DBS Black American Express Card

- Key Features

- Reviews (1)

- Discussions (0)

- More Details

Advertisement

DBS Black American Express Card

DBS Black American Express Card

This product has not been claimed by the company yet.

Summary

DBS Black American Express Card Review 2024

With effect from 1 March 2022, DBS has stopped accepting applications for new DBS Black Visa Card and DBS Black American Express® Card. For existing DBS Black Card customers, you will be able to continue using the card.

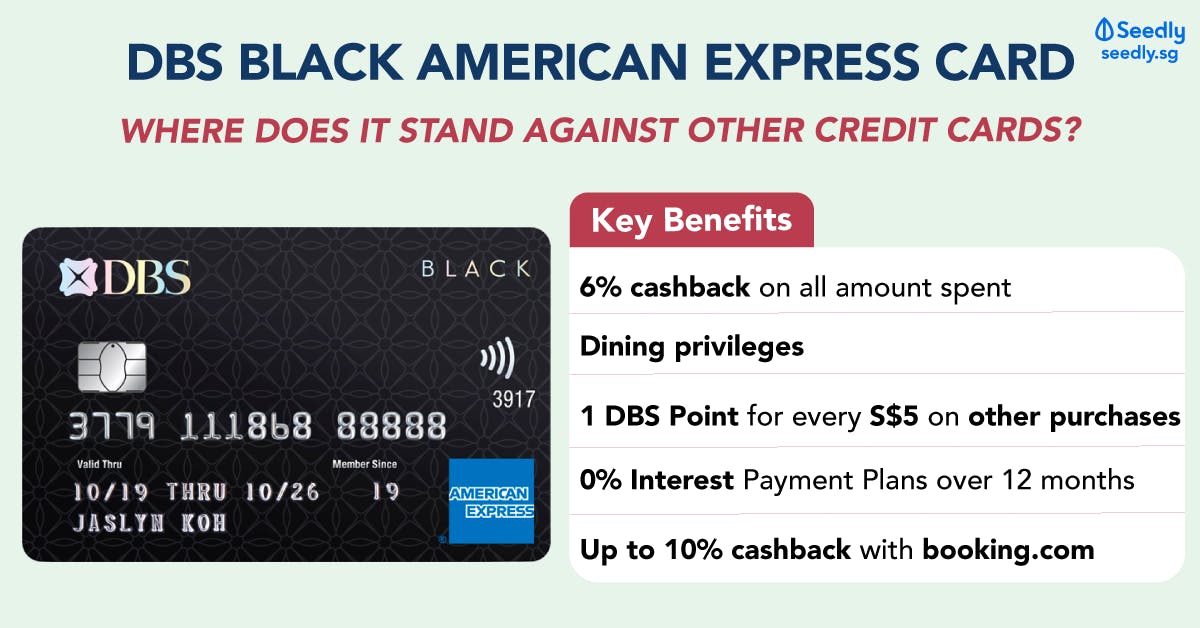

Highlights of DBS Black American Express Card 2024

- 6% cashback on all amount spent with the DBS Black American Express Card

- Dining privileges

- 1 DBS Point for every S$5 on other purchases

- 0% Interest Payment Plans over 12 months

- Up to 10% cashback with booking.com

Find out about the card's host of benefits, charges, promotions and eligibility criteria below.

Popular Products

4.1

176 Reviews

4.3

97 Reviews

4.4

57 Reviews

4.7

38 Reviews

Summary

DBS Black American Express Card Review 2024

With effect from 1 March 2022, DBS has stopped accepting applications for new DBS Black Visa Card and DBS Black American Express® Card. For existing DBS Black Card customers, you will be able to continue using the card.

Highlights of DBS Black American Express Card 2024

- 6% cashback on all amount spent with the DBS Black American Express Card

- Dining privileges

- 1 DBS Point for every S$5 on other purchases

- 0% Interest Payment Plans over 12 months

- Up to 10% cashback with booking.com

Find out about the card's host of benefits, charges, promotions and eligibility criteria below.

DBS Black American Express® Card

DBS Black American Express® Card

1X Points per $5

ALL SPEND

2 Miles per DBS Point

CONVERSION

1.0

1 Reviews

High to Low

Posted 13 Nov 2019

Purchased

DBS Black American Express® Card

The nature of it being Amex card, it inherits the issue of Amex , for many years. After being the leaders even before Visa / Master , Amex co exist with Diners card for more than 50 years beyond how long that I know, yet no matter how many times i've call CSO, they told me lots of places accept, lots of promotions, but when i go for dining / spending, especially dining, i still find it not being accepted. Not only so, the repayment from some bank is also quite limited in modern days, in DBS you got a special link / section to repay it via ibanking directly. The rest of the bank is even worst. So far, non of the bank allows anyone to repay Amex card via mobile app. The only point i see fit is to use it to top up Grabpay and use Grabpay app or GPMC for spending, but without much benefits, the other Amex true Cash back card at least fit this purposes with 1.5% cash back (besides beginning promotions of 3%). Thus don't recommend this card at all.0

What are your thoughts?

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

4.1

176 Reviews

4.3

97 Reviews

4.4

57 Reviews

4.7

38 Reviews

DBS Black American Express Card Review 2021

The DBS Black American Express Card is a popular option thanks to its myriad of cashback perks spanning transport, entertainment, food, flights and online shopping.

New to credit cards? Here's your complete guide to cashback credit cards.

Key Features and Benefits of DBS Black American Express Card

These are some features of the DBS Black American Express Card and the cashback benefits it has to offer.

Benefits of DBS Black American Express Card | DBS Points

|

|---|---|

Dining |

|

Shopping |

|

Travel |

|

DBS Black American Express Card - Benefits

Eligibility for DBS Black American Express Card

- Be at least 21 years old

- Income of S$30,000 and above per annum for Singaporeans and PR

- Income of S$45,000 and above per annum for Foreigners

Fees and Charges for DBS Black American Express Card

- Annual Principle Fee: S$192.60

- Annual Supplementary Card fee: S$96.30 for each supplementary card.

- Fee Waiver: First-year annual fee waiver

- Interest-Free Period: 20 days

- Charges for Card Transactions: 25.90%

- Annual Interest Rate: 25.90%

- Minimum monthly payment: 3% or S$50, whichever is higher

- Late payment charge: S$100

- Cash advance fee: 6% or S$15, whichever is higher

- Overlimit fee: S$40

Terms and Conditions of DBS Black American Express Card

- Promotions are not valid with other on-going promotions and discounts

- For dining privileges, there is a minimum spend requirement unless otherwise stated

- DBS Points will be awarded for every S$5 spend

- For the 0% Interest Instalment Plan, there is an administrative charge of S$150 for early repayment or card account termination

- DBS reserves the rights to approve or reject any instalment plan(s)

- The following transactions types will not qualify for rewards: bill payments, payments towards educational institutions, financial institutions, government institutions, hospitals and more

DBS Contact Info

- Loss of ATM card(s): 1800 339 6963 (SG) or +65 6339 6963 (if overseas)

- Banking and general enquiries: 1800 111 1111 (SG) or +65 6327 2265 (if overseas)

About DBS

Singapore bank DBS was founded in 1968, and currently has over 100 branches islandwide. With assets totalling some $518 million (as of end-Dec 2017), DBS is the largest bank in Southeast Asia - of which its primary shareholder is Temasek Holdings. The bank's key areas of focus include consumer banking, asset management, securities brokerage, treasury and debt fund-raising in Singapore and Hong Kong.

Still unsure? Find out everything you need about credit cards - including what the best credit cards in Singapore are for miles and cashback, factors to consider before getting one, fees to know, and why a good credit score matters.

You can also pose questions (anonymously, if you'd prefer) on the Seedly Q&A platform.

Advertisement