); and seek advice from a financial adviser before deciding whether to purchase the product. If you choose not to seek advice, you should consider if the policy is suitable for you and meets your needs in light of your objectives, financial situation and particular needs. For enquiries, please contact Etiqa Insurance. This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg). Information is accurate as of 30 May 2023. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Contact Etiqa

- Customer Service Tel: +65 6887 8777

- Main Office Tel: +65 6336 0477

- Address: 16 Raffles Quay, Hong Leong Building, #01-04A, Singapore 048581

Contact us at [email protected] should you require any assistance or spot any inaccuracies.

Advertisement

A very high quality place for all of us

https://www.khansaprint.com/

https://www.langgananprinting.com/

https://www.muliafotokopi.com/

https://www.luckyprinting9.com/

https://www.abizarprint.com/