Advertisement

Anonymous

Any family budgeting advice?

I'm friends with a married couple: the husband makes ~$8k monthly & the wife ~$4k monthly. They have 2 young kids aged 11 & 8. They have a typical Singaporean lifestyle - both kids go for tuition classes, they have a helper & own a small old car. The husband pays for most household expenses. The wife spends her own savings on her usual lady stuff. Every year, he can't save much since he spends all his money on his family's expenses. Is this normal? What could help him & his situation?

2

Discussion (2)

Learn how to style your text

Elijah Lee

05 Aug 2019

Senior Financial Services Manager at Phillip Securities (Jurong East)

Reply

Save

Hariz Arthur Maloy

04 Aug 2019

Independent Financial Advisor at Promiseland Independent

Needs to be more communication in the family.

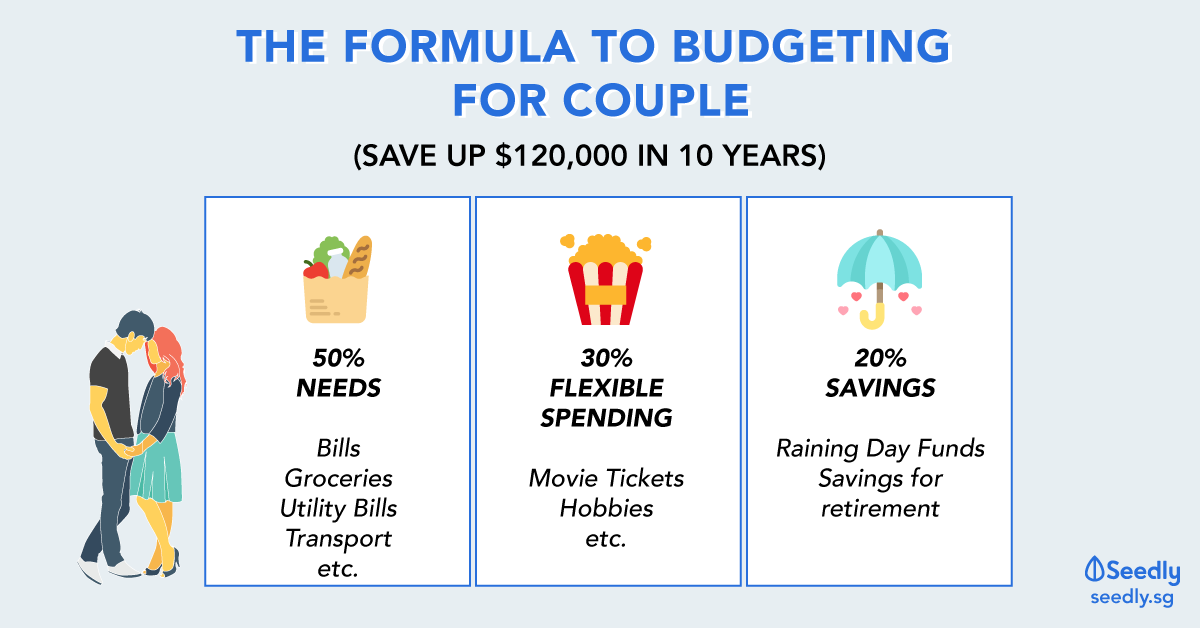

The family needs to save minimally 20% or 2400/mth for retirement and another 5% or 600/mth for their children's education.

If both wife and husband knows how much they're spending and on what and realise they can't save, then both of them should be scared and should start making some hard decisions.

Start tracking where all the money is going, and start figuring out where you can cut down to start saving at least 3k/mth for the retirement and children's education.

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

This is going to sound philosophical, but bear with me.

Somewhere in that list of monthly expenses are wants and not needs. By listing and segregating their expenses into various categories, it will be clear.

Understand this: Both Husband and Wife make a decent sum every month.

Make. While they still have their jobs. Their income is earned. It is not passive.

While they have their jobs, I'm sure they can afford their current lifestyle. If either of them were to be unable to work for whatever reason (say, retrenchment), their lifestyle would collapse.

And some day, they will have to stop working. What happens to the sum of money they were making? It stops coming to them. And if they start to worry and act at that point in time, it is a little too late.

They need to talk to each other. Either they can choose to remain wage slaves, or prepare themselves to truly be free.