Advertisement

Anonymous

Will the DBS Altitude Credit Card earn me 1.2 miles for my phone bills? Are there any better credit cards for monthly phone bill payments?

Have been using debit cards and setting up Giro payments for my Starhub bill so I'm very new to making my monthly phone bill payments with a credit card. First, do I stand to earn 1.2 miles for these Starhub/Singtel phone bills by using the DBS Altitude? Second, are there any better credit cards to make my monthly phone bill payments? Last, I would appreciate any tips for a new credit card user!

3

Discussion (3)

Learn how to style your text

Reply

Save

Pang Zhe Liang

06 Dec 2019

Lead of Research & Solutions at Havend Pte Ltd

Yes, you will be able to get the miles. The best way to check and confirm this will be to find out the MCC code from the merchant and do a serach on the card's terms and conditions, specifically in the exclusion section.

This ensures that you will be awarded the miles as you should be.

Next, if you love travelling and don't mind delayed gratification, then go for miles card. Additionally, some miles cards allow you to pay for your purchases by using the miles (more often than not, it is not worth it). As as result, the card is highly specialised for travel usage.

For general cards, consider Citi PremierMiles at 1.2 miles per dollar. For stacks in $5, consider UOB PRIV Miles @ 1.4 miles per dollar.

For online spending, consider Citi Rewards @ 4 miles per dollar, capped at $1k monthly.

For shopping and entertainment, consider OCBC 90°N CARD @ 4 miles per dollar.

On the other hand, if you prefer money and instant gratification, then go for cashback card. In essence, it works as simply as it should be - you spend money, and you receive a percentage back. As usual, the more you spend, the more cashback you get in return as well (not just limited to miles card).

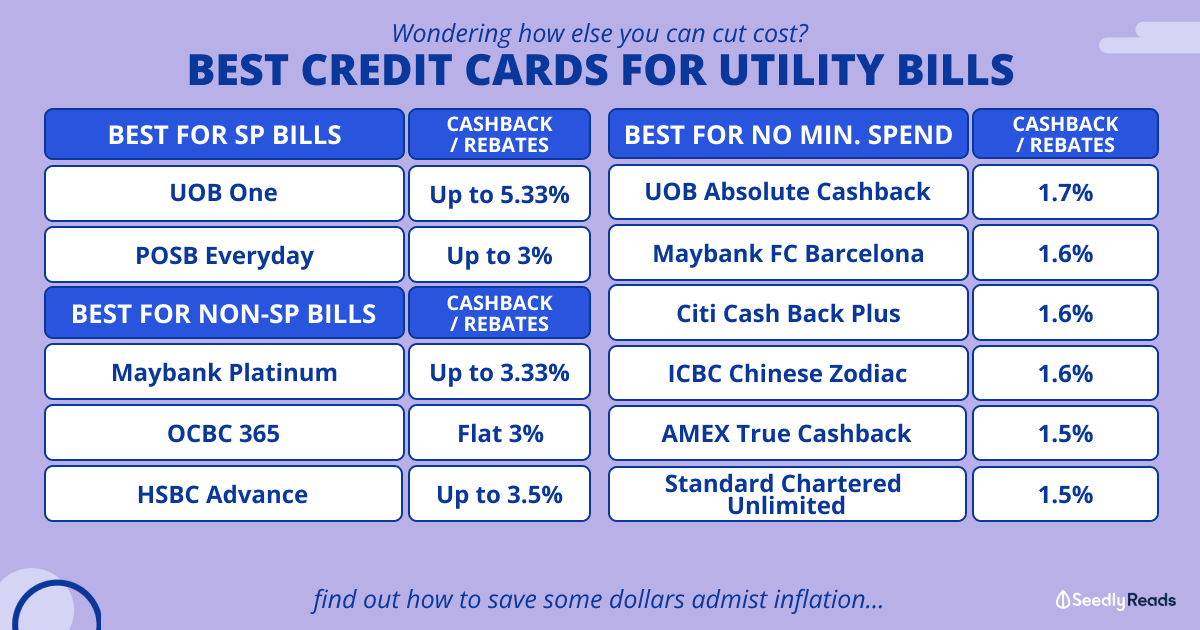

Consider UOB One or Standard Chartered Unlimited Cashback card to this end.

Here is everything about me and what I do best.

Reply

Save

For your question on DBS Altitude Card, yes.

I am going to refer you to this article for other car...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

StarHub

2.2

204 Reviews

Star Plan L

$32

RATE

150 GB

DATA

1,500 mins Local Calls

CALL TIME

750 Local & International SMS

SMS

Singtel

2.6

240 Reviews

DBS Altitude Visa Signature Card

4.3

97 Reviews

Related Posts

Advertisement

You can earn 1.2 miles paying Singtel bills. However truthfully there are better ways.

Use uob preferred platinum, top up to grab to earn 4mile per dollar top up. Then use your grabpay credit to pay singtel/starhub bills via axs mobile app payment method use grabpay