Income IncomeShield Integrated Shield Plan

- Key Features

- Reviews (306)

- Discussions (0)

- More Details

Advertisement

Income IncomeShield Integrated Shield Plan

Income IncomeShield Integrated Shield Plan

This product has not been claimed by the company yet.

Summary

Income Integrated Shield Plan Review 2024

Income has one of the most affordable Integrated Shield Plans for non-private hospital plans. Across Class A, Class B and Standard IP, Income is almost consistently priced below market average within the age groups of 25 to 45 years old. Here are Income Integrated Shield Plans' best features:

- IncomeShield is an Integrated Shield Plan (IP), which is additional coverage on top of one's MediShield Life. IPs are partially payable by Medisave.

- 4 tiers of, ranging from cheapest to the most premium:

- IncomeShield Standard Plan

- Enhanced IncomeShield Basic (Class B1)

- Enhanced IncomeShield Advantage (Class A)

- Enhanced IncomeShield Preferred (Private Hospital) - Lifetime coverage

- Policy yearly limit from S$250,000 to S$1,500,000 (excluding Standard Plan)

- Enhanced Income Shields offer almost entirely as charged covers on eligible treatments, up to a limit

- Access to more than 300 private medical specialists across various specialties and sub-specialties

- Provision of Letter of Guarantee that waives deposits required by hospital admissions

- Affordable and Flexible plans

- With easy application and claims process as attested by our Seedly Reviewers

Popular Products

4.5

83 Reviews

4.2

20 Reviews

3.7

25 Reviews

Summary

Income Integrated Shield Plan Review 2024

Income has one of the most affordable Integrated Shield Plans for non-private hospital plans. Across Class A, Class B and Standard IP, Income is almost consistently priced below market average within the age groups of 25 to 45 years old. Here are Income Integrated Shield Plans' best features:

- IncomeShield is an Integrated Shield Plan (IP), which is additional coverage on top of one's MediShield Life. IPs are partially payable by Medisave.

- 4 tiers of, ranging from cheapest to the most premium:

- IncomeShield Standard Plan

- Enhanced IncomeShield Basic (Class B1)

- Enhanced IncomeShield Advantage (Class A)

- Enhanced IncomeShield Preferred (Private Hospital) - Lifetime coverage

- Policy yearly limit from S$250,000 to S$1,500,000 (excluding Standard Plan)

- Enhanced Income Shields offer almost entirely as charged covers on eligible treatments, up to a limit

- Access to more than 300 private medical specialists across various specialties and sub-specialties

- Provision of Letter of Guarantee that waives deposits required by hospital admissions

- Affordable and Flexible plans

- With easy application and claims process as attested by our Seedly Reviewers

Plans (4)

NTUC Income IncomeShield Integrated Shield Plan Preferred

$1,500,000

LIMIT PER POLICY YEAR

180 / 365 days

PRE & POST HOSPITAL

As Charged

OUTPATIENT BENEFITS

Private Hospital

WARD ENTITLEMENT

4.4

306 Reviews

Service Rating

Ease of Claim

Agent Reliability

Application Process

High to Low

Posted 03 Feb 2025

Purchased

NTUC Income IncomeShield Integrated Shield Plan Preferred

[Agent Responsiveness] The first agent that contacted me have help me to relief the hospital bill many years later after 2012. thereafter agent did not provide any after sales service or support till today 2025 Feb . [Insurance Coverage] so far well covered especially for my hospitalization between 2012 to present day 2025 and incurring only about 25% of the bill in present day economy and mutation of covid-19 or related virus [Claims Process] [Claims Documents] Both are inter-linked and convenient and user-friendly during admission to Singapore Government Hospitals or can get assistance from income building staff .0

What are your thoughts?Posted 13 Dec 2024

Purchased

NTUC Income IncomeShield Integrated Shield Plan Preferred

good value as the coverage is quite good overall good plan as compared to similar plans on the market. Application is fuss free easy0

What are your thoughts?Posted 16 Sep 2024

Purchased

NTUC Income IncomeShield Integrated Shield Plan Preferred

Affordable and right product for me and my family. Have bought many plans from Income Insurance and worth the money spent.0

What are your thoughts?Posted 30 Jun 2024

Purchased

NTUC Income IncomeShield Integrated Shield Plan Preferred

I am using this plan as per recommendation from my agent. My agent has did comparison between several companies and tell me on the different.2

What are your thoughts?Reply

Save

View 1 repliesPosted 20 Jun 2024

Purchased

NTUC Income IncomeShield Integrated Shield Plan Preferred

Most affordable private health insurance in the whole of Singapore (huge upside), and given that their coverage is on-par or even better than other insurers, no reason to spend more money on other insurers when this will do just the trick.. Personally, I have also heard many good reviews on NTUC customer service and claims process (word of mouth), and they strike me as a reliable company and brand. It is also a well known brand and company locally. Policy documents are also extremely easy to understand. I signed up myself online without the need for an insurance agent and the English used in the policy documents were extremely clear without excessive use of jargon. I was originally on their Advantage Plan (which covers up to ward A) and decided to upgrade. I have had conditions in the past (many years ago), and NTUC income was the only company that saw my application and documents objectively and accepted my application AND upgrade WITHOUT any exclusions.1

What are your thoughts?Test

Reply

Save

Posted 06 May 2024

Purchased

NTUC Income IncomeShield Integrated Shield Plan Preferred

Their agreement has the most layman English. Price is also the most affordable. Insurance coverage is on par with other company0

What are your thoughts?Posted 25 Jul 2023

Purchased

NTUC Income IncomeShield Integrated Shield Plan Preferred

The Income Integrated Shield Plan is a reliable and comprehensive healthcare insurance option that I have had the pleasure of using. The plan seamlessly complements my existing MediShield Life coverage, offering enhanced benefits and minimizing out-of-pocket expenses during medical treatments.0

What are your thoughts?Posted 24 Jul 2023

Purchased

NTUC Income IncomeShield Integrated Shield Plan Preferred

i would say this NTUC Income plan is pretty value for money… one of the most affordable price in the insurance market. Not too sure how is the claim process as i have yet to file a claim. The agent is friendly0

What are your thoughts?Posted 11 Sep 2022

Purchased

NTUC Income IncomeShield Integrated Shield Plan Preferred

[Insurance Coverage] Adequate coverage for the premium paid. Switched to NTUC Income + riders + hospital cash that provide reasonably lower premium than my previous plans without hospital cash. However with the recent change, the rider plan doesn’t pay hospital cash anymore if you admitted to lower ward than your selected plan. [Claims Process] So far claim process has been smooth for me and my family on both Pte and Govt hospital. Reimbursement of claims were made within 1-2 months after discharged. Do review the settlement as they once paid wrongly on the hospital cash payout.0

What are your thoughts?06 May 2021

Purchased

NTUC Income IncomeShield Integrated Shield Plan Preferred

[Insurance Coverage] Love Income's health insurance coverage! Would definitely recommend it to anyone who wants the best coverage in SG.0

What are your thoughts?

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

4.5

83 Reviews

4.2

20 Reviews

3.7

25 Reviews

Types of IncomeShield Health Insurance Plans at a Glance

Preferred | Advantage | Basic | Standard | |

|---|---|---|---|---|

Policy Yearly Limit | S$1,500,000 | S$500,000 | S$250,000 | S$150,000 |

Ward Entitlement | Standard room in private hospital or private medical institution | Restructured hospital for ward class A and below | Restructured hospital for ward class B1 and below | Ward Class B1 and below |

Eligibility | last entry age is 75 (based on the insured's age next birthday). | last entry age is 75 (based on the insured's age next birthday). | last entry age is 75 (based on the insured's age next birthday). | no limit |

All Standard Integrated Shield plans across all insurers have the exact same coverage.

What's different would be the tiers above the Standard plans and for Income, these tiers are the Enhanced IncomeShield.

Enhanced IncomeShield has 3 tiers of plans, from the most expensive to the cheapest:

- Preferred - Offers a solid S$1,500,000 of policy year limit, with a private hospital standard ward entitlement

- Advantage - policy year limit of S$500,000, with a ward entitlement of class A wards and below at restructured public hospitals

- Basic - policy year limit of S$250,000, with a ward entitlement of class B1 wards and below at restructured public hospitals

What does Income Enhanced IncomeShield Cover?

Take a look at what the non-standard Income IP plans cover:

Coverage | Enhance IncomeShield Preferred | Enhance IncomeShield Advantage | Enhance IncomeShield Basic |

|---|---|---|---|

Ward Entitlement | Standard room in private hospital or private medical institution | Restructured hospital for ward class A and below | Restructured hospital for ward class B1 and below |

Inpatient Treatments & Day Surgery | ✓ As charged | ✓ As charged | ✓ As charged |

Pre and Post Hospitalisation Benefit | ✓ As charged | ✓ As charged | ✓ As charged |

Outpatient Treatment | ✓ As charged | ✓ As charged | ✓ As charged |

Major Organ Transplant

| ✓ As charged

| ✓ As charged

| ✓ As charged

|

Emergency Overseas Medical Treatment | As charged but limited to costs of Singapore private hospitals | As charged but limited to costs of ward class A in Singapore restructured hospitals | As charged but limited to costs of ward class B1 in Singapore restructured hospitals |

Enhanced IncomeShield also covers Autologous Bone Marrow Transplant for Multiple Myeloma

- Preferred: as charged up to S$25,000 per policy year

- Advantage: as charged up to S$25,000 per policy year

- Basic: as charged up to S$10,000 per policy year

Additional Riders for IncomeShield:

Deluxe Care:

- Keeps out-of-pocket expenses on hospital bills as low as possible.

- Treatment provided by panel: up to S$3,000

Treatment not provided by panel: no limit - You can also enjoy zero additional non-panel payment (each policy year) even if the treatment for your stay in the hospital is not provided by Income chosen panel

- Receive up to $80 per day (maximum of 10 days per hospital stay) to pay for an extra bed for you to sleep over if your insured child gets warded.

Classic Care Rider:

- Co-pay only 10% of the claimable amount to Keep your hospital bills by panel specialists cheaper.

- Treatment provided by panel: up to S$3,000

Treatment not provided by panel: no limit - Required to pay up to $2,000 additional non-panel payment (each policy year) if the treatment for your hospital stay was not provided insurer's panel.

- Receive up to $80 per day (maximum of 10 days per hospital stay) to pay for an extra bed for you to sleep over if your insured child gets warded.

* The last entry age for riders is 75 years old.

How much does Integrated Shield Plan, Enhanced IncomeShield Cost?

These are the premiums for Enhanced IncomeShield across 3 age groups. Assuming a status of Singapore Citizen or Permanent Resident

Age next birthday | Preferred | Advantage | Basic | Basic (Permanent Resident) |

|---|---|---|---|---|

21 to 30 | $255 | $71 | $57 | $62 |

31 to 35 | $375 | $104 | $71 | $81 |

36 to 40 | $392 | $128 | $81 | $99 |

41 to 45 | $648 | $212 | $123 | $151 |

How does Enhanced IncomeShield Compare with Other Integrated Shield Plans?

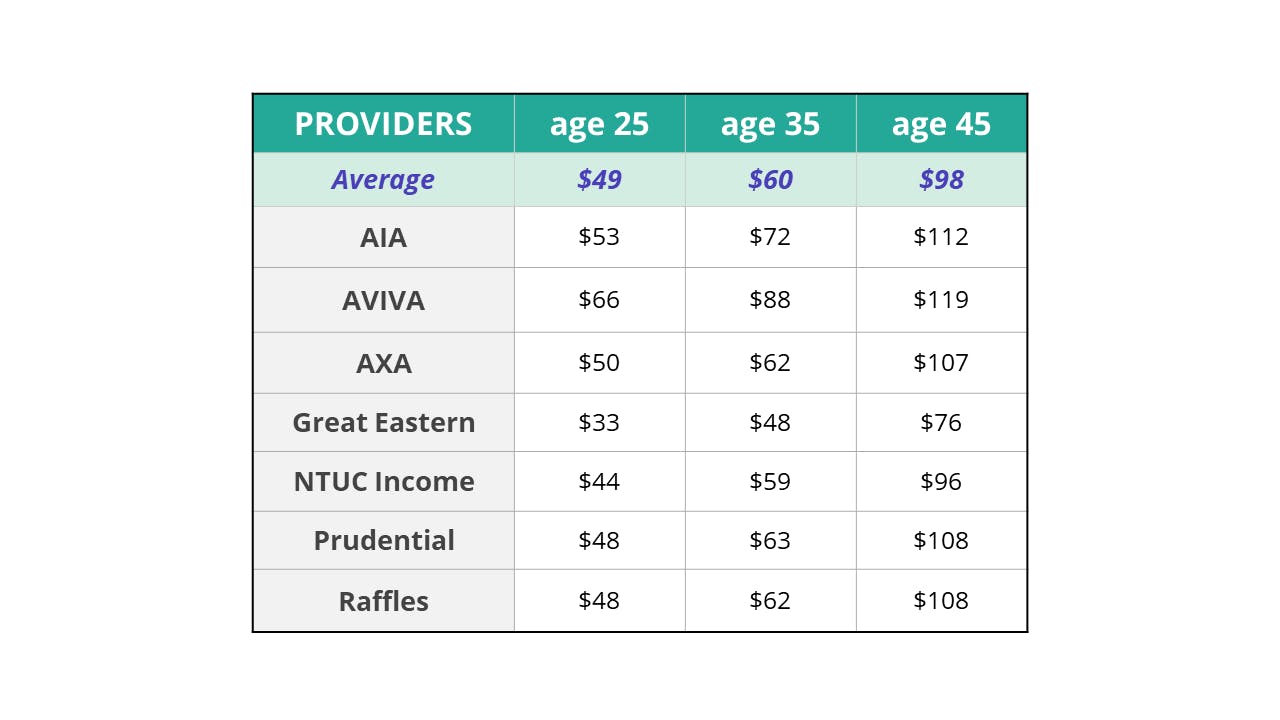

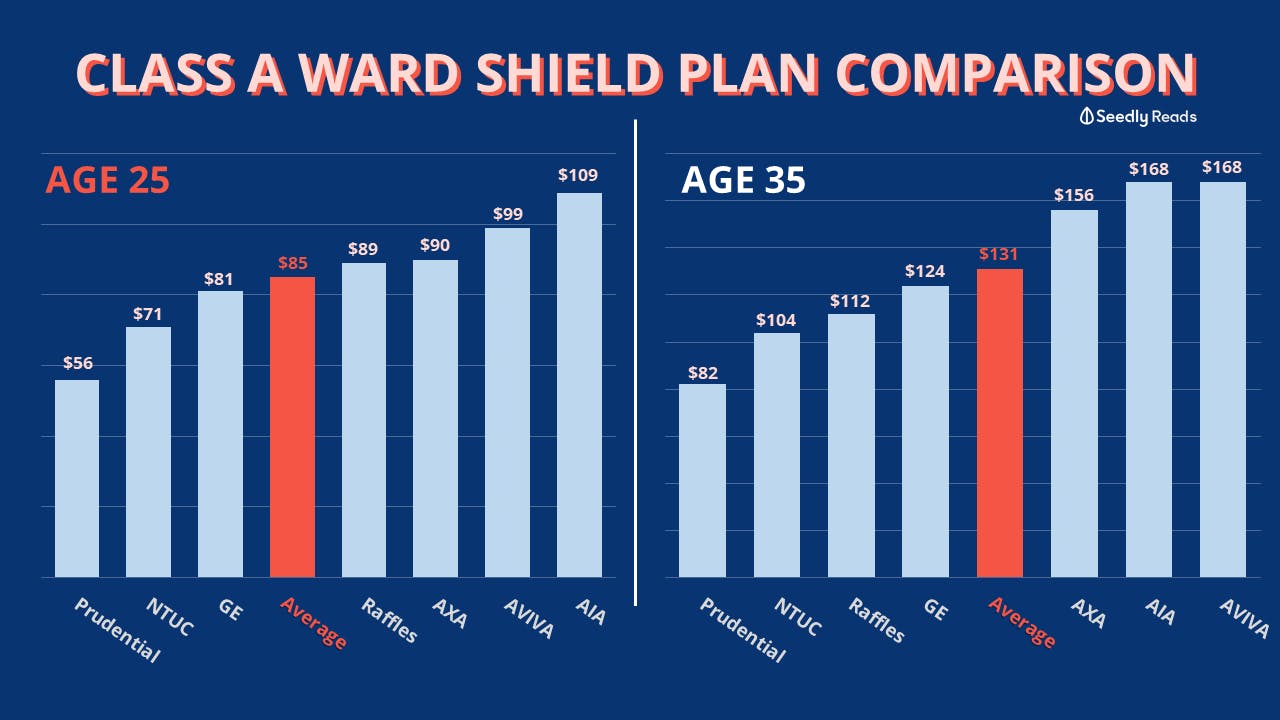

According to our calculations across 3 chosen age groups, IncomeShield is one of the most affordable Integrated Shield Plans for Class A, Class B, and Standard IP.

At age 25 to 35, Enhanced IncomeShield is priced below average for Class A and Class B and Standard IP. Thus, if your age next birthday is within 25 to 35 years old, you can definitely consider Enhanced IncomeShield for their affordability across 3 different tiers of plans.

Note that the pricing system for Income's IP is different - Singaporean Citizens are charged lesser than Permanent Residents for Class B plans. At Age 45, the premium for permanent residents is above average. Hence PR applicants might want to be wary of this.

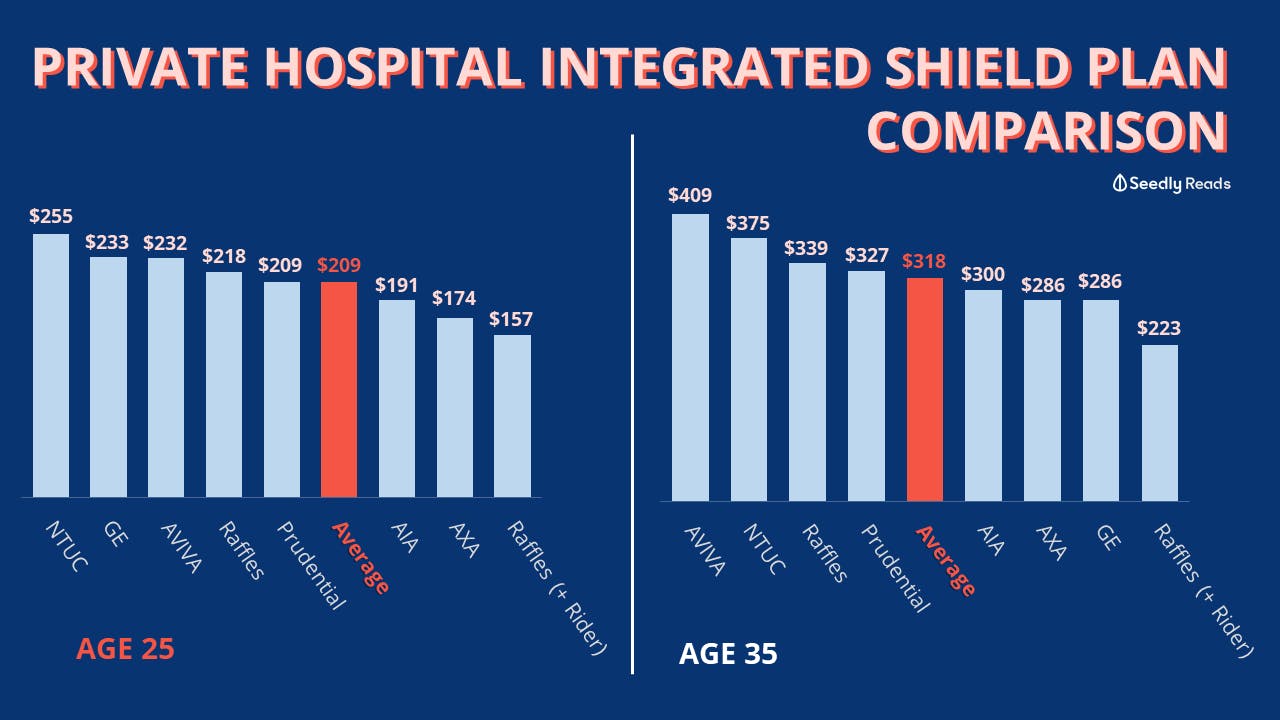

If you're looking for a Private Hospital IP, you should look somewhere else as Enhanced IncomeShield has one of the most expensive premiums for Private Hospital wards evidenced from the comparison chart below.

Apply for Income Integrated Shield Plan

Visit Income's website for a quick quote, and more details on the plan and exclusions

About Income

Income is the only insurance co-operative in Singapore. Established in 1970 to make essential insurance accessible to all Singaporeans, Income is now the leading composite insurer in Singapore offering life, health and general insurance. As a social enterprise, Income has also pushed out initiatives such as Income Family Micro-Insurance and Savings Scheme, Special Care, Orange Aid and more.

Contact us at [email protected] should you require any assistance or spot any inaccuracies

Advertisement

Do you mind to provide the agent name and contact?