Advertisement

Anonymous

Is the Aviva MINDEF/SAF Group Insurance enough coverage for all my areas of concern?

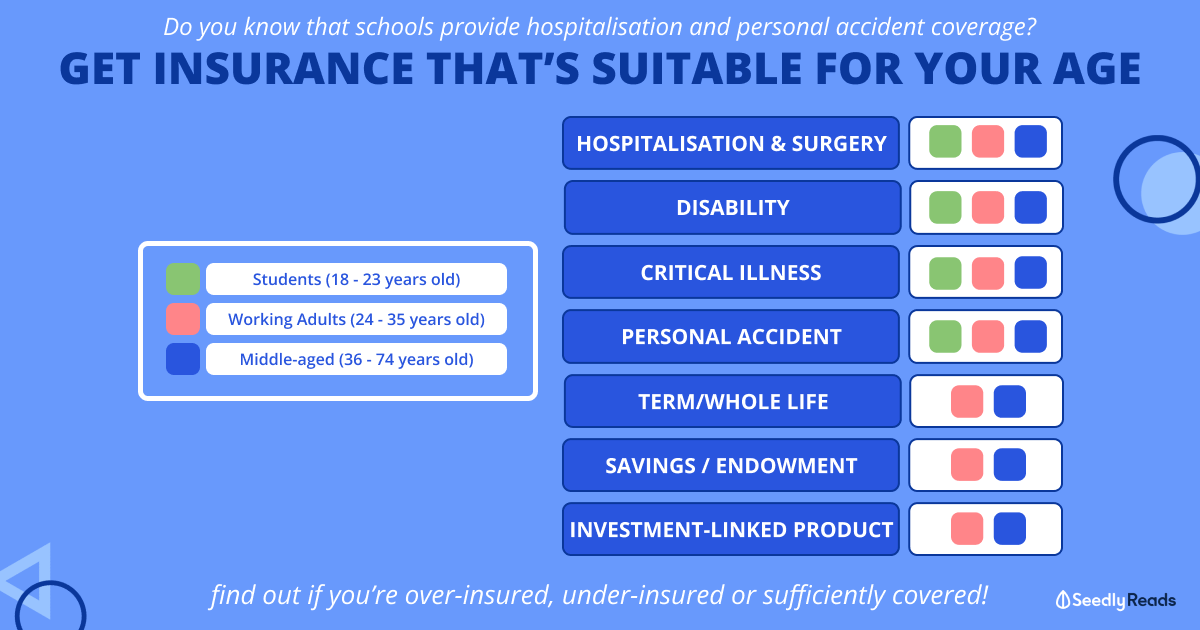

They provide almost all of the areas Seedly recommends to get as a minimum. Life Insurance, Hospitalisation, Critical Illness etc.

AND AT A REALLY GOOD PRICE!

Are there any other factors why I should consider getting from other places instead of just getting coverage from them and maybe for my dependents too?

Recently married so looking at increasing my coverage :)

2

Discussion (2)

Learn how to style your text

Jonathan Ng

24 May 2019

Penultimate Economics Undergrad at Singapore Management University

Reply

Save

Hariz Arthur Maloy

23 May 2019

Independent Financial Advisor at Promiseland Independent

It's a good tool. But there are quite a few cons on relying just on a group insurance policy.

First and foremost, you don't own the policy. Terms and conditions can change at anytime.

Also, for the mindef term, the ECI rider is lacking. It doesn't cover barely enough conditions to make it worthwhile.

I'll probably only use half of all my coverage needs with a group policy if I'm budget concious.

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hi!

The Aviva MINDEF/MHA Group Insurance is a voluntary scheme that comprises of Group Term Life & Group Personal Accident.

Here is a summary of the policy:

Group Term Life

Group Personal Accident

With regards to your concern, YES you can use this policy to cover your spouse and dependents too!

There are also additional riders such as:

All these riders will not reduce the coverage of your Group Term Life & Group Personal Accident policies.

You can read more on the policy here: https://blog.seedly.sg/should-you-cancel-your-a...

Alternatively, you can refer to Aviva’s website: https://www.aviva.com.sg/en/mindef-and-mha/mind...

If you feel that your current coverage is insufficient, you can purchase additional coverage under the Aviva MINDEF/MHS Group Insurance. It is one of the most value for money in the market given its coverage.

Alternatively, you can also look at Whole Life or Term Life policies from other insurance providers.

Other factors you should consider before getting an insurance policy:

Hope this helps!