Advertisement

Anonymous

I am a 60 year old single lady. Have been working since young and would like to know more about retirement?

What are the steps I can take to retire better? What are some things that I should know? Any financial advice for me?

2

Discussion (2)

Learn how to style your text

Pang Zhe Liang

02 Dec 2019

Lead of Research & Solutions at Havend Pte Ltd

Reply

Save

Hariz Arthur Maloy

02 Dec 2019

Independent Financial Advisor at Promiseland Independent

Hi Anon,

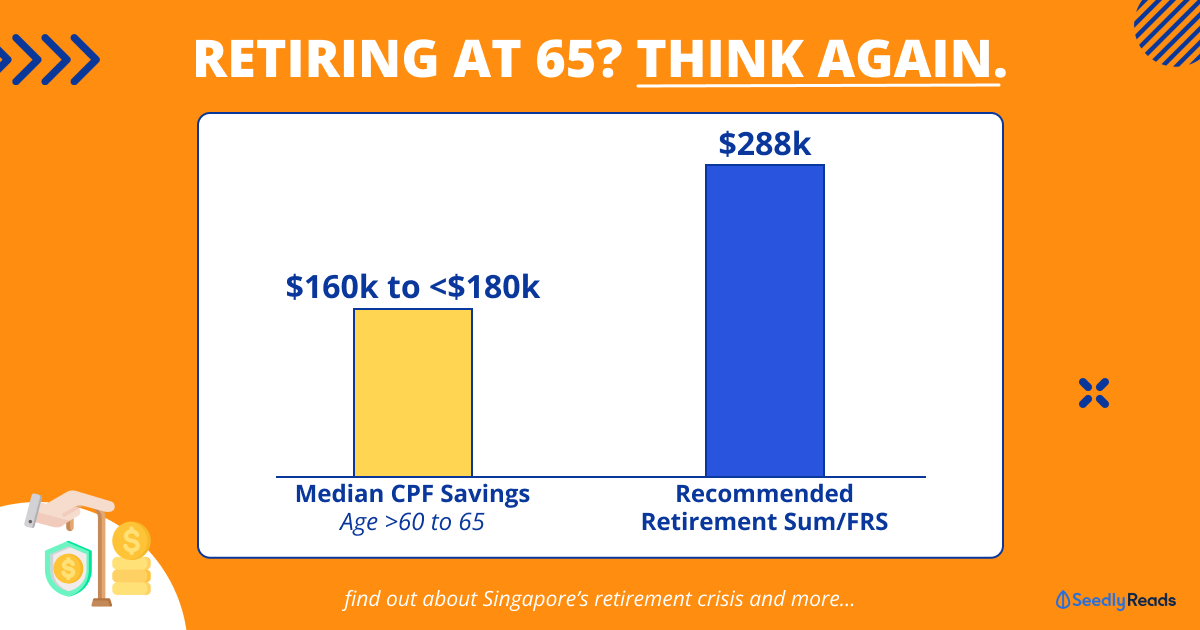

Firstly CPF should be your backbone in retirement. Understand how much you'll be receiving in 5 years time from CPF Life.

Next would be buying assets that pay out an income either for a period of time or for life.

Understand that there are 2 phases to retirement. Active phase where you're ticking off items in your bucket list, and passive phase, where you're physically unable to do too much anymore and waiting to kick the bucket.

You'll spend more in your active phase and little less in your passive phase. Do also take note the impact inflation has on your cost of living in the next 2 or 3 decades or so.

Most importantly, you want to make sure you don't outlive your money and you have enough to be comfortable. :) Thus, I put more emphasis into products that pay you a lifetime stream of income.

Lastly, make sure you are insured with a hospital plan and able to pay the premiums as you age as well because healthcare would be a big cost in your retirement as well.

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

The first step will be to understand your cashflow, alongside with your assets and liabilities.

From there, we will need to make detailed calculations on the required amount every month for your retirement needs, alongside with a delta for adjustment.

Additionally, we will have to evaluate any risk that you are undertaking from your liabilities (if any).

In most cases, your CPF will complement the savings that you have for your retirement. Now is more about calculations to allow you to further understand on how your retirement life will be like.

Additionally, it may be valued to use this opportunity to advise you to draft up a Will and to do a CPF Nomination. I have explained on why we need a Will here: https://www.blog.pzl.sg/what-is-a-will-singapore/

About CPF Nomination: https://www.blog.pzl.sg/what-is-cpf-nomination-...

All these steps ensure that we keep our estate neat for our intended beneficiaries. And estate planning is part of the important work that I do as a professional practice for my clients. This is especially after I have escaped death from a horrific car accident last year.

Here is everything about me and what I do best.