Advertisement

Anonymous

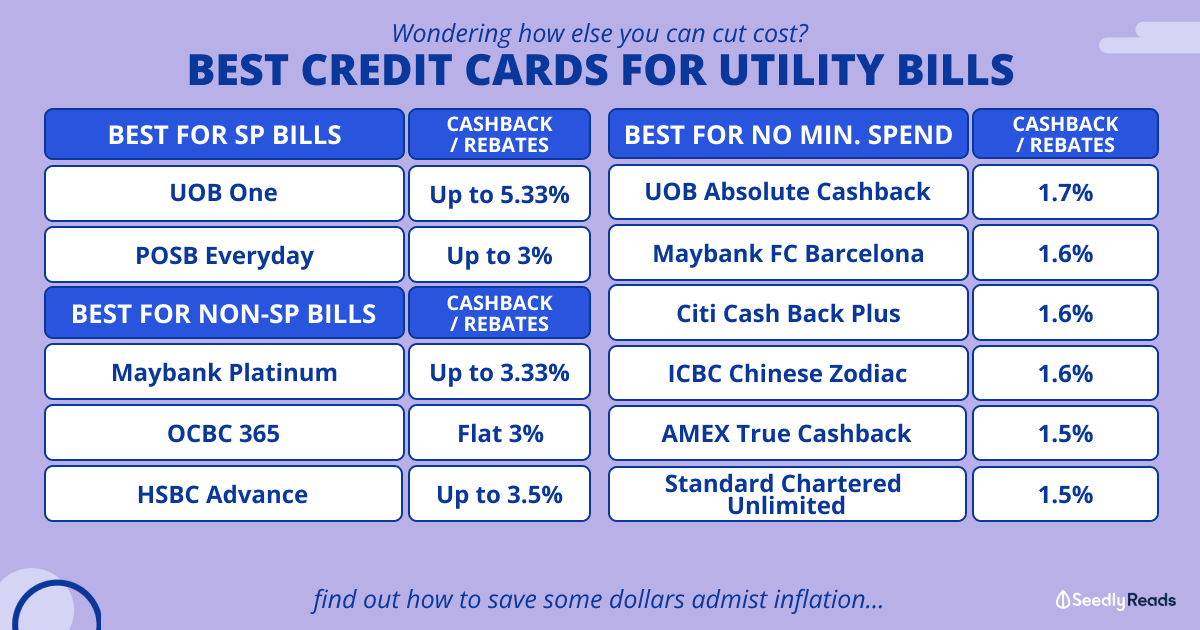

Which specific credit card or any payment method can get min. 3% cashback/loyalty/reward for monthly spend below $300 on groceries & online purchases? Excluding bills as most issuers exclude that.

Pls allow me to elaborate my specific situation. After being retired for over 9 years now and been living very simple and frugal life averaging around $200+ monthly spend, I found that all the cards which I currently hold have monthly minimum spend criteria ranging from $500 to couple of thousands to qualify for 3% or more cashback, or else those only returns miserable 0.2% cashback/reward.

These are the credit cards I am now intending to terminate in view of this situation:

- citi smrt, citi cashback

- stanchart unlimited, manhattan and in fact all stanchart cards

Debit cards from the 4 local banks also doesn't seem to give decent cashback/reward. Also cards like youtrip and wise I am thinking of cancelling too.

Anyone have switched from spending on credit cards to alternative payment methods such as Grabpay, shopeepay, atome, etc. and using them actively? What kind of cashback or reward % are you getting and is there minimum monthly spend criteria to hit the %?

Appreciate your helpful advices!

Given that there is no other advice, I dug deeper into the web to search for the nearest possible alternatives, and in case anyone in the future would face similar situation as me, here are 2 very useful articles found which suggested the best possible combo for 2022 and possibly till 2023 (well... T&Cs keep changing every couple of years). That is, the Absolute card + Grabpay combo gives the closest cashback % target to my goal at 2.9%. I think this is a brilliant strategy for retirees with low monthly spend.

10

Discussion (10)

Learn how to style your text

Ristrettz

28 Apr 2022

Life Journey at Founder

Reply

Save

Crypto.com credit card with a $5000 stake should be the only option.

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

The crypto.com card which you need to stake for the minimum 3% cashback for your purchases. Check my referral codes at the shop https://lifejourney.blog/referral-and-contacts-us/