Advertisement

Anonymous

Endowus Income Portfolio or Syfe REIT+ for cashflow/dividends?

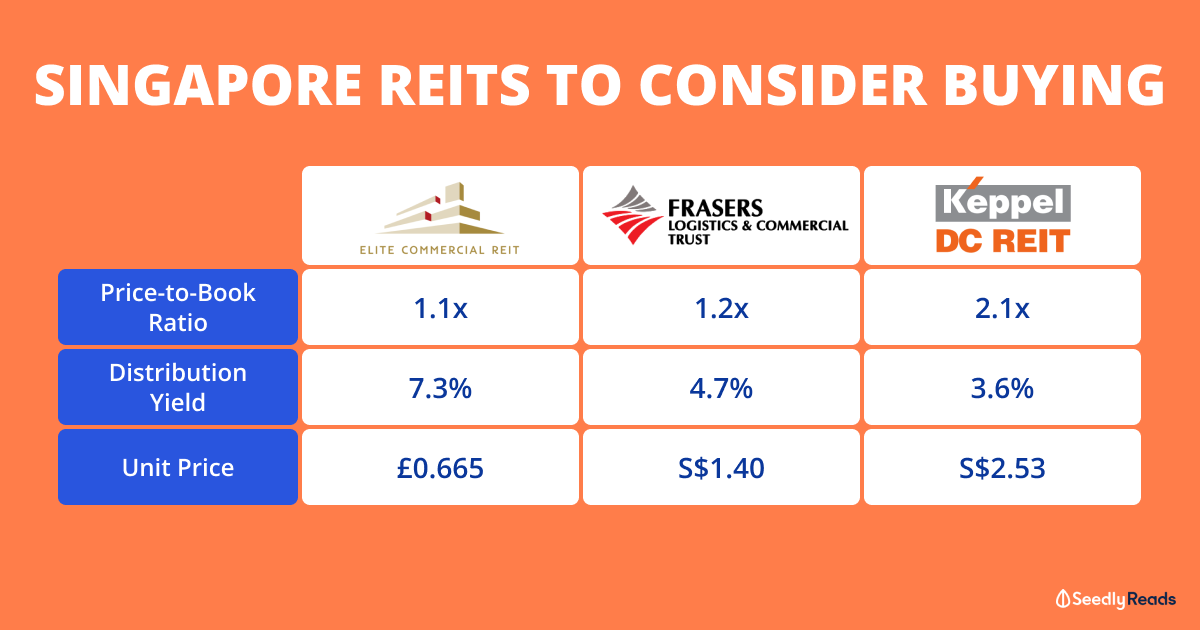

I am planning to start investing for some cashflow and to slowly build it up over the years. I am currently in my late 20s. I was exploring the various robo-advisors and I like both Syfe and Endowus. Currently I am leaning towards the Endowus Income Portfolio (Higher Income where 20% is in equities and 80% in funds), Endowus you will be paid monthly,on the other hand, Syfe REIT+ would be invested in SG REITs which have pretty nice dividends.

Endowus Income Portfolio would need a first investment of $10,000 SGD to ensure a proper amt of dividends, $10,000 would give you roughly $33 per month based on Endowus FAQ page before you can then invest in small amts. Syfe REIT+ can be started with small amt but only after your investment amt reaches a certain amt before dividends will be paid to you otherwise it will be reinvested back in.

Wanted to hear some feedback or opinions.

5

Discussion (5)

Learn how to style your text

Reply

Save

Now SGS saving bonds yield not bad. Can consider

Reply

Save

Dividends from syfe reit+ is based on what the underlying pays out. so the monthly income may not be...

Read 3 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hello! This guide gives a pretty good the comparison of different robo advisors including syfe and endowus! There's also a comparison review for syfe vs endowus if you need more information! This platform, Planner Bee, has an ongoing promo for Syfe! you get 0% management fee for 3 months (up to S$30,000) if you use the promo code BEEWAIVER 👍 I think they also have $20 off access with Endowus for new sign ups so its worth checking out:)