Raffles Shield Integrated Shield Plan

- Key Features

- Reviews (83)

- Discussions (0)

- More Details

Advertisement

Raffles Shield Integrated Shield Plan

Raffles Shield Integrated Shield Plan

This product is managed by Raffles Health Insurance.

Summary

Product Page Transparency

- Claimed in October 2020

Raffles Shield Health Insurance Review 2024

Some highlights of the Raffles Shield Health Insurance:

- Raffles Shield Health Insurance is an Integrated Shield Plan, which is an additional cover on top of your MediShield Life.

- 4 tiers of plans, ranging from cheapest to most premium: Standard, Shield B, Shield A, and Shield Private

- Benefits range from standard 100% coverage on B1 class wards in public hospitals all the way to Single Bed Class wards in private hospitals

- Most outpatient and inpatient treatments covered as charged

- at least 50% coverage in Raffles Private Hospital

- Policy Year Limit is S$150,000 to S$1,500,000

- Additional Riders applicable for Raffles Shield Private, Shield A and Shield B.

- Overall, RHI is said to offer competitive premiums for this comprehensive level of coverage

Popular Products

4.4

306 Reviews

4.2

20 Reviews

3.7

25 Reviews

Summary

Product Page Transparency

- Claimed in October 2020

Raffles Shield Health Insurance Review 2024

Some highlights of the Raffles Shield Health Insurance:

- Raffles Shield Health Insurance is an Integrated Shield Plan, which is an additional cover on top of your MediShield Life.

- 4 tiers of plans, ranging from cheapest to most premium: Standard, Shield B, Shield A, and Shield Private

- Benefits range from standard 100% coverage on B1 class wards in public hospitals all the way to Single Bed Class wards in private hospitals

- Most outpatient and inpatient treatments covered as charged

- at least 50% coverage in Raffles Private Hospital

- Policy Year Limit is S$150,000 to S$1,500,000

- Additional Riders applicable for Raffles Shield Private, Shield A and Shield B.

- Overall, RHI is said to offer competitive premiums for this comprehensive level of coverage

Plans (5)

Raffles Shield Integrated Shield Plan Private

$1,500,000

LIMIT PER POLICY YEAR

180 / 365 days

PRE & POST HOSPITAL

As Charged

OUTPATIENT BENEFITS

Private Hospital

WARD ENTITLEMENT

4.5

83 Reviews

Service Rating

Ease of Claim

Agent Reliability

Application Process

High to Low

Posted 07 Feb 2025

Purchased

Raffles Shield Integrated Shield Plan Private

Good coverage and definitely affordable. Recommended. Agent is good amd friendly. Customer service good too.0

What are your thoughts?05 Feb 2021

Purchased

Raffles Shield Integrated Shield Plan Private

[Insurance Coverage] good insurance coverage as compared to other providers for babies. competitive pricing [Customer Service] dedicated agent, not pushy1

What are your thoughts?Raffles Health Insurance

05 Feb 2021

Reply

Save

03 Feb 2021

Purchased

Raffles Shield Integrated Shield Plan Private

[Customer Service] Nice person able to reply fast . Hope claim Process would be smooth also . Will get more policy from him2

What are your thoughts?View 1 other commentsRaffles Health Insurance

04 Feb 2021

Hi Peter, thank you for your kind review! Glad that you had a positive experience with us :)

Reply

Save

02 Feb 2021

Purchased

Raffles Shield Integrated Shield Plan Private

Competitive pricing, affordable premium for the same benefits as other IP. Fast turnaround and responsive CRM.1

What are your thoughts?Raffles Health Insurance

02 Feb 2021

Hi Wai Hoh, thank you for your kind review! Glad that you had a positive experience with us :)

Reply

Save

01 Feb 2021

Purchased

Raffles Shield Integrated Shield Plan Private

Fuss free transaction. I am very happy with the package I got. I will definitely recommened this to my family and friends.1

What are your thoughts?Hi Ken, thank you for your kind review! Glad that you had a positive experience with us :)

Reply

Save

29 Jan 2021

Purchased

Raffles Shield Integrated Shield Plan Private

Wei Sing guided me very well during the application process. Took his time to explain the policy, guide me through the documents, and patiently answered my questions.1

What are your thoughts?Hi Radhytia, thank you for your kind review! Glad that you had a positive experience with us :)

Reply

Save

26 Jan 2021

Purchased

Raffles Integrated Shield Plan A + Raffles Hospital Option

[Customer Service] [Agent Responsiveness] Sam is very helpful, responsive, patient and explained properly whenever I need clarification. I will definitely recommend this plan to my friends.3

What are your thoughts?View 2 other commentsSure!

Reply

Save

25 Jan 2021

Purchased

Raffles Shield Integrated Shield Plan Private

I had a very good experience with Raffles till Now . Hope to continue with Raffles for a longer time.1

What are your thoughts?Hi Subhodeep Kundu, thank you for your kind review! Glad that you had a positive experience with us :)

Reply

Save

23 Jan 2021

Purchased

Raffles Integrated Shield Plan A + Raffles Hospital Option

[Insurance Coverage] [Agent Responsiveness] Agent Wei Sing attended to me and answered all my questions patiently. Upon wanting to sign up, he also helped inform us of the promotion and value of the policy without any hard-selling. Product coverage is unique and priced quite reasonably. Lastly when asked to do the documentation for application he was willing to come over to our residence so as to ease the process. Overall experience was good. I have also recommended my friends and family to this BUT! there was no referral benefit given financially which was the only downside to the Raffles Hospital Insurance purchase. Please include a referral benefit to your current policy holders so as it will also help motivate us to share this Insurance Coverage that we purchase to our family and friends. I highly recommend the policy of Raffles Private and Shield A+ as it is unique and worth the money. Lastly, the Agent Wei Sing is highly recommended and has now become a friend for future policy sharing and updates.1

What are your thoughts?Hi Aamir, thank you for your kind review! Glad that you had a positive experience with us :) We will definitely take your suggestion into consideration for improvement of our customers experience with us.

Reply

Save

18 Jan 2021

Purchased

Raffles Shield Integrated Shield Plan Private

My daughter was hospitalised on 14th Jan 2021 and it made me realised how blessed we are to have Raffles Shield Integrated Shield Plan. [Agent Responsiveness] Our agent, Mr Sam Wai Git is extremely reliable, dedicated and eternally courteous. Before we admitted, I sought Mr Sam’s advice on admission process and hospital fee structure. Despite the late night enquiry, Mr Sam rendered supports immediately and calmly. He clearly explained everything in details. As a result. The entire process from admission to discharge was extremely smooth. With Raffles Shield Integrated Shield Plan, it seems the admission and discharge processes were shortened. I did not have to worry about filing insurance claim as Raffles Hospital told me they will take care of it internally as soon as I told them I have Raffles Insurance. Mr Sam's assurance and the efficiency of the entire insurance scheme greatly reduced our anxiety and it certainly helped us to focus on taking care of our sick children. Mr Sam's visit also warmed our hearts too! [Insurance Coverage] My child had a similar hospitalisation incident a year ago, back then I did not have Raffles Shield Integrated Shield Plan. Therefore, we had to choose another public hospital. Thinking back, it was a nightmare compared to our stay at Raffles Hospital: that time, the public hospital did not have vacant room, we had to stand at hospital corridor for more than half a day, while my daughter having her IV drip. When we finally got a bed for her, it was a pretty poor condition ward with 6 beds. The caregiver's bed can only be deployed at night. Hence, we spent 2 days 2 days mostly standing up. In the end, I had to pay unbelievable expensive bill for the stay. This time at Raffles Hospital, we received the top notch healthcare. The professional team and best quality care certainly speed up my daughter’s recovery. We admitted to single bed room in excellent condition. I jokingly told the nurses it was more like a staycation! Despite receiving the best healthcare, I only had to pay a small amount of co-payment. I would say Raffles Shield Integrated Shield Plan is not just an insurance, it is the best care package that everyone should have! It definitely gives you the best healthcare when you needed it the most, which you do not have to worry about the hospital charges at all. I strongly recommend it to absolutely anyone!!2

What are your thoughts?View 1 other commentsHi YX, thank you for your kind review! Glad that you had a positive experience with us and RMG :) Wishing you and your family good health always!

Reply

Save

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

4.4

306 Reviews

4.2

20 Reviews

3.7

25 Reviews

Raffles Shield Plan Health Insurance at a Glance

There are 4 types of plans that may suit your needs:

- Shield Standard

- Shield B

- Shield A

- Shield Private

Benefits:

- Benefits range from standard 100% coverage on B1 class wards in public hospitals all the way to Single Bed Class wards in private hospitals

- From Shield B onwards, most outpatient and inpatient treatments are covered as charged

- Pre and Post-hospitalisation treatments covered up to 1 year.

- Inpatient Psychiatric Treatment, Inpatient Dental Treatment covered

- Chemotherapy, Kidney Dialysis and Immunotherapy can be claimed as charged.

- at least 50% coverage in Raffles Private Hospital

- Policy Year Limit is S$300,000 to S$1,500,000 (excluding Standard Plan)

- Additional Riders applicable for Raffles Shield Private, Shield A and Shield B.

- In the unfortunate case of death or total permanent disability of payor, RHI will waive the additional private insurance premiums of the IP and ensure that the child’s coverage continues.

- Raffles Shield offers Good competitive cost for an in-depth level of coverage of an Integrated Shield Plan

- Raffles Shield also provides multiple add-ons to customise your plan according to your preferences

What Does Raffles Shield Health Insurance Cover?

Benefit Description | Shield Standard | Shield B | Shield A | Shield Private |

|---|---|---|---|---|

Ideal for | Basic Top Up to MediShield Life Insurance | Increasing MediShield Life Yearly Limit | Gaining Better Access to A Class Wards in Public Hospitals | Getting everything taken care of - including access to all private hospitals |

Eligibility | Only for Singaporean Citizen or Permanent Resident | Only for Singaporean Citizen or Permanent Resident | Only for Singaporean Citizen or Permanent Resident | For all Singaporean citizen or Permanent Resident and Foreigners |

Policy Year Limit | S$150,000 | S$300,000 | S$600,000 | S$600,000 (out-panel treatment) and S$1,500,000 (in-panel treatments) |

Ward Entitlement |

|

|

|

|

Inpatient Treatment and Day Surgery Benefits | Different treatments have different limitations (All standard plans have the same financial parameters across all insurers) | as Charged | as Charged | as Charged |

Outpatient Treatment |

| as charged | as charged | as charged |

Pre-Hospitalisation Treatment | ☓ | As charged up to 90 days |

|

|

Post-Hospitalisation Treatment | ☓ | As charged up to 90 days |

|

|

Major Organ Transplant | Covered under Inpatient Hospital Treatment | As Charged | As Charged | As Charged |

Emergency Overseas Medical Treatment | ☓ | As Charged | As Charged | As Charged |

Pregnancy Complications Benefit | Covered up to MediShield Life Benefits | As Charged | As Charged | As Charged |

Special Riders for Raffles Shield Health Insurance

Choosing Raffles Shield Private, Raffles Shield A or Raffles Shield B allows you to further customise your plans with these options:

- Raffles Hospital Option

Get 100% coverage at Raffles Hospital, across all wards.

This rider allows you to enjoy Raffles Hospital Treatment without paying the full premiums for private wards only plans.

Only available for Shield A, which means you can enjoy some Raffles Shield Private's benefits at a lower premium of Shield A + Rider

Payable via Medisave up to CPF additional withdrawal limits.

What is special about Raffles Shield's Raffles Hospital Add-On Option?

If you're looking for a private hospital level of care, Raffles Shield offers an interesting rider on top of their Raffles Shield A Plan (which is a ward Class A plan). This is their Raffles Hospital Add-On which allows you to enjoy the comforts of a private hospital ward entitlement at a much lower than market average price. This entitlement will only be available for hospitalisations at Raffles Hospitals. However, the Raffles Shield A + Raffles Hospital Add-on combo still maintains the same level of coverage parameters as the regular Raffles Shield A. Your policy yearly limit and other coverages are not changed with the add on.

- High Deductible Option

Gives you lower premiums for higher deductibles. This Increases the Deductible applicable to $10,000. Available with all plans except Raffles Shield Standard plan and plans with the Key Rider added. - Key Rider

Replace the deductible and co-insurance with a 5% co-payment on every claim - Premium Rider (For additional benefits)

- Accommodation expenses for an Immediate Family Member

- Post-Hospitalisation Traditional Chinese Medicine

- Post-hospitalisation home care

- Emergency outpatient treatment due to accident

- Ambulance services

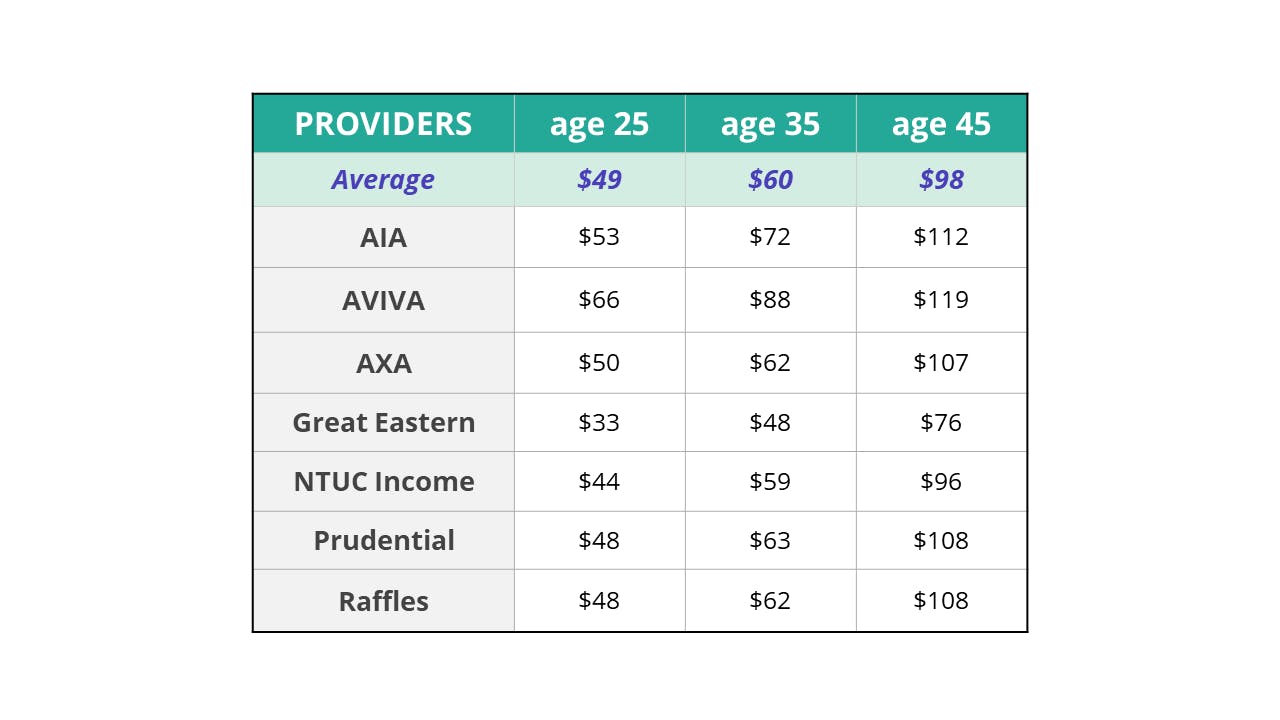

How much does Raffles Shield Health Insurance cost?

To help you compare health insurance quotes for integrated shield health insurance plans in Singapore, here's a chart of premiums for Raffles Shield.

Assuming the profile of the buyer is a Singaporean or PR, here are MediSave deductible premiums across 3 age groups

Age | Raffles Shield Private | Raffles Shield A + Raffles Hospital Add-on | Raffles Shield A | Raffles Shield B |

|---|---|---|---|---|

25 | S$413/ per year | S$352/ per year | S$284/ per year | S$254/ per year |

35 | S$649/ per year | S$533/ per year | S$422/ per year | S$393/ per year |

45 | S$972/ per year | S$771 / per year | S$652 / per year | S$561 / per year |

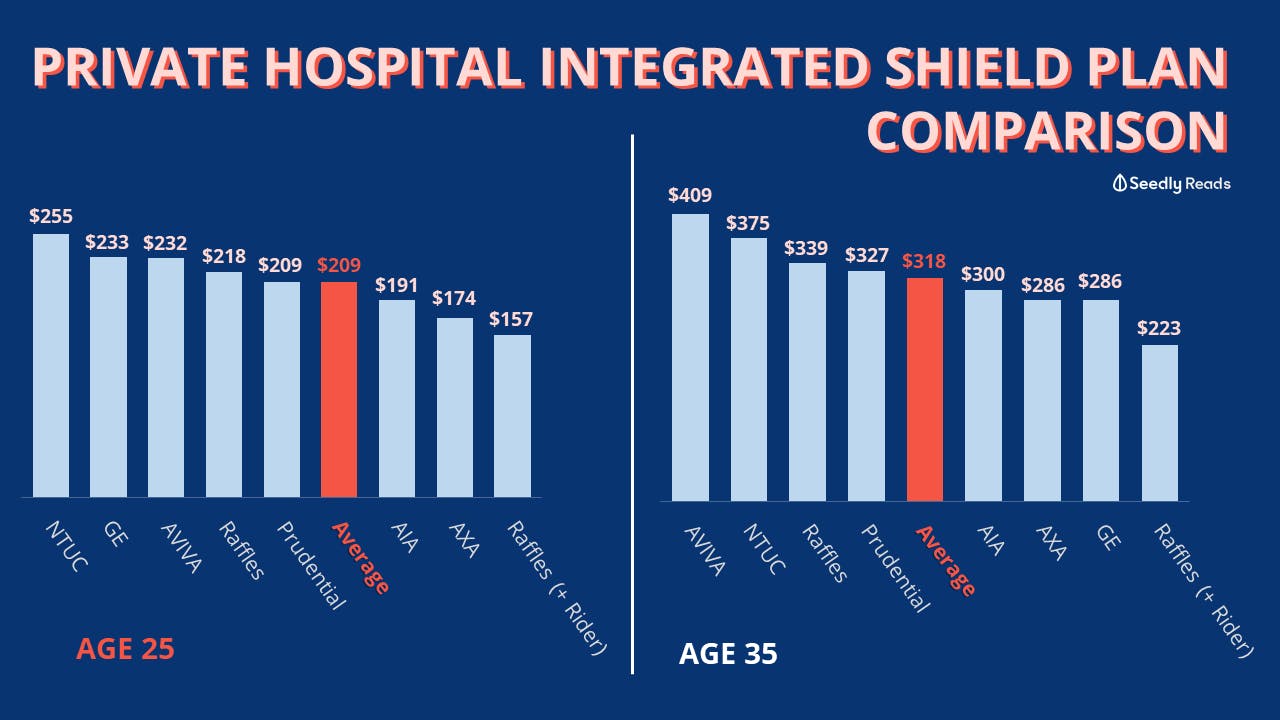

Best Integrated Shield Plans Compared: Is Raffles Shield Worth It?

In short, yes Raffles Shield is incredibly worth your money. Across Plans Class A and Class B, Raffles Health Insurance offers some of the most competitive pricing for their Integrated Shield Plans, from age 25 to 45. It also has one of the most competitive premiums for those seeking the comforts of private hospital ward entitlements.

As mentioned above, Raffles Shield provides an attractive rider combo ideal for individuals looking for the cheapest private hospital Integrated Shield Plan. However, Raffles Health Insurance's original private hospital plan - Raffles Shield Private - is much pricier compared to others.

Considering the prices of Standard Integrated Shield Plans, Individuals seeking for Standard IPs might want to try other cheaper Standard IP providers like Great Eastern or Prudential.

Exclusions

There are certain conditions under which no benefits are payable some of these exclusions include:

- Pre-existing illness

- Serious illness

- Congenital disease

- Organ transplant

- Dental treatment or surgery

- Eye / ear examination, correction, aids

- Overseas treatment

- Psychological disorders, personality disorders, mental conditions, etc.;

- Pregnancy and fertility treatments

- Sexually Transmitted Diseases (STDs), Human Immunodeficiency Virus (HIV), Acquired Immune Deficiency Syndrome (AIDS)

Get a Quote for Raffles Shield Health Insurance Plan

- Visit Raffles Health Insurance website for more details on the coverage, exclusions, and quote

About Raffles Health Insurance

Incorporated in 2004, Raffles Health Insurance commenced operations as a general insurer in 2005 and converted into a life insurer in 2006. As a wholly subsidiary of the Raffles Medical Group, it has access to a wide network of family medicine clinics and tertiary private hospital, Raffles Hospital, in providing a more cohesive and fully integrated health care for the public.

Contact us at [email protected] should you require any assistance or spot any inaccuracies

Advertisement

Hi Zoey, thank you for your kind review! Glad that you had a positive experience with us :)