DBS Takashimaya Visa Credit Card

- Key Features

- Reviews (3)

- Discussions (0)

- More Details

Advertisement

DBS Takashimaya Visa Credit Card

DBS Takashimaya Visa Credit Card

This product has not been claimed by the company yet.

Summary

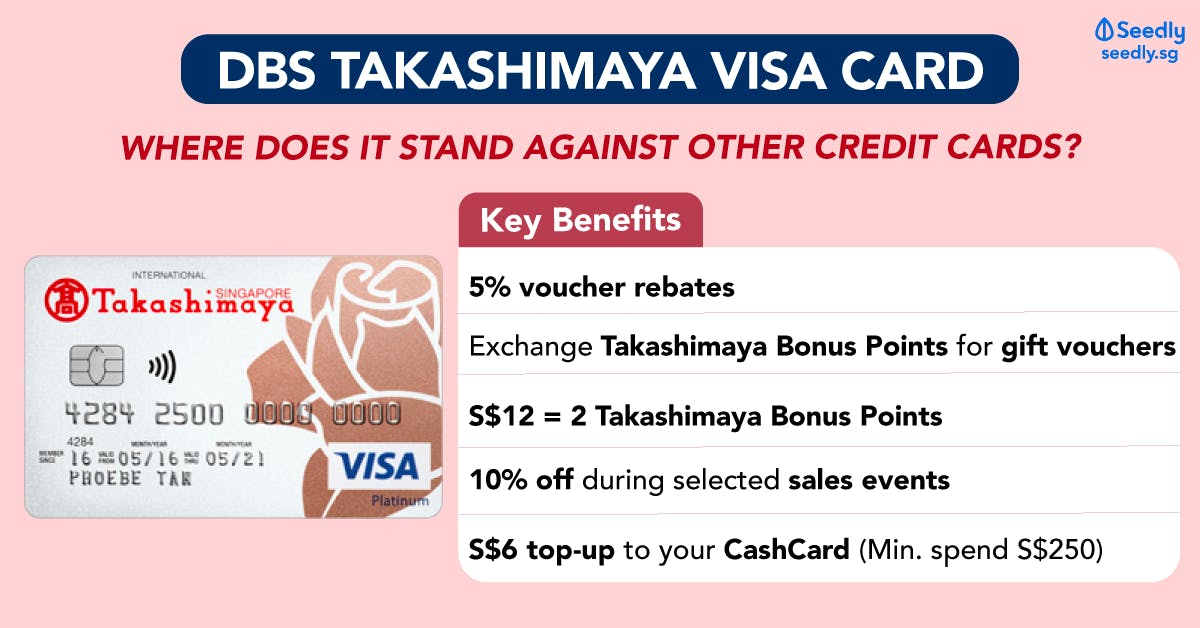

Highlights of DBS Takashimaya Visa Card

- 5% voucher rebates

- S$30 worth of Takashimaya Gift Vouchers with every 100 Takashimaya Bonus Points

- S$12 = 2 Takashimaya Bonus Points

- 10% off during selected sales events

- Up to S$6 top-up to your CashCard

Find out about the card's host of benefits, charges, promotions and eligibility criteria below.

Popular Products

4.1

176 Reviews

4.1

166 Reviews

3.9

199 Reviews

4.3

97 Reviews

Summary

Highlights of DBS Takashimaya Visa Card

- 5% voucher rebates

- S$30 worth of Takashimaya Gift Vouchers with every 100 Takashimaya Bonus Points

- S$12 = 2 Takashimaya Bonus Points

- 10% off during selected sales events

- Up to S$6 top-up to your CashCard

Find out about the card's host of benefits, charges, promotions and eligibility criteria below.

DBS Takashimaya Visa Card

DBS Takashimaya Visa Card

2 Takashimaya Bonus Points per $12 at selected stores

SELECTED SPEND

2 Miles per DBS Point

CONVERSION

3.7

3 Reviews

High to Low

Posted 10 Dec 2019

Purchased

DBS Takashimaya Visa Card

[Promotions and Perks] Use it for any Takashimaya shopping. Mine comes with ATM withdrawal function so its an ATM card doubled as a credit / debit card.0

What are your thoughts?Posted 13 Nov 2019

[Useful For...] Shopping at Takashimaya and getting discounts and perks. [Others] shopping makes it easy. [Promotions and Perks] [Cashback Card]0

What are your thoughts?01 Jul 2020

Purchased

DBS Takashimaya Visa Card

Good for accumulating points if you shop frequently at Takashimaya, especially during Takashimaya Sale. However, they don't allow fee waiver. Hence I've cancelled the card. The customer service lady is kind enough to remind me to redeem all the points into vouchers before cancelling it.0

What are your thoughts?

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

4.1

176 Reviews

4.1

166 Reviews

3.9

199 Reviews

4.3

97 Reviews

DBS Takashimaya Visa Card Review 2021

New to credit cards? Here's your complete guide to cashback credit cards.

Key Features and Benefits of DBS Takashimaya Visa Card

These are some features of the DBS Takashimaya Visa Card and the cashback benefits it has to offer.

Benefits of DBS Takashimaya Visa Card | What You'll Get |

|---|---|

Takashimaya Bonus Points |

|

Rebates | Enjoy 0.5% voucher rebates on all spend

|

Overseas Shopping | Up to 5% discount at Takashimaya Japan, Shanghai, Siam and Ho Chi Minh |

DBS Takashimaya Visa Card - Benefits

Eligibility for DBS Takashimaya Visa Card

- Be at least 21 years old

- Income of S$30,000 and above per annum for Singaporeans and PR

- Income of S$45,000 and above per annum for foreigner

Fees and Charges for DBS Takashimaya Visa Card

- Annual Principle Fee: $196.20

- Annual Supplementary Card fee: S$96.30 for each supplementary card.

- Fee Waiver: First-year annual fee waiver

- Interest-Free Period: 20 days

- Charges for Card Transactions: At the prevailing effective interest rate of 26.80% p.a. (subject to compounding if charges are not paid in full), chargeable on a daily basis from the date of transaction until receipt of full payment. A minimum charge of $2.50 applies.

- Charges for Cash Advance: At the prevailing effective interest rate of 28% p.a. (subject to compounding if charges are not paid in full) on the amount withdrawn, chargeable on a daily basis from the date of withdrawal until receipt of full payment. A minimum charge of $2.50 applies.

- Minimum Monthly Payment: 3% of the outstanding balance, in addition to: i) the total sum of any overdue minimum payment, ii) late payment charges, and iii) any amount exceeding your credit limit, or S$50 (whichever is greater).

- Late Payment Charge: A charge of $100 applies for outstanding balances of $50.01 and up, if payment is not received by the due date. For outstanding balances of $50 and below, no charge applies.

- $0, if the minimum payment specified in the statement is not received by the payment date.

- Cash Advance Fee: The fee for a cash advance is $5 or 3% of the transaction, whichever is greater.

Terms and Conditions of DBS Takashimaya Visa Card

- For cardmembers, the Takashimaya voucher will be mailed to their mailing address within 2 calendar months

- From 1 April 2020, the voucher will be issued via DBS lifestyle App instead of the physical vouchers

- Takashimaya Bonus Points are given upon presentation of the DBS Takashimaya Card when you purchase the goods sold in-store when you shop at Takashimaya

- For S$6 top-up to your CashCard for parking is only when you have a transaction of at least S$250 to your card. Maximum of 3 charge slips from the same day of purchase in order to obtain the benefit

- For Takashimaya Japan, enjoy 5% discount off your net amount

- With 300 Takashimaya Bonus Points accumulated, you can redeem for S$90 worth of Takashimaya Gift Vouchers

DBS Contact Info

- Loss of ATM card(s): 1800 339 6963 (SG) or +65 6339 6963 (if overseas)

- Banking and general enquiries: 1800 111 1111 (SG) or +65 6327 2265 (if overseas)

About DBS

Singapore bank DBS was founded in 1968, and currently has over 100 branches islandwide. With assets totalling some $518 million (as of end-Dec 2017), DBS is the largest bank in Southeast Asia - of which its primary shareholder is Temasek Holdings. The bank's key areas of focus include consumer banking, asset management, securities brokerage, treasury and debt fund-raising in Singapore and Hong Kong.

Still unsure? Find out everything you need about credit cards - including what the best credit cards in Singapore are for miles and cashback, factors to consider before getting one, fees to know, and why a good credit score matters.

You can also pose questions (anonymously, if you'd prefer) on the Seedly Q&A platform.

Advertisement