Advertisement

Anonymous

For individuals with pre-existing conditions, should we hold more cash (compared to investment) for out-of-pocket medical expenses in view of exclusions in insurance policies?

4

Discussion (4)

Learn how to style your text

Tan Li Xing

16 May 2020

Financial Consultant at Prudential Assurance Company (Singapore)

Reply

Save

Hey there!

In financial planning, wealth accumulation and insurance protection often go hand in hand. We probably will need to sit down to see how this will work out in your case. Because even if you didn't incur any costs due to your medical expenses, the value of your money will shrink due to inflation over the long run and your medical expenses will only get higher with age. Just food for thought.

Financial planning is an integral part of life. You can reach me here to find out more.

Reply

Save

Pang Zhe Liang

15 May 2020

Lead of Research & Solutions at Havend Pte Ltd

We need to spend more time to understand your medical condition in order to determine the best way t...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Income IncomeShield Integrated Shield Plan

4.4

306 Reviews

NTUC Income IncomeShield Integrated Shield Plan Preferred

$1,500,000

LIMIT PER POLICY YEAR

180 / 365 days

PRE & POST HOSPITAL

As Charged

OUTPATIENT BENEFITS

Private Hospital

WARD ENTITLEMENT

Raffles Shield Integrated Shield Plan

4.5

83 Reviews

AIA HealthShield Gold Max Integrated Shield Plan

4.2

20 Reviews

Related Posts

Advertisement

Hi Anon,

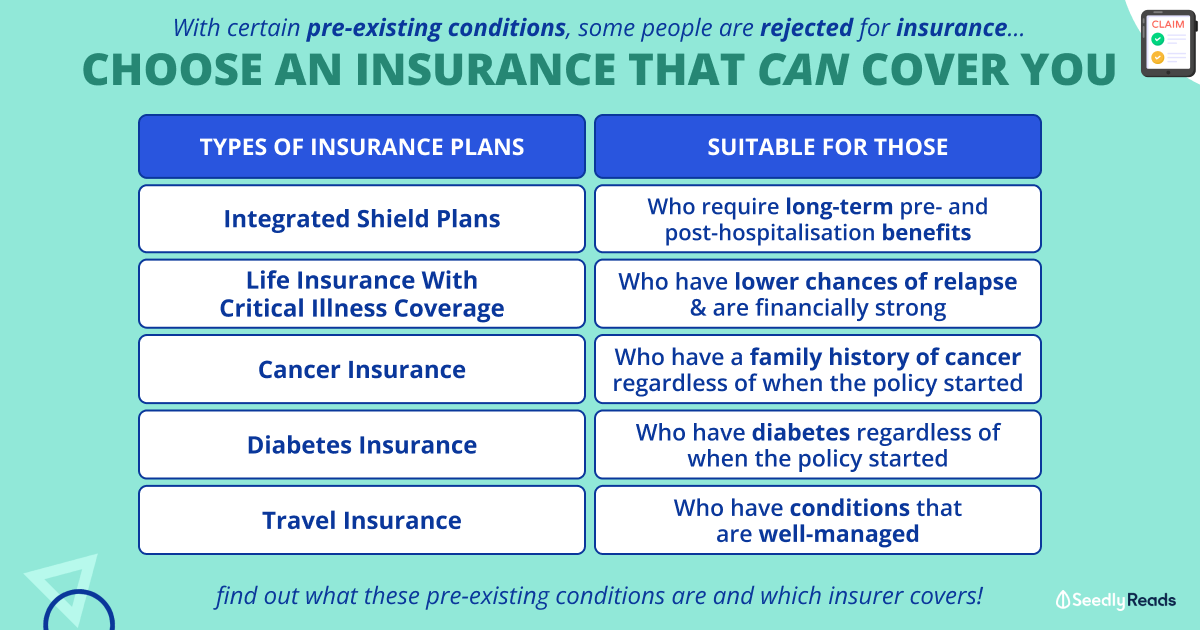

Medshield life should cover your pre-existing condition as it's the health insurance plan from the Government, but you would be limited to Government Restructured Hospitals and also B2/ C ward in the event you are hospitalised for the condition.

Also Health Insurance are on an reimbursement basis, so generally it's a good practice to have cash on hand in the event you do get hospitalised.