Advertisement

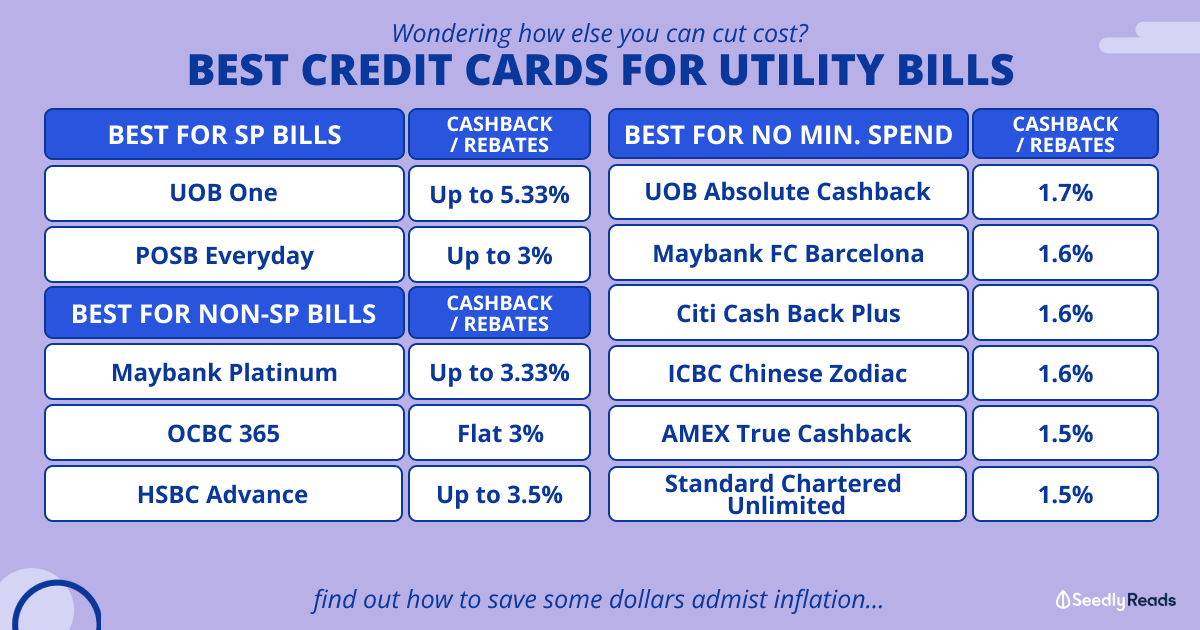

Which credit card is best for recurring bill payments?

Which credit card should I consider for recurring bills? is it more worth it to go for cashback or miles for recurring payments?

8

Discussion (8)

Learn how to style your text

Reply

Save

UOB One card has a tie up with Grabpay which grants you 8.33% if you spend $500 monthly.

I will seriously advise you to use grabypay to pay your recurring bills via AXS mobile app to enjoy this 8.33% cashback.

To do so, first link your UOB one card with your grab account to top up. And when your bill is due, simply log into AXS mobile app and pay via Grabpay

Reply

Save

If you're banking with UOB, UOB One would be a good option. Having recurring bills charged to your U...

Read 4 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

UOB One Card

4.2

166 Reviews

Get up to 10% cash rebate across 5 categories

CASHBACK

Up to 5% cash rebate on all other retail spend

ALL SPEND

Standard Chartered Simply Cash Credit Card

4.1

175 Reviews

DBS Altitude Visa Signature Card

4.3

97 Reviews

Related Posts

Advertisement

I think the UOB one card + Grabpay combi is one of the best to earn 8.33% interest.

So for recurring bills, you can use AXS mobile to pay using grabpay, topup your grabpay using UOB One card.