Advertisement

Anonymous

Hi guys, my mom currently has no health insurance. She has a pre-existing medical condition (Hep B carrier since 30 years ago with no symptoms). What should I do?

Hi guys, my mom (age 57) currently has no health insurance. She has a pre-existing medical condition (Hep B carrier since 30 years ago with no symptoms). Should I still proceed to get a shield plan with exclusion (have sought out quotes from GE, NTUC and Aviva)? What other areas should I focus on getting for her as well?

8

Discussion (8)

Learn how to style your text

Colin Lim

13 Apr 2020

Financial Services Consultant at Colin Lim

Reply

Save

Pang Zhe Liang

13 Apr 2020

Lead of Research & Solutions at Havend Pte Ltd

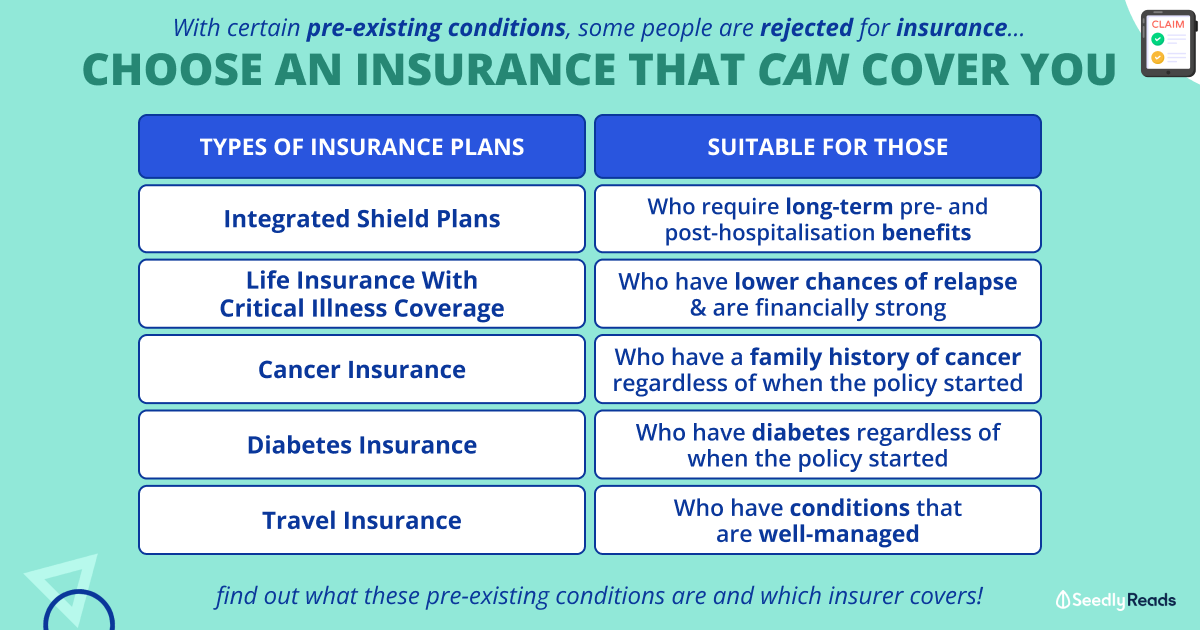

We need a bit of information with regards to her Hepatitis B situation. Generally, there may be an exclusion. In any case, I will still strongly encourage you to consider getting her a proper healthcare insurance coverage. This is because we are insuring her for all except the excluded pre-existing medical condition.

In the situation when she needs to seek treatment for the excluded condition, we can always fall back on MediShield Life.

More Details:

Is MediShield Life enough in Singapore?

Next, we need to have a complete understanding of your mother's existing insurance portfolio. Through this process, it allows us to understand the coverage that we have, any financial gap, as well as to find out whether we are overpaying for our insurance policies.

Key Reasons Why:

Why Every Client needs an Insurance Policy Summary

Thereafter, we can decide on the key areas to focus on. For instance, it could be on accident and injuries, critical illness, retirement planning and so forth. Without listening to her and knowing her needs, it is difficult for us to guess and attempt to give you the right fit.

I share quality content on estate planning and financial planning here.

Reply

Save

Hariz Arthur Maloy

12 Apr 2020

Independent Financial Advisor at Promiseland Independent

Hi Anon, consider doing a preliminary underwriting with every insurer and provide latest medical rep...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Income IncomeShield Integrated Shield Plan

4.4

306 Reviews

NTUC Income IncomeShield Integrated Shield Plan Preferred

$1,500,000

LIMIT PER POLICY YEAR

180 / 365 days

PRE & POST HOSPITAL

As Charged

OUTPATIENT BENEFITS

Private Hospital

WARD ENTITLEMENT

Raffles Shield Integrated Shield Plan

4.5

83 Reviews

AIA HealthShield Gold Max Integrated Shield Plan

4.2

20 Reviews

Related Posts

Advertisement

Hi, most probably will have exclusion.. Unless u have positive doctor report.

You can look into 5/10 years renewable term for her..as u know... Covid19 is more dangerous to our old folks.

Secondly, u can looking into long term care. Upgrade your mom eldershield plan. Or opt in eldershield if she do not have.