Budget Direct Travel Insurance

- Key Features

- Reviews (0)

- Discussions (0)

- More Details

Advertisement

Budget Direct Travel Insurance

Budget Direct Travel Insurance

This product has not been claimed by the company yet.

Summary

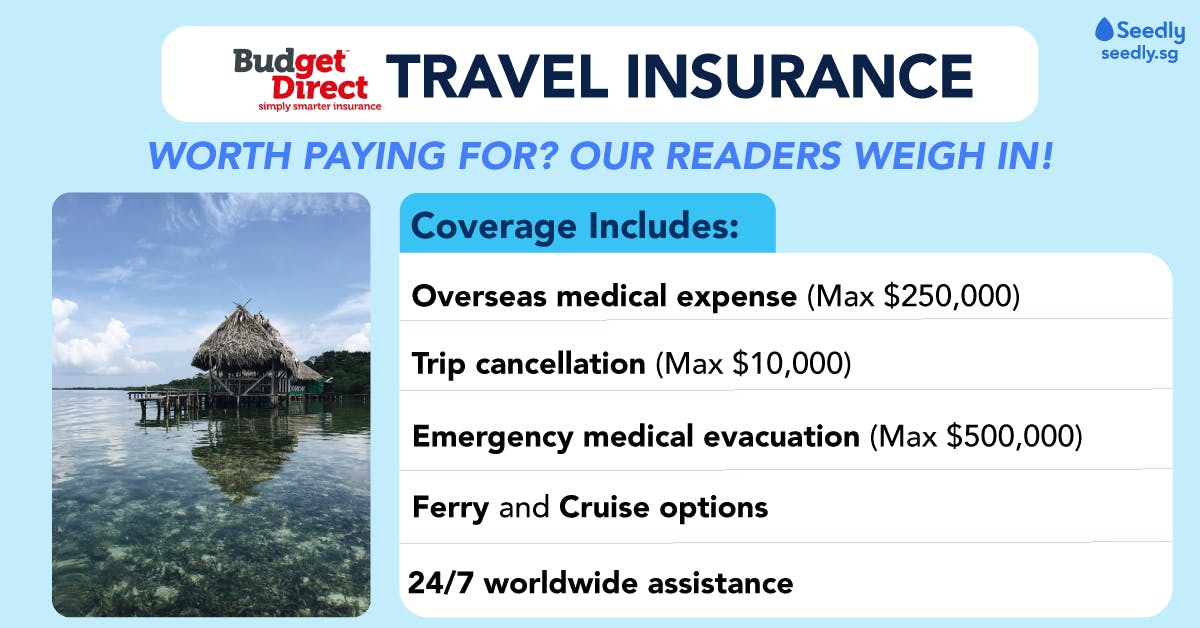

Budget Direct Travel Insurance Review

Here's an overview of what's covered under Budget Direct Travel Insurance:

- Overseas medical expenses

- Personal liability

- Accidental death

- Trip cancellation

- Rental vehicle excess

- Local medical expenses

- Overseas medical evacuations

Popular Products

4.8

218 Reviews

4.5

541 Reviews

4.5

197 Reviews

4.2

212 Reviews

Summary

Budget Direct Travel Insurance Review

Here's an overview of what's covered under Budget Direct Travel Insurance:

- Overseas medical expenses

- Personal liability

- Accidental death

- Trip cancellation

- Rental vehicle excess

- Local medical expenses

- Overseas medical evacuations

Plans (2)

Budget Direct Travel Basic Plan

$8.17

PER ADULT (THAILAND, 1 WK)

$50,000

MEDICAL COVERAGE (OVERSEAS)

-

TRIP CANCELLATION

$500

LOSS OR DAMAGE OF BAGGAGE

Budget Direct Travel Comprehensive Plan

$15.42

PER ADULT (THAILAND, 1 WK)

$250,000

MEDICAL COVERAGE (OVERSEAS)

$10,000

TRIP CANCELLATION

$5,000

LOSS OR DAMAGE OF BAGGAGE

Budget Direct Travel Basic Plan

$8.17

PER ADULT (THAILAND, 1 WK)

$50,000

MEDICAL COVERAGE (OVERSEAS)

-

TRIP CANCELLATION

$500

LOSS OR DAMAGE OF BAGGAGE

0.0

0 Reviews

High to Low

No reviews found.

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

4.8

218 Reviews

4.5

541 Reviews

4.5

197 Reviews

4.2

212 Reviews

What does Budget Direct Travel Insurance cover?

It can be a little overwhelming to choose the right travel insurance plan for yourself and if you don't know how to start, here's a travel insurance guide Singapore.

Budget Direct Insurance offers several types of travel insurance for you and your family. You'll find plans for everyone, including:

- Individual: For one pax

- Family: For two adults and four dependent children. Budget Direct Insurance defines children as anyone between 15 days -18 years old, or a full-time student up to 24 years old

- Group: For two to ten pax

You can then select the type of travel policy - Annual Trip and Single Trip

- Annual Trip: Unlimited number of overseas trips (maximum of 90 days per trip)

- Single Trip: Overseas trip is no longer than 182 days (approximately 6 months)

Here's an overview of what's covered under Budget Direct Travel Insurance:

- Overseas medical expenses

- Personal liability

- Accidental death

- Trip cancellation

- Rental vehicle excess

- Local medical expenses

- Overseas medical evacuations

Optional Covers:

- Overseas emergency allowance

- Travel documents, baggage, personal belongings, and cash coverage

Plan Tiers Offered by Budget Direct

Budget Direct Insurance in Singapore offers 2 different tiers of travel insurance coverage - Comprehensive and Basic

Here's a look at the benefits of each tier:

What You'll Get | Comprehensive | Basic |

|---|---|---|

Accidental Death (<70 years old) | $250,000 | $50,000 |

Overseas Medical Expenses (<70 years old) | $250,000 | $50,000 |

Treatment by a Chinese Medical Practitioner or Chiropractor | $500 | Not Covered |

Trip Cancellation | $10,000 | Not Covered |

Travel Delay | $1,000 | Not Covered |

Loss or Damage to Personal Belongings | $5,000 | $500 |

Emergency Medical Evacuation (<70 years old) | $500,000 | $50,000 |

Personal Liability | $1,000,000 | $100,000 |

Terrorism Coverage | Covered | Covered |

Home Contents | $5,000 | Not Covered |

Budget Direct Travel Insurance

If you planning to travel through Ferry, Cruise, Car, Coach or Train here is a summary of the coverage provided

What You'll Get | Comprehensive Plan | Basic Plan |

|---|---|---|

Loss or Damage of Baggage and Personal Items due to Theft, Robbery or Break-In | $2,000 | Not Covered |

Losing Money | $1,000 | Not Covered |

Losing Travel Documents | $1,000 | Not Covered |

Ferry/Cruise/Car/Coach/Train Options (per insured person)

Which Insurance Policy Is Suitable For Me

Annual travel insurance will be more suitable if you are planning to have multiple overseas trips in a year and if you don't travel often, Single Trip travel insurance will be more suitable.

If you still don't know what travel insurance is suitable, here's a list of the best travel insurance in Singapore.

How Do I Claim?

There a 4 simple steps to take for you to get your claim

- You have to submit your travel claim via mail at [email protected]

- You can get your travel claim form on their website. In order to support your travel claim. These documents are needed: invoices, receipts, authorization letters, medical reports, flight, accommodation and tour detail

- Budget Direct Insurance will contact you with regards to the claim

- Get your claim!

Additional Things To Know About Budget Direct Insurance - Travel Insurance

- If you have any medical emergencies overseas you can contact their 24/7 emergency hotline for further assistance

- Budget Direct Insurance only provides coverage if you are traveling overseas for business or holiday, not for the purpose of getting overseas medical treatment

- You should purchase Budget Direct Insurance as soon as you have paid for your trip. That way you can get the most benefit out of it

- You can make your purchase online or through the phone

Contact Budget Direct

- Main office: +65 6221 2111 (Monday to Friday, 8am - 8pm, Saturday, 9am - 3pm, Excluding public holidays)

- Address: 190 Clemenceau Avenue, #03-01, Singapore Shopping Centre, Singapore 239924

About Budget Direct Travel Insurance

Budget Direct Insurance’s policies are underwritten by Auto & General (Singapore) Pte. Limited. Auto & General (Singapore) Pte. Limited is regulated and licensed by MAS.

Budget Direct Insurance is a part of an international insurance group that provides insurance for millions of users worldwide.

They are headquartered in the British Isles, generating more than $2b in annual revenues and they operates across four continents.

Contact us at [email protected] should you require any assistance or spot any inaccuracies.

Advertisement