UOB One Account

- Key Features

- Reviews (89)

- Discussions (0)

- More Details

Advertisement

UOB One Account

UOB One Account

This product has not been claimed by the company yet.

Summary

UOB One Account Review 2024

UOB One Account is a popular high-interest savings account from UOB Singapore which allows you to enjoy tiered bonus interest rates of up to 2.50% p.a., with a base interest rate of 0.05% p.a., on your first S$75,000. The extra bonus interest rates are only available when account holders fulfill these 2 categories: hitting a minimum card spend of S$500 on UOB Cards, and Salary Crediting or Making 3 Bill Payments.

Product Page Transparency

- Pays to access additional features

Account Features & Details

1) Key Features

- Earn up to 2.50% p.a interest

- Base interest rate of 0.05% p.a

- To earn up to 2.50% interest: spend a minimum of S$500/month on an eligible UOB credit/debit card + credit your salary (minimum S$1,600) into UOB One Account or make 3 GIRO debit transactions per month

- UOB One Account comes with a complementary UOB One Debit Mastercard

- Easily track transactions with Bonus Interest Tracker in UOB TMRW app for bonus interest

2) Interest Rates

- Base interest rate: 0.05% p.a

- Max interest rate: 2.50% p.a

3) Eligibility

- Age: 18 years old and above

- Citizenship: Singaporeans, PRs, and Foreigners

- Minimum initial deposit: S$1,000

4) Fees

- Fall-below fee: S$5 (if monthly average balance is less than S$1,000)

- Early account closure fee: S$30 (within 6 months of opening)

- Cheque book: S$10 per cheque book (issued upon request)

5) Application Process

How to apply?

- Singaporeans & PRs

- Apply online through UOB’s website - Foreigners

- Apply at any UOB Branch

Supporting documents

- Singaporeans & PRs

- For all new and existing UOB customers, you may retrieve your personal information with MyInfo through Singpass

- Personal internet banking login details

- Credit/Debit card number and PIN - Foreigners

- Passport

- Proof of residential address

- Employment Pass/S Pass/Dependent Pass

Popular Products

4.8

783 Reviews

4.3

325 Reviews

4.7

213 Reviews

4.3

207 Reviews

Summary

UOB One Account Review 2024

UOB One Account is a popular high-interest savings account from UOB Singapore which allows you to enjoy tiered bonus interest rates of up to 2.50% p.a., with a base interest rate of 0.05% p.a., on your first S$75,000. The extra bonus interest rates are only available when account holders fulfill these 2 categories: hitting a minimum card spend of S$500 on UOB Cards, and Salary Crediting or Making 3 Bill Payments.

Product Page Transparency

- Pays to access additional features

Account Features & Details

1) Key Features

- Earn up to 2.50% p.a interest

- Base interest rate of 0.05% p.a

- To earn up to 2.50% interest: spend a minimum of S$500/month on an eligible UOB credit/debit card + credit your salary (minimum S$1,600) into UOB One Account or make 3 GIRO debit transactions per month

- UOB One Account comes with a complementary UOB One Debit Mastercard

- Easily track transactions with Bonus Interest Tracker in UOB TMRW app for bonus interest

2) Interest Rates

- Base interest rate: 0.05% p.a

- Max interest rate: 2.50% p.a

3) Eligibility

- Age: 18 years old and above

- Citizenship: Singaporeans, PRs, and Foreigners

- Minimum initial deposit: S$1,000

4) Fees

- Fall-below fee: S$5 (if monthly average balance is less than S$1,000)

- Early account closure fee: S$30 (within 6 months of opening)

- Cheque book: S$10 per cheque book (issued upon request)

5) Application Process

How to apply?

- Singaporeans & PRs

- Apply online through UOB’s website - Foreigners

- Apply at any UOB Branch

Supporting documents

- Singaporeans & PRs

- For all new and existing UOB customers, you may retrieve your personal information with MyInfo through Singpass

- Personal internet banking login details

- Credit/Debit card number and PIN - Foreigners

- Passport

- Proof of residential address

- Employment Pass/S Pass/Dependent Pass

UOB One Account

UOB One Account

Up to 2.50% p.a.

INTEREST RATES

$1,000

MIN. INITIAL DEPOSIT

$500

MIN. AVG DAILY BALANCE

4.3

89 Reviews

Service Rating

Customer Support

Ease of online banking

High to Low

Posted 07 Feb 2025

Purchased

UOB One Account

Fuss-free applied online. Free to cancel after 6 months, zero penalty for cancelling. Good to save.0

What are your thoughts?Posted 06 Aug 2024

Purchased

UOB One Account

Good savings account to have if you have other UOB credit cards to hit higher interest rates. Even though the interest rates have been nerfed in recent months, still a decent interest rate to get, considering the market.0

What are your thoughts?Posted 01 Nov 2023

Purchased

UOB One Account

One of the highest interest that any bank offers for now. EIR 5% for 100K. However, you need to spend $500 using UOB One card. Without this spending, you cannot get the bonus interest.1

What are your thoughts?Reply

Save

Posted 04 Sep 2023

Purchased

UOB One Account

[Interest] The effective interest rate of 5% assuming you have 100k is very attractive. Even for normal folks with about 30k or less cash, the interest of 3.85% is decent too. This is just a savings account after all and 0 risk since it is insured by SDIC up to 75k. The online banking experience is pretty decent too. I have no complains here.0

What are your thoughts?Posted 09 Mar 2023

Purchased

UOB One Account

[Fuss Free] easy to open account. Online baking is relatively stable [Interest] Nothing much [Customer Service] Usually can reach if not the chatbot works too0

What are your thoughts?Posted 20 Jun 2022

Purchased

UOB One Account

Overall easy to user friendly website and interface for my banking needs. Just that the queue can be very at the physical banks at times.0

What are your thoughts?Posted 23 Apr 2022

Purchased

UOB One Account

Easy to use online as well as on UOB TMRW app on mobile. UOB's UI is clean and easy to understand, signing up for an account didnt take very long as well.0

What are your thoughts?Posted 29 Mar 2022

Purchased

UOB One Account

[Fuss Free] Easy to achieve the maximum interest rate. just need spending credit card and giro salary. compare to other saving accounts where you need to buy insurance product and investment product. UOB one account will be a better account.0

What are your thoughts?Posted 02 Mar 2022

Purchased

UOB One Account

Customer service : Superb level Out of the 3 local bank , their customer support is the best. although their ATM might be lesser and harder to find0

What are your thoughts?Posted 21 Jul 2021

Purchased

UOB One Account

[Fuss Free] This is one of the high-interest savings account of the 3 local banks in Singapore. I find it attractive as it is relatively fuss-free - you get your high interest from meeting either one of two criteria; spend $500 monthly OR spend $500 & credit your salary (or perform 3 GIRO transactions). You'll need a One Card to fully utilise your savings with this one. This is great for when you don't want to/ can't meet the 3-5 steps require by other savings accounts, which may involve Insurance, investments, loans, or increasing your daily average of your savings. [Online Banking] Their Online Banking and Mobile App does seem outdated when you compare it to OCBC or DBS'. There's not much to see or do beyond your daily needs. That said, there's some work being done and you can see new features being added in like SimpleInvest and SimpleInsure. [Customer Service] UOB's customer services has always been prompt, frank, and patient with me and my inquiries so kudos to them!4

What are your thoughts?View 3 other commentsIf you're referring to online transactions such as shopping on Shopee and Lazada; yes! In fact if you shop on Shopee, you get additional 5% cashback with the UOB One Credit Card

Reply

Save

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

4.8

783 Reviews

4.3

325 Reviews

4.7

213 Reviews

4.3

207 Reviews

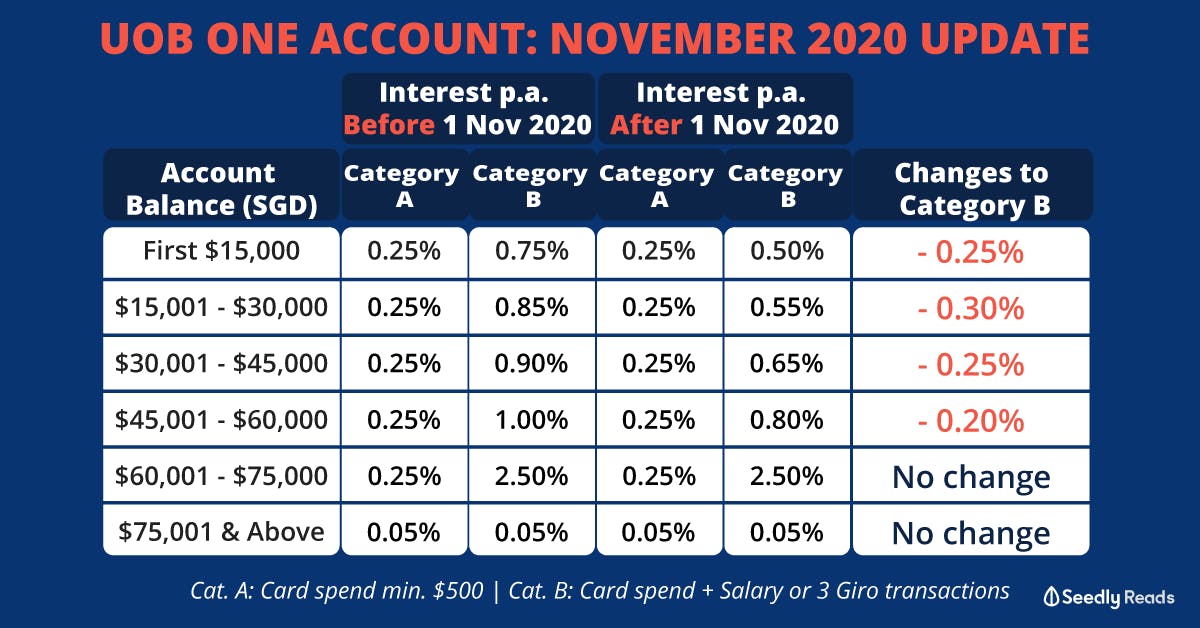

Updated UOB One Account Interest Rates for 2021

The latest UOB ONE Savings Account interest rates are illustrated in the table below:

Account Balance in your UOB One Account | Total Interest for Category A | Total Interest for Category B |

|---|---|---|

First S$15,000 | 0.25% | 0.50% |

Next S$15,000 | 0.25% | 0.55% |

Next S$15,000 | 0.25% | 0.65% |

Next S$15,000 | 0.25% | 0.80% |

Next S$15,000 | 0.25% | 2.50% |

Above S$75,000 | 0.05% | 0.05% |

UOB One Account interest rates according to account balances

How Does UOB One Account Work?

To earn extra bonus interest rates for your UOB One Savings Account, you have to hit at least 1 of the 2 available categories.

CATEGORY A: Hit a minimum spend of S$500 on UOB Cards

- Category A encourages you to hit a spend requirement of S$500 on a UOB Card to get extra 0.25% p.a.

CATEGORY B: Hit minimum Card Spend + Salary Crediting of at least S$2,000 OR Making 3 GIRO Bill Payment debit transactions

- Category B requires you to fulfil Category A, and either Salary Crediting or 3 GIRO debit transactions

- You need to make 3 GIRO debit transactions payable to any billing organisation with the bank, within the calendar month

- Only valid for salary credited through GIRO with the transaction reference “SALA”

- Bonus interest is paid on the Monthly Average Balance at month-end

For a more in-depth breakdown of all the updates to the UOB One Account, check out our blog article on UOB One Account

How to Get the Highest Interest Rates for UOB One Savings Account?

To enjoy the UOB One bonus rate, all you have to do is meet Category A's criteria of spending a minimum of S$500 on a UOB Card each calendar month.

This isn't too hard to meet if you plan out your monthly expenses like groceries and monthly recurring bills.

Qualifying UOB Cards include:

- UOB One Card

- UOB Lady’s Card

- UOB YOLO

- UOB One Debit Mastercard

- UOB One Debit Visa Card

- Mighty FX Debit Card

To maximise and get the highest possible interest rates possible, you'll want to hit Category B instead.

The interest rates for Category B are:

- 0.50% p.a. bonus for the first S$15,000 of your account balance

- 0.55% p.a. bonus for the next S$15,000 of your account balance (S$15,001 to S$30,000)

- 0.65% p.a. bonus for the next S$15,000 of your account balance (S$30,001 to S$45,000)

- 0.80% p.a. bonus for the next S$15,000 of your account balance (S$45,001 to S$60,000)

- 2.50% p.a. bonus for the next S$15,000 of your account balance (S$60,001 to S$75,000)

- 0.05% p.a. bonus for total account balances above S$75,000

Is UOB ONE the One Best Savings Account for You in 2020?

Despite the many changes to the interest rates, all existing qualifying criteria for the UOB One Savings Account remains unchanged.

Overall, it's relatively easy to perform and fulfil the two UOB One Account actions required in order to qualify for Category B interest rates. Additionally, UOB also offers flexibility for those who cannot perform the salary crediting action by allowing you to perform 3 GIRO transaction actions instead.

So if you're a freelancer or self-employed person who does not have a regular salary credited to your account, you can still qualify for Category B interest rates.

If you're thinking of alternatives to the UOB One savings account, it's important to note that given the current low-interest-rate environment that we're in, it's not surprising if the other banks will also continue to review and adjust their interest rates for their high-interest savings account accordingly.

Pros of UOB One Savings Account:

- Overall, UOB ONE provides competitive interest rates

- It is a simple and fuss-free account that does not require the fulfilment of many criteria to qualify for the bonus interest rates

- Suitable for consumers who plan to credit their salary and existing UOB cardholders who can spend a minimum of $500 a month via qualifying UOB cards

Cons of UOB One Savings Account:

- Does not incentivise additional spending on other financial products like loans, investments, or insurance

- Requires relatively high account balances of at least S$60,000 to reap the highest bonus rates possible

- Not suitable for those not looking to spend from this account

Want to know how UOB One Account compares with other savings accounts? Here's a compilation of The Best Savings Accounts in 2021!

Terms and fees for UOB One Savings Account

- Base Interest Rate: 0.05% p.a.

- Highest Interest Rate possible: 2.50% p.a.

- Initial deposit: S$1,000

- Minimum Average Daily Balance: S$1,000

- Fall below fee: S$2

- Early closure fee: S$30 within 6 months of opening an account

Eligibility: who can apply for UOB One Account?

- Citizenship status: Singaporeans, PRs and Foreigners

- Minimum age to open an account: 18 years old

Contact UOB Singapore

- Apply for UOB One Account via the "Apply Now" button above

- Tel: 1800 222 2121

Contact us at [email protected] should you require any assistance or spot any inaccuracies.

Advertisement

There will be a change in 1 May 2024 on the interest rate.