Advertisement

Anonymous

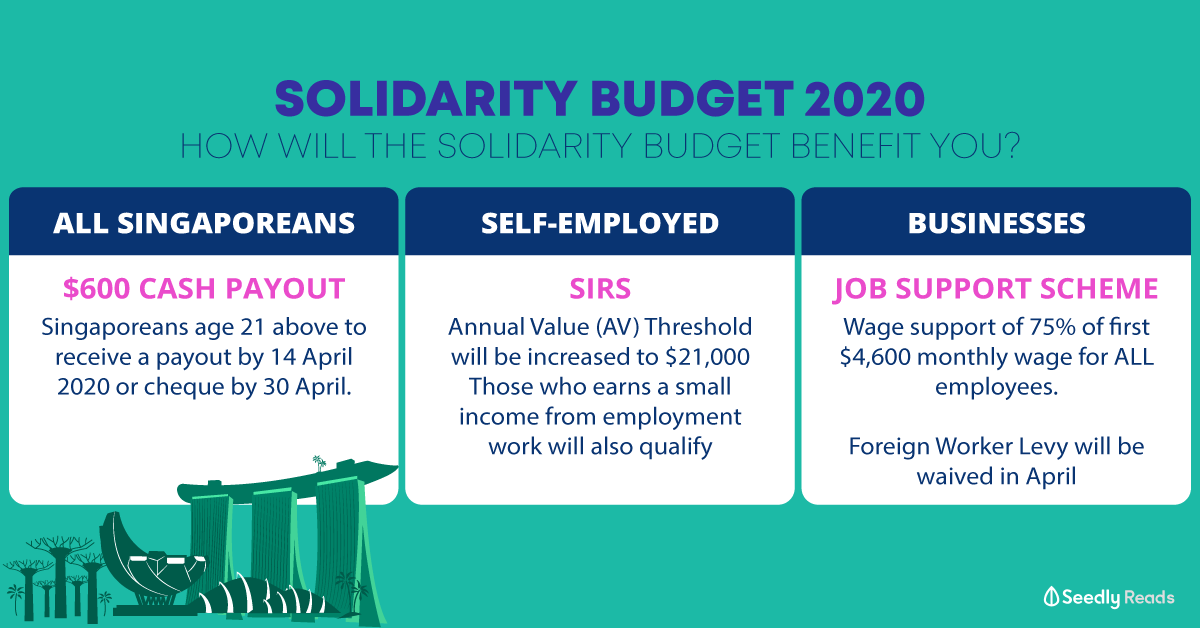

What's a suggested way to divide up the $600 solidarity budget money? Should I invest it or keep it in a high yield bank account, or use a small portion for living expenses or? What will you do?

27 yo this year.

Currently working part time as an Essential Worker.

Have a JUMPSTART account with SC.

Haven’t max out 20k.

Only at 11k$

4

Discussion (4)

Learn how to style your text

Han Jinyuan Larry

14 Apr 2020

SwimSafer 2.0 Instructor & Assessor at SWIMWITHUS

Reply

Save

Pang Zhe Liang

14 Apr 2020

Lead of Research & Solutions at Havend Pte Ltd

I have a simple principle when it comes to managing finances - any amount that does not come from my normal course of work is always saved or invested for the future. This includes bonuses and allowances (if any).

Acccordingly, if you do not need this money immediately, then consider setting it aside for your future.

I share quality content on estate planning and financial planning here.

Reply

Save

Colin Lim

14 Apr 2020

Financial Services Consultant at Colin Lim

This 600 is supposely for this month stay home. The govt bring the payout forward is because we gonn...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Standard Chartered JumpStart Account

4.8

784 Reviews

Maximum Interest: 2.50% p.a. for balances up to S$50,000

INTEREST RATES

$0

MIN. INITIAL DEPOSIT

$0

MIN. AVG DAILY BALANCE

DBS/POSB Multiplier Account

4.3

328 Reviews

OCBC FRANK Account

4.7

213 Reviews

Related Posts

Advertisement

If you have outstanding credit card, you could consider the $600/- to clear this debt.

Can also reduce the interest being charge for outstanding balance.

Reduction can improve your Credit Score with Credit Bureau Singapore.