Advertisement

Anonymous

Parents have a property and are looking to liquidate in the current uptrend. Expect to have a cashflow of ~500k that is not needed for immediate use. Should we sell and invest the money or is it better to just leave it and collect rental. TIA.

8

Discussion (8)

Learn how to style your text

Reply

Save

Pascal S

03 Mar 2020

MBA Graduate at Singapore Management University

Sell if you think the price is right...

And what to do with the cash?

Buy an island!

(With ideally, a house and enough land for farming and sun bathing!)

Alternatively, you can always park the money in a combination of Singapore REITs and Robo-advisors.

Reply

Save

If you do not need the money urgently, you should keep it and collect rental as property prices tend to trend upwards over the long run.

Reply

Save

Hi

If you own the property in Singapore, Don't dare to sell it. In Singapore properties are getting expensive and expensive day by day, because we have a shortage of land. Try to invest your income from rent in Stocks, Nowadays you can buy amazing stocks at the cheapest rate.

Reply

Save

Jason Sing

30 Oct 2018

School Of Hard Knocks And Life at School Of Hard Knocks And Life

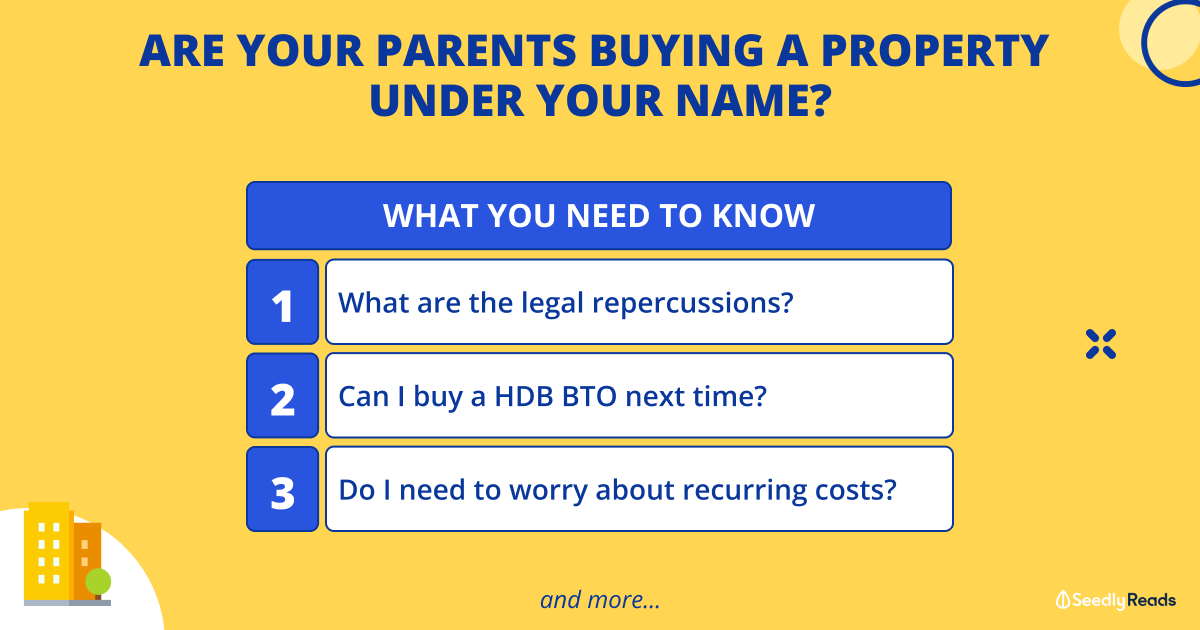

If it is freehold, just leave it and collect rental. If it is leasehold, you may want to sell it at ...

Read 4 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

What did you with the property in the end?! :D

Well, it takes most understanding & perspective of your situation to really get the most ideal advise and opinions.

However, with this limited info, just to throw in a different perspective.

Especially with the lower interest rates as of now, one can consider taking a mortage on the house right now and make new investments!

The market is at a discounted price! Or maybe invest in another property and get more rent?! Wow!

Of course, one would need a proper stragety and structure in venturing to all these different ideas. Hope your parents are doing well and are retire! Cheers!