Endowus

- Key Features

- Reviews (657)

- Discussions (0)

- More Details

Advertisement

This product is managed by Endowus.

Summary

Product Page Transparency

- Claimed in August 2020

- Pays to access additional features

Endowus Review 2024: Is Endowus the Robo-Advisor For You?

Endowus is an evidence-based robo advisor with competitive fees and prices in Singapore. Overall, Endowus has the lowest fees among Robo-Advisors that invest in unit trusts and is great for investors looking to maximise money from their CPF.

Endowus allows you to invest all three sources of wealth - CPF, SRS and cash. It is the first and only robo-advisor in Singapore to allow you to invest your CPF monies. In their investment strategy, Endowus takes an evidence-based approach to wealth, and strategic advice for asset allocation. Their portfolios utilise funds from global fund managers, such as PIMCO and Dimensional, with real, long-term proven track records. Additionally, assets are held in the client’s own name at UOB Kay Hian, Singapore’s largest broker.

- Endowus Platform Fees: $0

- Invest Cash Access fees of: 0.25% - 0.60% depending on your investments

- Cash Smart Access Fees: 0.05%

- Invest CPF & SRS Access Fees: 0.04%

- Minimum Investment: $1,000

- Investment Portfolio: Diversified, low-cost portfolios built on best-in-class mutual funds (or unit trusts)

- $20 off your access fees for new sign-ups through the "Visit Site" link or "Apply Now" button.

Popular Products

Summary

Product Page Transparency

- Claimed in August 2020

- Pays to access additional features

Endowus Review 2024: Is Endowus the Robo-Advisor For You?

Endowus is an evidence-based robo advisor with competitive fees and prices in Singapore. Overall, Endowus has the lowest fees among Robo-Advisors that invest in unit trusts and is great for investors looking to maximise money from their CPF.

Endowus allows you to invest all three sources of wealth - CPF, SRS and cash. It is the first and only robo-advisor in Singapore to allow you to invest your CPF monies. In their investment strategy, Endowus takes an evidence-based approach to wealth, and strategic advice for asset allocation. Their portfolios utilise funds from global fund managers, such as PIMCO and Dimensional, with real, long-term proven track records. Additionally, assets are held in the client’s own name at UOB Kay Hian, Singapore’s largest broker.

- Endowus Platform Fees: $0

- Invest Cash Access fees of: 0.25% - 0.60% depending on your investments

- Cash Smart Access Fees: 0.05%

- Invest CPF & SRS Access Fees: 0.04%

- Minimum Investment: $1,000

- Investment Portfolio: Diversified, low-cost portfolios built on best-in-class mutual funds (or unit trusts)

- $20 off your access fees for new sign-ups through the "Visit Site" link or "Apply Now" button.

Plans (6)

Endowus Cash Investments Portfolio

Equities, Bonds

INSTRUMENTS

0.25% to 0.60%

ANNUAL MANAGEMENT FEE

$1,000

MINIMUM INVESTMENT

N/A

EXPECTED ANNUAL RETURN

Web and Mobile App

PLATFORMS

4.7

657 Reviews

Service Rating

User Experience

Ease of Sign up

Customer Support

High to Low

Posted 27 Aug 2024

Purchased

Endowus Cash Investments Portfolio

is only right for me to testify to the expertise and good customer service offered by this organization. I approached them with some doubts in my mind, all doubts were cleared when they eventually came through like they promised Bsbforensic . c o m got all my funds back and I have proof0

What are your thoughts?Posted 26 Aug 2024

Purchased

Endowus Cash Investments Portfolio

I would like to express my gratitude to Bsb Forensic for their exceptional assistance in recovering my funds from a forex broker. Their expertise and professionalism in navigating the complex process were truly commendable. Through their guidance and relentless efforts, I was able to successfully retrieve my funds, providing me with much-needed relief. I highly recommend BsbForensic. com , to anyone facing similar challenges, as their dedication and commitment to helping clients are truly impressive. Thank you, Bsb Forensic, for your invaluable support in resolving this matter.0

What are your thoughts?Posted 02 Feb 2024

Purchased

Endowus CPF Investments Portfolios

Endowus is one of the easiest and most convenient platforms I have used. I love the interface as it is sleek and modern, the app is smooth and loads fast. The returns rate is also excellent and it is easy to monitor the graph within the app.0

What are your thoughts?Posted 31 Aug 2023

Purchased

Endowus SRS Investment Portfolios

Easy process of signing up, with the ability to invest using cash, cpf and srs funds. Provides the option of dollar cost averaging to maintain discipline. You get to choose the pre-defined set of funds based on your investment profile or select the funds yourself.0

What are your thoughts?Posted 25 Jul 2023

Purchased

Endowus Cash Investments Portfolio

Endowus has been an exceptional investment platform that has revolutionized the way I invest. As a robo-advisor specializing in low-cost, evidence-based investing, Endowus has provided me with a seamless and transparent approach to growing my wealth. I invest using my cpf OA.0

What are your thoughts?Posted 03 Sep 2022

Purchased

Endowus CPF Investments Portfolios

[Investment Method] 2nd review of Endowus - Been observing Endowus's development and progress. I would say that it is one of the best investment partners most retail investors can work with in Singapore for its fee (fairly reasonable), ease of use, safety, communication of insights and methodology. I have been speaking with some of my colleagues and I noticed that more people have started to realise that individual company's methodology and belief in the investment execution are very important. There is one clear difference that I thought people should realise here - I think Endowus believes in building a globally diversified portfolio first as your core portfolio for wealth accumulation and there shouldn't be any tactical regional or sectorial strategy/allocation added as part of the core portfolio to try to capture higher return (try ask your friends about Syfe and Stashaway). If you have built your core portfolio and you want to express your conviction/belief in certain market or sector through investment, you can add satellite portfolio using their thematic portfolios or fund smart option. [Fee] However, I do hope that Endowus can improve its fee structure by adding another tier between 200k - 1 million AUA so to make it a bit more affordable and reduce the cost barrier at that level. [Funding] The cash funding process has been greatly improved since few months ago too! It took 1-2 business days previously (at the beginning) but now I see my cash reflected in my account in less than 1-2 hours even during weekend (non-business day).3

What are your thoughts?View 1 other commentsReply

Save

View 1 repliesPosted 21 Jun 2022

Purchased

Endowus Cash Investments Portfolio

I’m a newbie in Robo advisor investment app and glad that I am using this app. It’s easy to use and the customer service help is great!0

What are your thoughts?Posted 04 Jun 2022

Purchased

Endowus CPF Investments Portfolios

It is rather interesting as Endowus provides an avenue for us to invest our CPF OA for higher returns over a long term period. The app was easy to navigate and user friendly.1

What are your thoughts?Allows me to invest CPF with ease as it is simple and easy to do so.. customer service is alright

Reply

Save

Posted 23 May 2022

Purchased

Endowus CPF Investments Portfolios

Thanks to Endowus we now have an avenue to invest our CPF OA for a higher returns over a long term period. The sign up process is easy and the app/website is very user friendly. I have been recommending friends who are looking to grow their retirement plan to consider using. I will recommend using Endowus to invest S&P500 ETF (Lion Global) using CPF OA.0

What are your thoughts?Posted 28 Apr 2022

Purchased

Endowus Cash Investments Portfolio

Super amazing user interface. I'm able to set automated deposits and investments so I don't need to think about having to invest every month anymore! [User Experience]0

What are your thoughts?

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

Exclusive Rewards

Get S$20 off access fees

- Promotion is valid till 31 December 2022

- Promotion is applicable to new Endowus clients only

- Min. deposit of S$1,000 is required

- Initial deposit must not be withdrawn for 90 days

- Terms and Conditions apply

- To apply, click on the "Apply Now" or "Visit Site" buttons

Benefits and Features of Endowus

- Endowus is priced competitively with attractive prices with low all-in cost with no sales fees, no transaction fees, tax, and currency efficiency. Overall, Endowus has the lowest fees among Robo-Advisors that invest in unit trusts.

- As mentioned, Endowus takes an evidence-based approach to investing which means analysing data and applying the research in a systematic manner as opposed to speculating. The aim of evidence-based investing is to ultimately provide the highest probability of success in growing your wealth over the long term. This can refer to securities that are subjected to specific elements or characteristics in order to maximise returns. Examples of these variables can be size, price, value, or profitability.

- Endowus robo-advisor's investment portfolio philosophy is diversified, low-cost portfolios built on best-in-class mutual funds (or unit trusts). See the list of funds in the different portfolios below.

- To cater to all levels of investors, Endowus will develop your portfolio based on your risk profile and rebalance it periodically.

- They offer 6 different types of risk profiles that constitute varying levels of selected funds according to how risky of an investor you are.

- Through Endowus, you can invest 3 ways, through CPF, Supplementary Retirement Scheme (SRS) or Cash. And each of these sources offers different types of investment portfolios.

Types of Portfolios at Endowus

Wondering How do I invest in Endowus? Starting from the type of funds you'd like to invest in, choose the type of portfolios that most suit your investment goals

Endowus CPF Portfolio

(All Funds are on the CPF Investment Scheme (CPF-IS) included List of Unit Trusts)

- Vanguard-managed Lion Global Infinity US 500 Stock Index Fund - an Endowus Exclusive (Equity Funds)

- Vanguard-managed Lion Global Infinity Global Stock Index Fund - an Endowus Exclusive (Equity Funds)

- First Sentier FSSA Dividend Advantage (Equity Funds)

- Schroder Global Emerging Market Opportunities Fund ( Equity Funds)

- Legg Mason Western Asset Global Bond Trust (Fixed Income)

- Eastspring Singapore Select Bond Fund (Fixed Income)

- UOB United SGD Fund (Fixed Income)

- Natixis Harris Associates Global Equity Fund (Equity Fund)

Endowus SRS and Cash portfolio

- Dimensional Global Core Equity (Equity Funds)

- Lion Global Infinity (Vanguard) US 500 Stock Index (Equity Funds)

- Dimensional Emerging Markets Large Cap Core Equity (Equity Funds)

- Dimensional Pacific Basin Small Companies (Equity Funds)

- PIMCO GIS Global Bond Fund (Fixed Income)

- PIMCO GIS Income Fund (Fixed Income)

- PIMCO Emerging Markets Bond Fund (Fixed Income)

- Dimensional World Equity (Equity Fund)

- PIMCO Global Real Return Fund (Fixed Income)

Endowus Fund Smart

Unlike the standard portfolios mentioned above, opting for Fund Smart gives you more freedom for customisation. You can now build your own portfolio thematically according to what your preferences from a curated list of more than 50 downselected unit trusts. Balancing out that flexibility, there's also safety in knowing these are institutional share-class funds from best-in-class global managers unit trusts that have been carefully screened by Endowus. nto make your own investment portfolio while getting advice on the risk level, underlying holdings of your fund.

You can still invest with your CPF, SRS or Cash.

After personalising your portfolio, it will be monitored and rebalanced automatically and intelligently as per usual.

Overall, Fund Smart appeals to self-directed investors, who seek to have more control over where their money is invested.

Endowus ESG Portfolio

Additionally, apart from their core portfolios, Endowus also crafted ESG Portfolios for those who wish to invest in a better sustainable future. The newest Endowus ESG portfolios are built with the best ESG, sustainable and climate funds for both equities and fixed income from top ESG fund managers.

Endowus Cash Smart Account: A Cash Management Solution

It is also worth mentioning that Endowus also offers a cash management solution called Cash Smart. This is a different product from the aforementioned standard investment offerings via robo-advisory.

With Endowus Cash Smart, this cash management account will allow you to invest in a low-risk, liquid cash management solution where you can get up to 2.2% returns with no limits and no restrictions.

How does Endowus work?

Endowus utilises portfolios of mutual funds managed by professional fund managers unlike other robo advisors in Singapore like Stashaway and Autowealth that invests in ETFs.

According to your preferred risk tolerance, Endowus will then build your portfolio accordingly and rebalance it for you periodically.

The levels of risk appetite will determine the ratio of the type of funds in your portfolio:

Risk Level | Portfolio Allocation Ratio |

|---|---|

Very Aggressive | 100% Equities 0% Fixed Income |

Aggressive | 80% Equities 20% Fixed Income and Others |

Balanced | 60% Equities 40% Fixed Income and Others |

Measured | 40% Equities 60% Fixed Income and Others |

Conservative | 20% Equities 80% Fixed Income and Others |

Very Conservative | 0% Equities 100% Fixed Income and Others |

Investment Portfolio Allocation Ratio according to Risk Level

Why choose Endowus as your Robo-Advisor?

1. Investment Strategy and Philosophy

Strategic and passive in asset allocation, Endowus believes in maintaining and building portfolios according to your personal goals and comfort. Evidence-based investing is at the forefront of their investment methods.

2. Accessibility to Leading Global Funds

Endowus portfolios can access the world’s stock and bond markets efficiently through leading global fund managers with the scale and proven track records to implement their strategies and manage your money.

Fund managers in their portfolios include Vanguard, Dimensional, PIMCO, Schroders, First State, Legg Mason, UOB Asset Management, and more.

2. Cost

By accessing the institutional share class funds, having no sales fees, no transaction fees, and rebating 100% of trailer fees, Endowus is low cost and aligned with its clients as an independent fee-only financial advisor. Coupled with the access to leading global funds, this means selecting the investment products that have exhibited good long-term performance with proven track records, that are also offered at attractive institutional-level costs.

- No sales charge,

- No distribution commissions,

- no transaction fees and other hidden charges

3. Security

Your assets are securely held in your own name at UOB Kay Hian, Singapore’s largest broker.

Fees and Charges For Endowus

- The current minimum amount for investment is S$1,000.

- Endowus also charges an all-in flat fee of 0.05% to 0.60%. depending on your investments:

CPF & SRS | 0.40% flat fee for any amount |

|---|---|

Cash | Up to S$200,000: 0.60% S$200,001 to S$1,000,000: 0.50% S$1,000,001 to S$5,000,000: 0.35% S$5,000,001 and above: 0.25% |

Cash Management | 0.05% flat fee for any amount |

Fees summary for Endowus

Do check for more information about Endowus Fees on their webpage.

Verdict: Is Endowus the Best Robo Advisor in Singapore?

Endowus usually scores a pretty high score on SeedlyReviews.

Many users like that Endowus is a user-friendly and flexible Robo-Advisor that allows CPF, SRS and cash investments. Currently, being the only robo advisor that offers CPF investment capability is also attractive for many new investors.

Endowus also has the lowest fees among Robo-Advisors that invest in unit trusts. Their pricing structure is attractive as they do not charge sales charges, transaction fees, or trailer fees. Additionally, redeeming your investments seems to be a breeze with no lock-in period.

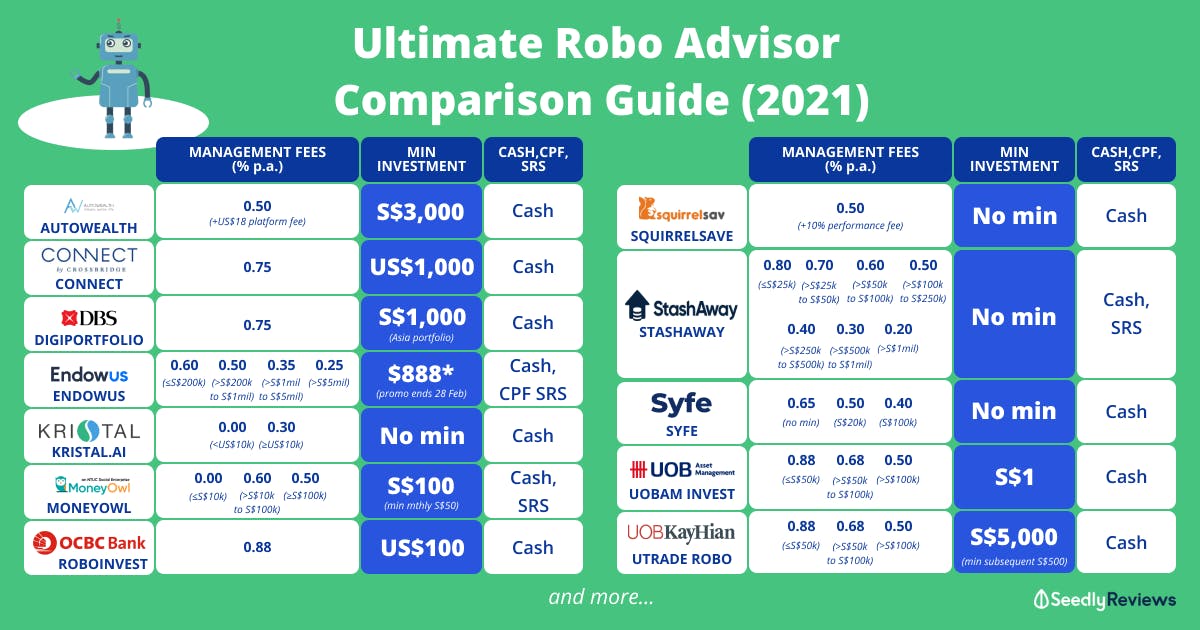

Endowus vs StashAway vs Syfe vs Autowealth

Wondering how Endowus will fair against other robos?

Check out our full blog article for the Ultimate Robo Advisor Comparison Guide where we break down their fees, pros and cons, and types of investment products offered by these Singapore robo advisors going head-to-head.

Exclusive Promotion with Seedly

Promotion is applicable for new sign-ups only.

No promo code required. To redeem the promotion, sign up by clicking on the "Visit Site" or "Apply Now" buttons to receive $20 off your access fees.

About Endowus

Endowus is a Singapore based Robo- advisory. It is the first and only digital advisor for CPF, SRS, and cash savings. Led by Sam Rhee, previously CEO and Chief Investment Officer at Morgan Stanley Investment Management, Endowus aims to help investors invest holistically, conveniently and confidently with expert advice, all at an affordable price tag.

Contact Endowus

- For more information, you can reach out to Endowus at

- Email: [email protected]

- Address: 158 Cecil Street, Singapore 069545

Operations

MAS Financial Advisers Licence no. 100066-1

Contact us at [email protected] should you require any assistance or spot any inaccuracies.

Advertisement

Regarding Funding, from my recent experience it seems that if you transfer with PayNow your cash will be reflected on the same day on Endowus. Seems like another example of continuous improvement and listening to customer. Keep it up!