OCBC Robinsons Group Credit Card

- Key Features

- Reviews (8)

- Discussions (0)

- More Details

Advertisement

OCBC Robinsons Group Credit Card

OCBC Robinsons Group Credit Card

This product has not been claimed by the company yet.

Summary

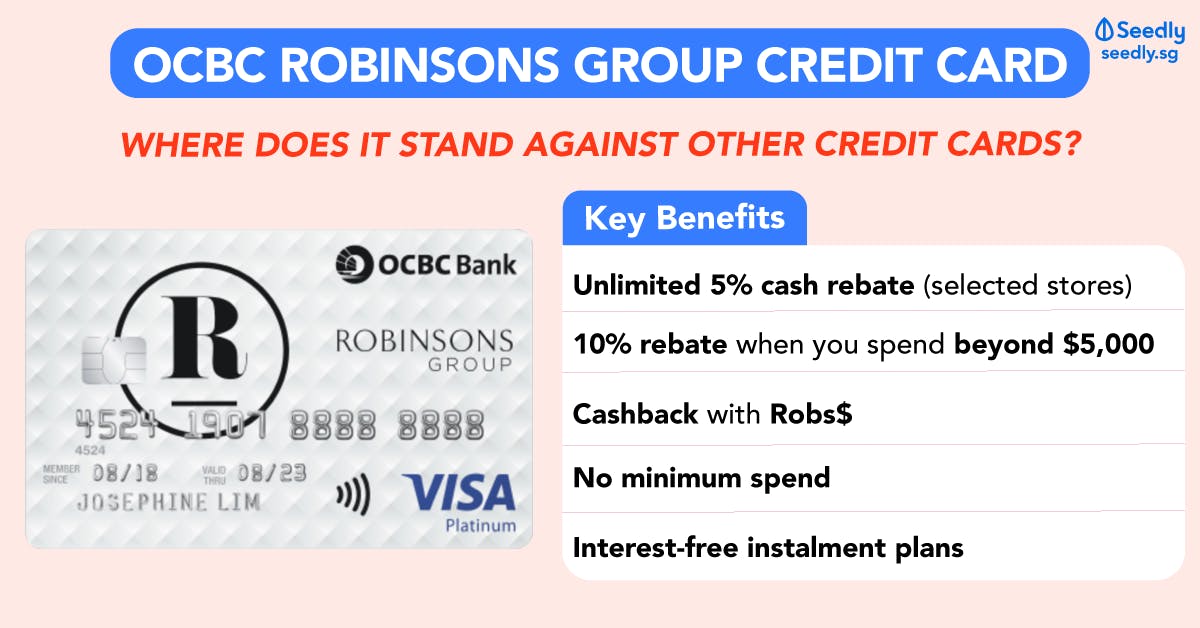

Highlights of OCBC Robinsons Group Credit Card

- All OCBC Robinsons Credit Cards will be cancelled on 15 April 2021.

From 6 November 2020, you will no longer earn any rebates for shopping at Robinsons and Marks & Spencer. However, you will still earn Robinsons$ for all purchases made using your OCBC Robinsons Credit Card. Robinsons$ can be used at all Marks & Spencer and Robinsons Singapore stores. - Unlimited 5% cash rebate with Robinsons and Mark & Spencer

- 10% rebate when you spend beyond $5,000

- Cashback with Robs$

- No minimum spend

- Interest-free instalment plans

Find out about the card's host of benefits, charges, promotions and eligibility criteria below.

Popular Products

4.2

166 Reviews

4.1

175 Reviews

4.3

97 Reviews

3.9

198 Reviews

Summary

Highlights of OCBC Robinsons Group Credit Card

- All OCBC Robinsons Credit Cards will be cancelled on 15 April 2021.

From 6 November 2020, you will no longer earn any rebates for shopping at Robinsons and Marks & Spencer. However, you will still earn Robinsons$ for all purchases made using your OCBC Robinsons Credit Card. Robinsons$ can be used at all Marks & Spencer and Robinsons Singapore stores. - Unlimited 5% cash rebate with Robinsons and Mark & Spencer

- 10% rebate when you spend beyond $5,000

- Cashback with Robs$

- No minimum spend

- Interest-free instalment plans

Find out about the card's host of benefits, charges, promotions and eligibility criteria below.

3.6

8 Reviews

High to Low

Posted 18 Nov 2019

Purchased

OCBC Robinsons Group Credit Card

[Fee Waivers] The phone system is not intuitive. I had to key my card numbers many times before it registered. I keyed in correctly but it keep saying wrong card number. But when I tried to speak to customer service, first it said the system is down and to try again later. I tried the next day and was put on hold for more than 10 minutes until I gave up.0

What are your thoughts?Posted 13 Nov 2019

Purchased

OCBC Robinsons Group Credit Card

This is one of my favourite credit card for shopping! I mainly use this card during Robinsons sales as on top of the Robinsons discount, this card also gives a very good cashback of 5% with no minimum spend required. If buy expensive stuff like mattress the expenses can easily reach few thousands dollars, cashback will be upgraded to 10% if spend beyond 5k within the qualifying period. This is literally the more you spend the more you save. 😄0

What are your thoughts?Posted 13 Nov 2019

Purchased

OCBC Robinsons Group Credit Card

Prompt and helpful service provided by customer service teams. No issue in using the card. Able to use points for cashback0

What are your thoughts?20 Nov 2019

Purchased

OCBC Robinsons Group Credit Card

This card is highly recommended if you shop at Robinsons and Marks & Spencer. One could earn a rebate of 5% with no minimum spend. With more spending, one could earn a rebate of up to 10%. For example, if one spends $8000, the first $5000 earns him/her a rebate of 5% and the next $3000 earns him/her a rebate of 10%. Otherwise it is a pretty average card.0

What are your thoughts?Posted 20 Nov 2019

Purchased

OCBC Robinsons Group Credit Card

This card is good if you like to shop at Robinsons. There are a lot of member's sales all year round and some of the discounts can be quite good. The Robinson's rebates are quite generous too.0

What are your thoughts?Posted 13 Nov 2019

Purchased

OCBC Robinsons Group Credit Card

[Useful For...] Shopping at Robinson with additional savings. I only use this card for shopping at Robinson0

What are your thoughts?Posted 13 Nov 2019

Purchased

OCBC Robinsons Group Credit Card

Not much use of it, reason being: 1) It's rebate scheme means can only use back rewards earn to spend at Robinson groups of company. 2) Most stuff in Robinson store were unique and overpriced. Thus rebates value / purchasing power is way lower compare to other cards / cash back / miles rewardy. 3) Good rebates if you're purchasing big items like 2 to 3k mattress, some household appliances but again price is high and may get better deals elsewhere! 4) Due to reason #1 and #2, so user were stuck at Robinson stores, a bad cycle. However, Robinson does carry quality stuff if that's what consumer is looking for and don't mind the pricing.0

What are your thoughts?20 Feb 2020

Purchased

OCBC Robinsons Group Credit Card

[Useful For...] Those who shop a lot at Robinsons. I'm personally not a huge fan of Robison fan so this card isn't the best for me! It doesn't give me good cashbacks as well, especially for overseas use. [Fee Waivers] Fee waivers are pretty easy! Just call and get them to waive your fees.0

What are your thoughts?

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

4.2

166 Reviews

4.1

175 Reviews

4.3

97 Reviews

3.9

198 Reviews

All OCBC Robinsons Credit Cards will be cancelled on 15 April 2021.

From 6 November 2020, you will no longer earn any rebates for shopping at Robinsons and Marks & Spencer. However, you will still earn Robinsons$ for all purchases made using your OCBC Robinsons Credit Card. Robinsons$ can be used at all Marks & Spencer and Robinsons Singapore stores.

The OCBC Robinsons Group Credit Card

New to credit cards? Here's your complete guide to cashback credit cards.

Eligibility for OCBC Robinsons Group Credit Card

To be eligible for the OCBC Robinsons Group Credit Card, you'll have to meet the following criteria:

- Be at least 21 years old

- For Singaporeans and PRs: Minimum annual income of $30,000

- For foreigners: Minimum annual income of $45,000

Fees and Charges for OCBC Robinsons Group Credit Card

- Annual Principle Fee: S$192.60 (First year waived)

- Annual Supplementary Card fee: S$96.30

- Fee waiver: Available (provided that you hit the minimum spending of at least S$3,000 in 1 year, starting from the month in which the card is issued)

- Interest-Free Period: 23 days

- Annual Interest Rate: 26.88%

- Minimum monthly payment: 3% or $50, whichever is higher

- Late payment charge: $100

- Cash advance fee: 6% or $15, whichever is higher

- Administration Fee: S$150 to accelerate payment of automatic instalments

- Extension of instalment term: 3% of outstanding amount applies for 3- and 6-month term extension, and 5% of outstanding amount applies for 12-month term extension.

Key Features and Benefits of OCBC Robinsons Group Credit Card

These are some highlights of the OCBC Robinsons Group Credit Card and the cashback benefits to offer.

Benefits of OCBC Robinsons Group Credit Card | What You'll Get |

|---|---|

Rebates | Unlimited 5% rebate for these retail brands:

10% rebate

|

Robs$ |

|

In-Store Privileges | Cardmember prices, promotions and exclusive invitations to member-only events |

Parking | Enjoy one hour free parking every weekend at

|

Interest-Free Instalment Plans | 6-12 months of 0% interest payment plans at robinsons |

Special Perks | 5% off at Angela May Food Chapters, Gyoza-Ya, Sushi Goshin, The Scene and &Made Burger Bistro |

OCBC Robinsons Group Credit Card - Benefits

Terms and Conditions of OCBC Robinsons Group Credit Card

- Transactions not eligible for cash rebate include: prepaid accounts and payment service providers (e.g. EZ-Link), charitable/religious organisation donations, cleaning, maintenance and janitorial services, real estate agents and bank fees

- Cash rebates will be automatically credited to your monthly statement

- Cash rebates are calculated based on selling price which is not inclusive of GST

- For Royal Sporting House, Lacoste, Reebok, Speedo, Sperry, Ted Baker and The Social Foot, it will be categorised under the RSH Group Rebate

- Effective 16 Jan 2020, the 5% cash rebate transactions spent on OCBC Robinsons Group Credit Card will be limited to Robinsons and Marks Spencer only

- 10% cash rebate will be active after you spend more than $5,000 at Robinsons or Marks & Spencers during the qualifying period

About OCBC

The Overseas-Chinese Banking Corporation, Limited - or OCBC Bank - is headquartered in Singapore. Its inception in 1932 was the result of a merger of three local banks. As the second-largest bank in Southeast Asia, the multinational banking and financial services has assets of close to $468 billion. It has an Aa1 rating from Moody's, and an AA-rating from Standard & Poor's.

At present, the bank has over 570 branches across 18 countries and regions. Its services range from commercial banking and specialist financial and wealth management to asset management, stockbroking, insurance and treasury services.

Still unsure? Find out everything you need about credit cards - including what the best credit cards in Singapore are for miles and cashback, factors to consider before getting one, fees to know, and why a good credit score matters.

You can also pose questions (anonymously, if you'd prefer) on the Seedly Q&A platform.

Advertisement