Advertisement

Anonymous

What are the differences between "ABF SG BOND ETF (A35)" and "Nikko AM SGD Investment Grade Corporate Bond Fund (MBH)"?

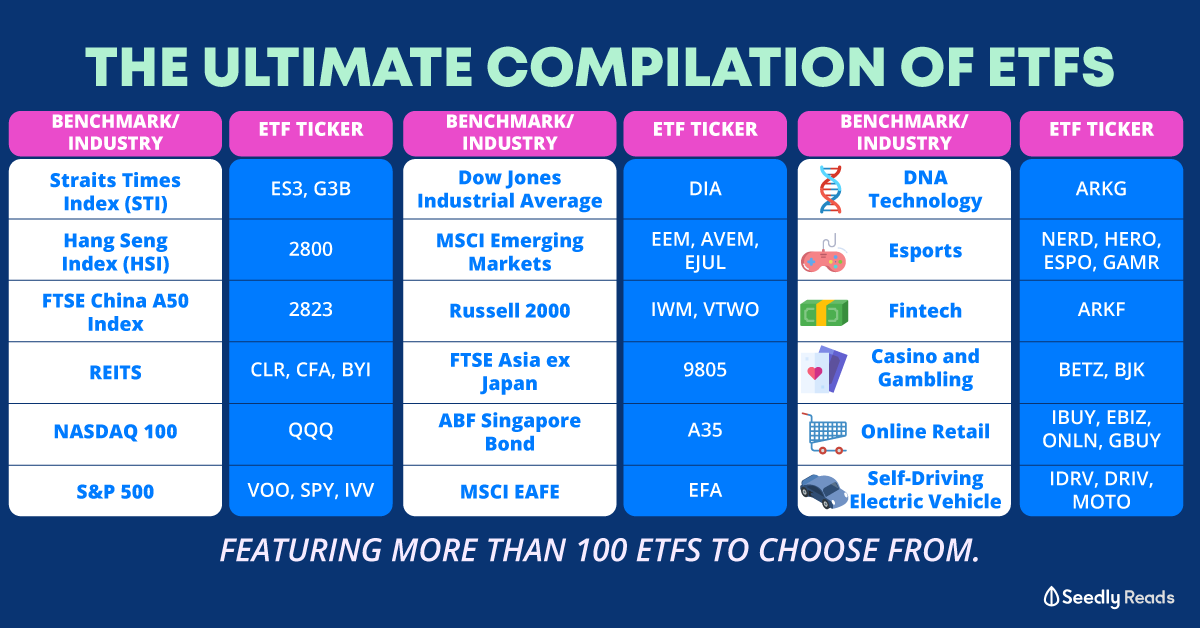

I know they are both bond ETFs but what's the exact difference? Does A35 only include bonds issued by the Singapore government, while MBH includes both bonds by corporation and Singapore government? Would greatly appreciate such an explanation on this. Thank you!!!

4

Discussion (4)

What are your thoughts?

Learn how to style your text

Elijah Lee

10 Oct 2019

Senior Financial Services Manager at Phillip Securities (Jurong East)

Reply

Save

View 3 replies

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

You are right.

The ABF SG BOND ETF tracks government/sovereign corporate bonds largely from the government of Singapore, as well as stat boards such as LTA, HDB. Hence, the average credit rating is AAA

The Nikko AM SGD Investment Grade Corporate Bond track corporate bonds from a mix of government/sovereign but this time with a mixture of private sector companies thrown in the mix, including our local banks, etc. Hence the average credit rating is A. It's perceived to be not as strong, credit-wise, compared to ABF SG Bond ETF, but it is still investment grade.