Advertisement

Anonymous

REITs vs rentals, which is a better investment/a more viable investment in Singapore?

What are the pros and cons of each type of property investment? how do you know which is a better investment for you? other than liquidity, what makes REITs so popular?

7

Discussion (7)

Learn how to style your text

Joe Lee

06 Mar 2020

Adventurer at Game of Life

Reply

Save

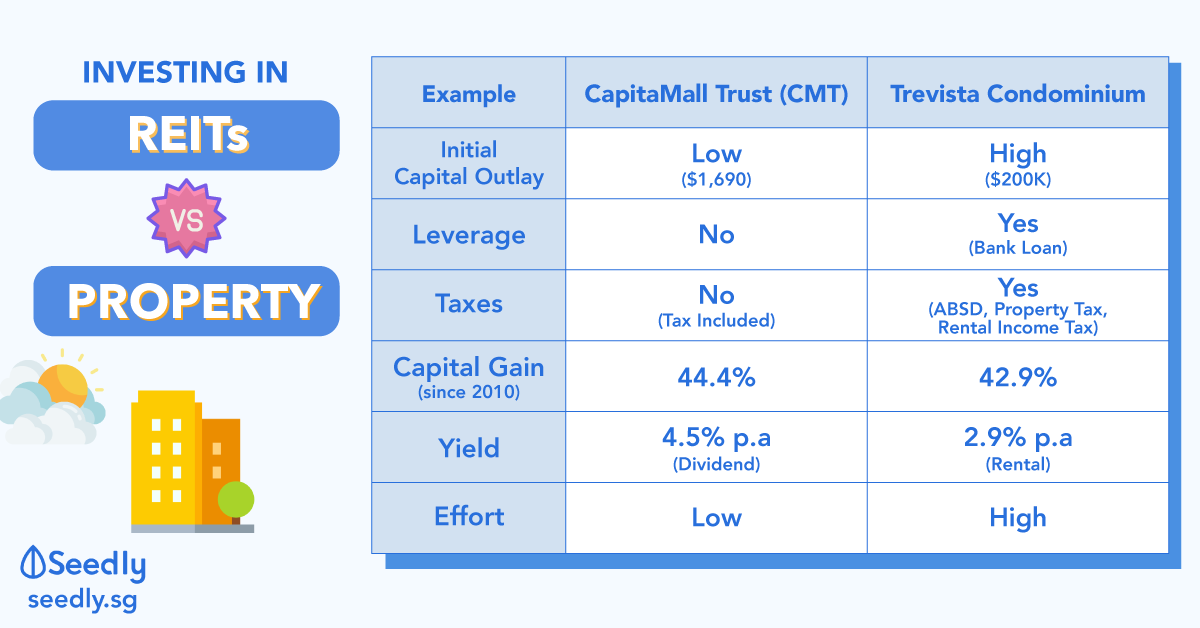

Both are viable options but one major consideration would be the capital outlay, there is a much higher barrier of entry especially with the need to pay the downpayment in cash and/or CPF whereas for REITs you can own a share of the property based on the price of the share and the lot size. S-REITs typically pay out a dividend yield of around 6.5% on average, while rental yield depends on alot of other factors like maintenance costs, mortgage, etc. If capital is not an issue for you, it might still be wise to diversify your investments across property, REITs and also other asset classes.

Reply

Save

Rais M

06 Mar 2020

Accountant at SME

I would say REITs for general investors. With REITs, you do not need

1) large lump sum investment

2) leveraging / borrowing from bank

3) look for tenants

4) worry about non payment or late payment of rents

5) repairs and management

6) tax filing

Reply

Save

Andy Sim

06 Mar 2020

HR Professional at a Financial Institution

To add on to the other answers, it depends if you have the capital. Property requires a huge amount of capital so not many people can afford it. But if you really can afford it, then it's a good form of passive investment through the rentals as well as future capital appreciation, provided that the property its a good choice in terms of location etc.

Reply

Save

Pascal S

06 Mar 2020

MBA Graduate at Singapore Management University

REITs man...

unless you want to deal with broken tap, blocked toilet and oily kitchen walls......

Read 3 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Reit has lower path of resistance for me. Lower barrier of entry meant that you can start investing earlier and divisify over a few counters instead of just 1 property.