Prudential PRUShield Integrated Shield Plan

- Key Features

- Reviews (25)

- Discussions (0)

- More Details

Advertisement

Prudential PRUShield Integrated Shield Plan

Prudential PRUShield Integrated Shield Plan

This product has not been claimed by the company yet.

Summary

Prudential PRUshield Integrated Shield Plan Review 2024

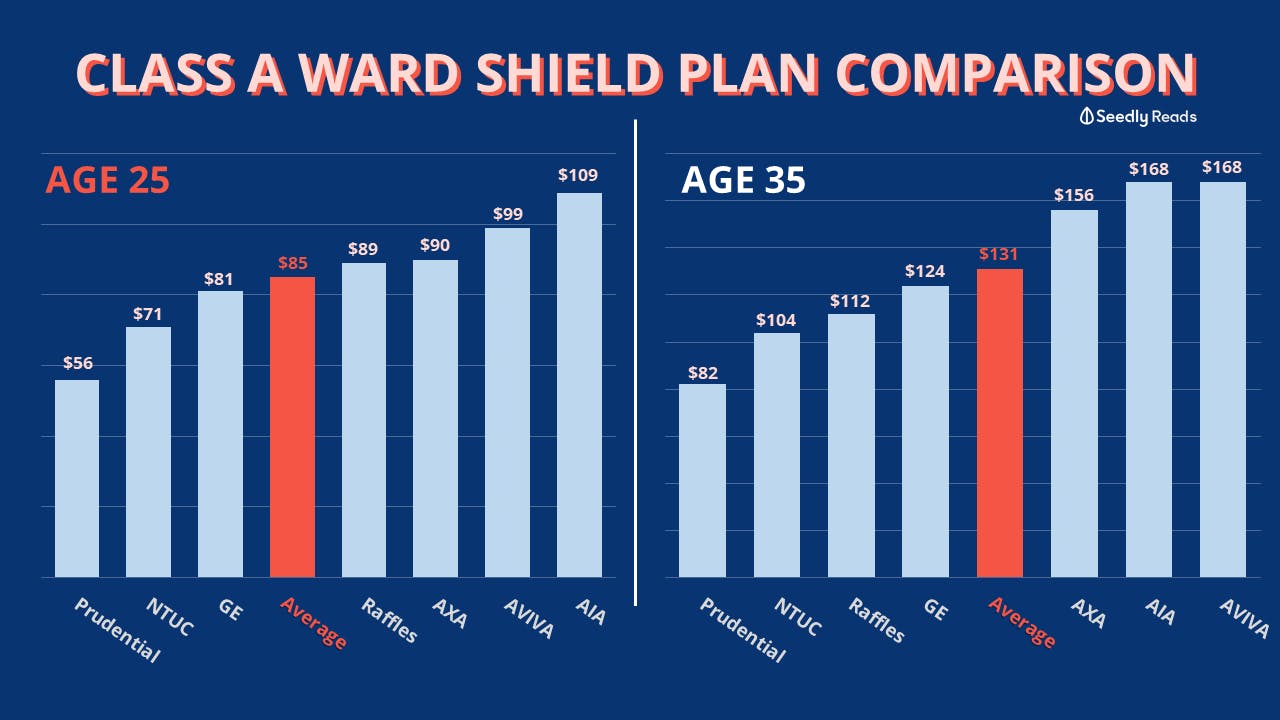

The PRUShield Integrated Shield Plan health insurance is a crowd favourite as it offers the lowest premiums for Class A ward Integrated Shield Plans. Here are PRUShield's highlights:

- Integrated Shield Plan with 3 tiers: PRUShield Standard, PRUShield Plus, PRUShield Premier.

- Lifetime Coverage

- Policy Yearly Limit ranging from S$600,000 to S$1.2 million for Plus and Premier respectively

- Pre- and post-hospitalisation coverage of up to 180 days and 365 days respectively, for both PRUShield Plus and Premier.

- 3 plan add-ons to help reduce your eventual out-of-pocket expenses by up to 95%, these are: PRUExtra Premier Copay, PRUExtra Preferred Copay, PRUExtra Premier Lite Copay

- Overseas medical treatment available

- Annual coverage of S$1.2 million not as high as some insurers offering S$1.5 million

Popular Products

4.4

306 Reviews

4.5

83 Reviews

4.2

20 Reviews

Summary

Prudential PRUshield Integrated Shield Plan Review 2024

The PRUShield Integrated Shield Plan health insurance is a crowd favourite as it offers the lowest premiums for Class A ward Integrated Shield Plans. Here are PRUShield's highlights:

- Integrated Shield Plan with 3 tiers: PRUShield Standard, PRUShield Plus, PRUShield Premier.

- Lifetime Coverage

- Policy Yearly Limit ranging from S$600,000 to S$1.2 million for Plus and Premier respectively

- Pre- and post-hospitalisation coverage of up to 180 days and 365 days respectively, for both PRUShield Plus and Premier.

- 3 plan add-ons to help reduce your eventual out-of-pocket expenses by up to 95%, these are: PRUExtra Premier Copay, PRUExtra Preferred Copay, PRUExtra Premier Lite Copay

- Overseas medical treatment available

- Annual coverage of S$1.2 million not as high as some insurers offering S$1.5 million

Plans (3)

PRUShield Integrated Shield Plan Premier

$1,200,000

LIMIT PER POLICY YEAR

180 / 365 days

PRE & POST HOSPITAL

As Charged

OUTPATIENT BENEFITS

Private Hospital

WARD ENTITLEMENT

3.7

25 Reviews

High to Low

02 Jul 2021

Purchased

PRUShield Integrated Shield Plan Premier

my trustable agent recommend this policy to me which i think that the coverage is enough for myself and easy to claim through prudential website0

What are your thoughts?28 Dec 2020

Purchased

PRUShield Integrated Shield Plan Premier

[Customer Service] [Agent Responsiveness] Bought it mainly for emergency in case of critical illness and for hospitals and endowment fund. Agent was very responsive in follow up and throughout the whole process.0

What are your thoughts?17 Aug 2020

Purchased

PRUShield Integrated Shield Plan Standard

[Agent Responsiveness] My agent is very responsive! He recommend good advice and options. We make a good relationship from continuous engagement yearly. [Insurance Coverage] Coverage is well tailor to my needs.0

What are your thoughts?15 Jul 2020

Bought it mainly for emergency in case of critical illness and for hospitals and endowment fund. Agent was very responsive in follow up and throughout the whole process. [Customer Service] [Insurance Coverage] [Agent Responsiveness]0

What are your thoughts?15 Jul 2020

Purchased

PRUShield Integrated Shield Plan Plus

[Insurance Coverage] Pretty much everything except only can choose public / government hospitals. I also pay rider to max to avoid paying full fee with extra cash . Better have it just for emergency.0

What are your thoughts?08 Jul 2020

Purchased

PRUShield Integrated Shield Plan Plus

[Agent Responsiveness] My agent Eunice was very responsive and gives very good financial advice and analysis for my current financial situation.0

What are your thoughts?16 Jun 2020

Purchased

PRUShield Integrated Shield Plan Plus

[Customer Service] Agent was able to come down to my house to provide detailed information during the purchase process and during this period of time, he was quick to inform that Prudential covers Covid-19 which is good as we were quite worried about the coverage.0

What are your thoughts?26 Mar 2020

easy to claim and highly recommended...rare gem in the market with low excess. No hidden terms and shady stuff!0

What are your thoughts?04 Feb 2020

[Claims Process] Very fast claims process. Simply have to submit all the forms and receipts and my agent did everything for me. [Terms & Conditions] Need to be very careful with the terms and conditions. Some exclusions here and there which I didn't read carefully so I couldn't claim a few hundred. Would suggest that prudential makes its terms and conditions more reader-friendly for the layman.0

What are your thoughts?21 Jan 2020

Got my son insured with Prudential since he was a few months old. Now he is 4 y.o and he has been in and out of hospital for at least 4 times. Claims were always easy and hassle free.0

What are your thoughts?

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

4.4

306 Reviews

4.5

83 Reviews

4.2

20 Reviews

Prudential Health Insurance PRUshield at a Glance

- Inpatient and Day Surgery Benefits as charged

- Hospitalisation Benefits

- Surgical Benefits (including Day Surgery)

- Living Organ Donor Transplant Benefits

- Overseas Medical Treatment - Pre-Hospitalisation Benefits up to 180 days

- Post-Hospitalisation Benefits for Up to 365 days

- Outpatient Hospital Benefits

- Outpatient Cancer Treatment

- Outpatient Renal Failure Treatment

- Approved Immunosuppressant drugs for organ transplants

Types of Prudential PRUshield Plans

1. PRUShield Premier

- Ward Entitlement: 100% coverage on Restructured and Private hospitals

- Supplementary Plans to Add On:

PRUExtra Premier CoPay - Covers 95% of your Deductible and half of your Co-insurance, with a S$3,000 annual limit on out-of-pocket expenses if you go to a panel provider. Your renewal premium is subject to claims-based pricing. - PRUExtra Premier Lite CoPay: Covers 50% of your Deductible (up to S$1,750 per policy year) and half of your Co-insurance, with a S$3,000 annual limit on out-of-pocket expenses if you go to a panel provider.

2. PRUShield Plus

- Ward Entitlement: 100% coverage on Restructured hospitals (Up to A class ward)

- Supplementary Plans to Add-On:

PRUExtra Plus CoPay - Covers 95% of your Deductible and half of your Co-insurance, with a S$3,000 annual limit on out-of-pocket expenses if you go to a panel provided

3. PRUShield Standard

- Ward Entitlement: 100% coverage on Restructured hospitals (Up to B1 class ward)

- Benefits identical to other Standard IP

What does Prudential PRUShield Health Insurance Cover?

Benefits / Coverage | PRUShield Premier | PRUShield Plus |

|---|---|---|

In patient treSurgical benefits (including Day Surgery)

| as charged | as charged |

Pre-Hospitalisation benefit | as charged up to 180 days before | as charged up to 180 days before |

Post-Hospitalisation benefit | as charged up to 365 days after | as charged up to 365 days after |

Outpatient Hospital benefits | as charged | as charged |

Living Organ Donor Transplant Benefit | $60,000 per Policy Year | $40,000 per Policy Year |

Overseas Medical Treatment | As charged (paying the lower of: the overseas charges; or in accordance with a Singapore Private Hospital’s charges) | As charged (paying the lower of: the overseas charges; or in accordance with a Singapore Private Hospital’s charges) |

Add-on Riders and Payment Schemes for PRUShield

These additional supplementary plans are meant to help limit your out-of-pocket expenses to S$3,000 per policy year.

1. PRUExtra Plus CoPay

- All Singapore Restructured Hospitals (Class A Ward)

- 95% of Deductible covered

- 50% of Co-insurance covered

- For PRUShield Plus Only

- PRUPanel Connect additional benefits available

2. PRUExtra Premier Copay

- All Singapore Private Hospitals

- 95% of Deductible covered

- 50% of Co-insurance covered

- 20% Reward of staying healthy

- For PRUShield Premier Only

- PRUPanel Connect additional benefits available

3. PRUExtra Preferred Copay

- Private Hospitals under Panel and Non-panel providers

- 95% of Deductible covered

- 50% of Co-insurance covered

- 20% Reward of staying healthy

- For PRUShield Premier Only

4. PRUExtra Premier Lite CoPay

- All Singapore Private Hospitals

- 50% of Deductible covered (up to $1,750 per policy year)

- 50% of Co-insurance covered

- For PRUShield Premier Only

Supplementary Plan | PRUExtra Premier CoPay | PRUExtra Preferred CoPay | PRUExtra Premier Lite CoPay | PRUExtra Plus CoPay |

|---|---|---|---|---|

Eligibility | for premier plan | for premier plan | for premier plan | for plus plan |

Hospital & Ward Entitlement | All Singapore Private Hospitals | Singapore Private Hospitals under our Panel or Non-panel providers | All Singapore Private Hospitals | All Singapore Restructured Hospitals (Class A Ward) |

PRUShield Deductible | Covers 95% of Deductible Amount. | Covers 95% of Deductible Amount. | Covers 50% of Deductible Amount. You will cover remaining 50%, subject to a maximum of $1,750 per policy year. | Covers 95% of Deductible Amount |

PRUShield Co-insurance | Covers half of Co-insurance. | Covers half of Co-insurance. | Covers half of Co-insurance. | Covers half of Co-insurance. |

Stop-loss | S$3,000 for Panel providers | S$3,000 for Panel providers | S$3,000 for Panel providers | S$3,000 for Panel providers |

Subject to Claims-Based Pricing (CBP) | Yes | Yes | No | No |

PRUPanel Connect | Available | Available | Not Available | Not Available |

Cost of Premiums for aged 30 | S$515 | S$361 | S$249 | S$225 |

Deductible = a fixed amount to be paid by a policyowner before the MediShield Life and PRUShield benefits are payable.

Co-insurance = a percentage of the claimable amount that a policyowner needs to co-pay after deductible

What is PRUPanel Connect?

PRUPanel connect is a host of additional benefits applicable for those who opt for either PRUExtra Premier CoPay or PRUExtra Preferred CoPay. These 2 plans are private hospital plans. Policyholders with any of these 2 plans will automatically qualify for PRUPanel Connect for free.

Benefits of PRUPanel Connect:

- Appointment Booking - for Prudential's Panel of healthcare providers

- Concierge Service - to offer help for any PRUShield related enquiries

- Enhanced Letter of Guarantee - get a higher LOG amount

- Pre-Authorisation Letter - if not eligible for LOG, you may still apply for a pre-authorisation letter

- Transport - receive complimentary taxi voucher or hospital parking coupon from PRUPanel Connect

- Others - discounts for selected products and services from PRUPanel Connect Private Hospitals

How much does PRUShield cost?

Here, we breakdown the approximate premiums for Prudential PRUShield into 3 age groups

Premiums for PRUShield Premier:

for Singapore Citizens & Permanent Residents

Age Next Birthday | 21 - 25 years old | 26 - 30 years old | 31 - 40 years old | 41 - 50 years old |

|---|---|---|---|---|

Annual Premium for PRUShield Premier | $209 | $245 | $327 | $654 |

Premiums for PRUShield Plus

for Singapore Citizens & Permanent Residents:

Age next birthday | 21 - 30 years old | 21 - 35 years old | 36 - 40 years old | 41 - 45 years old |

|---|---|---|---|---|

Annual Premium for PRUShield Plus | $56 | $82 | $107 | $140 |

Is Prudential PRUShield the Best Health Insurance Shield Plan for You?

Prudential's PRUShield Plus has the lowest premiums for Class A ward Integrated Shield Plans. This crowd favourite is great for people who are looking for more comfort in a public hospital.

Eligibility: Who can apply for PRUShield?

- Citizenship Status: Singaporeans and Permanent Residents

- Age: up to 75 years of Age, Foreigners up to 55 years of age

Prudential Health Insurance PRUshield Quote

- Visit Prudential Health Insurance website for more details on the coverage, exclusions, and quote

About Prudential

For over 85 years, Prudential have served the financial and protection needs of Singaporeans and has built its reputation today as one of the market leaders in Protection, Savings and Investment-linked plans. Awarded by Standard & Poor's, Prudential has an AA- Financial Strength Rating. Prudential was also awarded People Developer Award by SPRING Singapore in their efforts to groom and develop employees.

Contact us at [email protected] should you require any assistance or spot any inaccuracies

Advertisement