Advertisement

Anonymous

How should a 33-year-old start to save and invest in preparation for kids and retirement?

I have an annual income of $70k before CPF and my yearly expense is about $35k. How would you advise me to start saving and investing to prepare for my future with kids? And even beyond for my retirement?

3

Discussion (3)

Learn how to style your text

Jefremy Juari

25 Jul 2019

Financial Writer at Medina Books

Reply

Save

Hariz Arthur Maloy

25 Jul 2019

Independent Financial Advisor at Promiseland Independent

Save 20% of whatever you earn for retirement and 5% of whatever you earn for children's education.

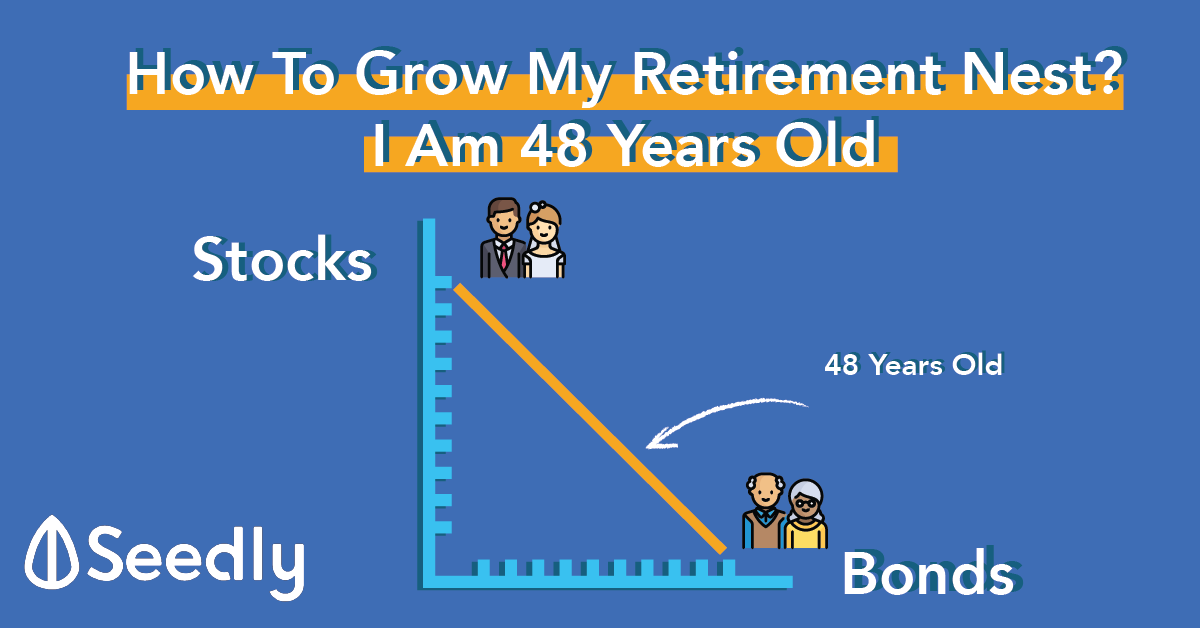

You're young enough to start investing more aggressively until you touch your 40s where you want less volatility and then capital preservation in your 50s.

Your children would also most likely go to school in 15-20 years time when you're about 50 as well.

If you're not familiar with investments, you can choose to hire an Independent Financial advisor like myself to invest on your behalf for a yearly fee.

If not, you can DIY and manage your own investments, just make sure to rebalance at least yearly, stay invested, switch your allocation like I mentioned in your 40s and 50s, and invest more after markets go down.

All the best!

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hi Anon,

I'm actually around the same age as you. Your priority now should be, structuring a safety net of insurance and assets. What I'm doing now is as follows :

Insurance should include but not limited to;

1) hospitalization plans for the whole family

- inclusive of cash riders to offset 5% co-pay and loss of salary if 1 parent need to take care of child

2) Basic accident policy (check out LONPAC)

Assets should include

1) gold coins as reserve for your family

2) 1 BTC for yourself, 1 BTC for your kids

3) knowledge how to replace your salary with other income.

You see, if your investments can get to 35k to 40k a year, basically you're retired. Always follow the value of your assets not your age.

Anyways it's good to learn about etfs and managed funds and robo advisors, but none of them can match your own performance once you understand your options and take responsibility for your own finances.