Advertisement

11 Nov 2019

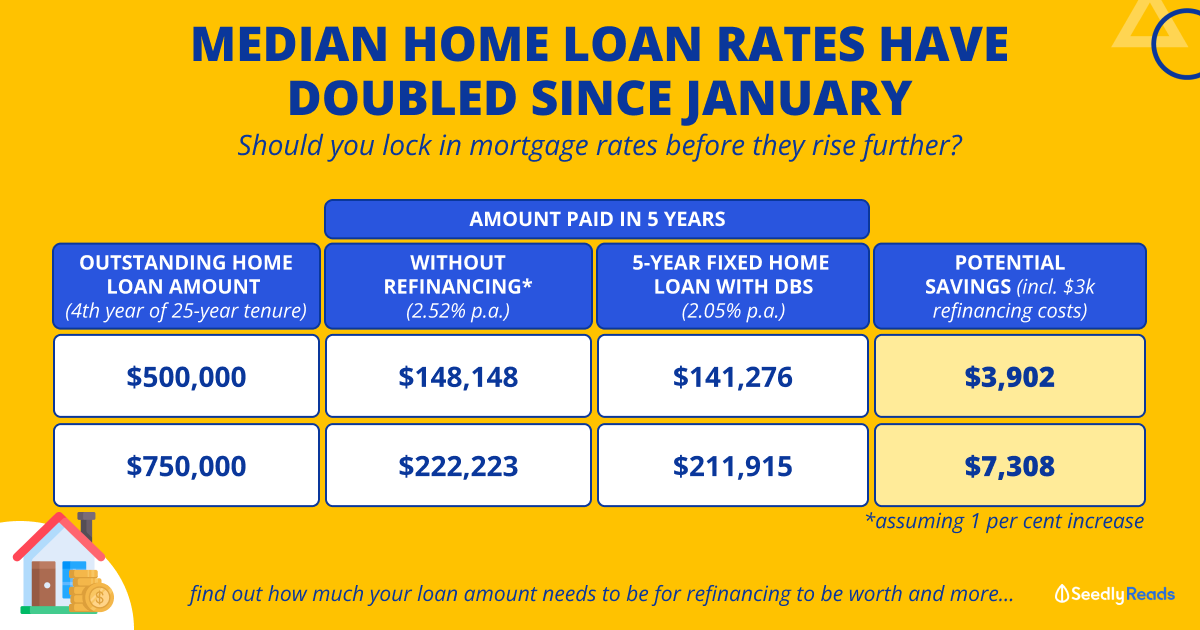

Should we go for floating or fixed rates for a mortgage loan?

Given the current market now?

2

Discussion (2)

What are your thoughts?

Learn how to style your text

Alvin Teo

09 Nov 2019

Aviva Relationship Consultant at Aviva Affinity Channel

Reply

Save

View 1 replies

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

You mean now is fixed or floating rates offered or which is better fixed or floating?

Bank loans offer fixed then floating after 3 years. It idea is to have you refinance.

If the short term loan of 10 years or less bank mortgage loans are not bad due to current interest rates. And In event of crisis, there should be interest rate cuts to promote lending.

But for long term loans of >20 years fixed rates like HDB loans are better as it offers stability and no penalty for early repayment or partial repayment.

Have to plan for events of prolonged unemployment as well.