Only Want One Credit Card? Here Are The Ones That Cover The Most Categories!

Are you someone who prefers simplicity and would rather just have one credit card to concentrate all your spending on?

Or perhaps you’re just someone who can’t be bothered with all the Merchant Category Codes (MCCs) and all sorts of other Terms and Conditions (T&Cs)?

Well, you’ve come to the right place!

As someone who has a ton of credit cards now, I feel the pain of dealing with all T&Cs, MCCs, and having just one too many CCs (credit cards).

So, if I could only have one credit card, here are my recommendations based on the widest coverage of categories, ease of use, and rewards!

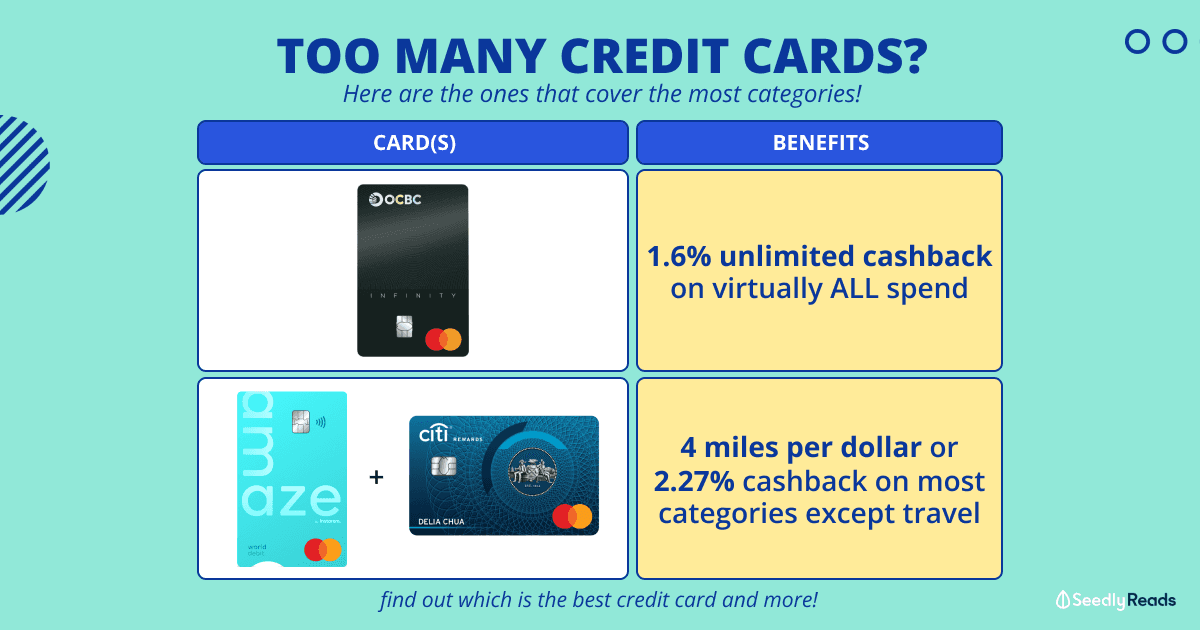

TL;DR: Best Credit Cards With The Most Spending Categories

If you are completely new to credit cards, check out our ultimate guide to credit cards before returning to this article!

Disclaimer: This is a non-sponsored article. The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before signing up for any products.

Which Credit Card Suits You?

Before we begin, you’ll need to identify what type of credit card suits you!

In general, cashback credit cards are less complicated than miles or rewards, but for the full rundown of differences, check out this article:

As always, everyone’s spending habits are different, and other cards may be better suited for you.

However, for this article, I will recommend just two credit cards that most adults should consider having.

Assumptions:

- An adult earning more than $30k annually

- Has good financial discipline to own a credit card

Unlimited Cashback Credit Cards

As mentioned previously, cashback credit cards are some of the simplest credit cards to use. These cards are the most fuss-free but come at the cost of lesser rewards when compared to miles or rewards credit cards.

Then again, you really can’t put a price tag on simplicity!

The best unlimited cashback card currently is the OCBC INFINITY Cashback credit card

Apply Now

OCBC INFINITY Cashback Credit Card:

- Cashback:

- 1.6% on virtually ALL spend (except the typical credit card exclusions such as insurance payments and top-ups to wallets)

- Min. Monthly Spend: N.A.

- Cashback Cap: N.A.

- Annual Fee: S$196.20 (first two years waived)

- Income Requirement:

- $30,000 per year for Singaporeans and PRs

- $45,000 for Foreigners

- Minimum Age: 21

This card is an unlimited cashback credit card, which means that you can get 1.6% cashback on virtually ALL your spending with no minimum spending or caps!

But wait a minute, other cards give higher/similar cashback, right? Like the UOB Absolute Cashback (1.7%), American Express True Cashback (3% for the first 6 months, 1.5% thereafter) or the Citi Cash Back Plus (1.6%).

Let me explain! For any American Express card, which the UOB Absolute is too, you might find it hard to find merchants to use it due to the lack of acceptance. Otherwise, AMEX cards would easily be number one.

As for the Citi Cash Back Plus, cashback can only be redeemed via SMS, which is an extra hurdle.

The OCBC INFINITY Cashback Credit Card, on the other hand, is a MasterCard that is widely accepted and automatically offsets your next credit card bill with the cashback you’ve earned, hence making it the number one fuss-free credit card for all your spending needs.

Even so, here are some other unlimited cashback credit cards that you may consider:

Higher Cashback/Miles/Rewards Credit Cards

If you don’t mind putting in a little more work to optimise your spending, you may consider opting for regular cashback, miles, or rewards credit cards.

These credit cards often have cashback caps and specific categories that you’ll need to take note of in order to enjoy higher cashback.

Luckily, there is a neat little workaround that most credit-card-savvy people would know about: the amaze + Citi Rewards Credit Card combo!

This combo lets you earn 4 miles per dollar (or 2.27% cashback) on most categories except travel.

All you need to do is sign up for the amaze card, link your Citi Rewards Card to it, and you’re all set!

Here’s an in-depth guide about the amaze card and how it works:

As for travel-related expenses, you will have to use another card:

| Credit Card | Earn Rate | Min. Annual Income |

|---|---|---|

| Citi PremierMiles Mastercard Apply Now | 10 mpd on hotel transactions at Kaligo (Valid till 31 December 2024) Up to 7 mpd on hotel transactions at Agoda (Valid for bookings made now till 31 December 2024 and for stays until 30 April 2025) | $30k |

| Citi PremierMiles Visa Card Apply Now | 10 mpd on hotel transactions at Kaligo (Valid till 31 December 2024) Up to 7 mpd on hotel transactions at Agoda (Valid for bookings made now till 31 December 2024 and for stays until 30 April 2025) | $30k |

| UOB PRVI Miles Mastercard Apply Now | 6 mpd on vacation rentals and hotels worldwide via Agoda (Valid till 31 Dec 2024) 6 mpd on accommodations, flight, car rentals and activities worldwide via Expedia (Valid till 30 Apr 2024) | $30k |

| UOB PRVI Miles Visa Card Apply Now | 6 mpd on vacation rentals and hotels worldwide via Agoda (Valid till 31 Dec 2024) 6 mpd on accommodations, flight, car rentals and activities worldwide via Expedia (Valid till 30 Apr 2024) | $30k |

| UOB PRVI Miles AMEX Apply Now | 6 mpd on vacation rentals and hotels worldwide via Agoda (Valid till 31 Dec 2024) 6 mpd on accommodations, flight, car rentals and activities worldwide via Expedia (Valid till 30 Apr 2024) | $30k |

| DBS Altitude Visa Signature Card Apply Now | 4.3 mpd on hotel transactions on Agoda (Valid till 30 Jun 2024) | $30k |

| DBS Altitude American Express Card Apply Now | 4.3 mpd on hotel transactions on Agoda (Valid till 30 Jun 2024) | $30k |

| UOB Lady's Card Apply Now | 4 mpd (up to 10 mpd when you save with UOB Lady's Savings Account. Travel must be chosen as a preferred category, capped at S$1k per month) | $30k |

| UOB Lady's Solitaire | 4 mpd (up to 10 mpd when you save with UOB Lady's Savings Account. Travel must be chosen as a preferred category, capped at S$2k per month) | $120k |

| HSBC Revolution Apply Now | 4 mpd on contactless spending and online transactions (Limit $1K per month, excluding MCC 4722 (Travel Agencies and Tour Operators) and 7011 (Lodging – Hotels, Motels, Resorts, Central Reservation Services)) | $30k |

| DBS Woman’s World Card Apply Now | 4 mpd (Limit S$1.5k per month) | $50k |

Afterthoughts

Again, I would like to stress that everyone’s preferences for credit cards are different. But for most Singaporeans who only want to use one credit cards, the above are the recommended cards!

Are you using just one credit card? Comment below and tell us why it is the best credit card for you!