Advertisement

When selling our house, why do we have to return the interest "we would have earned" as if the money was in our OA?

Everyone, if not all, uses our OA monies to pay for our houses. We are already paying 2.6% interest rate p.a. to HDB for our housing loan. Upon selling the house, we would have to put back what we have utilised from our OA to pay for the housing loan PLUS 2.5% p.a. as if the money was in our OA over the years we were paying the loan. Albeit the money is still ours, but we won't be able to touch them until earliest at age 55. Why do we need to put back the 2.5% interest?

11

Discussion (11)

Learn how to style your text

Siow Nan

11 Jun 2019

E at NUS

Reply

Save

Chris Chin

10 Jun 2019

Senior Supply Chain at Mnc

Don't see why we are charged 2.6%pa by CPF Board when we are taking 脸from our own CPF Account.

When we are taking a loan from our own personal cpf account, we should be paying the 2.6%pa to our own CPF account, instead of the CPF Board. This will make it unnecessary to pay extra 2.5%pa to our CPF Account that resulted in a total 5.1%pa cpf loan.

Reply

Save

Alvin Teo

10 Jun 2019

Aviva Relationship Consultant at Aviva Affinity Channel

That’s the rules, no choice. if no accrued interest, everyone will cash out this way and some of not most will squander it away.

some people will want to sell their bigger flats to buy smaller apartments to ’cash out’ their flat.

Reply

Save

Steph Yeo

10 Jun 2019

Auntie Uncle Whisperer at Agency for Integrated Care

CPF is a retirement fund that the govt forces on everybody. To ensure its people age well, the basic thing the govt can do is to help us have enough money by then. You wanna use the money, you follow its terms and conditions.

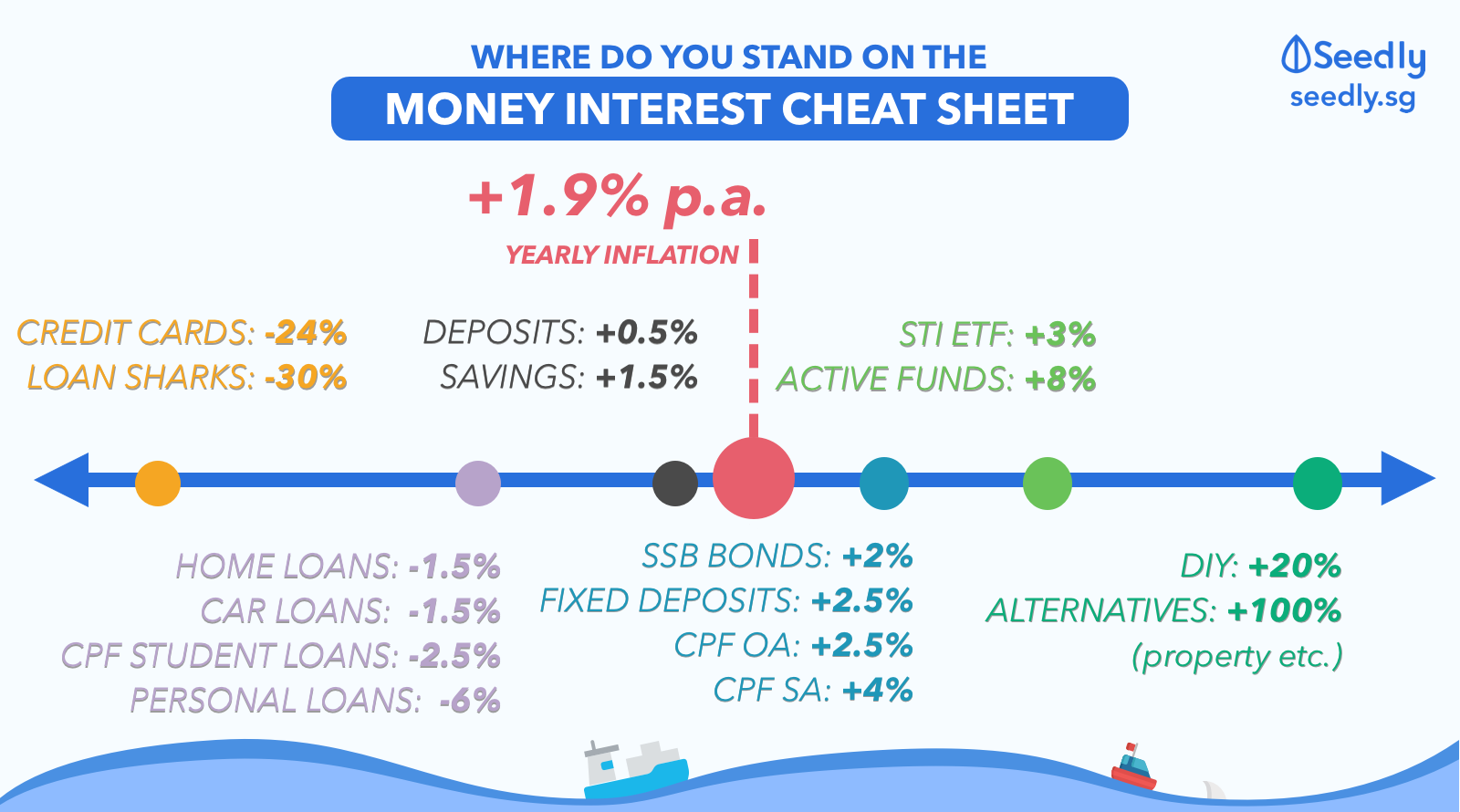

If you can pay w cash instead of CPF then you pay less when it comes to the 2.5% lor. Call this a paternalistic state or whatever, but not everybody is financially savvy enough for the govt to allow much flexibility. If you're good enough at investing then go earn more than 2.5% so that you have no worries repaying.

If you borrow from a bank, you need to pay interest. That is why you pay hdb the 2.6% interest. If you use your CPF money, you are sacrificing the interest it otherwise earns. So it makes sense that when you return the money, you include the interest. Because that makes up your retirement funds anyway. Borrowing money from your future self means you need to pay your future self the interest he/she deserves.

Reply

Save

The primary purpose of the money (CPF) is for a basic level of retirement fund. Money taken out mean...

Read 3 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Advertisement

CPF does have strict rules on its usage, with OA allowable for housing payments.

In this regard, we are allowed to utilize our OA for home purchase. Having the "accrued interest" component helps us to think deeper when we want to utilize our OA for housing purchase, so that we can manage our finances better.

Rather than thinking about why we need to pay back the accrued interest into our OA, we can look back into the purpose in selling our house.

This accrued interest would not be a problem if we are not selling our house.

This accrued interest would not be a problem if we are selling our house with the intention to purchase another house. As the "returned accrued interest" can be utilized for the next house.

It would be not an issue If we hit our FRS and sell the house after 55 years old as we can withdraw the excess over FRS.

Hence in most cases, we should not be worrying over the "accrued interest". It serves mainly to remind us those interest would be given to us had we not use it for housing loan repayments with CPF, but had used our cash instead.