Hey there! I’m planning to get a DBS Live Fresh Card too so I did a little research into it.

Earning cashback and miles is really important to me too, so I got your back!

Hopefully, the information I found and my recommendations would be helpful!

TL;DR

- Know the monthly cashback caps you can be rewarded

- Understand the types of spending that are eligible for cashback

- Sort out if you’re prioritising miles or cashback

- Use a combination of recommendations to maximise your gains

Reasons & Recommendations (for the lack of eligible cashback):

- Monthly caps.

- Perhaps you were unaware of the monthly caps for the various types of spending. This explains why you thought some of your transactions were “uncaptured as eligible cashback spend”.

- Recommendation: Look through your previous month’s statement and identify which transactions qualified for cashback. Calculate the total cashback you were rewarded for that month and check if it tallies up with the various types of monthly cashback cap. If they do, great! If they don’t, move on to the next recommendation.

- Exceptions for the different types of spending.

- There are various types of transactions that do not qualify as Online Spend, Visa Contactless Spend and All Other Spend. Some of your S$800 monthly expenses might be the exceptions under this category and therefore, aren’t rewarded with the due cashback.

- Recommendation: Identify the type of transactions you’ve made in the month and whether they fall under the exceptions. If they do, that would most likely be the reason why you weren’t rewarded with the cashback.

If neither of these reasons is why you didn’t get your due cashback, I would suggest speaking to DBS directly to check if there were any other unnoticed discrepancies.

BTW, you can earn an extra 5% cashback!

- I also found out in my research that 5% cashback on Overseas Spending is valid from 5 Apr - 30 Jun 2019 if you didn’t know! All you gotta do is hit a min. spending of S$700.

- Just like the other types of cashback, there is an S$35 monthly cashback cap for your overseas spending too.

Recommendations:

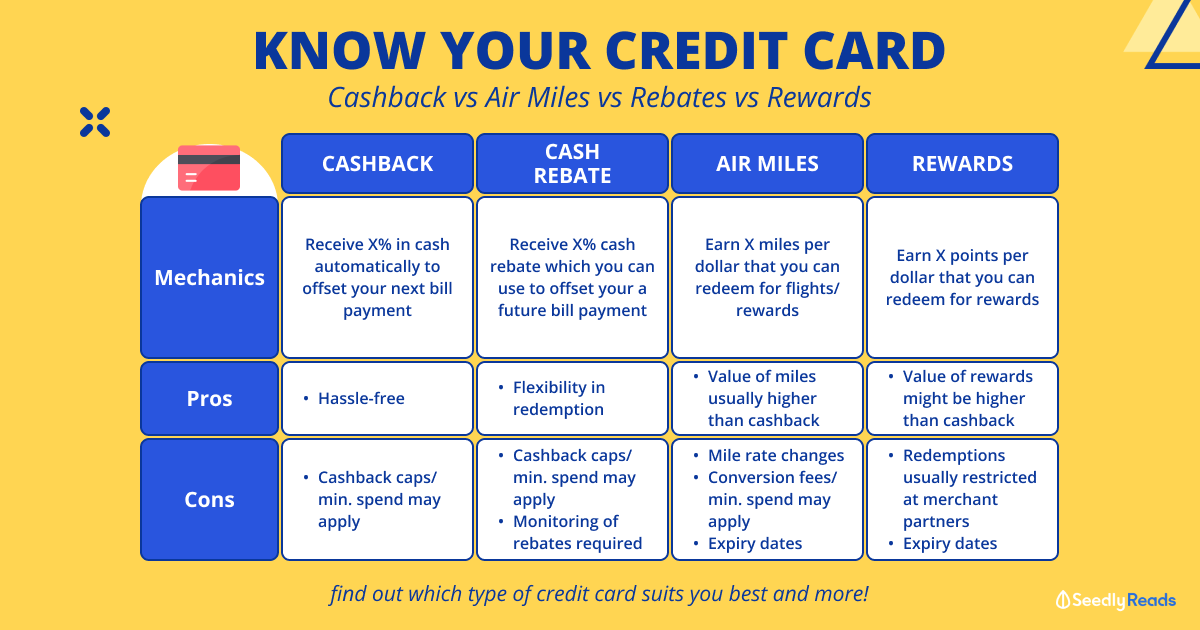

Before getting into further recommendations to help you earn greater cashback (or miles), I suggest you check out our Seedly blog article on the differences between them. Knowing the different types of rewards helps you understand which one you should prioritise based on your spending behaviour and therefore, which CC you should get on top of your DBS Live Fresh.

- If you would like to get a new CC that focuses on miles, you should check out SeedlyTV Ep 2 where Aaron (Founder of Milelion) broke down the differences between miles and cashback rewards that a CC can offer. On top of that, he also gave some tips for anyone starting their miles collection! Have a look at Milelion’s comprehensive categories of miles CC here. But before that, do determine the following first:

- What’s your spending priority (e.g. local spending, foreign currency spending or others)? Different CCs offer different miles rates based on it.

- How often do you travel/intend to travel? This helps you in strategising a plan to collect the right amount of miles by your designated deadline.

- How much do you spend every month? Certain CC’s miles promotions are only valid with minimum spending, or else you would be earning slightly lesser miles.

As a loyal fan and frequent traveller on SIA, my personal recommendation would be the KrisFlyer UOB Credit Card. I find their miles rate pretty reasonable and appreciate the additional exclusive privileges when I travel too.

- If you are looking for another CC that can give you further cashbacks, here’s another Seedly blog article for your reference. It’s best to understand the following before deciding on another CC that provides you with extra cashback:

- What’s your main form of expense (e.g. dining out)? Different CCs provide different cashback rates based on it.

- How much do you spend every month? Certain CC’s cashback offers are only valid with minimum spending.

- Understand the monthly cashback caps for these CCs too and see if they suit your spending behaviour.

My personal recommendation would be the POSB Everyday Credit Card. I find the cashbacks offered for Watsons and Sheng Shiong really applicable for me, and there isn’t a minimum spending too! Additionally, I get to enjoy greater interest rates from my DBS Multiplier account with this card too.

- Other Suggestions:

- ShopBack: If you’re a frequent online shopper, ShopBack is the place to go if you would like to earn some additional cashback. Cashback also applies for your travel expenses on ShopBack (e.g Agoda, Expedia), so even if you’re not earning the miles, perhaps you can consider gaining some extra cashback from your travels instead! The cashback I got from booking my hotels via ShopBack is amazing.

- DBS Multiplier Account: If you haven’t opened a DBS Multiplier Account, I would highly recommend it. Instead of earning cashback, you get to earn from greater interest rates when you accompany your DBS Live Fresh Card with the Multiplier Account.

I hope my research and recommendations are helpful!!

Hey there! I’m planning to get a DBS Live Fresh Card too so I did a little research into it.

Earning cashback and miles is really important to me too, so I got your back!

Hopefully, the information I found and my recommendations would be helpful!

TL;DR

Reasons & Recommendations (for the lack of eligible cashback):

If neither of these reasons is why you didn’t get your due cashback, I would suggest speaking to DBS directly to check if there were any other unnoticed discrepancies.

BTW, you can earn an extra 5% cashback!

Recommendations:

Before getting into further recommendations to help you earn greater cashback (or miles), I suggest you check out our Seedly blog article on the differences between them. Knowing the different types of rewards helps you understand which one you should prioritise based on your spending behaviour and therefore, which CC you should get on top of your DBS Live Fresh.

As a loyal fan and frequent traveller on SIA, my personal recommendation would be the KrisFlyer UOB Credit Card. I find their miles rate pretty reasonable and appreciate the additional exclusive privileges when I travel too.

My personal recommendation would be the POSB Everyday Credit Card. I find the cashbacks offered for Watsons and Sheng Shiong really applicable for me, and there isn’t a minimum spending too! Additionally, I get to enjoy greater interest rates from my DBS Multiplier account with this card too.

I hope my research and recommendations are helpful!!