AXA Shield Integrated Shield Plan

- Key Features

- Reviews (6)

- Discussions (0)

- More Details

Advertisement

AXA Shield Integrated Shield Plan

AXA Shield Integrated Shield Plan

This product has not been claimed by the company yet.

Summary

AXA Health Insurance AXA Shield Integrated Shield Plan Review 2024

AXA Shield offers one of the cheapest premiums for the Private Hospital tier Integrated Shield Plan. Here are some of the best highlights of AXA Shield:

- AXA Shield is an Integrated Shield medical reimbursement plan designed to complement the Singapore MediShield Life plan

- Apart from the Standard Plan, AXA offers 2 other tiers: Plan B and Plan A

- Both plans offer Lifetime Coverage

- The policy yearly limit is up to S$550,000 and S$1,000,000 for Plan B and Plan A respectively

- Plan B Ward Entitlement: Public Hospital Ward Class A and below

- Plan A Ward Entitlement: Standard Room in Private Hospital or Private Medical Institution, and below.

- For pre- and post-hospitalisation, AXA Shield covers 180 days before admission and 365 days after discharge

- Emergency Overseas Inpatient Treatment covered as charged

- AXA Shield is the first insurer to offer a GP panel

Popular Products

4.4

306 Reviews

4.5

83 Reviews

4.2

20 Reviews

3.7

25 Reviews

Summary

AXA Health Insurance AXA Shield Integrated Shield Plan Review 2024

AXA Shield offers one of the cheapest premiums for the Private Hospital tier Integrated Shield Plan. Here are some of the best highlights of AXA Shield:

- AXA Shield is an Integrated Shield medical reimbursement plan designed to complement the Singapore MediShield Life plan

- Apart from the Standard Plan, AXA offers 2 other tiers: Plan B and Plan A

- Both plans offer Lifetime Coverage

- The policy yearly limit is up to S$550,000 and S$1,000,000 for Plan B and Plan A respectively

- Plan B Ward Entitlement: Public Hospital Ward Class A and below

- Plan A Ward Entitlement: Standard Room in Private Hospital or Private Medical Institution, and below.

- For pre- and post-hospitalisation, AXA Shield covers 180 days before admission and 365 days after discharge

- Emergency Overseas Inpatient Treatment covered as charged

- AXA Shield is the first insurer to offer a GP panel

Plans (3)

AXA Shield Integrated Shield Plan A

$1,000,000

LIMIT PER POLICY YEAR

180 / 365 days

PRE & POST HOSPITAL

As Charged

OUTPATIENT BENEFITS

Private Hospital

WARD ENTITLEMENT

4.7

6 Reviews

High to Low

Posted 18 Mar 2022

Purchased

AXA Shield Integrated Shield Plan A

AXAShield plan's premiums and coverage are very competitive! Claim processes were fast and smooth. Contacting AXA for assistance is easy, would not be put for hold.0

What are your thoughts?Posted 16 Mar 2022

Purchased

AXA Shield Integrated Shield Plan A

Love this and it has served me well in times of need. Agent support was good, claims organised and speedy. Good value so far0

What are your thoughts?28 May 2021

Purchased

AXA Shield Integrated Shield Plan A

[Agent Responsiveness] Agent really responsive for claims. Helped with the paper work Besides that, their app is pretty good! It's easy to find a specialist that is suited for you. They also have a cool built-in function for e-cards0

What are your thoughts?22 Jul 2020

Purchased

AXA Shield Integrated Shield Standard Plan

AXA’s products are value for money one of the best insurance name in the insurance industry. My insurance agent is good too!0

What are your thoughts?Posted 24 Jan 2024

Purchased

AXA Shield Integrated Shield Plan A

[Customer Service] The agent that serves me is pretty good and responsive. Hopefully, my medical condition is cleared so that I can be covered with rider.0

What are your thoughts?16 Jul 2020

Purchased

AXA Shield Integrated Shield Plan B

I purchased AXA Shield when I first started out as an insurance agent with AXA 4-5 years ago. Main reason I have gotten this Shield plan was because being the newest insurer, their premiums and coverage was VERY competitive (and it still is)! Over my course with them, I got to experience the claims process for a handful of clients. Hospitalisation e-filing and post-hospitalisation claim was smooth and fast, almost hassle-free for both the clients and myself (the agent). I moved on to join other FA firms and started dealing with Shield plans from other insurers too. Most of the time (depending on client's needs and wants), my clients still tend to favour AXA's benefit and cost compared to other the competitors. I stopped dealing with AXA totally for almost 2 years now due to change of job. My Shield insurer remains the same. (Reason why I rated 4 stars is due to my somewhat outdated experience. Otherwise, a 5)0

What are your thoughts?

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

4.4

306 Reviews

4.5

83 Reviews

4.2

20 Reviews

3.7

25 Reviews

AXA Shield Benefits at a Glance

There are a total of 3 plans to select from:

- Plan A

- Plan B

- Standard plan

Benefits:

- Coverage: Lifetime

- 3 plans in total ranging from cheapest to most premium: Standard, Plan B and Plan A

- Plan A and Plan B policy yearly limit of up to S$1,000,000 and S$550,000 respectively

- Major Organ Transplant as charged

- Inpatient Pregnancy Complications as charged

- Pre-hospitalisation treatment of 180 days and post-hospitalisation treatment of 365 days

- Value-added services comprising an extensive AXA Shield Panel (including a first-of-its- and Letter of Guarantee service)

- Emergency overseas inpatient treatment covered as charged

- Possible add-on: AXA Enhanced Care to cover extra of up to 95% of eligible bills

Public Service Officers will get to enjoy AXA Shield Plan A, Plan B and Standard Plan with a 10% discount off yours and your family's additional private insurance premiums for the first year.

What Does AXA Shield Cover?

Benefits Description | Plan A | Plan B | Standard Plan |

|---|---|---|---|

Lifetime Limit | No limit | No limit | No limit |

Hospital Ward Entitlement | Standard room in private hospital and below | Public hospital ward class A and below | Public Hospital Ward class B1 and below |

Policy Year Limit | Up to S$1,000,000 | Up to S$550,000 | Up to S$150,000 |

Inpatient Treatments | As charged | As charged | Limited coverage amount |

Pre-Hospitalisation Treatment | As Charged (within 180 days before hospitalisation) | As Charged (within 180 days before hospitalisation) | - |

Post-Hospitalisation Treatment | As Charged (within 180 days before hospitalisation) | As Charged (within 180 days before hospitalisation) | - |

Outpatient Treatment (e.g. Cancer Treatments, Kidney Dialysis) | As Charged | As Charged | Limited coverage amount |

Major Organ Transplant | As charged | As charged | N/A |

Inpatient Pregnancy Complications | As charged (300 days waiting period) | As charged (300 days waiting period) | N/A |

Emergency Overseas Medical Treatment Benefit | As Charged pegged to Reasonable and Customary charges of Singapore Private Hospitals | As Charged pegged to Reasonable and Customary charges of Singapore Private Hospitals | - |

Additional Benefits:

|

|

| - |

Summary of Key Benefits

How much does AXA Shield Health Insurance cost?

Here are the approximate quotes for AXA Shield Health Insurance according to the tiers of plans, and age groups.

Annual Premium for AXA Shield Plan A

Ward entitlement: standard ward in a private hospital

Age Next Birthday | AXA Shield Plan A annual premium |

|---|---|

21 to 25 years old | $174 |

26 to 30 years old | $221 |

31 to 35 years old | $286 |

36 to 40 years old | $299 |

41 to 50 years old | $600 |

Annual premium for AXA Shield Plan A

Annual Premium for AXA Shield Plan B

Ward entitlement: Ward Class A and below at Restructured Public Hospitals

Age Next Birthday | AXA Shield Plan B Annual Premium |

|---|---|

21 to 30 years old | $90 |

31 to 35 years old | $156 |

36 to 40 years old | $156 |

41 to 45 years old | $229 |

AXA Shield Health Insurance Add-Ons:

AXA Enhanced Care

- Coverage: Up to 95% of eligible bills

- Covers the following benefits, subject to different limits for Plan A, B and Standard Plan:

- Emergency outpatient treatment due to accident

- Fractures, dislocations and sports injuries

- Hand Foot Mouth Disease, dengue and food poisoning

- Ambulance/taxi charges

- Accommodation charges for immediate family members

How will AXA Enhanced Care help with paying for health insurance?:

- All the Deductible and Co-insurance amounts under AXA Shield is covered

- but subject to the Deductible, Co-insurance and Co-payment Cap under AXA Enhanced Care

Treatments | Deductible | Co-Insurance | Co-Payment Cap per policy year / Out-of-pocket expenses |

|---|---|---|---|

Restructured Community Hospital | $0 | 5% | $3,000 |

AXA Panel of Specialists | $0 | 5% | $3,000 |

Non-Panel Specialists | $1,500 | 5% | n/a |

*Deductible = a fixed amount to be paid by a policyowner before the MediShield Life and other health insurance benefits are payable

*Co-insurance = a percentage of the claimable amount that a policyowner has to co-pay in after deductibles

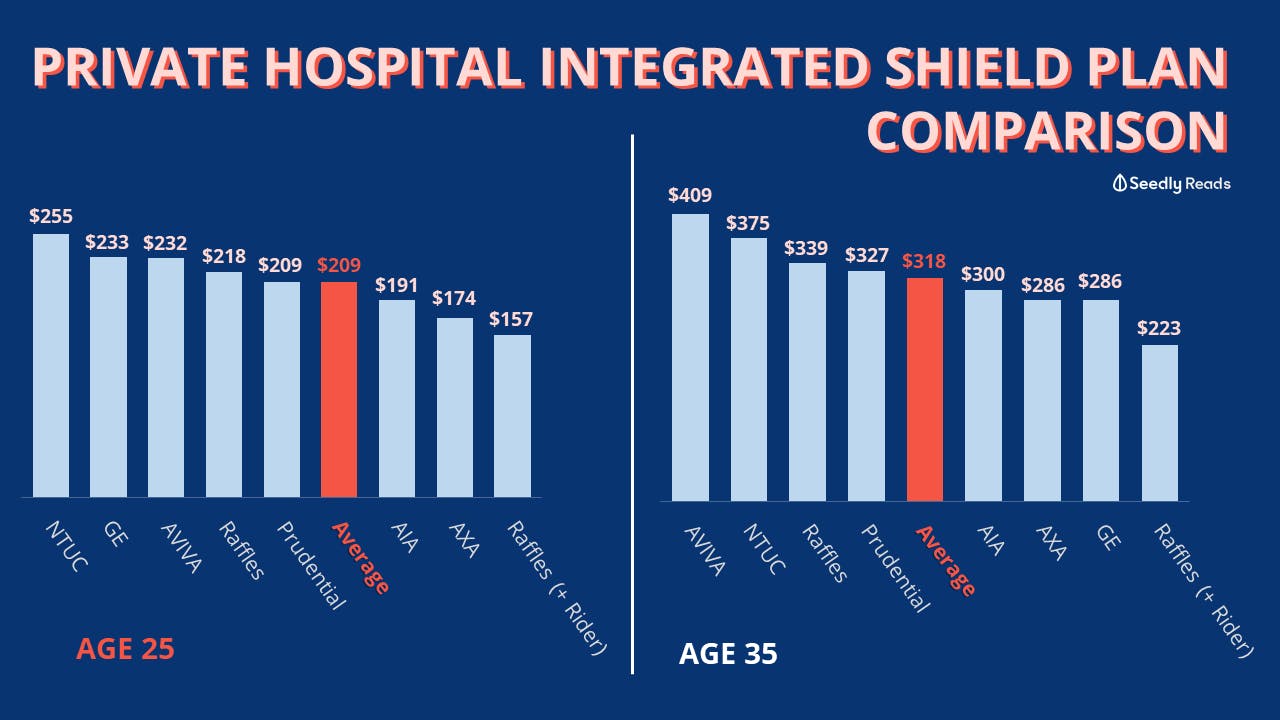

Comparison of Integrated Shield Plans: Where Does AXA Shield Stand?

From our calculations, AXA Shield's premiums are generally priced slightly higher than average - from Standard IPs to Class A ward plans. However, AXA does provide one of the cheapest premiums for Private Hospital IPs. Hence, AXA Shield would be value-for-money for individuals looking for larger coverage under private hospital ward entitlements.

Eligibility: Who Can Apply for AXA Shield?

- Citizenship status: Singaporean or Permanent Resident

- Age: Under 75 years old

AXA Health Insurance AXA Shield Quote

- Visit AXA website for more details on the coverage, exclusions, and quote

Contact us at [email protected] should you require any assistance or spot any inaccuracies

Advertisement