Advertisement

Anonymous

Which insurance or policies should I consider first?

I just started working and I have no health/life insurance beside Medisave.

5

Discussion (5)

Learn how to style your text

Shulingg Chen

22 Nov 2019

Scientist at LonzA Biologics

Reply

Save

Leslie Koh

12 Nov 2019

Associate Financial Services Manager at Prudential Assurance Company Singapore

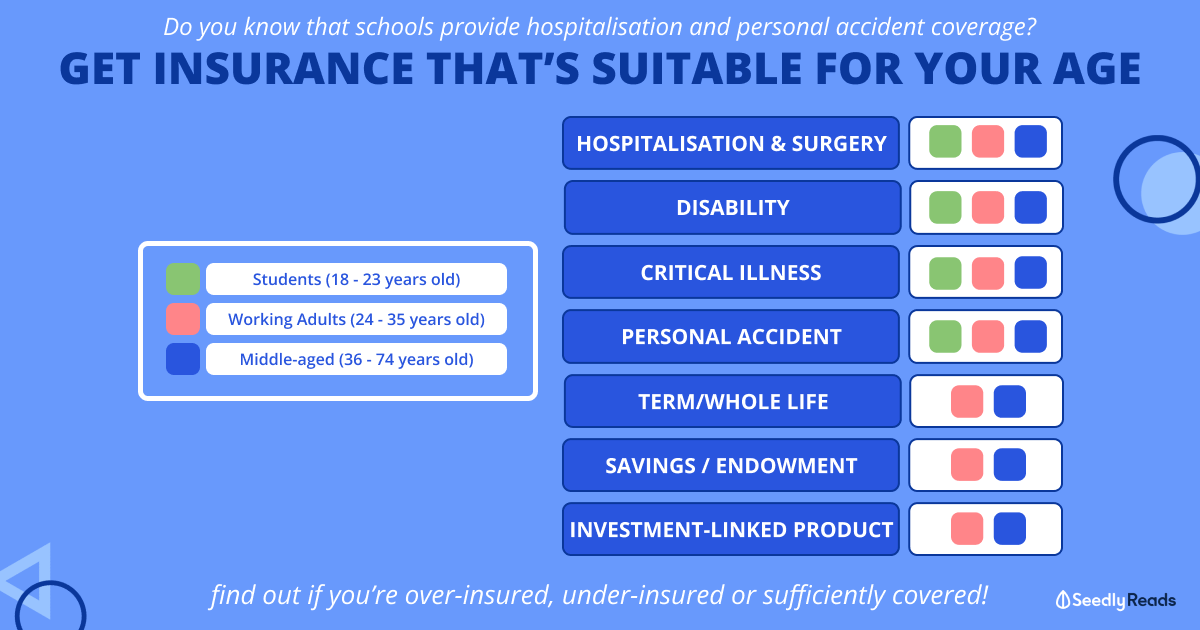

In order of priority:

1) Integrated Shield Plan with a Rider.

2) Illness Cover: Rule of thumb: 5x Your Annual Income.

3) Life and Disability Cover: Rule of thumb: 10x Your Annual Income.

You can speak to anyone of us if you're keen to know more in detail what each category entails :)

Reply

Save

Elijah Lee

10 Nov 2019

Senior Financial Services Manager at Phillip Securities (Jurong East)

Hi anon,

Medisave is not an insurance, but rather an account that you add to via your work contrib...

Read 3 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

(1) Hospitalization and surgical plan. Ideally, to upgrade the MediShield life plan to private (more affordable premium at younger age) then downgrade to A or B ward when older.

(2) Critical Illness (5 x annual income). May varies dependent on your expenses and liabilities.

(3) Disability income and/or income replacement. In cases of depression or chronic back pain which may affect your ability to work, this allows you to still receive your income (capped at 75%) to pay your expenses. If income is not important, why are we working?

(4) Life insurance (10x annual income). May vary depending if you have any dependents.

(5) Personal accident. For outpatient and permanent dismemberment which is not covered in TPD.