Great Eastern GREAT CareShield

- Key Features

- Reviews (18)

- Discussions (0)

- More Details

Advertisement

Great Eastern GREAT CareShield

Great Eastern GREAT CareShield

This product is managed by Great Eastern.

Summary

Great Eastern GREAT CareShield Review 2024

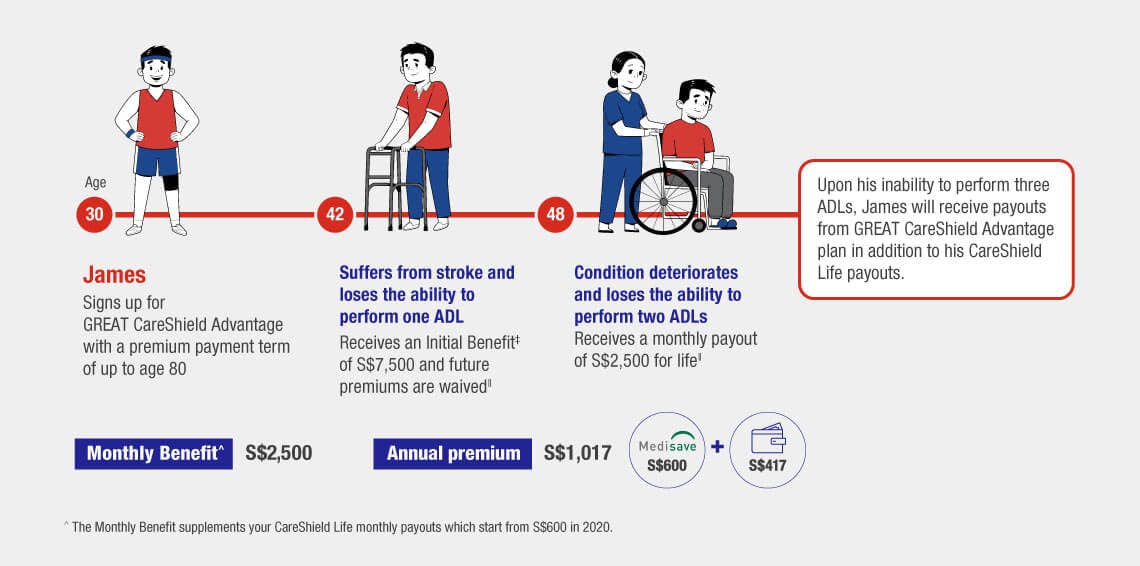

GREAT CareShield supplements your CareShield Life's starting monthly payouts of S$600 in 2020 that increase over time. Your supplementary coverage starts early with additional monthly payouts1 and a lump sum Initial Benefit2 upon the inability to perform just one of the six Activities of Daily Living3 (ADLs). In addition, receive extra monthly payouts from our Caregiver Benefit4 and Dependant Care Benefit5 if you are unable to perform two or more ADLs.

What's more, GREAT CareShield can be fully payable using your MediSave funds6 or cash to start your disability coverage with lower premiums whilst you are still young.

Exclusive Rewards

Enjoy 20% perpetual discount on your premiums (discount applies throughout your coverage) when you sign up.

Product Page Transparency

- Claimed in November 2020

Popular Products

4.3

3 Reviews

No rating yet

0 Reviews

Summary

Great Eastern GREAT CareShield Review 2024

GREAT CareShield supplements your CareShield Life's starting monthly payouts of S$600 in 2020 that increase over time. Your supplementary coverage starts early with additional monthly payouts1 and a lump sum Initial Benefit2 upon the inability to perform just one of the six Activities of Daily Living3 (ADLs). In addition, receive extra monthly payouts from our Caregiver Benefit4 and Dependant Care Benefit5 if you are unable to perform two or more ADLs.

What's more, GREAT CareShield can be fully payable using your MediSave funds6 or cash to start your disability coverage with lower premiums whilst you are still young.

Exclusive Rewards

Enjoy 20% perpetual discount on your premiums (discount applies throughout your coverage) when you sign up.

Product Page Transparency

- Claimed in November 2020

4.1

18 Reviews

Service Rating

Agent Reliability

Ease of Claim

Application Process

High to Low

Posted 05 Jan 2026

Purchased

GREAT CareShield

[Insurance Coverage] It's a very good supplement to Careshield Life. GE is pretty reliable and efficient, I've been with them for over 30 years.0

What are your thoughts?Posted 30 Oct 2024

Purchased

GREAT CareShield

I have not perform any claimed yet but I switch to GE recently. In terms of benefit and premium, it still worth it0

What are your thoughts?Posted 06 Aug 2024

Purchased

GREAT CareShield

GREAT CareShield enhances your CareShield Life plan by providing additional monthly payouts starting at S$600 in 2020, with increases over time. This supplementary coverage offers extra monthly payouts and an Initial Benefit lump sum if you are unable to perform just one of the six Activities of Daily Living (ADLs). Additionally, if you cannot perform two or more ADLs, you will receive extra monthly payouts through our Caregiver Benefit and Dependant Care Benefit. [Customer Service]0

What are your thoughts?Posted 29 Feb 2024

Purchased

GREAT CareShield

Easy to submit thru app or online, and no need cash payment just using medisave. Which I find it a good policy for everyone.0

What are your thoughts?Posted 11 Feb 2024

Purchased

GREAT CareShield

straightforward product and ease of purchase Medisave paid overall recommended thank you 😊 yet to claim so I am not sure how is the process0

What are your thoughts?Posted 11 Sep 2022

Purchased

GREAT CareShield

Bought direct via online application so it’s pretty easy as it illustrate all details you needed to know. Entire process took less than a week to obtain your policy documents. Prefer GE plans as compared to the other insurers due to its offering of 1 ADLs payout and reasonable premium since there is a perpetual discount provided for signup now.0

What are your thoughts?Posted 28 Jul 2022

Purchased

GREAT CareShield

[Claims Process] The claim process takes really long (coming to a year soon) but the agent is very patience and helpful with his continuous follow-ups.0

What are your thoughts?Posted 09 Oct 2021

Purchased

GREAT CareShield

[Online Application Process] It was a seamless user journey when signing up via Singpass Myinfo. CareShield Life Supplement is only available for folks ≥ 30 years old. [Insurance Coverage] [Additonal Premium] Medisave covers up to S$600 of the annual premium (after a 20% discount), which means you don't have to top up cash if you're comfortable with recurring monthly payouts of ≤ S$1,500 in the event of disability (≥ 1 ADL).0

What are your thoughts?17 Mar 2021

Purchased

GREAT CareShield

[Agent Responsiveness] My agent was great - responsive and explains GREAT CareShield Advantage very clearly to me... so that I can just buy it online. You can also buy it now at 20% discount.0

What are your thoughts?Posted 04 Jan 2024

Purchased

GREAT CareShield

Apply and payment easiest. No claim yet. Hope singapore brand can help more people. What do you think?0

What are your thoughts?

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

4.3

3 Reviews

No rating yet

0 Reviews

Great Eastern GREAT CareShield Insurance Coverage Summary

Enhanced and Advantage ranges from the cheapest to the most comprehensive

Benefit Coverage | GREAT CareShield |

|---|---|

Selectable Monthly Benefit | $300 to $5,000 |

Initial Benefit | 300% of Monthly Benefit (≥ 1 ADL) |

Monthly Benefit | 100% of Monthly Benefit (≥ 2 ADL) for life or 50% of Monthly Benefit (≥ 1 ADL) for life |

Premium Waiver | Premiums are waived upon any inability to perform at least 1 ADL |

Policy Term | Lifetime |

Premium Type | Level premium based on age last birthday at entry |

GREAT CareShield Disability Health Insurance Coverage Summary

What is GREAT CareShield for?

According to Great Eastern, "GREAT CareShield is a MediSave-approved supplementary plan to your CareShield Life scheme aimed to provide additional long-term care coverage in the event of a disability. Depending on the plan type, it can provide payouts and benefits starting from as early as the inability to perform 1 Activity of Daily Living (ADL)."

How Does GREAT CareShield Work?

Activities of Daily Living (ADL)

ADL refers to ‘Activities of Daily Living’ or basic self-care tasks which is a measure of how physically independent a person is. Activity of Daily Living encompasses washing, toileting, dressing, feeding, walking or moving around and transferring.

GREAT CareShield Premium Price

How much your premium costs depends on:

- Premium Payment Term - whether you choose to pay until you're 65 years old or 80 years old. The shorter premium term at 60 years old will mean higher annual premiums.

- Age of policy entry - the later you start your policy, the higher the annual premiums

- Gender - Females will need to pay a higher yearly premium than males

- How much monthly benefit you want to enjoy when the policy comes into effect - the higher the monthly benefit you'd like to receive upon being disabled, the higher your annual premium.

Premium Payment Term

The premiums for GREAT CareShield are payable on an annual basis. Premiums for CareShield do not increase with age.

Depending on your entry age (at last birthday), the selectable premium terms are as follows:

- If you are 30 to 55 (age last birthday) when you purchase GREAT CareShield -

Up to and including the Policy Anniversary when you are 65 or 80 (age last birthday) - If you are 56 to 64 (age last birthday) when you purchase GREAT CareShield -

Up to and including the Policy Anniversary when you are 80 (age last birthday) or 10 Years

Premium Waiver

The policy premium will be waived when the insured becomes unable to perform at least 1 ADL.

Premiums paid with MediSave

GREAT CareShield premiums can be paid by cash, your own MediSave funds or the MediSave funds of your family members, up to a limit of S$600 per calendar year per insured person.

Eligibility: Who can apply for Great Eastern GREAT CareShield?

- Citizenship Status: Singaporeans and Permanent Residents. To be an eligible buyer of GREAT CareShield, you must have the standard CareShield Life or ElderShield 300/ ElderShield 400.

- Entry Age: 30 to 55 years old, OR 56 to 64 years old. Policy is renewable up to 80 years old.

Contact Great Eastern

- For product enquiries: +65 6248 2211

- Customer Service: 1800 248 2888

Contact us at [email protected] should you require any assistance or spot any inaccuracies.

Advertisement