Advertisement

Discussion (3)

Learn how to style your text

Victor Chng

21 Feb 2019

Co-Founder at Fifth Person Pte Ltd

Reply

Save

Initial Capital Outlay

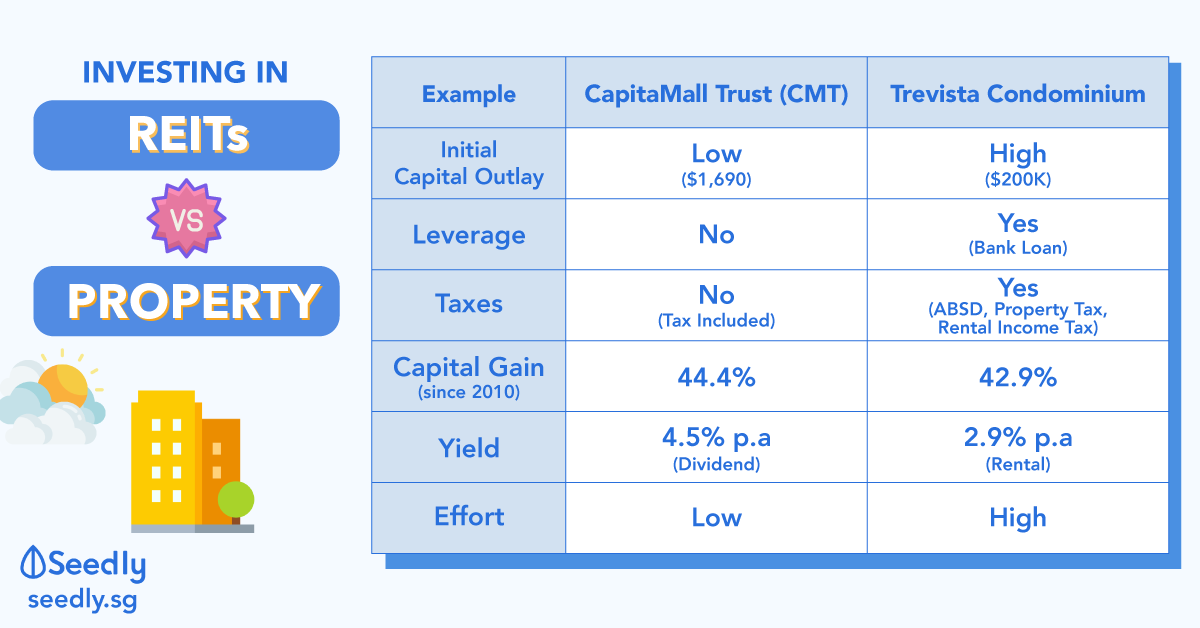

Investing in a physical property would require a large downpayment. Especially with cooling measures; additional buyer's stamp duty (ABSD) and total debt (TDSR). Many invests in a physical property under the assumption that the property value will soar over the next few years and that rental collected will be sufficient to offset mortgage. The downpayment for a property is at least 20%, which can amount to more than $10,000 for a condo! Whereas, REITs investment require a much smaller amount.

Leverage

Previously, one could easily utilize his/her CPF Ordinary Account to pay the downpayment and mortgage rates are low (approx 1.7%) however, with the current cooling measures, it is no longer as easy to get as much leverage. For REITs, due to high interest rates, brokers charge 2.5 to 3.5 times the value of the stock.

Liquidity

Physical properties are one of the most illiquid assets, as it may take months to years to sell, depending on the market condition. On the other hand, REITs can be bought and sold easily.

Income Tax

In terms of profitability, rental income on physical properties are subjected to income tax while REITs are tax free!

If you're looking to diversify your portfolio, REITs offer the opportunity to own overseas asset as investments in physical properties are usually done locally. If you're looking to grow your portfolio, REITs is a cheaper method as you would not have to pay the large downpayment and ABSD.

Reply

Save

Nicholes Wong

18 Feb 2019

Diploma in Business Management at Nanyang Polytechnic

Physical property depends if you are able to find a good place that can get you money and it require...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hi,

Both method are profitable when it comes to investing in it. The important thing is to buy them at the right valuation and knowing the pro and con of each instrument.

Physical Property have the leverage factor that will boost your returns if it works the right way but the downsides are that you only own one property, find your own tenant, and handle all the relevant issue.

For REITs, basically you have a reits manager to handle all the issue for you and own multiple property (usually grade A property) instead of one. Sometimes, the REITs can be trading below the property price for you to take opportunity. The downside is that you don;t have the leverage factor to boost returns.