Advertisement

Anonymous

I want a plan that can guarantee 3kSGD payout per month. Should I buy 1 plan from 1 Insurance provider or buy a few plans from various providers ( 1500 SGD payout from 2 companies or 1000 SGD payout from 3 companies ) to diversify any risk ?

4

Discussion (4)

Learn how to style your text

Hariz Arthur Maloy

07 Jun 2019

Independent Financial Advisor at Promiseland Independent

Reply

Save

Bang Hong

06 Jun 2019

Sustainable Spender Specialist at Spender Bang

If you are looking strictly into plan, as a layman perspective I will go for at least 2 different insurer.

You might want to consider exploring the following too:

1) Top up SRS yearly $15,300

2) Top up CPF-SA yearly $7000

3) Top up CPF-MA (If applicable for tax relief)

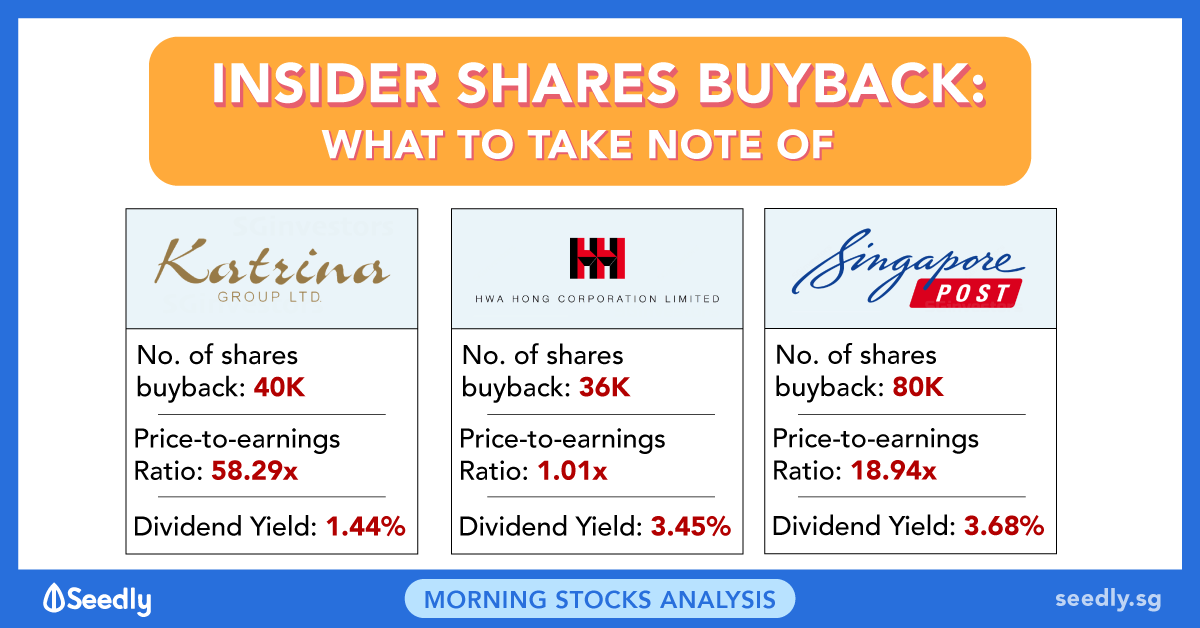

4) Buy into Dividend paying stocks (i.e. REITs, blue chips).

Reply

Save

Elijah Lee

06 Jun 2019

Senior Financial Services Manager at Phillip Securities (Jurong East)

Some things you might need to consider are:

1) The policy owners protection scheme provides for a p...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hi Anon, I see that you're worried about insurer default. In that case, SDIC will cover up to $100k on a policy.

But personally, I think I'll just go for the highest guaranteed and highest IRR policy. If you have two policies giving you almost equal IRR, then sure split between both. But don't settle for a lesser IRR just because you might afraid of the insurer going bust.

There are strict rules in place for insurers here by MAS, and even in the even of an insurer leaving Singapore, they'll still service your policy or another insurer will take over the portfolio.