Advertisement

Anonymous

I'll be getting my flat in 2 year's time +/- in 2025. I currently have 74k in OA. What is the best way to use my CPF.

Should my $$ in OA be used for my home or top up to my other accounts? I have investments, emergency funds and insurance. I have also saved around 50k on the side for future use for my home reno...

3

Discussion (3)

Learn how to style your text

Cryotosensei

02 Jan 2023

Blogger at diaperfinancingfund.blogspot.com

Reply

Save

The info you have provided is too limited. The easy answer is it depends on your planning - some thoughts you can consider, I hope it's helpful.

1) Loan/how you plan to finance the flat - how much loan (what is the house value)/what kind of loan (HDB/bank)/how long are you (10,15,20,25 years) / + your spouse (if any) taking the loan/how much by cash? How long you plan to work?

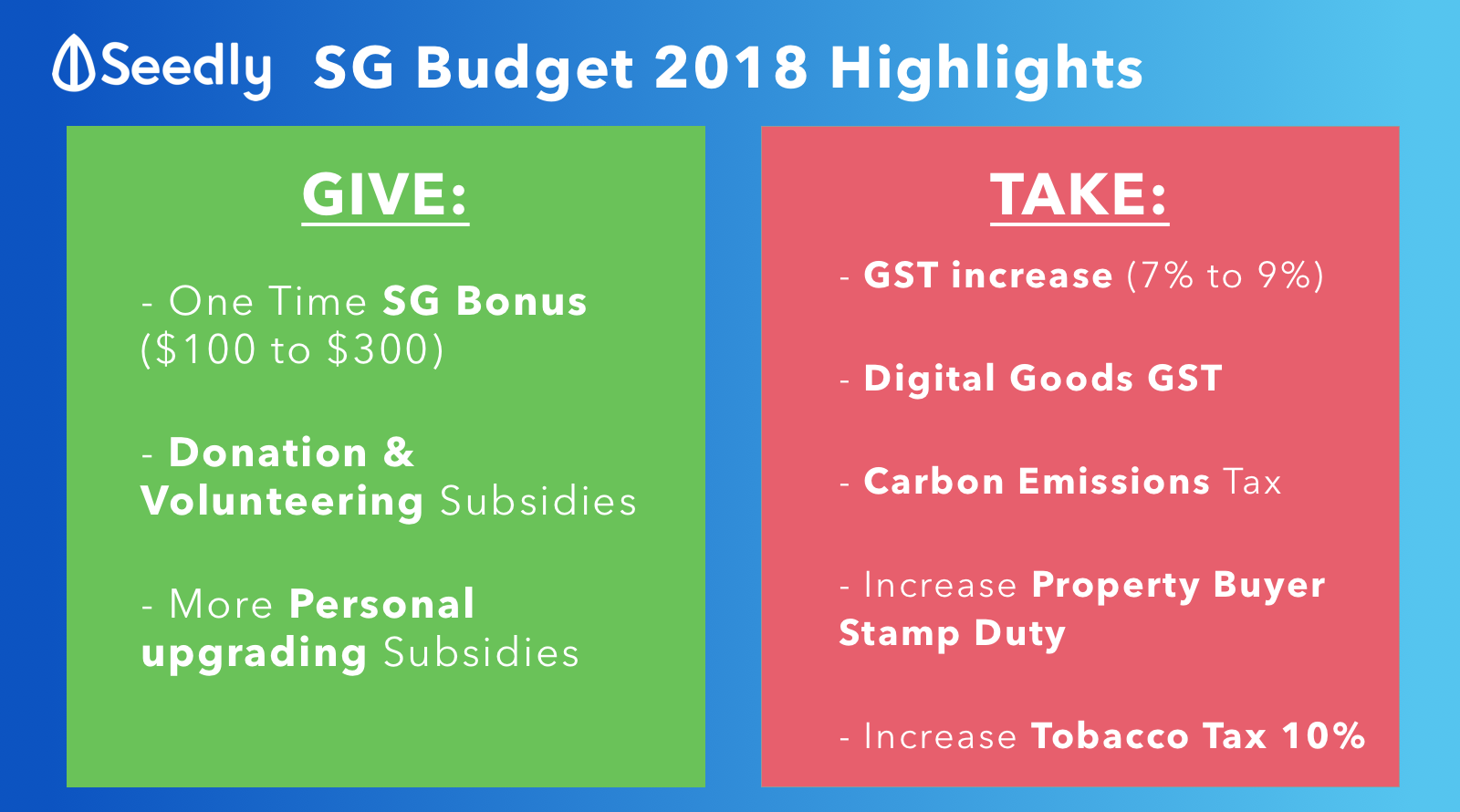

2) Retirement - how are you planning for your retirement? Hit FRS etc? Or you plan to plan only after getting your house?

3) Investment - are your investments for retirement or also a portion will help to pay flat loan?

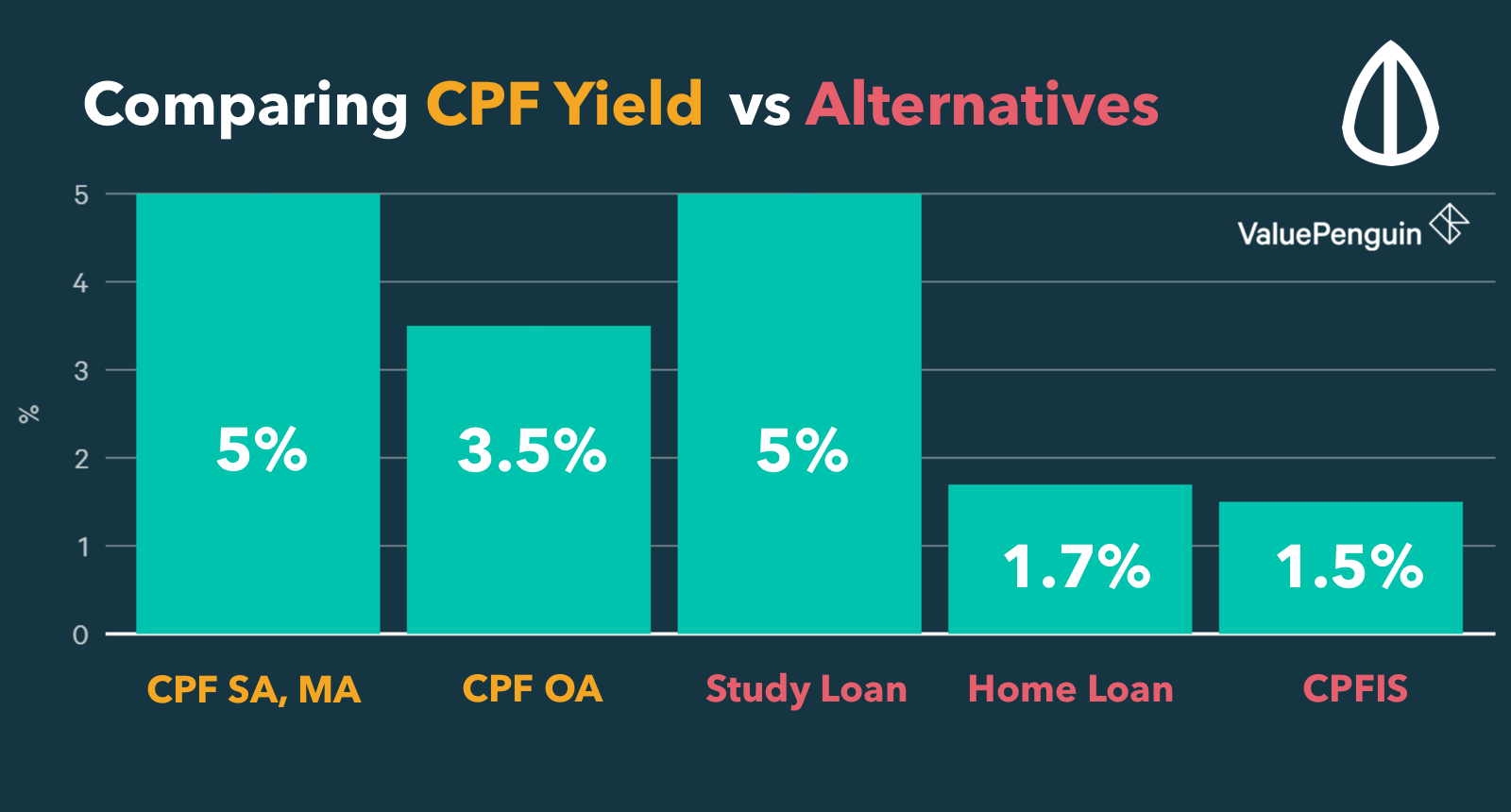

4) CPF - do you and your spouse plan to retain $20K in CPF OA balance when financing for the flat or no?

There's no same way/right or wrong answer for different ppl w different obligations/scenario.

Reply

Save

Ryan Yap

23 Dec 2022

Retirement Specialist at AIA

If you have set aside an emergency fund for yourself, including enough to pay off 1-2years of housin...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

I can only share my experience because your priorities may be different from mine

I took a HDB housing loan, wiped out my CPF OA money and paid off my entire mortgage in about five years. Only when my mortgage was paid off did I transfer my CPF from OA to SA. This meant that I hit my FRS only when I reached 41. (There are stories of how others hit their FRS in their early 30s).

but I don't care lar. I just hate the feeling of being in debt. I'm making Voluntary Housing Refunds to my CPF OA whenever I can - but that doesn't cause me stress at all.

you can achieve all your financial goals - just not at the same time