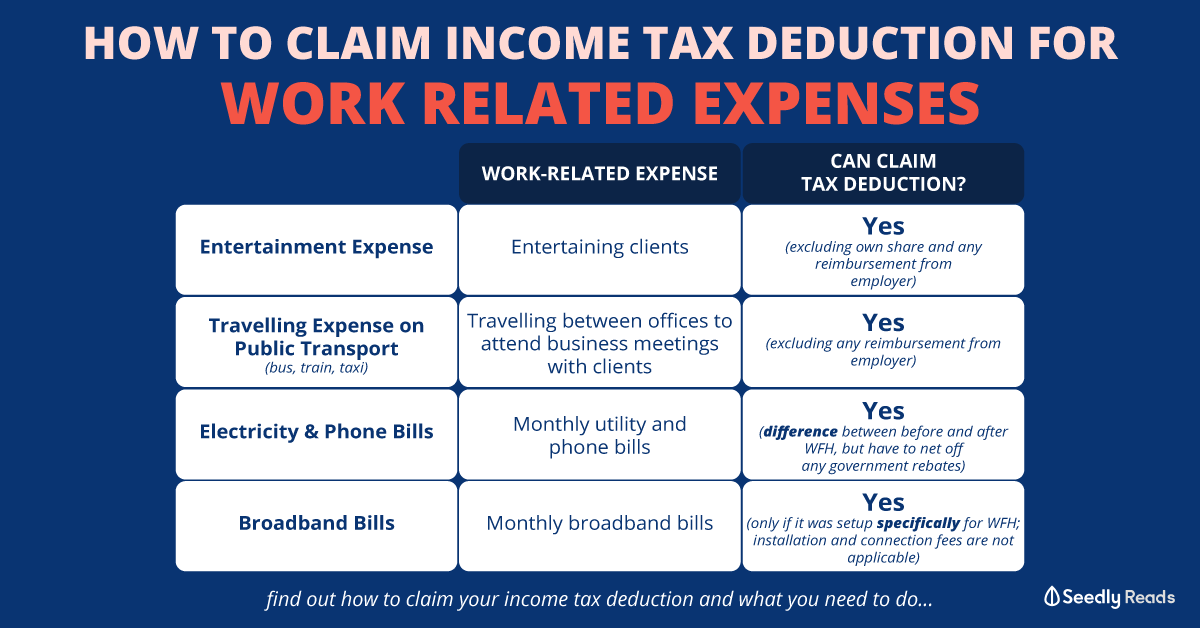

SINGAPORE - Workers can claim tax deductions on expenses incurred while working from home last year, including the cost of air-conditioning and Wi-Fi.

The process of making such claims for year of assessment 2021 has been made easier for the current tax filing season, which started March 1 and ends on April 18, as calculations have been simplified to the difference between charges before and after working from home.

For instance, if the usual monthly electricity bill before working from home was $200 and then rose to $250 while working from home, the additional $50 can be claimed as a deduction.

The person must have incurred the charges while carrying out work duties and must not have been reimbursed for these charges by his employer.

The additional $50 should also be divided among the number of people working from home during that period, according to guidelines laid out by the Inland Revenue Authority of Singapore (Iras).

However, the likes of water and gas expenses are wholly regarded as private costs and not eligible for claims. Capital expenses such as the purchase of furniture and computers, as well as installation and connection fees, are also not allowed as a tax-deductible expense.

The move to include work-from-home expenses comes as the Covid-19 pandemic drove much of Singapore's workforce to operate remotely last year, often at their own expense.

Some taxpayers have noted that making the deduction claims means extra trouble, although they could reap some savings.

Human resources manager Chia Eng Hwee, 49, said the increase in electricity costs for his household of five was not significant when he was working from home last year.

"Since it was not a huge increment and my expenses are quite stable, I don't think it's worth the trouble to claim the tax deduction," he said.

Professional services firm director Chin Ching, 51, had similar sentiments.

"I'm not likely to claim the deductible expenses as you need to substantiate the claim with bills and must keep the bills for the next five years," she said.

"It's too troublesome."

However, lawyer Yu Peiyi said he would look into the possibility of making a claim for the months from April to December, when he was largely working from home.

"I usually have the air-conditioning turned on during the daytime when I'm working, so it was probably quite a significant increase in the electricity bills," said the 27-year-old.

Mr Adrian Sham, head of personal tax and global mobility at Grant Thornton Singapore, pointed out that there may not be significant savings for taxpayers.

Citing an example where a taxpayer makes a claim for $100 of expenses monthly for the nine months from April to December, he noted that someone earning the median wage of about $4,500 a month would see only $63 in tax savings.

Experts acknowledged that Iras has made the claims process easier, but suggested that there be further relaxation as telecommuting becomes more common in the post-Covid-19 economy.

Mr Sham suggested that one way of making deduction claims easier could be to have a flat rate available for all taxpayers without having to substantiate claims.

Associate Professor Simon Poh from the National University of Singapore Business School said that Iras could allow a specified percentage of bills as attributable to work usage.

"Where more than one person is working from home in the same household, this specified percentage can be apportioned equally to each person," he said.

Other tax reliefs and rebates you may be eligible for

Besides claims on expenses incurred while working from home, taxpayers may also be eligible for other reliefs and rebates.

1. Course fees

If you have attended courses, seminars or conferences relevant to your job or that lead to an approved qualification, and if you paid for the courses yourself, you may claim relief.

This is applicable for fees incurred up to a maximum of $5,500 each year.

Courses for recreational or leisure purposes or general skills such as social media and basic website building are not eligible.

2. Parents

You can claim $9,000 per dependant - parents, grandparents, parents-in-law or grandparents-in law - if the dependant is staying with you.

If the dependant does not stay with you, you can claim $5,500 for each individual. This is as long as the dependant's income did not exceed $4,000 and the person was at least 55 years old last year.

If the dependant lived in a separate household in Singapore, you must have incurred $2,000 or more in supporting them last year.

3. Central Provident Fund

Self-employed people with a yearly net trade income exceeding $6,000 must make compulsory MediSave contributions to their CPF accounts.

You can claim CPF relief on your MediSave contributions.

4. Parenthood tax rebate

Eligible parents can claim the rebate to offset their payable income tax. This rebate is given in the year of assessment immediately following the year when the child is born, and ranges from $5,000 to $20,000.

The rebate can be shared between both parents, with unutilised rebate balances automatically carried forward to offset future taxes payable.

Online businesses: Tax obligations

About $3.4 million in taxes and penalties was recovered from people operating online businesses, between 2016 and last year.

The funds were reaped from 70 audit cases, said the Inland Revenue Authority of Singapore (Iras).

Income derived from selling goods or providing services and content online - on a part-time or full-time basis - is taxable.

More Singaporeans have been starting online businesses amid the Covid-19 pandemic, so it is vital that they know the key points regarding their tax obligations.

1. Declaring income

A taxpayer must file a tax return if his total annual net trade income exceeds $6,000, or his annual taxable income, including net trade income, is more than $22,000. He must report the total income earned from his online activities under the "Trade, Business, Profession or Vocation" section of his tax return.

If you are below 21 years old, income from your online activities can be taxed in your name, and your guardian is responsible for the tax filing of your income.

Online activities where income earned is taxable include buying and reselling goods, posting online content and providing part-time services.

2. Registering for Goods and Services Tax (GST)

Businesses must apply for GST registration within 30 days if their 12-month taxable turnover exceeds $1 million at the end of any calendar year. Companies that fail to register for GST still have to pay GST on all their past transactions from the date they became liable for registration.

Failure to register for GST is an offence. Errant businesses may be required to pay 10 per cent of GST due, and may be fined up to $10,000.

3. Keep records and documentary evidence

Businesses must keep records and documentary evidence, such as accounts of business transactions, for a minimum of five years.

Iras may disallow their expense claims, and their tax payable may be adjusted upwards accordingly, should they be unable to produce evidence to support their declarations.

SINGAPORE - Workers can claim tax deductions on expenses incurred while working from home last year, including the cost of air-conditioning and Wi-Fi.

The process of making such claims for year of assessment 2021 has been made easier for the current tax filing season, which started March 1 and ends on April 18, as calculations have been simplified to the difference between charges before and after working from home.

For instance, if the usual monthly electricity bill before working from home was $200 and then rose to $250 while working from home, the additional $50 can be claimed as a deduction.

The person must have incurred the charges while carrying out work duties and must not have been reimbursed for these charges by his employer.

The additional $50 should also be divided among the number of people working from home during that period, according to guidelines laid out by the Inland Revenue Authority of Singapore (Iras).

However, the likes of water and gas expenses are wholly regarded as private costs and not eligible for claims. Capital expenses such as the purchase of furniture and computers, as well as installation and connection fees, are also not allowed as a tax-deductible expense.

The move to include work-from-home expenses comes as the Covid-19 pandemic drove much of Singapore's workforce to operate remotely last year, often at their own expense.

Some taxpayers have noted that making the deduction claims means extra trouble, although they could reap some savings.

Human resources manager Chia Eng Hwee, 49, said the increase in electricity costs for his household of five was not significant when he was working from home last year.

"Since it was not a huge increment and my expenses are quite stable, I don't think it's worth the trouble to claim the tax deduction," he said.

Professional services firm director Chin Ching, 51, had similar sentiments.

"I'm not likely to claim the deductible expenses as you need to substantiate the claim with bills and must keep the bills for the next five years," she said.

"It's too troublesome."

However, lawyer Yu Peiyi said he would look into the possibility of making a claim for the months from April to December, when he was largely working from home.

"I usually have the air-conditioning turned on during the daytime when I'm working, so it was probably quite a significant increase in the electricity bills," said the 27-year-old.

Mr Adrian Sham, head of personal tax and global mobility at Grant Thornton Singapore, pointed out that there may not be significant savings for taxpayers.

Citing an example where a taxpayer makes a claim for $100 of expenses monthly for the nine months from April to December, he noted that someone earning the median wage of about $4,500 a month would see only $63 in tax savings.

Experts acknowledged that Iras has made the claims process easier, but suggested that there be further relaxation as telecommuting becomes more common in the post-Covid-19 economy.

Mr Sham suggested that one way of making deduction claims easier could be to have a flat rate available for all taxpayers without having to substantiate claims.

Associate Professor Simon Poh from the National University of Singapore Business School said that Iras could allow a specified percentage of bills as attributable to work usage.

"Where more than one person is working from home in the same household, this specified percentage can be apportioned equally to each person," he said.

Other tax reliefs and rebates you may be eligible for

Besides claims on expenses incurred while working from home, taxpayers may also be eligible for other reliefs and rebates.

1. Course fees

If you have attended courses, seminars or conferences relevant to your job or that lead to an approved qualification, and if you paid for the courses yourself, you may claim relief.

This is applicable for fees incurred up to a maximum of $5,500 each year.

Courses for recreational or leisure purposes or general skills such as social media and basic website building are not eligible.

2. Parents

You can claim $9,000 per dependant - parents, grandparents, parents-in-law or grandparents-in law - if the dependant is staying with you.

If the dependant does not stay with you, you can claim $5,500 for each individual. This is as long as the dependant's income did not exceed $4,000 and the person was at least 55 years old last year.

If the dependant lived in a separate household in Singapore, you must have incurred $2,000 or more in supporting them last year.

3. Central Provident Fund

Self-employed people with a yearly net trade income exceeding $6,000 must make compulsory MediSave contributions to their CPF accounts.

You can claim CPF relief on your MediSave contributions.

4. Parenthood tax rebate

Eligible parents can claim the rebate to offset their payable income tax. This rebate is given in the year of assessment immediately following the year when the child is born, and ranges from $5,000 to $20,000.

The rebate can be shared between both parents, with unutilised rebate balances automatically carried forward to offset future taxes payable.

Online businesses: Tax obligations

About $3.4 million in taxes and penalties was recovered from people operating online businesses, between 2016 and last year.

The funds were reaped from 70 audit cases, said the Inland Revenue Authority of Singapore (Iras).

Income derived from selling goods or providing services and content online - on a part-time or full-time basis - is taxable.

More Singaporeans have been starting online businesses amid the Covid-19 pandemic, so it is vital that they know the key points regarding their tax obligations.

1. Declaring income

A taxpayer must file a tax return if his total annual net trade income exceeds $6,000, or his annual taxable income, including net trade income, is more than $22,000. He must report the total income earned from his online activities under the "Trade, Business, Profession or Vocation" section of his tax return.

If you are below 21 years old, income from your online activities can be taxed in your name, and your guardian is responsible for the tax filing of your income.

Online activities where income earned is taxable include buying and reselling goods, posting online content and providing part-time services.

2. Registering for Goods and Services Tax (GST)

Businesses must apply for GST registration within 30 days if their 12-month taxable turnover exceeds $1 million at the end of any calendar year. Companies that fail to register for GST still have to pay GST on all their past transactions from the date they became liable for registration.

Failure to register for GST is an offence. Errant businesses may be required to pay 10 per cent of GST due, and may be fined up to $10,000.

3. Keep records and documentary evidence

Businesses must keep records and documentary evidence, such as accounts of business transactions, for a minimum of five years.

Iras may disallow their expense claims, and their tax payable may be adjusted upwards accordingly, should they be unable to produce evidence to support their declarations.