Advertisement

Anonymous

Mindef group term and ci insurance?

Hi, Mindef Group Term and CI are affordable up to age 65. Should I get them? I have my own private insurance WL and Term too from Prudential. Thought of getting additional Term just to cover for when my kids are below 25 yrs old. Mindef looks cheaper.

2

Discussion (2)

Learn how to style your text

Elijah Lee

11 Mar 2023

Senior Financial Services Manager at Phillip Securities (Jurong East)

Reply

Save

Pang Zhe Liang

03 Mar 2023

Lead of Research & Solutions at Havend Pte Ltd

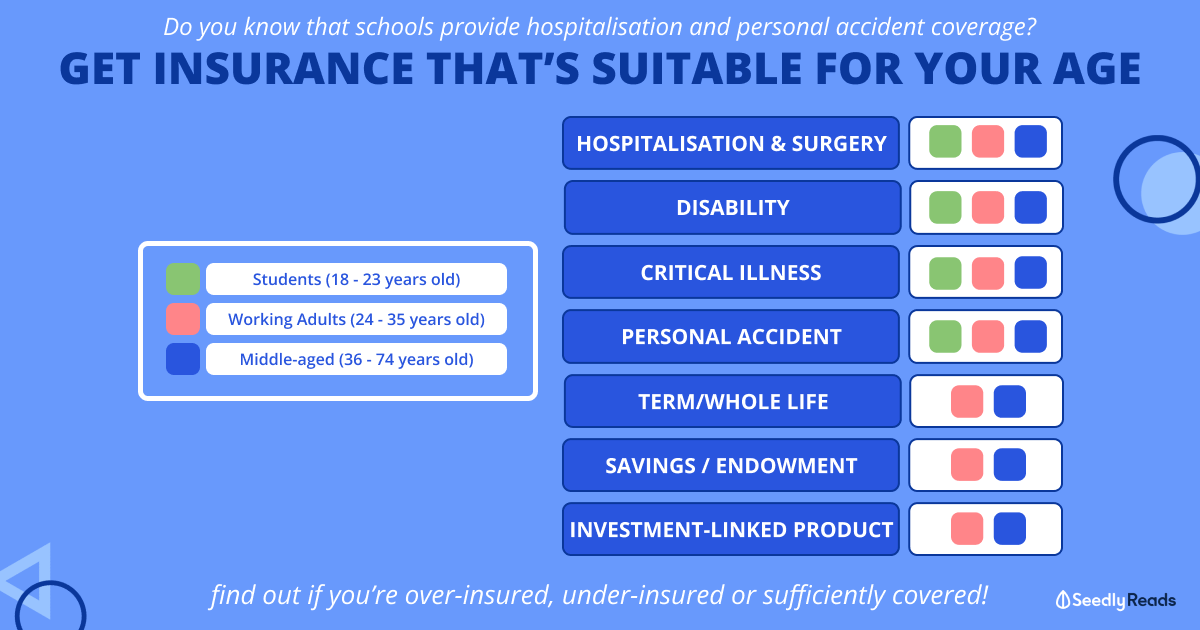

Firstly, I feel that in order to determine whether you need additional insurance coverage (or not), it is imperative to conduct a comprehensive financial health review first. Through this process, we get to understand more about you, your priorities, alongside with financial data such as your assets, cash flow, and existing insurance policies.

From there, it becomes easier to assess whether you really need to buy an additional insurance policy. Regardless of whether the new insurance policy is affordable or not, it is still an opportunity cost - money spent on an insurance policy cannot be spent elsewhere. As a result, I always like to ask my clients if there is a better use for their dollar instead.

Meanwhile, back to your question on the Group Insurance scheme. While the premium rates seem affordable at a glance, you must take note and bear in mind that for Critical Illness coverage, the monthly premium rate payable is revised on 1 January ever year based on your age next birthday. Additionally, the rates are non-guaranteed and may change. To this end, you must consider these points when you evaluate whether the policy is suitable for you; another point to note will be the length of the survival period.

As you can see, it is not easy to give you a straightforward answer on whether you should get the group term policy or not in a sentence or two. Summing up, I feel that the more appropriate and responsible approach would be to conduct an in-depth review and analysis of the various options available on the market. Thereafter, it becomes easier to help you make the right decision to that end.

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hi anon,

Mindef group term and CI are generally affordable as the group to be insured is larger and the insurer can factor that in when pricing (CI does increase drastically however, after around age 40)

Personally I think it is ok to get some coverage from group term, however do note that you do not own the policy and if you are no longer a member of the group, you will immediately lose the benefits.

Price can change any time when the yearly renewal of the group policy occurs. Terms may change as well (e.g. MINDEF group insurance moved everyone to 2019 CI definitions for all renewals since Aug 2020, even if you wanted to stay on the 2014 definitions)

I'd suggest that for the bulk of your coverage needs, ensure that your personal policies sufficiently cover you. If you need $1.5M D/TPD and $500K CI coverage at a minimum, make sure you've got that from your personal policies. Only after that is settled, should you consider adding another $1M D/TPD and say, $200K CI from group term due to the low cost (and also if you can afford it).

I'd take a mixture of both for my protection needs. Group insurance can be cost effective but I will always have a backup plan with my personal policies since they will always protect me regardless.