Advertisement

For the various major life stages (big ticket items), whats the expense range I should be looking at when planning for it?

Currently what i can think of are like

- Marriage

- House (say BTO)

- Renovations

- 1st kid (baby, education idk)

Because knowing these major expense can help gauge how much we need as we enter these life stages, to know if we are financially ready

3

Discussion (3)

Learn how to style your text

Hariz Arthur Maloy

07 Jun 2019

Independent Financial Advisor at Promiseland Independent

Reply

Save

It seems like most of the big ticket items you have identified are related to starting a family. Aside from that, you might want to think about the down-side protections ie. illness etc, if not already covered with insurance.

Now with that said, I agree with Hariz that it really boils down to how much you can afford.

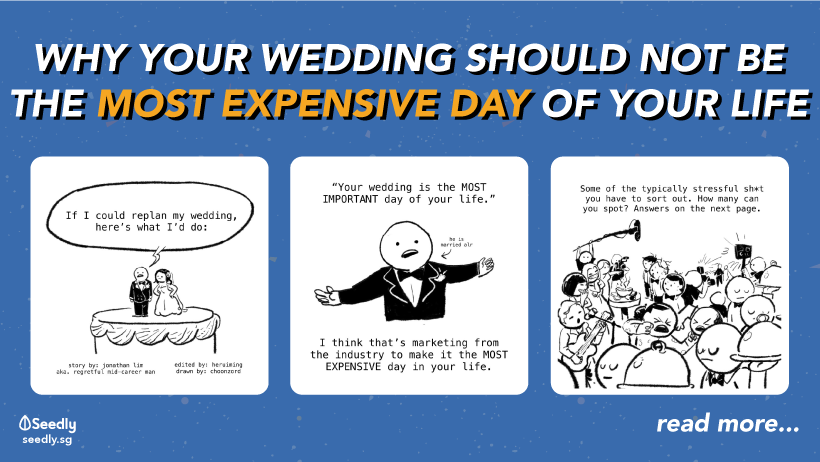

Take weddings for example. It can be super simple and lowkey, or super extravagant. The budget range would then be anything from thousands to a six-digit figure.

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Instead of planning for future expense and working backwards, I suggest focusing on doing a bottom up approach.

Focus on ability to make money and save.

When you're single, if you can't save 60% of your income, you can't afford to get married.

When you're married and can't save 40% of your income, you can't afford to have children.

When you're married and have children, if you can't save 20% of your income, you can't afford to retire.

This works better psychologically, future prices are honestly a guesstimate, for all we know uni education fees could be free 20 years from now.

So save that % first, and then when you're there, you know your affordability.