Advertisement

Anonymous

My friend told me that buying bonds are always safer than buying shares of a company. This is true right?

From what he was telling me, if a company fails, They will have to pay back all the bonds first before paying back the people who own shares, that's why its always safer

13

Discussion (13)

Learn how to style your text

Reply

Save

Rais M

07 Mar 2020

Accountant at SME

True but not totally true. What your friend shared is a very general statement from the accounting/business books.

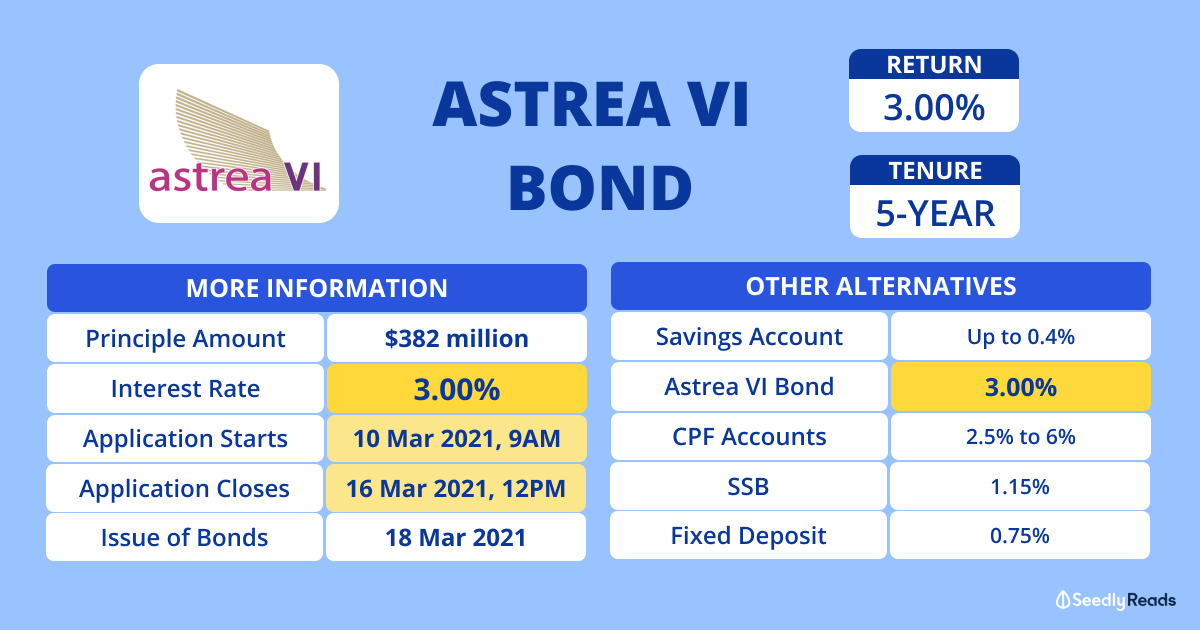

Bonds is a form of borrowing. When company offer bonds, they are in fact going to borrow money from the general public. One of the possible reason they borrow from the general public is because the banks are not willing to lend them money, or if they do, the interest rate is too high. We could be a cheaper alernative for the company to borrow money.

In bad times, the company can default on interest payments. And what could happen next is they could literally default on the bonds totally. In fact, if the company fails, while in theory, they are supposed to pay back all bonds, they might end up paying only $0.10 per $1 of the bonds you own.

Not to forget, there are also many different types and grades on bonds as well.

Reply

Save

Bonds are much safer than stocks - largely due to bonds not being exposed to market risk- which is of course compensated with greater return.

That being said there are still a multitude of risks bond investors are exposed to:

Default risk- Non govt bonds hold small % of default risk no matter how insignificant it might be.

*Interest rate risk- This is the main risk! While bond interest payouts will not change , the real yield and prices of bonds will drop as interest rates(or inflation) increases.

Call risk- Only applies to callable bonds. Bonds may be prematurely terminated.

Reinvestment risk- Coupon value might not be able to be reinvested at same rate as original bond.

Reply

Save

Hariz Arthur Maloy

07 Jun 2019

Independent Financial Advisor at Promiseland Independent

Yes, other than just in the event of liquidation, bonds are less risky assets because their price is less volatile on the open market.

Plus when held till maturity and without and default, you get what was promised to you.

However, bonds also have their ratings. There are junk bonds, investment grade bonds, and the stuff in between. Higher rating, less likely to default.

Equities are more volatile, and there's no maturity on a stock. You decide when to sell it. And especially in the short term, your stock price could be much lesser than how much you bought them for.

Reply

Save

Loh Tat Tian

07 Jun 2019

Founder at PolicyWoke (We Buy Insurance Policies)

What your friend tells you is just a common general statement (and should be correct more than 50% o...

Read 10 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

On one level yes.

but even with bonds, particularly corporate bonds You could loose bigtime.

And isn't it also somehow a risk when You buy bonds, but stocks would appreciate better (opportunity costs)?