Advertisement

Discussion (30)

Learn how to style your text

Ngooi Zhi Cheng

04 Oct 2024

Student Ambassador 2020/21 at Seedly

Reply

Save

Ngooi Zhi Cheng

03 Oct 2024

Student Ambassador 2020/21 at Seedly

Is $1.5 Million Enough to Retire at 40 in Singapore?

As a financial consultant who's helped numerous professionals in Singapore plan for their futures, I've encountered this question more times than I can count. The allure of early retirement is strong, especially in our fast-paced city. But before we dive into the numbers, let's take a step back and consider what retirement really means to you.

The Early Retirement Dream vs. Reality

I once worked with a client who was adamant about retiring at 40 with $1.5 million. He had visions of traveling the world and living a life of leisure. However, as we dug deeper into his goals and the realities of early retirement, he realized that what he really wanted was financial independence and the freedom to pursue passion projects, not necessarily a complete exit from the workforce.

Breaking Down the Numbers

Now, let's look at whether $1.5 million is sufficient for retirement at 40 in Singapore:

Life Expectancy: Singaporeans have one of the highest life expectancies in the world. Planning for 50+ years of retirement is crucial.

The 4% Rule: This popular retirement guideline suggests you can withdraw 4% of your portfolio annually with a low risk of running out of money. For $1.5 million, that's $60,000 per year or $5,000 per month.

Cost of Living: Singapore's high cost of living means $5,000 per month might not provide the lifestyle many envision for retirement, especially if you're planning for 50+ years.

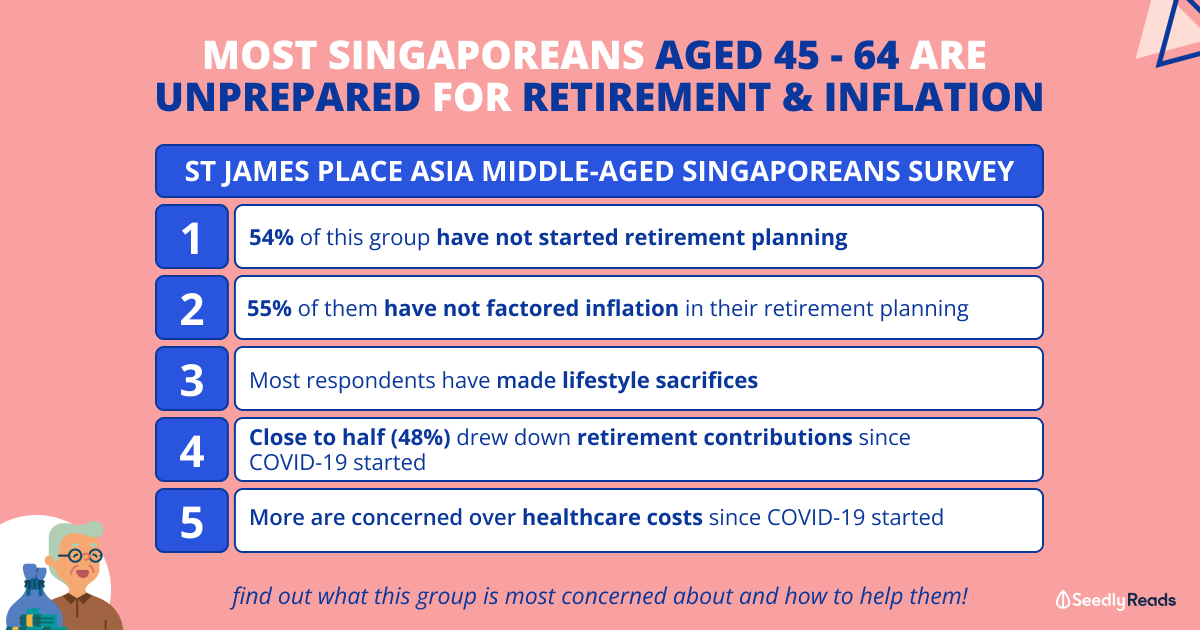

Healthcare Costs: As you age, healthcare expenses are likely to increase. Long-term care insurance and sufficient savings for medical emergencies are crucial.

Inflation: Over a 50-year period, inflation can significantly erode your purchasing power. Your investments need to outpace inflation to maintain your lifestyle.

Housing: If you own your home outright, $1.5 million goes much further. If not, factor in ongoing housing costs.

Beyond the Numbers: Lifestyle Considerations

Retirement isn't just about having enough money; it's about how you want to spend your time. Consider:

- Purpose and Fulfilment: Many retirees struggle with loss of identity and purpose. How will you stay engaged and fulfilled?

- Social Connections: Work provides social interactions. How will you maintain and build relationships in retirement?

- Flexibility: Could a phased retirement or part-time work provide a better transition?

A Realistic Approach

In my experience, for most professionals in Singapore, $1.5 million at age 40 is likely not sufficient for a traditional full retirement lasting 50+ years, unless you're willing to significantly adjust your lifestyle expectations.

However, it could be an excellent foundation for:

- Financial Independence: The freedom to work on your terms, perhaps transitioning to part-time or consulting work.

- Career Change: Pursuing a lower-paying but more fulfilling career without financial stress.

- Semi-Retirement: Working part-time or seasonally to supplement your investment income.

Strategies to Make It Work

If early retirement is your goal, here are some strategies to consider:

- Diversify Investments: Balance between growth (to combat inflation) and income-generating assets.

- Optimize CPF: Maximize your CPF Life payouts for a stable income stream later in life.

- Geographic Arbitrage: Consider spending part of your retirement in lower-cost countries to stretch your dollars.

- Side Hustles: Develop skills now that can generate passive income in retirement.

- Health Investment: Prioritize your health to potentially lower future healthcare costs.

The Bottom Line

While $1.5 million is a commendable achievement by age 40, whether it's sufficient for retirement depends on your individual circumstances, lifestyle expectations, and how you define "retirement." For most, it's likely to be more of a strong foundation for financial independence rather than a ticket to traditional full retirement.

Remember, retirement planning isn't a one-size-fits-all equation. It's about creating a personalized strategy that aligns with your unique goals, values, and vision for the future.

If you're serious about planning for early retirement or financial independence, I'd strongly recommend sitting down with a financial advisor to create a comprehensive plan tailored to your specific situation. We can dive deep into your numbers, goals, and create a strategy that gives you the freedom and security you're looking for.

Want more insights on retirement planning and financial independence in Singapore? Follow me on Instagram @ngooooied for daily tips and strategies to help you build a secure financial future. Let's turn that early retirement dream into a well-planned reality!

Reply

Save

I would like to have $3K per moth to retire at age 40. Life span for men roughly around 85 and ladies 87.

$3K x12x47 = $1.692M

how to achieve this retirement sum?

Reply

Save

It's sufficient but lifestyle needs to be altered.

Reply

Save

Based on 4% rule, if you can live by 60k a year, you should be fine....

Read 23 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

The prospect of early retirement in Singapore's high-cost environment is appealing yet complex. Before celebrating, let's examine the realities of retiring at 40 with $1.5 million.

A Client's Early Retirement Success

A client came to me at 38 with $1.2 million, aiming to retire by 40. We optimized her portfolio, cut expenses, and created multiple income streams. Now at 41, she's "retired" from her corporate job, runs a small online business, does part-time consulting, and has grown her net worth to $1.6 million. The key? She transitioned to a fulfilling lifestyle that includes income-generating activities.

Dispelling the "Magic Number" Myth

There's no universal retirement number, especially for early retirement. Here's why:

Is $1.5 Million Sufficient?

It depends on individual circumstances. Consider these factors:

The Zhi Cheng Approach to Early Retirement

Successful early retirement in Singapore often involves:

Whether $1.5 million is enough depends on your specific situation and goals. The key is a comprehensive, flexible plan tailored to your needs.

For more insights on FIRE strategies and sustainable withdrawal rates in Singapore's context, follow @ngooooied on Instagram. Let's work towards your financial independence together!