Hi Anon,

I'd say that the HSBC Revolution Card is superior in almost all aspects to the CITI Lazada Card, unless you live on Lazada.

If you'd like to have an in-depth understanding of the CITI Lazada Card, we actually have a question thread wrt the CITI Lazada Card here. Alternatively, you can check out this article by Seedly's content team, and this article by The MileLion.

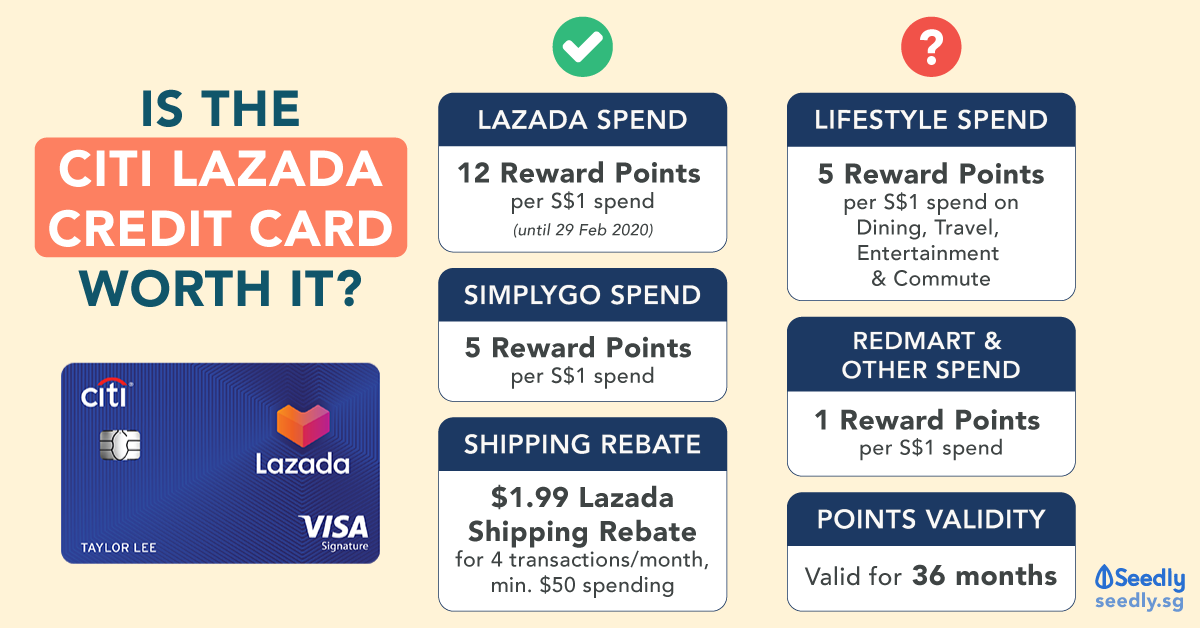

CITI Lazada Card:

4.8 miles (12pts) per S$1 spend on Lazada

2 miles (5pts) on dining, transport & more

Shipping rebates & exclusive Lazada deals

Rewards capped at 4k miles (10k pts) per month

S$192.60 fee waived just 1 year

General spend earns 0.4 miles per S$1

To give a general consensus regarding the CITI Lazada Card- most view this card as pointless, as although the 4.8 MPD ratio you get when buying things off Lazada does seem quite generous, you have to keep in mind that CITI cards do not pool their points together. Hence, in order for you to actually accumulate enough miles on this card for a worthwhile miles redemption, you'll have to practically live your life on Lazada in order to get some actual value out of this card.

HSBC Revolution Card

2 miles/S$1 spend on local dining, entertainment & online spend (no min. spend req.)

Online payments for travel bookings, recurring bills & transit payments are rewards-eligible

Annual fee is waived with S$12,500/yr spend

0.4 miles per S$1 general & overseas spend

The most attractive thing about the HSBC Revolution Card would be it's verstaility with online payments, as you earn 2 mpd if you pay online, these include utilities payments, shopping transactions, insurance premiums, education/tution fees.

If you use this card for all these online payments, the $12,500/yr spend to waive the annual fee should definitely be achievable! The versatility of the card makes this one of the better cards to have in your wallet if you're looking to be a less active mile hacker, and imo it's definitely a good entry-level card to use for dining, entertainment and online spending.

Thus, unless you're looking to spend predominantly on Lazada, I'd suggest you go ahead with the HSBC Revolution Card! It definitely seems like the more feasible card long-term.

Hi Anon,

I'd say that the HSBC Revolution Card is superior in almost all aspects to the CITI Lazada Card, unless you live on Lazada.

If you'd like to have an in-depth understanding of the CITI Lazada Card, we actually have a question thread wrt the CITI Lazada Card here. Alternatively, you can check out this article by Seedly's content team, and this article by The MileLion.

CITI Lazada Card:

4.8 miles (12pts) per S$1 spend on Lazada

2 miles (5pts) on dining, transport & more

Shipping rebates & exclusive Lazada deals

Rewards capped at 4k miles (10k pts) per month

S$192.60 fee waived just 1 year

General spend earns 0.4 miles per S$1

To give a general consensus regarding the CITI Lazada Card- most view this card as pointless, as although the 4.8 MPD ratio you get when buying things off Lazada does seem quite generous, you have to keep in mind that CITI cards do not pool their points together. Hence, in order for you to actually accumulate enough miles on this card for a worthwhile miles redemption, you'll have to practically live your life on Lazada in order to get some actual value out of this card.

HSBC Revolution Card

2 miles/S$1 spend on local dining, entertainment & online spend (no min. spend req.)

Online payments for travel bookings, recurring bills & transit payments are rewards-eligible

Annual fee is waived with S$12,500/yr spend

0.4 miles per S$1 general & overseas spend

The most attractive thing about the HSBC Revolution Card would be it's verstaility with online payments, as you earn 2 mpd if you pay online, these include utilities payments, shopping transactions, insurance premiums, education/tution fees.

If you use this card for all these online payments, the $12,500/yr spend to waive the annual fee should definitely be achievable! The versatility of the card makes this one of the better cards to have in your wallet if you're looking to be a less active mile hacker, and imo it's definitely a good entry-level card to use for dining, entertainment and online spending.

Thus, unless you're looking to spend predominantly on Lazada, I'd suggest you go ahead with the HSBC Revolution Card! It definitely seems like the more feasible card long-term.