Advertisement

Anonymous

Other than the OCBC 90 Degrees N Credit Card being miles focused, are there any other key uses to this card?

I am not completely towards accumulating miles because I don't travel much.. will it still make sense to get this card?

2

Discussion (2)

Learn how to style your text

Carrie Rose

08 Apr 2020

Senior Research Analyst at ValueChampion

Reply

Save

There are definitely benefits that are not related to miles! The OCBC 90 degrees N credit card uses the STACK feature to the rewards (STACK marketplace) or you can convert your travel money to cashback (1.2% from your earned travel money).

If you don't travel frequently, I would suggest you go for other cards that are less travel focused and more daily expenses focused.

Reply

Save

Write your thoughts

Related Articles

Related Products

OCBC 90 Degrees N Mastercard Credit Card

3.7

27 Reviews

1.2 mpd

LOCAL SPEND

2.1 mpd

FOREIGN SPEND

Up to 8 mpd on Accomodation and Flight

SELECTED SPEND

$30,000

MINIMUM ANNUAL INCOME

UOB One Card

4.2

166 Reviews

Standard Chartered Simply Cash Credit Card

4.1

175 Reviews

Advertisement

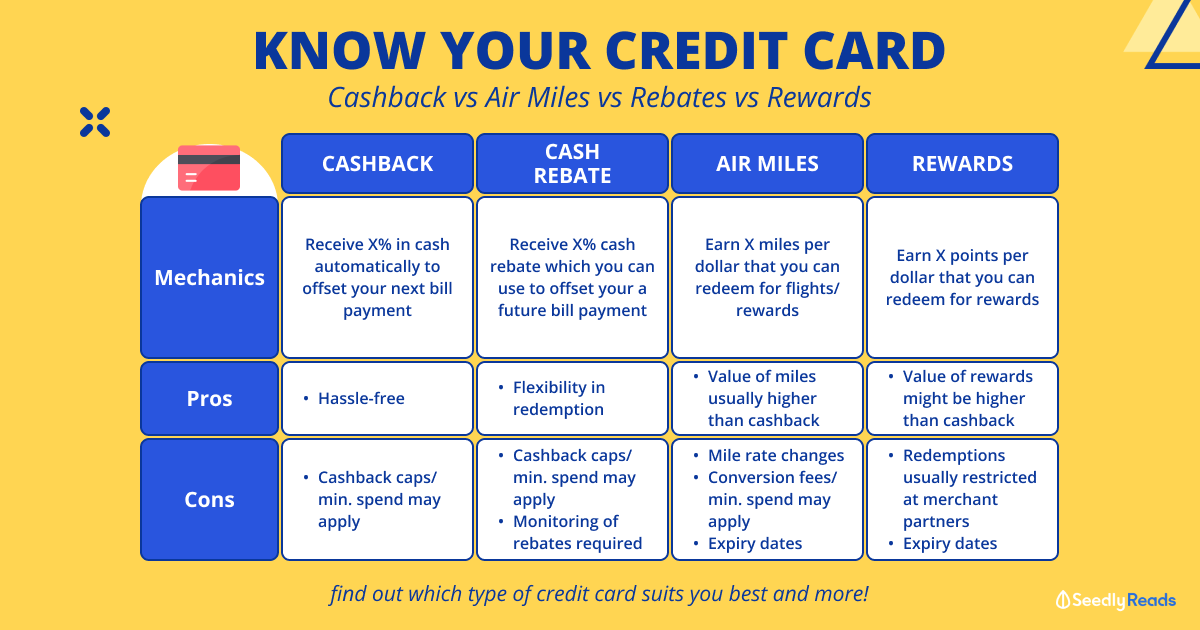

OCBC 90°N Card is actually great precisely because of its flexibility–you earn rewards in the form of Travel$, which can be redeemed for miles or for cash rebate. Many travel credit cards offer this feature, but OCBC 90°N stands out because there are no conversion fees (most cards charge S$25/transfer) and your points are not devalued if you opt to redeem rewards as cashback (most travel and points-earning cards reduce the "value" of a point when you convert to cash). As a result, OCBC 90°N Card provides a fluidity that allows you to choose exactly how you want to earn rewards, and to switch between the two whenever it makes sense.

That being said, the rewards rate for this card in terms of cashback are equal to an unlimited 1.2% locally and 2.1% overseas. These rates highly favour people with large overseas budgets, which seems may not be a fit for your lifestyle. Additionally, unlimited cashback rates tend to be lower and are best suited to very high spenders; people with budgets below S$6k–8k/month can earn more with a capped cashback card with higher rates (like UOB One or Maybank Family & Friends).

Hopefully this helps! If you're curious about the 3 cards mentioned, I've written a few reviews with extra details (as a credit card analyst, I'm always digging through the TnCs):

OCBC 90°N: https://www.valuechampion.sg/ocbc-90-degrees-n-...

UOB One: https://www.valuechampion.sg/uob-one-card-review

Maybank Family & Friends: https://www.valuechampion.sg/maybank-family-fri...