Citi SMRT Card

- Key Features

- Reviews (59)

- Discussions (0)

- More Details

Advertisement

Citi SMRT Card

Citi SMRT Card

This product has not been claimed by the company yet.

Summary

Citi SMRT Card

Product Page Transparency

- Pays to access additional features

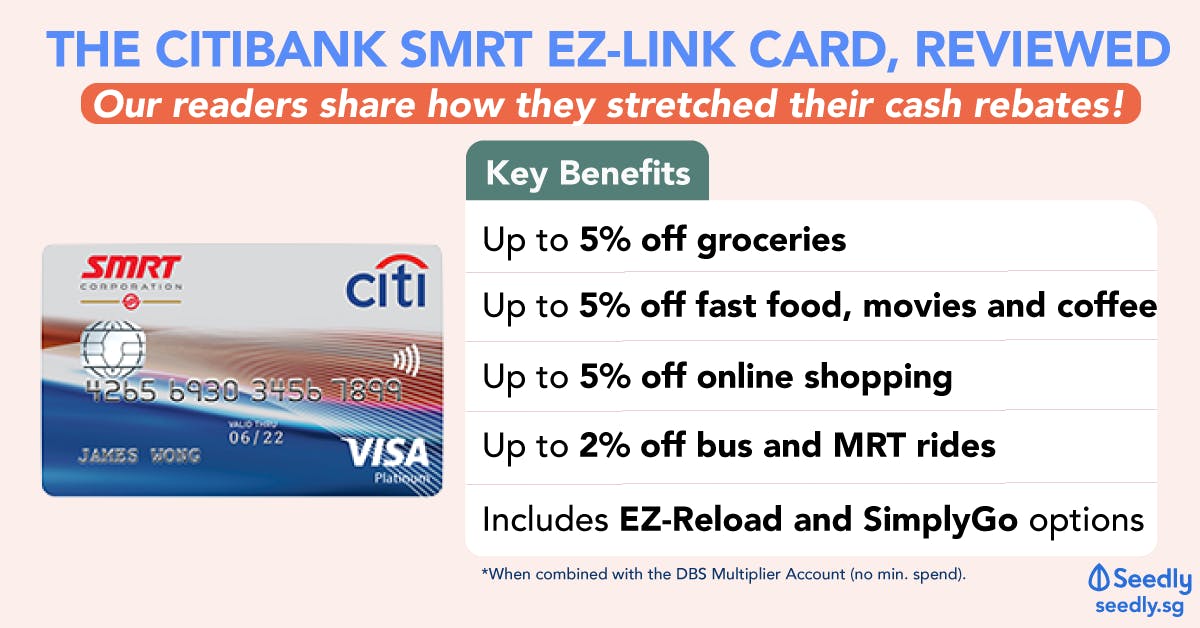

Citi SMRT Card Review 2025

Here are the highlights of Citi SMRT Credit Card:

- Rebates in the form of SMRT$ which can be used to redeem cash rebates and vouchers

- Up to 5% off Groceries (7.3% at FairPrice Xtra Kallang Wave)

- Up to 5% off Fast food, Movies, and Coffee

- Up to 5% off online shopping

- Up to 5% off EZ-Link Auto Top-Up SimplyGo

- Up to 2% off Health & Beauty

- These rebates already include the base rebate rate of 0.3%

- Doubles as an EZ-Link Card with an automatic top-up function

- If your total monthly statement of retail purchases falls below S$500, the eligible rebate rates will be reduced to 0.3%

Find out about the card's complete host of benefits, charges, and promotions below.

Popular Products

4.1

176 Reviews

4.1

166 Reviews

3.9

199 Reviews

4.3

97 Reviews

Summary

Citi SMRT Card

Product Page Transparency

- Pays to access additional features

Citi SMRT Card Review 2025

Here are the highlights of Citi SMRT Credit Card:

- Rebates in the form of SMRT$ which can be used to redeem cash rebates and vouchers

- Up to 5% off Groceries (7.3% at FairPrice Xtra Kallang Wave)

- Up to 5% off Fast food, Movies, and Coffee

- Up to 5% off online shopping

- Up to 5% off EZ-Link Auto Top-Up SimplyGo

- Up to 2% off Health & Beauty

- These rebates already include the base rebate rate of 0.3%

- Doubles as an EZ-Link Card with an automatic top-up function

- If your total monthly statement of retail purchases falls below S$500, the eligible rebate rates will be reduced to 0.3%

Find out about the card's complete host of benefits, charges, and promotions below.

3.7

59 Reviews

Service Rating

Speed of Approval

Ease of Fee Waiver

Customer Support

High to Low

Posted 11 Feb 2022

Purchased

Citi SMRT Card

This card is a rare gem amongst cashback cards. It is the only one with essentially unlimited (capped at 12k annually) monthly online spend which nets you 5% back. Great if you are moving into a new home and constantly buying appliances or even furniture online. No other card even comes close to this as cashback cards all have monthly rebate caps, or else the other unlimited ones are closer to 1.5-1.7%.1

What are your thoughts?Chin Guo Qiang (CSM / CAL / ITIL4)

26 May 2022

Principal Engineer at Defence Science & Technology Agency

Reply

Save

Posted 23 Aug 2021

Purchased

Citi SMRT Card

Super useful card for public transport, especially for folks who travel to and from office daily on commute. the cashback is great0

What are your thoughts?17 Oct 2020

Purchased

Citi SMRT Card

I like this card and company very much. Fast, easy convenient, bill paying. Also very kind and cheery staff. Everything is clear, I didnt feel sketched out at all, which is unusual0

What are your thoughts?16 Jul 2020

Purchased

Citi SMRT Card

[Customer Service] Their reply on the secure messages on any enquiry is very fast! This card is good. High cashback if your spendings fall into the categories - Fast food, NTUC Finest... Besides that, Phone bill (M1, Starhub, Singtel) 0.7% - 1% cashback also available when you sign up for OneBill - recurring payment incorporate into the credit card bills. Redemption of the cashback is FAST AND EASY. SMS to 72484 on the amount you want to redeem (min. $5), they will reply you within minutes on the successful redemption. Take note: the amount is to trade off the spending on your next credit card bill instead of paying off your current credit card bill.0

What are your thoughts?08 Jul 2020

Purchased

Citi SMRT Card

The is the best and most convenient and flexible credit card in Singapore. Can be used for almost anything and get fair rebates. Even if you don't hit spending target, the rebates already more than other cards with lower spending. This is very good for the wallet. Can even get credit rebates. Although their customer service a bit hard to reach, they will try their best to help you. Whenever you top up for ez-link card, there will be SMRT points rewarded which is awesome.0

What are your thoughts?08 Jul 2020

Purchased

Citi SMRT Card

This is the best transitlink card that gives you rebates when you travel too! It’s a necessary card and I highly recommend it0

What are your thoughts?08 Jul 2020

Purchased

Citi SMRT Card

This is a good credit card for individuals who take public transport regularly and spend substantially on groceries! It gives up to 5% rebate on groceries from different supermarkets allowing you to get the best deals from different supermarkets! It doubles up as a ezlink auto top up giving you a piece of mind when travelling for work or leisure. It gives you up to 3% for online shopping as well! Excellent all in 1 card!0

What are your thoughts?08 Jun 2020

Purchased

Citi SMRT Card

Probably the best all rounder cashback cc in the market. Don’t let the minimum spend deter you from finding out more. Should you be unable to hit $300, the cash back percentage is still a reasonable amount, in fact, higher than most Cashback cc.0

What are your thoughts?09 May 2020

Use it daily as my ez-link. Zero auto reload fees. Great for buying groceries (read: Beer) at NTUC. Only gripe I have is that it no longer offers SMRT vouchers you can exchange the reward points for (totally removes the point of it being a co-branded cc). Back to 5 stars once this will be available again. Edit May 2020: someone on seedly pointed out to me I can sms to redeem points against the monthly bill. Which indirectly negates the need to redeem for SMRT vouchers to top up the ezlink account. Bumped up to 5 stars for ease of use. Too bad I'm not really using the card now due to wfh arrangements and circuit breaker.0

What are your thoughts?Posted 30 Dec 2019

Purchased

Citi SMRT Card

It's very useful for ezlink card top up when it's linked to the ez-reload. This is a very good credit card everyday use (ie 7eleven, McDonald's, Sheng Shiong, etc.) that can be used to collect rebates. The app is also easy to use and navigate for points tracking and redemption.0

What are your thoughts?

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

4.1

176 Reviews

4.1

166 Reviews

3.9

199 Reviews

4.3

97 Reviews

Key Benefits of Citi SMRT Card

These are some highlights of the Citi SMRT EZ-LINK Card and the cashback benefits on offer.

Citi SMRT Card Benefits | What You'll Get (in cash rebates, or SMRT$) assuming |

|---|---|

Groceries |

|

Coffee, Movies and Fast Food |

|

Online shopping |

|

Public Transport |

|

Lifestyle |

|

|

Citi SMRT Card: Benefits

Individual SMRT$ Rebate Rate Breakdown

How does Citi SMRT Card Work?

As demonstrated above, to earn the maximum rebate rates, the total monthly spending should be at least S$500.

Eligibility for Citi SMRT Card

To be eligible for the Citi SMRT card, you'll have to meet the following criteria:

- Be at least 21 years old

- For Singaporeans and PRs: Minimum annual income of $30,000

- For foreigners: Minimum annual income of $42,000

Fees and Charges for Citi SMRT Card

- Annual Principle Fee: $192.60

- Annual Supplementary Card fee: $96.30

- Fee Waiver: First 2 years annual fee for Basic and two Supplementary Cards; thereafter chargeable

- Interest-Free Period: 25 days

- Annual Interest Rate: At the prevailing effective interest rate of 25.90% p.a. subject to compounding; or 29.99% p.a. subject to compounding in the event that your account has three or more defaults~ and/or one default~ which remains unpaid for two or more consecutive months in the last 12 months.

- Minimum monthly payment: 1% or $25, whichever is greater

- Late payment charge: If the Minimum Payment Due is not received on or before the Payment Due Date, a Late Payment Charge of $40 will be levied.

- Cash advance fee: $15 or 6% of amount withdrawn, whichever is greater

- Handling fee for dishonoured cheque/payment order: $25.00, if any check or other payment order tendered as payment to Citibank is dishonoured

- Overlimit fee: $40 will be charged on the card with highest balance on the statement billing date, if the total outstanding balance (including unbilled balance) of all credit card(s) exceeds customer’s combined credit limit on any day within the statement period.

The Best Cash Back Credit Cards Review 2020: How does Citi SMRT Compare?

The Citi SMRT Card offers rebates in the form of SMRT$, which can be exchanged for shopping vouchers for use at Giant, Sheng Siong, Watsons, Shaw Theatres, Popular and Pizza Hut. You can also enjoy discounts on shopping and dining transactions, among other things.

Citi SMRT is a great card for people who always commute via Public Transport and frequent the merchants around SMRT Exchange or Public Transport Interchanges. While its rebate per month is capped at S$50/month ($600/ a year), the low minimum spend continues to make this card attractive. To fully maximise the Citi SMRT Card, there is a minimum required spend of S$300, which is a very reasonable amount. The 5% coverage on groceries and certain food outlets might not be the best, but they are still pretty decent. Overall, this card is best for commuters with a thrifty lifestyle.

Still unsure? Find out everything you need about credit cards - including what the best credit cards in Singapore are for miles and cashback, factors to consider before getting one, fees to know, and why a good credit score matters.

You can also pose questions (anonymously, if you'd prefer) on the Seedly Community.

EZ-Reload vs SimplyGo: What's the Difference?

As an aside - and if you're wondering about the differences between the EZ-Reload and SimplyGo functions - this table might serve you well.

EZ-Reload | SimplyGo |

|---|---|

Automatic EZ-Link top-up upon insufficient value (default top-up: $30) | Allows for use of contactless debit or credit card. (No need for top-up) |

No fee charges | No fee charges |

Auto top-ups will be charged to monthly credit card statement | Automatically charged to monthly credit card statement |

Up to 2% SMRT$ on your EZ-Reload transactions. | NIL |

EZ-Reload on Citi SMRT EZ-Link Card VS SimplyGo

Terms and Conditions of Citi SMRT Card

- Approximately 7 working days should be allowed for the processing of a cash rebate redemption request. The cash rebate will be reflected as a credit in the statement of account and is not to be taken as a payment in reduction of the minimum payment due, total amount due or any amount in between that is due on the Basic Cardmember’s Card account statement. The Basic Cardmember is required to settle at least the minimum amount due to avoid late charges from being billed to his Card account.

- If the EZ - Reload By Card Facility on your Card has been activated, all refunds of the stored value remaining on the ez-link Facility (whether valid or expired) will be effected into your Card account.

- Without prejudice to any of our rights and remedies, we are entitled to, at any time in our reasonable discretion and without giving any reason or notice, refuse to approve any proposed Card transaction notwithstanding that the total outstanding balance, if the proposed Card transaction was debited to the card account, would not have exceeded the combined credit limit.

- You are liable for all unauthorized Card transactions, whether they are effected as a result of the unauthorized use of the Card, the PIN and/or the TBS Access Code or otherwise

How to Apply for Citi SMRT Card

- Apply Online or

- Visit Citibank Branches

About Citibank

Citi Singapore established its presence in 1902, and is the city's largest foreign banking employer. In 2005, Citi incorporated its Global Consumer Banking (GCB) arm in Singapore - in what's today known as Citibank Singapore Limited. The subsidiary is wholly owned by Citigroup.

Citibank Singapore offers wealth management products and services, including investments, insurance, deposits and treasury products; credit cards and personal lines of credit, and housing loans and share financing.

Advertisement

The 5% cashback in this sense, is capped at $1,000 or $12,000 annual spending. Might want to change the tone of this review, makes a better clarity. Good feedback though. :)